Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Appen's got the hat out to shareholders again -

Highlights

• A$50 million underwritten institutional placement to provide balance sheet flexibility to fund

generative AI related opportunities (Placement)

• Appen has returned to underlying EBITDA and underlying cash EBITDA profitability in Q3

FY24, having taken the necessary steps to manage its cost base in line with the revenue

opportunity

• Appen’s external customer environment continues to show signs of improvement,

particularly from generative AI related projects. Proceeds from the Placement will provide

additional liquidity to fund working capital and provide greater flexibility to pursue

generative AI related opportunities

• Upon settlement of the Placement, Appen will have a pro-forma cash balance of

approximately US$62.4 million

• Opportunity for eligible existing shareholders to participate via a non-underwritten Share

Purchase Plan (SPP) which is targeting to raise a further A$5 million at the same offer

price as the Placement (A$1.92 per share (Offer Price))

The accompanying trading update and commentary are positive, but I don't like the repeated issuance of new shares, and I doubt the market will be too (though happy to be surprised!).

30-Aug-2024: Appen is still losing money: Appen-2024-Half--Year-Results-and-2024-Outlook.PDF

Down -17.7% today on these results. Not a barge pole long enough for mine.

Back down to $1 and still above where they were two weeks ago, and well above their 26 cps year low in February.

However, zoom out to their 3 year chart and they look horrible (down from over $10 to $1).

And zoom out to their 5 year chart and it looks worse - from over $30 to $1/share.

Yet this dead horse is still getting flogged around the place as a potential winner.

Yeah, nah.

Appen shares have been on a tear of late, more than trebling from their lows hit only last month. Quite extraordinary.

What I would like to know to gauge the sustainability of this trend (apart from meaningfully positive fundamental developments which may come out with earnings next week), is who has been buying?

It will be good if institutions were behind the strong buying seen lately, though there have been no significant change in sub. holding notices filed. Is it just retail-driven meme-stock-like FOMO?

The company responded to a recent ASX price query too saying they know nothing.

News SummaryDJ Appen Suitor Withdraws $101M Proposal on Confidentiality BreachAPX$0.965$0.00 (0.0%)$1.00$0.95

14 Mar 2024 09:00:011 ViewBy Stuart Condie

SYDNEY--Appen said that Innodata withdrew its $101 million takeover proposal after the Australian data-annotation provider was forced by the local stock exchange to announce its existence.

"Innodata informed Appen that it was withdrawing the Indicative Proposal on the basis that it was intended to remain confidential," Appen said Thursday.

Trade in Appen shares was halted on Tuesday so that the Australian Securities Exchange could ask the company if it could explain a 30% jump in its share price. In response, Appen said that it had received an indicative, non-binding takeover proposal from Nasdaq-listed Innodata.

Write to Stuart Condie at [email protected]

(END) Dow Jones Newswires

APX has responded to the ASX aware query, revealing that it "recently" received a highly indicative merger proposal from US-listed Innodata, in a stock for stock deal that was at a 100% premium to the prevailing share price.

Hopefully that is very recent, and not from the 52w lows. That may determine whether the next move is up or down when it comes out of the halt.

https://hotcopper.com.au/documentembed?id=uOMxKKzFkiWRTLKhOROKAxjvSDYL5g%2B9yhjzv%2FZp57FiGug%3D

A pause in trading after a 30% ride in the first half of the session.

Not a leaky ship at all. Hope they announce that big telco contract they were touting/expecting.

A new CEO has been announced today. Their announcement included the following for the outgoing CEO.

Mr Freudenstein acknowledged Mr Ahmad’s tenure at Appen:

“Armughanhas been CEO during a period of great change at Appen. Having overseen a new strategic direction and re-sizing of the business, Armughan has decided to pursue new challenges. We wish him well for the future.”

I like the marketing spin. "re-sizing" in reality meant complete destruction of shareholder value .

Its a bit of a long read but for those of you willing to spend the time on a deep dive into the Aspen business b=model going forward, is worth the effort.

The bottom line is there is probably a viable business in there, it just hasn't got much cash to make it come to fruition:

Source: Scott Middleton

Appen: the $309m fall in AI revenue

How segmenting between AI Builders and AI Adopters might help it return to growth

FEB 1

Being at the forefront of AI isn’t a straightforward ticket to rocket-ship growth. Appen, an AI data annotation company listed on the ASX, is going through some severe performance issues.

Appen has gone from profitable with growing revenue to declining revenue and losses. To add salt to the wound, Google recently ended an $82m contract.

But, through analysing Appen and the forces at play in AI, it looks like there might be a segment of the business that has a high gross margin, probably growing and supported by strong tailwinds.

This hidden segment, data annotation for the AI Adopters, is obscured by the significant revenues Appen gets from massive technology companies like Amazon, Facebook and Google.

The AI Adopters segment is only 29% of total revenue, but its gross margin is 38% of the overall margin.

Appen needs to navigate servicing large contracts with the world’s biggest technology companies while quickly growing into the market for companies adopting AI. They’ve just raised ~$30m in working capital to help them start to figure this out.

If they can’t figure it out then they’ll need to either take drastic action or sell the company to someone that can take on the turnaround.

It’s an intriguing situation. Let’s take a closer look at Appen.

Each week we dive deep into listed tech companies to get insights on managing and investing better

About Appen

Linguist Dr Julie Vonwiller founded Appen in 1996 with her engineer husband, Chirs Vonwiller.

In 2009, Anacacia Capital acquired a 51% share of Appen as the Vonwillers looked to transition out and retire. Over the next 18 months, Appen increased its holding to 70% for a total investment of $5.5m.

Appen was then merged with the Butler Hill Group, a US-based firm with a similar offering to Appen. The Butler Hill Group was founded in 1993 by ex-IBM Watson researcher Lisa Braden-Harder.

The merged group was IPO’d in 2015, led by Braden-Harder.

Appen went on to make a handful of acquisitions: Wikman Remer, Mendip Media Group, Leapforce for $80m USD, Figure Eight for $300m USD and Quadrant for $45m.

Appen’s stock price surged but has fallen in line with falling revenues and losses. Appen recently raised a $30m round to help fund working capital to ensure the business survives.

Product (or Solution): A workforce for tagging AI, supported by specialised data and software

Appen’s solution is about tagging and reviewing data used in AI and Machine Learning.

It’s primarily a large army of people working away to tag, review, edit, and markup data to feed into algorithms or that has come out of algorithms. These people are made more efficient and effective by Appen’s technology and prebuilt data sets.

Source: FY21 Annual Report

The key features of Appen’s solution are:

- Ready to go data sets to help train, tune or validate AI. Like data sets for domains like health care, finance and vehicles.

- The Crowd (the people) to build data, prepare data and evaluate results. These can be relatively unskilled or trained copywriters/linguists.

- Software to make data preparation, sourcing and evaluation better. Including algorithms to automatically fix data, make tagging easier and prefill.

- Management of the people, software and data to make this efficient and effective. Including hiring the people, determining pay, scheduling them and training them.

Business Model:

Appen’s business model boils down to:

- A Salesperson sells a project for an average size of $120,000 (as per annual report)

- The Crowd works it (i.e. tags, labels, evaluates), Appen’s technology helps the client and the crowd.

- Appen makes a Gross Margin of ~38% (as per annual report)

- Client (might) do repeat projects, especially with some Account Management. This could expand to millions in revenue.

- Reinvest the margin in better ways to help build, prepare and evaluate AI data.

Appen has had some substantial customers (Facebook, Google, Microsoft) who have been in the repeat projects loop with substantially larger-than-average projects. For example, Google did $82.8 million with Appen in FY2023. But these massive customers are falling away.

Market: the challenge and opportunity of being on the edge of AI

The market for Appen is interesting in how rapidly it is evolving and how turbulent markets at the forefront of technology can be.

Appen is primarily in the now fairly competitive ‘data annotation market’ and, to some extent, the crowd-sourcing market with a specialism in AI. Both markets are estimated to each be $4-$5 billion markets that are growing.

Companies in annotation, like Snorkel AI, reported a five times increase in enquiries in late November 2023.

What’s happening in AI?

Everything AI-related is undergoing a significant shift due to recent innovation.

The most well-known is the explosion of large language models like OpenAI’s ChatGPT.

However, behind the scenes, progress has been made by cloud vendors and data platform providers. They are looking to commoditise and give greater access to the tooling and infrastructure required to configure and run artificial intelligence and machine learning.

In some cases, especially in the larger or more AI-focused tech companies, algorithms have been built to help annotate and label faster.

Algorithms need data, and lots of it, to be developed. Then, once developed, they need to be tuned from time to time with more data.

We do have large, open annotated data sets for images (e.g. ImageNet), speech (e.g. the 10 data sets on Stanford’s website), and language. There is also a much larger trove of data within Amazon, Google, Microsoft, OpenAI and others (including Appen). Amazon, for example, has hours of recordings from people talking to Alexa.

But, we haven’t yet built “The Final Algorithm”. So, this process of annotating large data sets, training AI on it, and then tuning it is likely to continue for some time.

The building of new algorithms, generally, requires volumes of new data that is annotated and output that is evaluated. This needs large data sets to be labelled that haven’t been labelled or annotated before in the way you need.

Adapting these algorithms, which is what most organisations applying AI are doing, is where you tune or customise algorithms to your specific requirements.

Appen’s Market Segments: Adopters,Builders, and Users

This broadly means the market for Appen breaks into these segments:

- AI Builders: the companies building new algorithms such as Google, OpenAI and Microsoft, as well as more specialised technology companies.

- AI Adopters: companies looking to customise what the AI Builders have created for their own uses.

- AI Users: companies that will use the AI and algorithms others create without any modification.

The AI Builders will continue to need to build algorithms. So they will continue to need labelled data, and they will continue to need to evaluate their algorithms’ output.

The key questions for this segment are:

- Have the major data sets been mostly annotated (for now)? The AI Builders have possibly performed the bulk of annotation for datasets around image, language, and speech. If so, it’s into tuning mode (less need for annotation).

- Is there another major data set or algorithm on the horizon? If so, what element of human intelligence would it be? If there is, then there will be another massive need for annotation and data preparation.

- Do the algorithms they’ve developed now allow their AI to annotate and evaluate itself? If this is even partly correct, then the need for humans in the loop has decreased (Appen’s loss of Google might be a sign of this).

The AI Adopters are currently working to apply the recent advances made by the AI Builders. This requires data, data annotation and labelling but not at the same scale as building AI models.

The AI Users don’t require any data annotation services. Most small to medium businesses will be AI users. Larger businesses may be AI Adopters in one department (where it gives a competitive advantage) and AI Users in another where it provides no real advantage (i.e. payroll for most).

The number of AI Adopters is large; almost every meaningfully sized company on the planet is arguably in this market. While the number of AI Builders is small: in the tens, maybe hundreds.

Customer Value Proposition

The Customer Value Proposition (or CVP) differs for the AI Builders and AI Adopters. We won’t cover AI Users because they don’t have a need for annotation.

AI Builders

AI Adopters

Competition: Pressure from big customers and marketing machines

Appen’s competition comes from other Data Annotation Solutions, Crowdsourcing more broadly, and the AI Builders themselves creating better Annotation AI.

Companies providing Data Annotation Solutions provide a fairly similar offering to Appen. They help prepare data and evaluate algorithm output with teams of people and software to help manage this workflow. Some provide ‘value adds’ like off-the-shelf data sets, advisory, and algorithms to help others just provide the people capacity.

Customers needing to get data annotated can also do it themselves within their company or crowd-source themselves. There are a variety of Crowdsourcing options available. Customers going down this path just need to manage the process themselves.

Given the amount of processing the AI Builders have to do, they have a need to make this faster and more efficient (let’s call it Annotation AI). They’re constantly looking to apply the AI they’ve built or build new AI to help with annotation. You can, for example, use a large language model to quite accurately classify documents now. Previously, this needed a person. Similarly, image recognition advances mean AI can annotate images to help train another AI without needing a human.

Appen, and data annotation providers, face pressure from multiple directions.

- The general Crowdsourcing companies are powerful machines when it comes to winning new customers and growing revenue, particularly in the broad market Appen now finds itself in.

- Appen’s original customers, the AI Builders, are heavily incentivised to automate this away (speed to market and cost to a lesser extent) and are continually improving their ability to do so.

But they also have the tailwind of the broad AI Adopter market segment in which all businesses are looking to increase their AI projects.

Go-to-market: Sales Teams and Account Management

Appen uses a sales-led approach to winning business from new customers and account management to expand their existing relationships.

Appen has sales representatives in each of the regions they want to win business, including Australia, the United States, China, Japan and Korea.

They don’t use a self-service sign-up. You have to request a call and quote from a salesperson.

The go-to-market will likely go through a shift as well. The type of account management team you need to manage an $82 million relationship with Google is different to the type of salesperson you need to win $120,000 projects from enterprises.

To get a feel for their go-to-market motion, I applied for a demo with a legitimate use case and haven’t received any contact. In contrast, for another analysis I did, I received a phone call within an hour after submitting a request for a demo form. For a company desperate to grow revenue, it was a little surprising not to hear back quickly.

There is little information about Appen’s go-to-market in publicly published investor information, so I’ve had to infer what is happening from their website, reports, and other sources.

Finances

Appen was a profitable growth machine as recently as 2021. Yet, as the AI Builders have decreased their workloads, Appen’s financial results have turned into a serious problem. As revenues fell, Appen didn’t adjust its expense base, posting a $34m operating loss in 2022.

The Gross Margin held, though. Crowd costs adjusted down with the decrease in revenue. This is promising because it gives a 39-40% gross margin to work with that can scale relatively well with revenue up or down. This margin shows the business has (or can have) underlying resilience.

So what needs to happen with expenses? How can we get profitability and growth happening again?

Splitting the business

Splitting the business might work as a solution going forward. Let’s split the two tracks: the declining business of servicing the AI Builders, and a business for servicing AI Adopters that has signs of market growth.

AI Builders

This business is about servicing the AI Builders, which is primarily about account management and, it seems, some improvements around efficiency.

From the disclosure on the Google contract, we can also see that Google’s contract had only a 26% gross margin. So we can infer that contracts with Meta and any other large remaining AI Builders probably have a lower margin as well.

If we assume that Google, Meta, and Amazon made up 80% of revenue prior to Google ending the contract, then Appen’s AI Builders Business would have $218m in 2023 and something like $191m in 2024.

The probability of further revenue or margin decline in this segment is likely, such as losing another big account or being squeezed on cost respectively. So, the stance here would need to be one of cash flow and profitability through the lowest possible expense base to continue to service the revenue (i.e. no new major product development and no ‘new account’ teams - just focus on what’s in front of you).

AI Adopters

The AI Adopters business is made up of hundreds of customers doing, it seems, smaller projects at higher margins. This business is adding new accounts.

The expense base here likely has a slightly different stance of a mixture of profitability and investment in growth. That investment in growth could be marketing and sales. Given recent performance, this can’t be an overinvestment, though, until the business unit proves itself.

Runway

At the ~$30m loss rate of 2022, Appen’s recent capital raise gives it 12 months of losses of a similar magnitude. Appen says it has cut costs substantially but was still incurring losses as of the last update and may still need to adjust further based on the loss of Google.

Runway is a real concern.

Disc: not held

Bombshell from $APX this morning. Full text of the release is below.

This kind of announcement has been foreshadowed by many here, so it will not really be a surprise to them. However, the market has taken a sharp intake of breath with SP down almost 40%. This says that some holders remain in denial that this business model has had its day.

I first took a position in $APX in December 2016 as part of the MF PRO recommendations, like many here. And over the next year built a sizeable position premised on the growth of demand for data to train AI models. I'll admit to being initially skeptical when some started saying the model would be short-lived, but as the chorus of respected voices grew, I progressively exited (missing the peak on the way down) and pocketing between $12.90 and $39,00 over the period Feb-2020 to July-2021. How long ago that now seems.

Today's announceent is surely a very important milestone. Full text follows.

As a personal observation, I teach business operations as one of my occupations. A current student of mine last week showed how he coached ChatGPT 4.0 to solve a rather complex analytical problem I set for the class. The level of coaching was non-trivial, but the progress LLM's have made in one year is remarkable.

ASX Announcement

----------------------------

Appen Limited (Appen) (ASX: APX) received notification on Saturday, 20 January 2024 AEDT from a material customer, Google LLC, that as part of a strategic review processit will be terminating its global inbound services contract with Appen, resulting in the cessation of all projects with Appen by 19 March 2024. Appen had no prior knowledge of Google’s decision to terminate the contract.

In FY23, Appen’s revenue from Google was $82.8m1 at a gross margin2 of 26%.

The news is unexpected and disappointing, particularly considering the progress made against Appen’s transformation and performance in November and December 2023. Appen saw Q4 on Q3 growth in both Global Services and New Markets (including China). On a YoY basis, Global Services Q4 2023 revenue was down while New Markets (including China) was up. Within the New Markets division, China achieved a quarterly revenue record in Q4 2023 of $11.1m. At a group level, based on unaudited management accounts, Appen recorded revenue of $24.1m and $25.9m in November and December 2023 respectively, along with execution of cost management initiatives, which enabled achievement of cash EBITDA breakeven objectives.

Based on the unaudited management accounts, Appen also recorded:

• Underlying EBITDA3 (excluding FX) of $3.2m and Underlying cash EBITDA (excluding FX)4 of $2.3m in December 2023;

• Revenue of $273.0m and an Underlying EBITDA (excluding FX) loss of $20.4m for the full year; and

• $32.1m cash on hand at 31 December 2023.

These results are preliminary and subject to change as the audit process is finalised. Appen’s full year FY23 results remain unaudited and are subject to Board review and approval as well as completion of the external audit.

Appen continues to focus on cost management, business turnaround and delivery of high-quality AI data for its customers. Appen will immediately adjust its strategic priorities following the notification of the Google contract termination and provide further details in its FY23 full year results on 27 February 2024.

Authorised for release by the Board of Appen Limited.

Underlying EBITDA (before impact of FX) was ($15.7) million, compared to $9.6 million in 1H FY22. This is due to reduced revenue and gross margin, and a proportionally higher cost base coming out of FY22.

APX well it's not a investment grade stock. Lets have look.

Previous: 12,070,052 7.62% / Present 10,188,473 6.45%

From 604: State street.

How deep the price go? . Deeper than coal mine..lol

"Deeper than the deepest ocean ..wider than the sky" ...you know the song!!!

14-July-2023: Just revisiting this old straw from just over two years ago (May 2021). It's interesting to see how wrong those brokers were back then!

09-May-2021: I do not hold Appen (APX) shares, as I believe their business model is being undermined and they are becoming less and less relevant now. I also think they are much less of a "tech" company than most people realise. They rely on cheap labour to constantly provide a serious flow of data into their systems, which is not a very automated system at all. Once the data is in they can do plenty of stuff with it, but the data entry itself is very labour-intensive, and they pay peanuts to those people who are doing it. I don't claim to know the business very well, but I know enough to know that I'm not interested on doing further research on them, as they face more headwinds than tailwinds - in my opinion.

That said, to add to the conversation here, as Appen (APX) appears to be a very polarising and popular company to discuss here, I thought I'd include a snapshot of the latest broker views on Appen - see image below. Remember that this is only part of the data available - on FNArena.com - and it could be worth considering a subscription to their service if you want to stay up-to-date with this stuff, or read Rudi's summaries of those brokers' reports and client notes. As a subscriber, you can create a watchlist and every time there is any news or updates on any company on your watchlist, you'll receive an email about it - usually immediately - or at the very least on the same day.

It pays to note however that FNArena only cover 7 brokers:

...so there are limitations there - you have to remember that the consensus views are only a consensus of those 7 brokers, and usually not all 7 of them will cover the company you are interested in, so it's usually a consensus of less than 7. For instance, only 5 of those 7 currently cover Appen. Anyhow, for what it's worth, here is a snapshot - as of today - Sunday 09-May-2021 - of what Macquarie, Citi, Ord Minnett, UBS and Credit Suisse currently think of Appen:

If that is too small to read, click on it and it should get bigger.

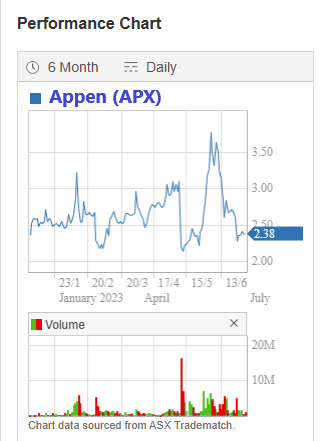

04-July-2023: The lowest target price (TP) for Appen there was from Macquarie, who reckoned Appen were worth $16.00/share, and the highest was Citi who thought $30.90 was a fair price. Appen closed at $2.38 today, and they are still in a long-term downtrend that started back in August 2020 when they were just below $40/share.

Today they're around -94% off those highs, or are being valued by the market now as being worth around 6% of what they were selling for back then (in August 2020).

Brokers are often behind the curve, or behind the play and trying to catch up, and they are rarely right it seems.

Appen was trading at $22.23/share and all five major broking firms had either a "Neutral" or "Buy" call on APX at that point. Appen are down 89% from there, and here's what the brokers' views are today:

I note that three of those five brokers from two years ago have ceased coverage of Appen (Ord Minnett, UBS and Credit Suisse), however Bell Potter and Morgan Stanley have joined Citi and Macquarie in covering Appen, and only Bell Potter is neutral (with a "Hold" call made back on May 18th). The other three are negative, with 1x "Sell", 1 x "Underperform", and one "Underweight". The four price targets range from $1.35/share up to $2.40/share. Still too high. They're going lower than that!

Additional: Looks like FNArena cover 8 broking firms now, being the seven I've listed above (with links), plus Bell Potter as well.

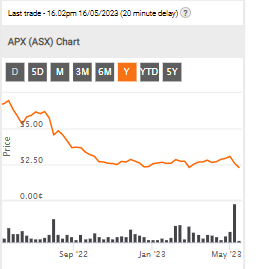

03-July-2023: Things can look different depending on your point of view. For instance, this looks sort-of bullish:

And then Appen released this: 10-May-2023: Trading-update,-cost-reduction-program-and-strategy-refresh.PDF

Which confirmed they were running at a loss - i.e. no longer profitable, but they had a plan. A plan to return themselves to profitability. But it would cost money and take time.

So, on that day (10-May-2023), the APX share price (SP) drops -90c (-28.2%).

Then we get these announcements:

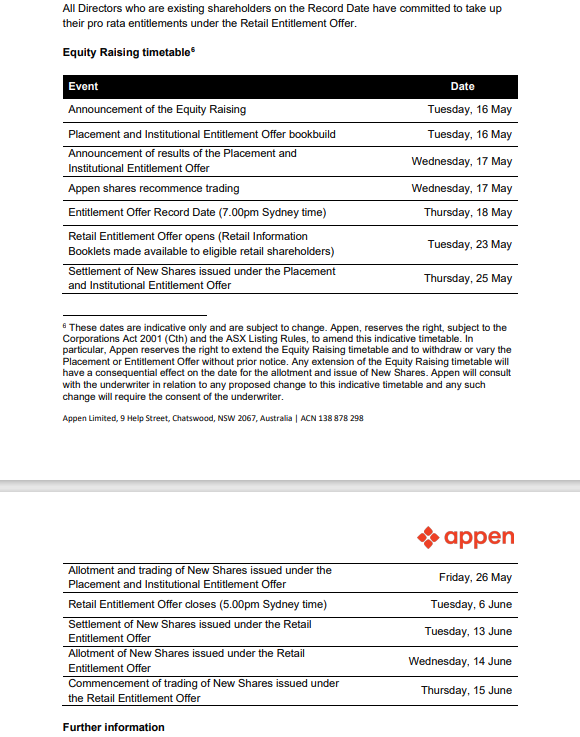

16-May-2023: Appen-announces-fully-underwritten-A$60m-equity-raising.PDF

26-May-2023: 2023-Annual-General-Meeting---Chair's-Address.PDF

From the 26th May to the 2nd June, the APX SP rose from $2.42/share to $3.76/share, a rise of +55.37% in one week, so now their chart looks like this:

VERY bullish - who wouldn't jump on that ride? Well, anyone who had followed the company for a few years would probably be a bit wary, but for those trend-followers who don't care about fundamentals or management, it might well look enticing.

And then this happens:

09-June-2023: Completion-of-Retail-Entitlement-Offer.PDF

And the underwriters, who were left with 45% of the retail entitlement offer started selling, and the usual shorter suspects began to lodge "Substantial Holder" notices, and Appens' CFO, appointed on May 1st (see here: Helen-Johnson-appointed-Chief-Financial-Officer.PDF) announces she is quitting that role ("for personal reasons") on June 26th:

Departure-of-CFO-and-appointment-of-Deputy-CFO.PDF

So their latest CFO lasted just 8 weeks.

And the 6 month graph, up until today, looks like this:

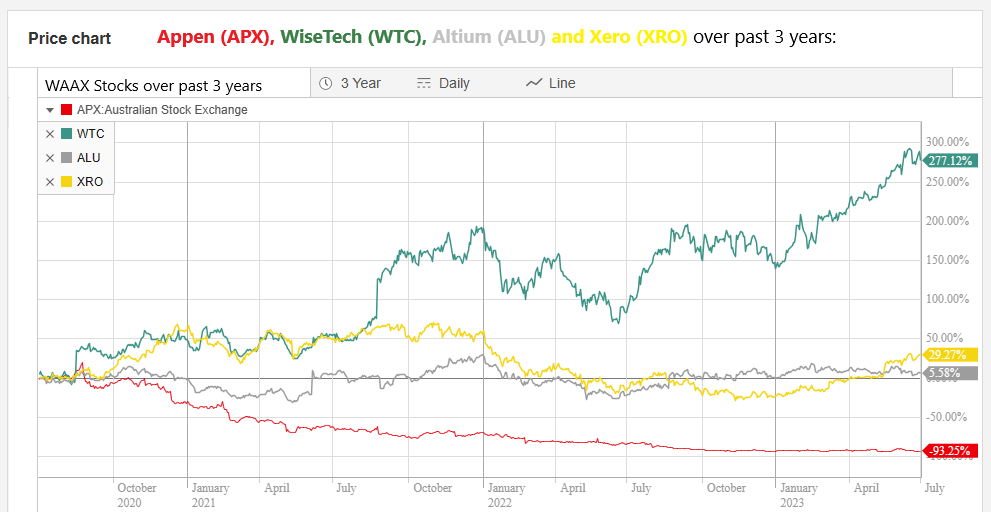

That's the thing about Appen. Every rally is followed by a fall back down. Have a look at their 3 year chart:

Not pretty. Sometimes you need to zoom out and look at the bigger picture. This is a business in serious decline. Apart from short term trading, which just might be profitable if you time it right, Appen is a company I would completely avoid, no matter what they announce.

Here is the 3 year chart of WiseTech (WTC):

Now that's the sort of company you want to be invested in. Like Appen, WiseTech also have a volatile share price. The WTC SP has plenty of drawdowns. But the overall trend is up. So far, WTC have weathered every storm, including a public attack by a US shorting firm, and they just keep heading north east at a decent clip, over time.

Appen, not so much.

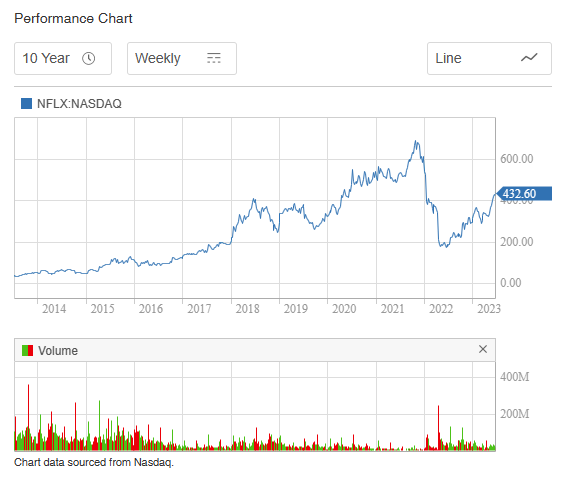

What have Wisetech and Appen got in common? Well, remember WAAAX? It was our almost pitiful version of the US' FAANG stocks. FAANG is now MAMAA, which is an acronym for the top five tech stocks listed in the US. Together, they have a total market capitalisation of around US$10 Trillion (or they did in January 2022) and carry an approximate 21% weight in the S&P 500 index (again, that was in Jan, 2022). MAMAA are Meta Platforms (Meta, formerly Facebook), Alphabet (formerly Google), Microsoft, Amazon, and Apple. This acronym was coined as a replacement for FAANG after Facebook changed its name to Meta Platforms, and Google had become Alphabet, and Netflix was thought to be ex-growth after their share price fell by over 70% from around $690 in mid-November 2021 down to around $190/share in late June 2022. Unlike Appen, Netflix did bounce, and it doesn't seem like a dead cat bounce...

So WAAAX was once Wisetech, Appen, Altium, Afterpay and Xero. Then Afterpay got swallowed up by Square and Square became Block, and it isn't an Aussie company now. So, we have WAAX with two As instead of three As. But there's a bloody good argument that it should be just the one A, which would be Altium, because Appen isn't really even a tech stock, they are more of a labour hire company for data input (such as tagging images to assist machine learning), and they're definitely not a growth stock. Here's the past 3 years, with the share prices of Appen, Wisetech, Altium and Xero from the same common starting point.

Big difference between the best and worst there. Of course they don't compare to the FAANGs/MAMAAs of the USA, as they are HEAPS smaller, and together they represent a very small percentage of our All Ords Index (our equivalent to the S&P500 over in the US). The USA's Tech (or "IT" sector) is their largest sector, and it's one of our smallest. Our largest sectors are Materials (Miners) and Financials (Banks).

I maintain that Appen has no place as a WAAX company, or any place in the portfolio of any serious investor who is prepared to do even a small amount of research before buying shares. They are going lower, or they are going broke, probably both, in that order.

They often have a nice bounce (such as that +55% rise in one week recently, as explained above), but because they're coming off SUCH a LOW BASE now, these percentages are almost meaningless, as the 3 year graph clearly shows.

It's all about proper perspective.

Unless you're in them for a short-term trade (and history would suggest the shorter the better), there wouldn't be a barge pole long enough.

Form 604: basically J.P. MORGAN SECURITIES PLC

Nature of Changes: (some headings of note below)

1/ Purchase and sales of securities in its capacity as Principal/Proprietary,

2/ Holder of securities subject to an obligation to return under a securities lending agreement

3/ Purchase and sales of securities in its capacity as Principal/Proprietary

4/ Holder of securities subject to an obligation to return under a securities lending agreement

Previous notice 'Present Notice'

Person’s votes Voting power (5) Person’s votes Voting power

Ordinary 9,994,515 8.04% 9,504,804 6.07%

Five Directors 3Y - Stuart Davis, Vanessa Liu, Stewart Hasker, Robin Low, Robert Freudenstein.

3Y for Robert Davis below: Trading for Directors at $1.85 during their allowable trade.

....ah, yes. Because that's what long-suffering shareholders were looking forward to - more dilution near multi-year lows!

It's early days to judge new management, but this and the "strategy refresh" have the distinct clutching-at-straws feel.

16/5/23:

Growth Return (inc div) 1yr: -65.52% 3yr: -56.71% pa 5yr: -25.25% pa

Maybe APX has hit the bottom of the "bath tub curve"! ...Merve the Perve...lol

Entitlement Offer Record Date (7.00pm Sydney time) Thursday, 18 May

The strategy refresh will address four key focus areas:

1. Customer diversification – generative AI expected to create material demand beyond large tech customers

2. Margin improvement – greater reliance on technology to improve gross margins

3. Revenue visibility – new products to have a greater proportion of recurring revenue

4. Strong ROI – generative AI investments will leverage existing technology investments Further detail on Appen’s strategy refresh will be provided at the Appen Investor Technology Day which will take place after the AGM on 26 May 2023.

Equity Raising The Equity Raising will consist of an offer of fully paid ordinary shares (“New Shares”) through: • A 1 for 6 pro rata accelerated non-renounceable entitlement offer (“Entitlement Offer”) to existing eligible shareholders to raise ~A$38 million; and

• An institutional placement (“Placement”) to raise ~A$21 million. The Equity Raising price of A$1.85 per share represents a: • 16.2% discount to the theoretical ex-rights price of A$2.21 (“TERP”)5

• 19.6% discount to Appen’s last closing price of A$2.30 on 15 May 2023. Approximately 32.2 million New Shares will be issued under the Equity Raising, representing ~26% of Appen’s existing shares on issue.

Things not getting better for poor old Appen. Trading conditions have simply not improved, with YTD revenue (first 1/3 of their financial year) down 21.4% on last year.

Here too the plan is to cut their way to greatness, They had already announced $10m in annual cost savings in Feb, and now they reckon they can cut a further $36m in costs. They expect to exit FY23 (dec 31) with an annualised run-rate of positive underlying EBITDA and operating cash.

There's also a strategy refresh, with the business planning to focus more on generative AI (like ChatGPT), which require large amounts of human feedback.

We'll see, but I doubt shares will return to their 2020 high of $40 anytime soon.. At present, if you pro-rata the first 4 months, shares are on a P/S of 1.4x

Way too hard for me to handicap the odds of a successful turnaround. I wish them well.

Announcement here

ARK FYI podcast gives a good explanation of why Appen's TAM is reducing due to the maturing of AI models and the automation of labelling.

Held in SM and RL should have believed the opinions of others rather than the company announcements. Tried to catch the falling knife and got badly cut! Painful lesson.

Conversation with Manu Sharma, founder and CEO of Labelbox

Key Points From This Episode:

How Labelbox tries to improve mission-critical AI systems across industries by building software products.

Manu’s experience working in satellite imaging at Planet Labs before starting Labelbox.

What it was like to see AI applications powering real-world solutions for the first time.

Why the Manu believes the AI paradigm is really all about data.

How the need to create a product suite to orchestrate AI activities motivated Manu to create Labelbox.

The rapid AI driven transformations that enterprises using Labelbox experience today.

How enterprises navigated solutions for data engines before Labelbox.

How Tesla has built a data engine to create a closed loop system.

What AI labeling actually is.

The impact of unsupervised learning on the need for labeling.

Three layers of AI capabilities.

Why AI is accessible to everyone today.

How AI powers John Deere’s tractors through See & Spray technology.

The biggest challenge that AI adopters are facing today.

Manu’s prediction for the rate of progress in AI technology.

"...there has been no improvement in trading conditions in August and September"

Management pointing out lower revenue and lower margins. And now expecting US$13-18m in EBITDA for FY22 (ends Dec31). Last year they did US$79m...

EV/EBITDA of 15x could seem cheap, but there's just way too much uncertainty for me. Potential for their business to be far less relevant due to rapid structural change to the industry. Or not.. it's just waaaay outside of my wheelhouse.

ASX announcement here

It is for me!!! After all this time, I've decided to cut my losses and move forward ...... Lesson learnt.

Can say that I already feel better & can now focus on making better decisions into the future. Thank you Strawman ....... So glad I could try it here & not in my RL portfolio ...... here it's just pride that takes a hit!!!

Valuation/price target based on:

- Target PE = 15

- Underlying NPAT = $25m (AUD)

- Cash = $42m

I believe this to be highly optimistic at this point given the deteriorating fundamentals.

Why I sold now:

I sold all of my holding yesterday after the announcement of the downgrade expected in the 1HFY22 results and rest of FY outlook. Group revenue down 7%, with a weak global division, "underlying EBITDA" down to only $8.5 mil (69% down) and worst of all, NPAT loss of $9.4 mil. The company made it clear the outlook for the rest of FY22 is uncertain and are expecting lower revenue and profits than previously thought. The only glimmer of hope someone could take from the announcement is the continued growth of the China segment with first half revenue up 141% PCP to $18mil, however, if you actually compare this to H2FY21, the result is only up from $17.2 mil so half on half a terrible result considering this segment was looking to be a real growth engine. I get a strong feeling results will get worse again before they get better in the future. Note all $ figures in USD.

My thesis was based on a turnaround from the bump in the road that was COVID for Appen, with the potential for growth to be restarted after the initial COVID hit. This turned out to be incorrect with the opposite occurring, results are continuing to degrade with no positive move in sight. Assuming that the old results could be a baseline was incorrect. I would currently give a valuation/target price of 15x times a $25mil profit for FY23 + $50 mil cash. This gives a valuation of $3.44 a share. This valuation is optimistic at this point but is still below the current market price. After previous updates I could still justify holding (obviously wrongly now) with a lower personal valuation, but those new valuations were still above the market price at the time. Needing to lower my valuation should have been another warning sign.

Post Mortem - Summary of mistakes and lessons learnt from owning Appen:

- The first day you bought, you bought because they were up a few percent and a recent high. One day doesn't show any momentum. Over the next month the shares were down 35% at one point. There was no momentum. Always buy with some real momentum, otherwise wait.

- You bought when you knew results were imminent. Always wait for results to confirm your expectations. It is all about risk adjusted returns. The risk of unexpected results is much higher at this point in time than the likely returns from jumping in early in the hope of a quick buck from better-than-expected results. Ie, I would rather miss the first 20% of a multi bagger potential company than jumping in early in the hope of a quick jump but turns out, results are poor.

- Compounding the point above, I bought a smaller batch again before results, this was after some management guidance was released because I thought the market was wrong and now there was great value because the shares were down 25%, I hadn't changed my view and management had confirmed my view. Don't catch a falling knife...

- The momentum of expectations, results and the company in general always continue to get worse and worse than expected. Very rarely are bad results and expectations turned around quickly unless there is an obvious factor. There was a bit of hope in this thesis (I guess every thesis really requires some hope otherwise you can't invest). I did not appreciate how hard it is to change momentum, not share price momentum but the momentum of everything to do with a company including the time it takes for changes made by a company to take effect. As a result of the holding Appen I have appreciated having a watchlist and taking my time sitting on the sidelines waiting and watching. At some point the market might give you the opportunity you are looking for when the outlook and momentum becomes positive then is the time to buy. If this is at a higher price so be it, you will receive better returns due to reducing the risk of permanent capital loss from a poor decision. In many cases you could be picking up a company on the upswing from the lows, therefore, maximising returns.

- No clear buying plan was set out at the start. Potentially shows how important this step can be because it acts as a guide and limits the impulse buy due to changes/announcements. A strong justification would be required to change the original plan. I didn't write down any notes on the second parcel of shares bought, this purchase was just after the initial purchase in the same month and still before results! A buying plan is a must do in the process now.

- Buying a full position must be done over a decent amount of time, generally at least 6 months for longer-term holds. You went to a full position very quickly. This was always viewed as a long-term buy not a shorter-term trade. Therefore, there was no rush to create a full position so quickly. If I were following the new rules I have implemented, the losses would have been much lower. The importance of buying over time is that you learn more about the company over the time you own and watch the company. What you originally thought you knew about company changes and your conviction should change accordingly.

- In my original thesis notes it was time to sell if revenue after the initial covid impacts didn't return to 20%. While it was maybe fair to say covid impacts lasted longer than expected, if this exit point was followed more closely, my capital could have been saved.

- Hard and painful lessons learnt. Many of the points above have already been integrated into my processes and checklists to stop the same mistakes from occurring again.

- Market sediment/opinion does matter. It is not just about what your convictions and belief of the fundamentals are. You need to consider the market and not think you are smarter than it, to a point of course.

- When there is negative momentum and deteriorating fundamentals, it is better to just get out early and sit on the side-lines and if positivity of the story or momentum changes you can get back in. Holding because you see the potential for change or the long-term story being different isn't enough because it is too late when you find out you are wrong and capital is lost permanently. I have found when I have exited other failing positions it often provides me with better clarity as it reduces some of the bias you have when you hold a position.

- I was too confident in the turnaround story that really had no basis besides management saying things should get better but in reality, it was disappointment after disappointment.

- Conviction did decrease. I should consider a rule that this means cutting or trimming a position as a result. My concept is for long term holds, that over time of holding I should be becoming more confident and have a better understanding of the business. If you don't want to buy more (if you could with no consideration for portfolio weighting or available capital) then should you be selling.

- Just because you think a stock is cheap doesn't mean it won't get even cheaper! Appen is now an example of a stock where it was down 80% and halved from there! Ie down 90%! Luckily, I didn't get in at that point!

- Don't believe management words but the undertones of the message. When a downgrade is given it tends to end up worse. This was a great example of the need to not listen to closely to the positive messages of management, about how they plan for things to get better. Rather read the underlying message and take a cynical view of management comments.

Why Appen’s big problem is that it’s not a tech company OR Why Appen's caught in an identity crisis

Interesting article in the AFR today – "it is still a services business, not a technology business"

https://www.afr.com/technology/why-appen-s-big-problem-is-that-it-s-not-a-tech-company-20220526-p5aoun

Having just listened to this podcast it’s difficult to see the bull case for Appen any more. Others seemingly correctly pointed out that we have mostly tipped over the cusp where humans are required to teach AI I didn’t believe we had reached that point yet.

fascinating stuff

https://podcasts.apple.com/au/podcast/babbage-from-economist-radio/id508376907?i=1000565537282

Oh dear.

In a late-afternoon announcement Appen said: "This afternoon, Telus informed us that they were revoking their Indicative Proposal. No reasons were given."

This doesn't look good, as everyone will be asking why Telus backed out so quickly. On the other hand, Appen also said "No confidential information was provided to Telus" so presumably Telus doesn't have any more information than they did when then made the proposal. I'm not sure what to make of it, but the share price tomorrow is surely (?) going to take a beating.

At any rate, that's the definition of "non-binding".

Disc: held. (Why didn't I sell earlier today...?)

I went to sleep at the wheel on Appen and as a result it has continued to destroy value. It’s not a quality company and it’s getting worse.

Earnings have been flat for 3 years, and ROE is now less than 10% for 3 years. This (10%) is the most you could expect as a return if the business were valued appropriately. Future ROE based on analyst forecasts is not amazing either at 10%.

(Source: CommSec).

Analyst earnings forecasts aren’t shooting the lights either. At best, Earnings growth of 15% with a FY24 earnings estimate of 69 cps (Average of 7 Analysts, S&P Global. Simply Wall Street (SWS) data). Commsec FY24 earnings forecasts are less optimistic at 50 cps.

Margins are poor, Gross Margin 24% and Net Profit Margin 6.4% (SWS).

APX trades on an historical PE of 18 (CommSec) and a trailing 12 month PE of 22 (SWS). Forward PEG ratio is 1.5 is over 1, but OK.

Dividend is 1.4% with a payout ratio of approx 30%.

Insider activity: Richard Freudenstein bought $100,000 at $6.68 on 8 March 2022. He is ahead by 2cps, but I don’t think for long!

On the positive side Appen is debt free!

Valuation:

StockVal Method (see my Codan valuation for full explanation)

V = (APC/RR x RI + D)/RR x E

APC = Adopted performance criteria ( I use forward ROE) %

RR = required return %

RI = portion of APC reinvested

D = portion of APC paid as dividend

E = Equity per share

Assuming 10% forward ROE and a required return of 10% per year

V (APX) = (10/10 x 7 + 3)/10 x $3.18

= $3.18 (Nasty!)

Using a quick valuation using PE x E discounted by a required return of 10%

V = 18 x 60cps x 0.7 = $7.56 (based on historical PE)

However, I think a PE of 18 for a business growing at 15% and with a ROE of 10% is far too generous. I sometimes use an average of Earnings Growth and ROE to check if the PE used for a valuation is reasonable ( Rick’s Check! :) Unless Appen’s performance improves in coming years I can see it’s PE gravitating towards 12 or 15. It’s a very average business based on current and forecast performance.

Using a PE of 12, Appen would be valued at $5.00.

So, I’ve ended up with 3 values for Appen, $3.18, $5.00 and $7.56. If we averaged these the value would be $5.20. I think that’s reasonably generous given the ongoing deterioration in business quality. I think there are better opportunities elsewhere and today, with a little kick in the share price, I’m going to take a painful hit (Ouch!).

Lesson learnt - Stay awake at the wheel! :)

Lessons Learnt, Thesis Review and Comments on Appen

Some expensive lessons learned the hard way while holding Appen:

- There is no need to jump on a company just before results. Unless it is clear they will be positive. There was a highly likely possibility when I entered APX that results for FY20 could be negative and they were...

- So what did I do? Buy some more... If I liked it at $25, why wouldn't I like it at $18? Lesson learnt - don't catch the falling knife! Why enter a stock that has negative sediment and negative outlook on results even if I believe longer-term it is worth more than the current price? Things almost always normally get even worse before they get better. The negative momentum continues for much longer than you think. It makes it extremely hard to tell if you are wrong or it is just bad sediment is pushing the price down?

- This report should have been the time when I added Appen to the watchlist ready to jump in after the next report when they have two positive half-year results that match with the thesis. Expectations would have been reined in after a bit more knowledge watching the company. I think it will be an awfully long time before I see my original valuation of $32 again.

- It takes time for the turn around to happen... So why not wait for the actual turn around in case it doesn't come or takes too long?

- If most of the brokers are downgrading then good luck fighting that sediment... Brokers prices tend to be optimistic as well, so you got to take a factor off their target price. These are normally 1-year targets, so you must take some short-term pain as a minimum.

- One very strong positive day does not mean momentum has changed. Momentum changes over time, one day is just noise/reaction.

What has changed to my approach to investing as a result:

- Need to have positive momentum/sediment to make a purchase. There is no point buying otherwise. The positivity needs to be in the company’s results and the market sediment. I have been interested in buying Magellan (MFG) but haven't seen any positive news to even think about deep dive researching it yet. This has paid off as MFG is down significantly since I did a quick review to put it on the watchlist.

- In the book "Taming the Lion" by Richard Farleigh, he notes you should never buy unless the trend has begun, you may not get the lowest price but you have reduced the risk of loss as you are not fighting potential negative momentum. QAV's basic three-point trend-line is another example of this. I can't see a valid argument against this approach, yes, you may miss the maximum outcome but risk-to-reward ratio is swayed very strongly to the reward side comparatively. I am investing to make multi-bag returns. What's the issue with missing the first 10-20% to earn 200%+ and minimise potential losses on the way there?

- You need to sell if all signs are negative but still within the thesis. You can always jump back in. There was no guarantee 6 months ago the recovery may be starting in 2H as it did. When I have done this before with AVA, DUG, RBL it has been the right decision.

Onto the future of Appen and my holding:

The thesis for purchasing was based on Appen having 1-2 years of pain before re-joining the previous growth trajectory, not incorrect at this point but points out in hindsight how stupid it was to jump in at the point I did. The 2H result was positive with the resumption of growth, additionally the YTD revenue and booked work well ahead of the PCP. This is what I should have waited for.

Problem is, as I have learnt the lessons above, I have been holding APX shares. Do I sell out now when I see some positive company results which are aligned with my original thesis because the market sediment is still negative? I wouldn't be buying at the current point in time but it seems too cheap to sell and my thesis hasn't been proved wrong yet (the thesis revolved around picking up a downtrodden stock and holding long-term). Therefore, I will continue to hold but on a serious watch, ready to dump if any company results aren't positive.

In terms of the company, I still think Appen as a significant role to play in the AI space. Appen admits the big 5 tech giant's revenues will reduce proportionally over time. Management has a plan to diversify the business. Non-tech-giant companies (Boeing, Adobe, Siemens and Home Depot are examples of companies that use Appen's services) have unique data that will need to be labelled for their own applications of AI/ML, data-labelling as a service is Appen's core business.

AI/ML needs a high-quality training dataset, human verification of datasets must be a part of this loop to ensure accuracy. Without high quality data, as with all algorithms, rubbish in = rubbish out. For example, look at this meme video of Elon Musk promising self-driving cars every year since 2014, even with all the data collected so far by Tesla, they haven't produced a publicly available autonomous vehicle. AI/ML is hard to perfect!

I think the world is yet to discovery how many ways AI/ML can be used to improve productivity/profitability of businesses, the big tech giants have been integrating these systems for a while now but AI/ML is becoming a focus area of other enterprises, as shown by the large increases in AI/ML spending predicted into the future.

The "China" business (which is expanding into Japan and Korea) is a new high growth segment of the business which is performing well. The recent capex investments in new products, improving automation/productivity and restructuring do need to start showing results through increased revenue. The lack of capex previously was something missed in the initial thesis as a flag. Upon noticing this, I am not surprised over the past couple of years that growth slowed, compounded by COVID. Appen is in the innovation space so needs to continue to change over time, just like it has previously, moving away from its origins as a company that developed linguistic technologies.

FY21 Results Notes

General Notes

- Management aspirations for FY26:

- Double FY21 revenue.

- 1/3 Revenue from non-global customers.

- EBITDA margin of 20%.

- How management plans to meet above aspirations:

- Customer aligned organisation structure.

- Increasing investment in product and engineering to up to 10% of revenue.

- Team of data scientists to build and deploy machine learning models to pre-labelled training data.

- Quadrant unlocking point of interest market.

- Key financials:

- Revenue = $447.8m, up 8%.

- Statutory EBITDA = $72.9m, down 2%.

- Statutory NPAT = $28.5m, down 20%

- "Underlying" NPAT = $40.6m, down 10%.

- Dividend = 10c (AUD) - entire year. 50% franked

- Investment in product development of $30.2m.

- Use of underlying NPAT is roughly fair. Amortisation of acquisition-rated intangibles is a significant contributor to the difference between underlying and statutory results. $1.6m in restructure costs I would add back, companies are always restructuring.

- Underlying diluted EPS = 32.53c (US).

- Cash balance of $47.9m (no debt).

- "Free cash flow" (Operating activities - payments for intangibles - plant - lease) = 53.9 - 21.8 - 1.3 - 4.9 = $25.9m. Noting receivables are up $38m which may be the reason for the low number here but also contract assets down $21m, moved to receivables, therefore net $19m. Working capital increased $17.6m. Should see a pickup in operating cash flows next half.

- New customers included Salesforce, Boeing, Adobe and Bloomberg.

- New senior managers in 2H21: Chief Transformation Officer, SVP and GM of Enterprise, SVP and GM of Quadrant (Quadrant founder) and Chief Product Officer (from Microsoft). Good time for some change.

- Roadmap notes the expansion of the China business into Japan and Korea.

- Looking back at financials, Appen appears to have not spent much money on internal capex prior to 2019. Acquisitions was the main "capex" prior to 2019. This takes a few years to start filtering through. Development spend is: "increasing the range of products with more pre-labelled data sets, automated data labelling and model evaluation products".

- Product development is amortised over 3 years.

Positives

- 2H revenues were very strong compared to previous halves at $250m. Previous largest half was $212m. Global services revenue up 32% on 1H. Higher proportion of non-ad related projects.

- China revenue up 442% to $24.7m. This business is expanding into Japan and Korea.

- Revenue order book YTD plus orders in hand approx $190m this was $165m in PCP.

Negatives

- EBITDA guidance was missed and no guidance given. This doesn't provide any confidence to the market.

- Most risks in the risk section of the report make note of an increase or equal level or risk going forward. Not a positive sign for the future.

- Risks note increasing pressure from competitors.

Has the thesis been broken?

- On serious watch. Not a buy but not a sell yet based on thesis expecting weakness during COVID. Revenues need to start a strong upwards trajectory from here. See overall notes above.

- Note: there is no denying I might just by putting my head in the sand again...

Valuation

- Ongoing NPAT = $55m, PE target = 20, Cash = $66m. Price target = $9.48. Conservative PE ratio used due to previously very poor market sediment. If APX grows valuation can be rerated. All calculations in AUD.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Revenues must continue to increase and beat previous PCP.

- Cash flows increase to approximately match underlying NPAT (smoothing out over time required).

- Capex investments must start to show some improvements in terms of revenue and/or margins.

- Given Appen is capitalising the majority of the product development, EBITDA is not a fair measure of profitability going forward. Need to look at cash flows and profitability (NPAT/EBIT).

- Management "promises":

- Target of 35% growth from non-global customers.

Note all figures quoted in USD unless stated. Fiscal years are calendar years.

APX - Over and Out

First of all, a big shout out to my fellow members for the various notes and references which I have digested. As a long term investor, I am a reluctant seller, and resisted the desire to sell at the market opening yesterday after having listened to the investor call.

My valuation scenarios are $11.00 base with downside $9.00 and $17.00 upside, with none of the cases assuming a fundamental change to the business model and competitive positioning we are seeing now.

In all cases, I assume that automation of data-labelling grows progressively and over time captures the lion's share of the AI-data opportunity. However, I assume that a signficant and growing niche for manual labelling persists and that APX continues to develop its own limited automation capabilities.

In terms of revenue growth scenarios, I settled on 10% as a central case: established markets are stable at best and new market growth starts out at 25% from a low base and also matures over the decade, due to competition. (Evidence: yesterday's call cited autonomous driving in China as a new market, but based on the recent Tesla AI day, it will not take long for automation capability to reduce the opportunity here too.)

In essence, I believe APX has a place in using manual labelling enhanced with productivity tools to take on emergent and niche customer opportunities, particularly where those customers cannot access advance data-labelling tech and rely on manual data-labelling at the early stage and for validation. However, the more material of these project will warrant development of automation, which over time will become ubiquitous.

Yesterday's Q&A was not a pretty sight. CEO Mark Barayan seemed almost weary in defending the guidance on 2H21. The pattern of a strong 2H is well-established, and it sounds like they have got close to their customers and are confident in the revenue. But guidance for 2H21 is well beyond what has been achieved in the past. Success gets APX towards 10% growth longer term, which is my starting point. But it is unclear where the further upside and return to higher growth is coming from. I have no doubt that he has been beaten up a lot in the last 12 months from instos and Board. A final straw for me was the re-issuing of new guidance, and then in the same breath guiding towards the bottom of the new range. Surely, no-one can believe that the risk profile around H2 delivery is weighted so finely that you wouldn't put your target in the middle of the range? I consider there is too much pressure for another "miss" here.

A comment on my $9.00/$11.00/$17.00 scenarios- this doesn't mean the upside is asymmetric and that I should HOLD. These are more sensitivities in the modelling than true scenarios. I have not valued the scenario where the business model is broken (see some of the commentary from other Members) and we see lower growth and lower margins. You can create anything from $5-7 in that case, but I have chosen not to. I also did not seriously consider scenarios whereby APX invests significant capability in automated data labelling. It looks like that game is over and big tech has got their first.

I look forward to returning to this note in 12 months time, as I think we will learn a lot over that period. I am not sure I would have done much differently based on what I know today, but will review the lessons with time.

[DISC: Not Held.]

I exited APX this morning at $10.81. I first bought APX at $2.75 on 9/12/2016. Enjoyed the ride up and took profits along the way and lost some of the returns on the way back down. Overall, a c.100% return over 4.5 years, which is better than my portfolio average.

Margins like the share price are dropping right down

You might say this is just a one-off result,

But I'd say there is more competition in town,

So growth will be harder; it's not Appen's fault.

Here are some competitive threats taken from this article about Appen's business model.

-----

One trend to watch out for is the advent of projects like Snorkel, a Stanford University initiative started in just 2016, after Appen listed. It “set out to explore the radical idea that you could bring mathematical and systems structure to the messy and often entirely manual process of training data creation and management, starting by empowering users to programmatically label, build, and manage training data.”

Today, Snorkel, which explicitly seeks to reduce reliance on human contractor data labelling, is “used by many of the big names in the industry (Google, IBM, Intel),” according to this machine learning specialist. The 2019 version of Snorkel brought with it an improved capability to automate data labelling.

The point here is not that Appen is a bad company, but that the public narratives around Appen are inadequate to explain its recent results. We live in a world where market participants are variously incentivised not to dig too deeply into the weaknesses of the business models of high flying stocks. That is why you still see unquestioned claims that it is not possible to realistically automate the data labelling services that Appen provides.

And yet, if stock market researchers dared to delve beyond the confines of company presentations, they would see this is a problem that smart people are actively attacking. Appen is an expense for big tech; do you really think no-one will try to undercut them?

Data Labelling Can Be (Partially) Automated, At Appen’s Expense

The authors of this study state that “As machine learning models continue to increase in complexity, collecting large hand-labeled training sets has become one of the biggest roadblocks in practice. Instead, weaker forms of supervision that provide noisier but cheaper labels are often used…” Their goal is to improve the weaker, cheaper labelling techniques, and they conclude that “our approach leads to average gains of 20.2 points in accuracy over a traditional supervised approach, 6.8 points over a majority vote baseline, and 4.1 points over a previously proposed weak supervision method that models tasks separately.”

Oh, and by the way, those authors are the same people running Snorkel, you know, the data labelling tool used by Google and IBM.

But it gets worse than that for Appen. You see, when Facebook was just starting out with deep learning neural networks, every new project would have started from just about zero, in terms of labelled data. These days, “A procedure called ‘transfer learning’ takes a neural network trained on a vast data set and specializes it with a small supplement”, according to Alex Krizhevsky, one of the early proponents of neural networks.

Put simply, “Transfer learning allows us to deal with these scenarios by leveraging the already existing labeled data of some related task or domain”, and “Andrew Ng, chief scientist at Baidu and professor at Stanford, said during his widely popular NIPS 2016 tutorial that transfer learning will be — after supervised learning — the next driver of ML commercial success.”

Finally, we have the spectre of unsupervised learning. I’m not quite sure how this will impact need for fully supervised data labelling like Appen provides, but I’m sure it will reduce demand. Below, you can see Facebook’s CTO boasting about a recent advance in image segmentation, without data labelling. Clearly, here, the change is that Appen was not required, whereas its services (or a competitor’s) would previously have been needed to achieve the same result.

https://twitter.com/schrep/status/1388189398496202752

A report in the SMH today, a few hours old now - not great timing for Appen following a tough for days.

_______________________________________________

"Australian artificial intelligence company Appen has been hit by claims of racism in its recruitment processes after it asked job candidates to take a “paper bag test” about their skin colour.

A recruiter for Appen contacted Houston based Charné Graham to apply for a role as a social media evaluator at Appen. But after selecting ‘Black or African American’ from a drop down box on the online application she was then asked to select her complexion as Light - pale white, White- fair, Median - white to light brown, Olive - moderate brown, Brown - dark brown or Very dark brown to black."

https://www.smh.com.au/business/companies/paper-bag-test-artificial-intelligence-firm-appen-criticised-for-skin-colour-test-20210512-p57r5r.html

General Notes/Neutral outcome:

- Revenue up 12% to $600 mil. Relevance up 15% while speech & image down 10%.

- Underlying EBITDA $108.6m (+8%)

- 136 new customers.

- Guidance is positive with 18-28% growth but I don't think this is reliable.

- China and government are focus growth areas.

- 34% increase in projects with existing major customers. However, this is a result of a greater number of smaller projects.

- Company noted face-to face sales and customer engagement was down due to COVID restrictions. This is potentially critical to COVID recovery for Appen. They will be able to personally meet and sell their product again over the next year. Customers will be able to sell their product which uses Appen's datasets. To me this point is a strong reason as to why revenue has not matched previous expectations. The need to be physically present to make sales is underestimated in my opinion. Engagement will need to improve, I think this will happen naturally as companies can begin to reduce their focus on core business and look for opportunities.

Positive:

- Profit up 21.4% to $50.5mil

- Customer wins in the Q4 was strong after declining Q1-Q3.

- China growth.

- Around US$100m of ACV at the end of CY20. However, as of 1 Feb 2021 this had risen to $124.4mil. Is this customers moving to committed revenue over projects or a bullish sign for H1CY21?

- Relevance is the main driver of the business.

- Strong employee engagement.

- Overall cash flow positive with $78.4 mil cash on hand and no debt. Important to make it through the current downturn.

- Cash flow from operating activities up 39% to $93.5mil

Negatives:

- Revenue growth below long-term requirement for thesis.

- Speech & image is going backwards and growth isn't as spectacular as relevance. Still producing positive EBITDA.

- Appen now quoting annual growth rate of AI industry at 24%, I think this figure was previously 28%.

- Brokers downgrading due to the poor result causing downward price action.

- Current figures for revenue so far might be a bit weak. Purposefully hazy on year-to-date revenue whether its better or worse I can’t tell?

Has the thesis been broken?

- No, thesis was based on purchasing Appen at a weak point. The thesis requires growth to restart over the next 1-2 years. Will need to see signs of improvement over the next year.

- Thesis is based on this point in time being a temporary stall rather than a negative inflection point. If a negative inflection point (lower growth in revenue/profitability) becomes evident = sell.

Appen at current prices appears to be a great opportunity with strong tailwinds behind it for at least the next 10 years. AI is one of Ark Invest's 5 innovative disruptive technologies. However, the investment case requires continual growth at 25%+ which will taper down to 20% by 2030. These are large numbers for a company already creating $500+ million in revenue.

Appen has a nice segment of the market. I found a figure that projects AI data will be 10% of all AI spending. Given Appen only has one other major competitor that I can find this gives Appen the opportunity to realise the revenue figures quoted above.

Customer value proposition:

Appen's value proposition to it's customers is the removal of project risks and provides price certainty. AI requires large and accurate datasets to train AI. For the customer to collect, process and use the data this expands the internal scope of the project. Questions customers have to ask themselves is: how many people to hire, who are the experts and how to hire them short time, what to do with them after collecting the data if it is a short project, how many working hours are required, do we have the correct systems to create and store the data, will we do this right? By purchasing the AI training data from Appen, all of these risks are removed and the cost is known at the start. The time saving alone could be well worth it in the fast moving tech world. To use the popular jargon I see Appen as an "AI data/training as a service or AI data/training on demand" company.

Positives:

- Appen is a growth company that is strong cashflow positive and profitable.

- Net cash

- Strong momentum with growing revenues and profitability. 5 year ROE = 21% CAGR

- "Picks and shovels of AI"

- Management has significant skin in the game:

- Chairman (founder) owns 7.61%

- CEO and Bill Pulver have high 7 figures of wealth in the company (at current prices)

- All other directors have at least $1m invested

- MD pay in comparison to other companies:

- Base salary is 8th percentile

- STI is 33rd percentile

- LIT is 80th percentile

- Show me the incentive I'll show you the outcome... MD is paid lower for short term and higher for long term outcomes when compared to other similar companies.

- Unless the case was for a strong bear case. I am yet to see a price estimate or valuation under $20. No sell analyst ratings only buy and hold.

- Strong network effect having built up over 1 million workers to assist in the processing of data. This would take time to reproduce.

- China expansion with strong protections of Appen IP ensured. This part of the business is only just getting started. China doesn't appear far of the US in terms of AI tech. A potential area for even more growth.

- Long term chart - bottom left to top right. Any graph of revenue, profits, cash flows is the same. A great indictor of a company that exceeds in my view. Winners keep winning.

- AI datasets need continued training. Over time the dataset is outdated or degrades.

- Price appears to have a strong floor at around $20-22 since Feb 19. Dipped well below a long term 3 point trend line (on log scale).

- Industry growth expected to be around 28% a year.

Negatives:

- Concentration of customers - Top 5 clients provide 88% of revenues.

- Increasing AUD/USD will reduce profitability

- Recent announcements of weak figures. Is this a one off?

Risks:

- Big tech giants take AI data work in house due to the amount of data they require it may become more economical or this puts pressure on margins.

- Growth stops and is not as strong as predicted.

- I can't find many negative reports on Appen therefore research and thesis could be based on confirmation bias.

- Current figures are weak. Company says this is COVID related. What if this is not a one off as widely believed.

- My figures are way to optimisitic.

- Losses to other competitors.

When to get out:

- When growth stops or significantly reduced.

- Share prices in significant gains for a long time and doesn't discount any risk.

- Margins are reduced causing a substantial change in valuation that no longer justifies the risk. Appen has had margins in a tight range historically.

Expected outcomes:

- 30% Worst case - growth stops and Appen can only maintain profitability at current levels. No future growth from here. I use this as a base case given the expected growth in field. PE of 15 + cash = $8.6 per share

- 60% Expectated outcome - 2030 PE of 30, Revenue growth 25% from 2021 to 2025 then taper to 20%. NPAT = 11% and discounted back at 15% = $32.44 per share.

- 10% Best case: Same as above but 30% p.a revenue growth for every year to 2030. $82 per share.

- Overall approximately a 60% downside risk for a 10 year return in the order of 20% p.a. compounding. Target price based on probabilities = $30.22

I see Appen as a strong "value" growth buy. I have been sitting on the fence due to the weak EBITDA expectation. Why only release the expected EBITDA figure? Are the revenue and profit figures worse? I understand the companies explanation. At a granular level my guess is teams are all working from home in the US and its probably getting to the point where teamwork is dropping off and new projects are less important than keeping to your known strengths.

I will be looking to buy in small chucks to build a position given the current outlook but don't won't hold off if others start to realise the value I see here.

I would be very interested in a forum conversation with anyone who would like to point out what I have got wrong with this thesis! As mentioned I couldn't find many negatives...

Re APX my read is that anyone who listened to the company's last call would not be too surprised at the downgrade. IMO the last call had quite a few caveats, MD was quite cautious, APX do not have significant visability on sales and although the US stock market is booming C19 is still impacting normal activity. i sold APX a little while ago with the strategy to see if we get a pre xmas downgrade then reass for potential re-entry. i think APX still has a growth pathway, a coupe of brokers still o/w, one upgdraed to o/w on this call. Likely Relevance will be irreleavnt (excuse the pun) one day, but not yet. my best guess at this stage is buy around $24-5. DYOR this is not advice.