03-July-2023: Things can look different depending on your point of view. For instance, this looks sort-of bullish:

And then Appen released this: 10-May-2023: Trading-update,-cost-reduction-program-and-strategy-refresh.PDF

Which confirmed they were running at a loss - i.e. no longer profitable, but they had a plan. A plan to return themselves to profitability. But it would cost money and take time.

So, on that day (10-May-2023), the APX share price (SP) drops -90c (-28.2%).

Then we get these announcements:

16-May-2023: Appen-announces-fully-underwritten-A$60m-equity-raising.PDF

26-May-2023: 2023-Annual-General-Meeting---Chair's-Address.PDF

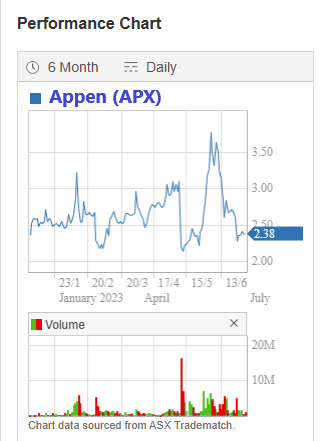

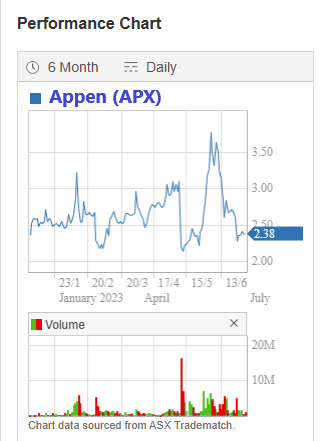

From the 26th May to the 2nd June, the APX SP rose from $2.42/share to $3.76/share, a rise of +55.37% in one week, so now their chart looks like this:

VERY bullish - who wouldn't jump on that ride? Well, anyone who had followed the company for a few years would probably be a bit wary, but for those trend-followers who don't care about fundamentals or management, it might well look enticing.

And then this happens:

09-June-2023: Completion-of-Retail-Entitlement-Offer.PDF

And the underwriters, who were left with 45% of the retail entitlement offer started selling, and the usual shorter suspects began to lodge "Substantial Holder" notices, and Appens' CFO, appointed on May 1st (see here: Helen-Johnson-appointed-Chief-Financial-Officer.PDF) announces she is quitting that role ("for personal reasons") on June 26th:

Departure-of-CFO-and-appointment-of-Deputy-CFO.PDF

So their latest CFO lasted just 8 weeks.

And the 6 month graph, up until today, looks like this:

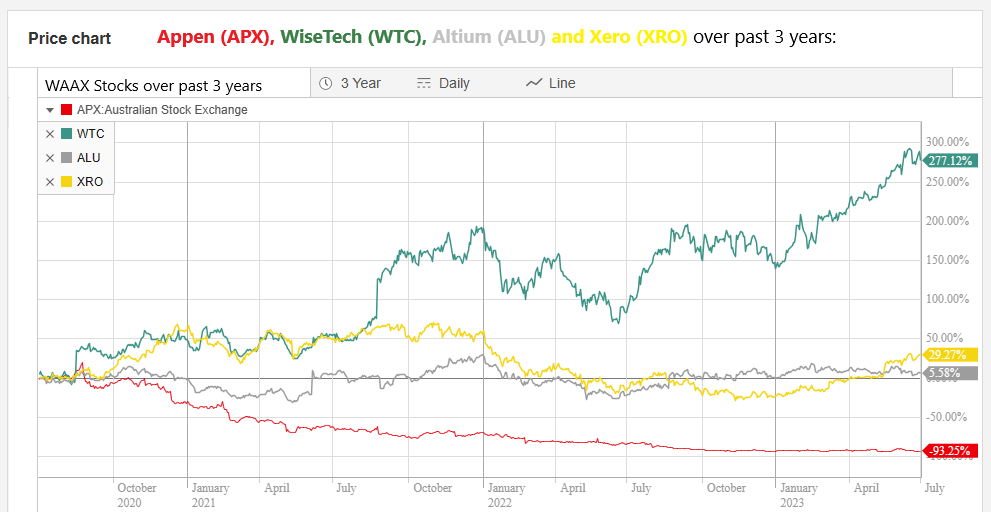

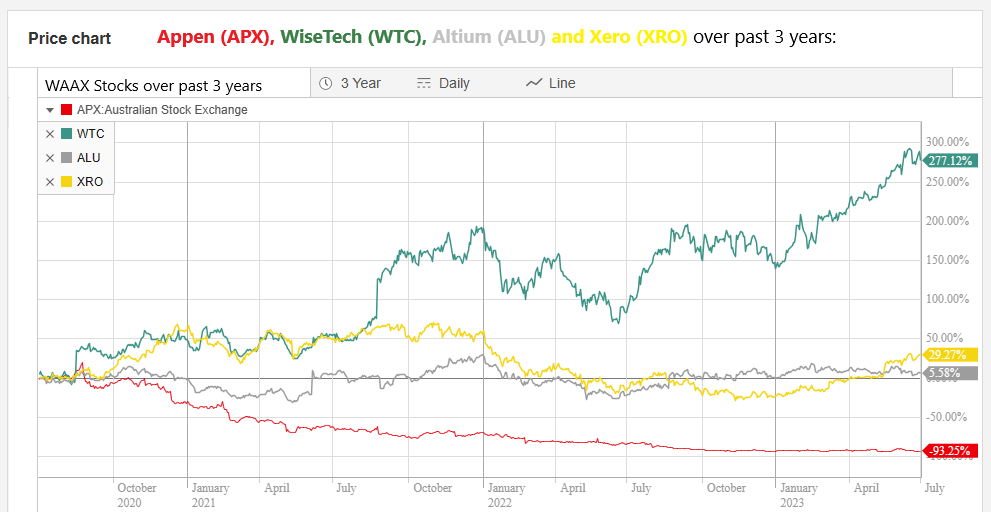

That's the thing about Appen. Every rally is followed by a fall back down. Have a look at their 3 year chart:

Not pretty. Sometimes you need to zoom out and look at the bigger picture. This is a business in serious decline. Apart from short term trading, which just might be profitable if you time it right, Appen is a company I would completely avoid, no matter what they announce.

Here is the 3 year chart of WiseTech (WTC):

Now that's the sort of company you want to be invested in. Like Appen, WiseTech also have a volatile share price. The WTC SP has plenty of drawdowns. But the overall trend is up. So far, WTC have weathered every storm, including a public attack by a US shorting firm, and they just keep heading north east at a decent clip, over time.

Appen, not so much.

What have Wisetech and Appen got in common? Well, remember WAAAX? It was our almost pitiful version of the US' FAANG stocks. FAANG is now MAMAA, which is an acronym for the top five tech stocks listed in the US. Together, they have a total market capitalisation of around US$10 Trillion (or they did in January 2022) and carry an approximate 21% weight in the S&P 500 index (again, that was in Jan, 2022). MAMAA are Meta Platforms (Meta, formerly Facebook), Alphabet (formerly Google), Microsoft, Amazon, and Apple. This acronym was coined as a replacement for FAANG after Facebook changed its name to Meta Platforms, and Google had become Alphabet, and Netflix was thought to be ex-growth after their share price fell by over 70% from around $690 in mid-November 2021 down to around $190/share in late June 2022. Unlike Appen, Netflix did bounce, and it doesn't seem like a dead cat bounce...

So WAAAX was once Wisetech, Appen, Altium, Afterpay and Xero. Then Afterpay got swallowed up by Square and Square became Block, and it isn't an Aussie company now. So, we have WAAX with two As instead of three As. But there's a bloody good argument that it should be just the one A, which would be Altium, because Appen isn't really even a tech stock, they are more of a labour hire company for data input (such as tagging images to assist machine learning), and they're definitely not a growth stock. Here's the past 3 years, with the share prices of Appen, Wisetech, Altium and Xero from the same common starting point.

Big difference between the best and worst there. Of course they don't compare to the FAANGs/MAMAAs of the USA, as they are HEAPS smaller, and together they represent a very small percentage of our All Ords Index (our equivalent to the S&P500 over in the US). The USA's Tech (or "IT" sector) is their largest sector, and it's one of our smallest. Our largest sectors are Materials (Miners) and Financials (Banks).

I maintain that Appen has no place as a WAAX company, or any place in the portfolio of any serious investor who is prepared to do even a small amount of research before buying shares. They are going lower, or they are going broke, probably both, in that order.

They often have a nice bounce (such as that +55% rise in one week recently, as explained above), but because they're coming off SUCH a LOW BASE now, these percentages are almost meaningless, as the 3 year graph clearly shows.

It's all about proper perspective.

Unless you're in them for a short-term trade (and history would suggest the shorter the better), there wouldn't be a barge pole long enough.