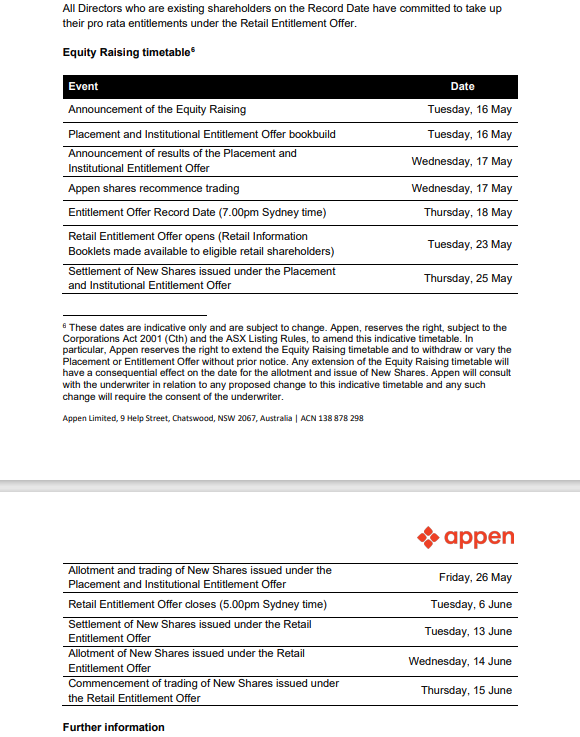

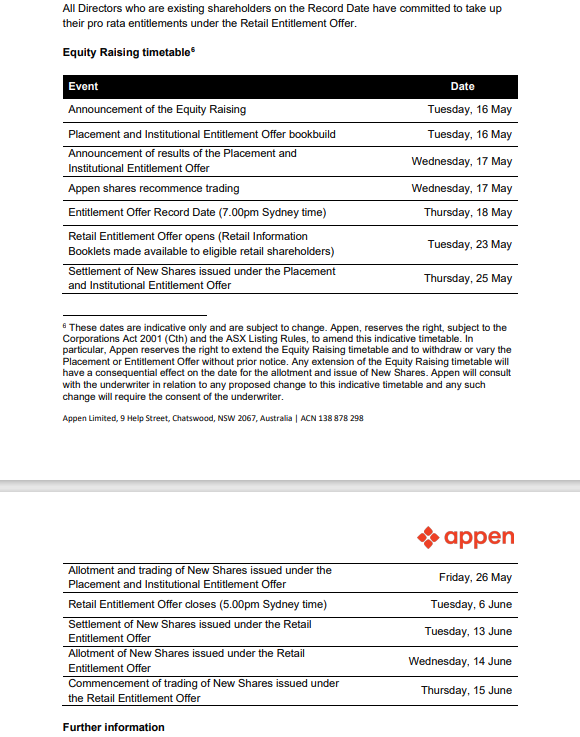

Entitlement Offer Record Date (7.00pm Sydney time) Thursday, 18 May

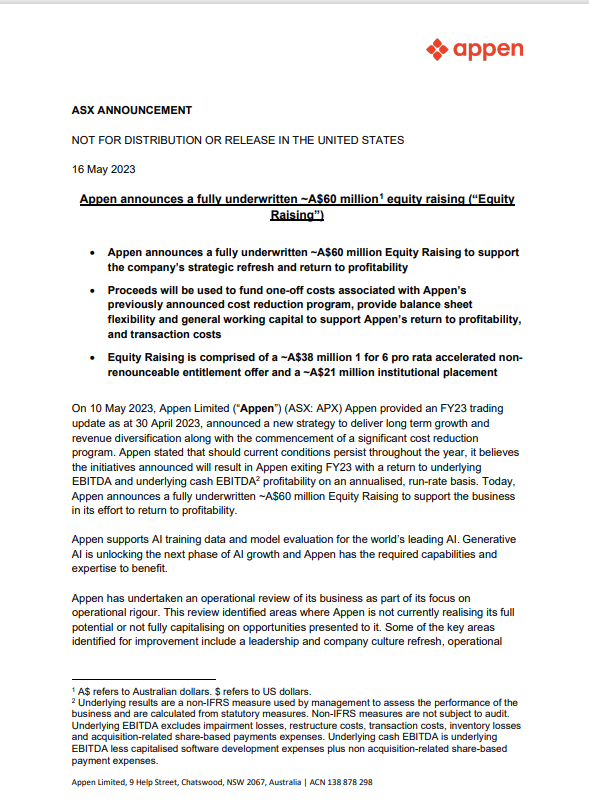

The strategy refresh will address four key focus areas:

1. Customer diversification – generative AI expected to create material demand beyond large tech customers

2. Margin improvement – greater reliance on technology to improve gross margins

3. Revenue visibility – new products to have a greater proportion of recurring revenue

4. Strong ROI – generative AI investments will leverage existing technology investments Further detail on Appen’s strategy refresh will be provided at the Appen Investor Technology Day which will take place after the AGM on 26 May 2023.

Equity Raising The Equity Raising will consist of an offer of fully paid ordinary shares (“New Shares”) through: • A 1 for 6 pro rata accelerated non-renounceable entitlement offer (“Entitlement Offer”) to existing eligible shareholders to raise ~A$38 million; and

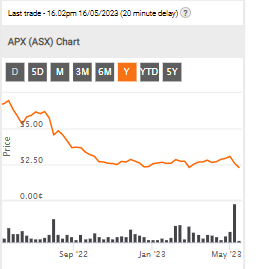

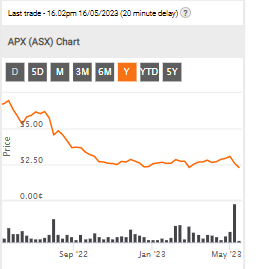

• An institutional placement (“Placement”) to raise ~A$21 million. The Equity Raising price of A$1.85 per share represents a: • 16.2% discount to the theoretical ex-rights price of A$2.21 (“TERP”)5

• 19.6% discount to Appen’s last closing price of A$2.30 on 15 May 2023. Approximately 32.2 million New Shares will be issued under the Equity Raising, representing ~26% of Appen’s existing shares on issue.