Is there a deep value play hiding in CTI Logistics (ASX:CLX)? I think there is.

So CLX advised yesterday that PBT is expected to be in the realm of $23m. Which is marginally better than H1 and approximately 25% up on the PCP. Not bad.

Let's thumb suck a number of NPAT and apply a 30% tax rate to PBT = $16.1 NPAT (roughly).

CLX has seen a decent run in the last ~5 days in the lead up and following the announcement, but based off current MC ($130m), this puts it on a PE of about 8(ish). Also not bad, especially with a touch of growth. Oh and a dividend of approximately 6-7%.

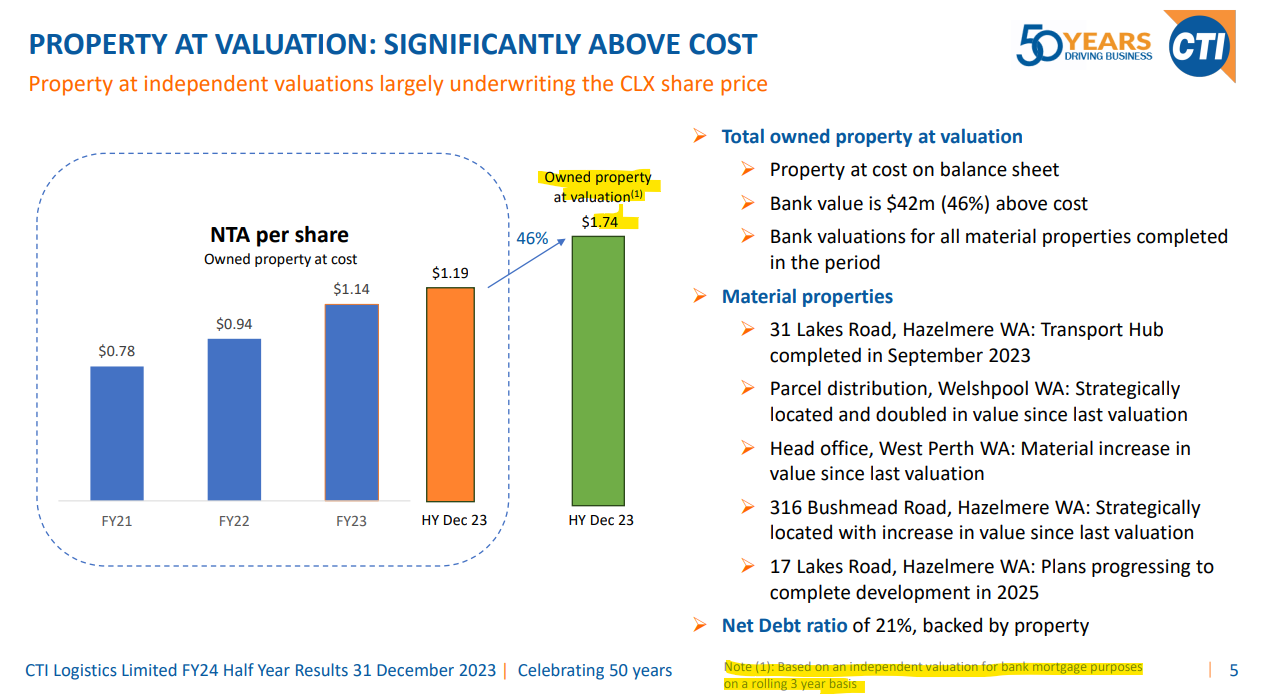

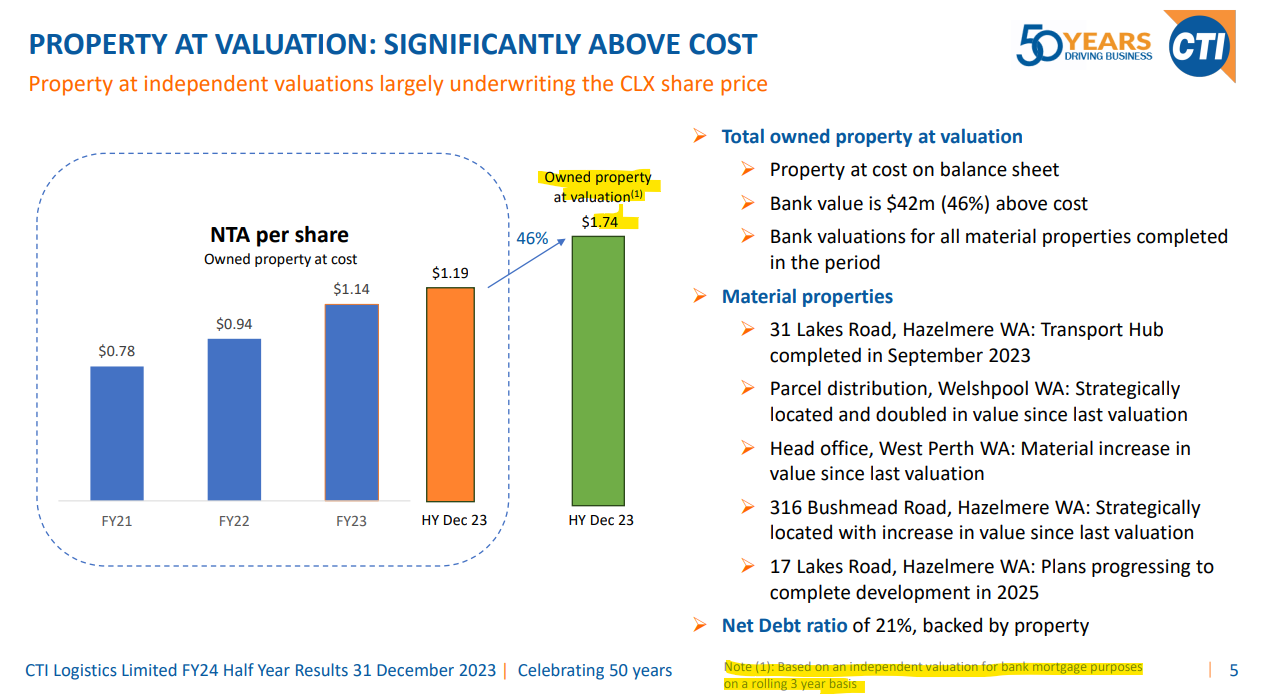

Here's a curveball to throw into the mix - looking through their Market Presentation for their FY24 Half results you will see that their property is valued at $1.74/share.

So it appears there is a floor here which could limit downside risk in the short to medium term - appear to be getting the actual business for nothing which is pretty decent given the complexity of logistics.

Main question here is how do they realise this value in the property business? Is it a takeover target? Will they look to sell some of their properties? Unlikely that much will change given the long-term leadership and management team. Which brings me to my next point.

Insider ownership? Sitting at approximately 49%. With Founder and Executive Chairman David Watson holding roughly 32% of the business. Definitely aligned. Other Joint MD's (interesting), Bruce Saxild and David Mellor hold roughly 7% between them.

Bit of a lobster pot yes, which shouldn't bother most in this forum. Other consideration as well is the management risk with David Watson probably closing in on Golden Years and may want to exit? Which then increases the likelihood of a takeover IMO.

Genuinely didn't know much about the company before 7am WA time today, so this is purely based off a 30-minute assessment. No position, however taking a bite at current levels on SM. Keen to hear from others on their thoughts of the business. Please feel free to provide feedback on the above, or if I have missed anything.