Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Is there a deep value play hiding in CTI Logistics (ASX:CLX)? I think there is.

So CLX advised yesterday that PBT is expected to be in the realm of $23m. Which is marginally better than H1 and approximately 25% up on the PCP. Not bad.

Let's thumb suck a number of NPAT and apply a 30% tax rate to PBT = $16.1 NPAT (roughly).

CLX has seen a decent run in the last ~5 days in the lead up and following the announcement, but based off current MC ($130m), this puts it on a PE of about 8(ish). Also not bad, especially with a touch of growth. Oh and a dividend of approximately 6-7%.

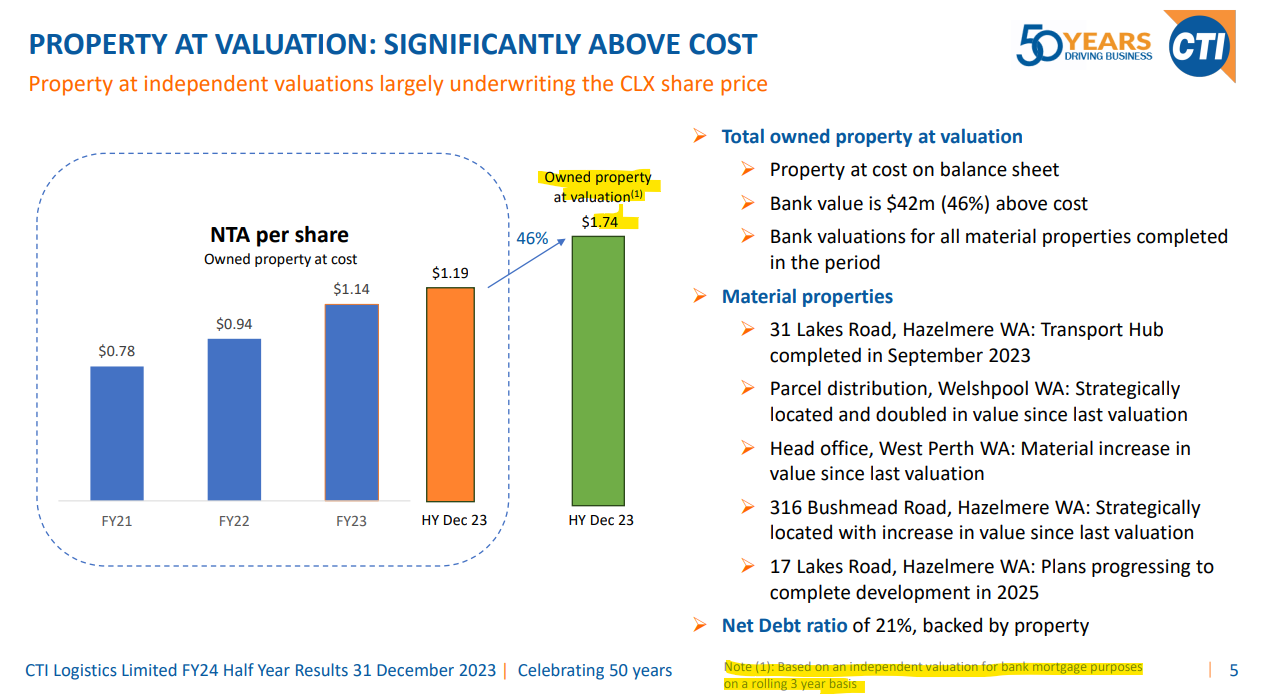

Here's a curveball to throw into the mix - looking through their Market Presentation for their FY24 Half results you will see that their property is valued at $1.74/share.

So it appears there is a floor here which could limit downside risk in the short to medium term - appear to be getting the actual business for nothing which is pretty decent given the complexity of logistics.

Main question here is how do they realise this value in the property business? Is it a takeover target? Will they look to sell some of their properties? Unlikely that much will change given the long-term leadership and management team. Which brings me to my next point.

Insider ownership? Sitting at approximately 49%. With Founder and Executive Chairman David Watson holding roughly 32% of the business. Definitely aligned. Other Joint MD's (interesting), Bruce Saxild and David Mellor hold roughly 7% between them.

Bit of a lobster pot yes, which shouldn't bother most in this forum. Other consideration as well is the management risk with David Watson probably closing in on Golden Years and may want to exit? Which then increases the likelihood of a takeover IMO.

Genuinely didn't know much about the company before 7am WA time today, so this is purely based off a 30-minute assessment. No position, however taking a bite at current levels on SM. Keen to hear from others on their thoughts of the business. Please feel free to provide feedback on the above, or if I have missed anything.

Bull case? Interested in the community's thought's on this one? Looks to be growing, market cap of $102m reflects net asset value with FY22 NPAT of $15m. Seems to have a lot of property on balance sheet, which makes me think could be an interesting asset play? Any one else looking at this?

31-August-2021: Euroz Hartleys have downgraded CTI Logistics (CLX) from a "Spec Buy" to a "Hold" and maintained their $0.94/share PT. For the update from their analyst, Seth Lizee, check out the attachment.

Brief Extract:

"We have updated our forecasts post these results; We maintain our $0.94/sh Price Target, however, in light of negative earnings momentum in the short term we have downgrade our recommendation to a Hold. We view the key risk to our recommendation being continued abnormal operating conditions, which could generate positive earnings momentum in the short term."

Disclosure: I do not hold CLX shares.

02-Mar-2021: Euroz Hartleys: CTI Logistics Ltd (CLX): Mighty 1H Results

Analyst: Seth Lizee - Associate Research Analyst, +61 8 9488 1414

Recommendation: Speculative Buy, Price Target: $0.94/sh (up from $0.85/sh)

Mighty 1H Results

Investment case

CTI reported robust 1H results, delivering $17.8m in underlying EBITDA, exceeding our forecasts. This beat is mostly the result of stronger than expected margins in the transport and logistics segments. We continue to look towards a softer second half (EBITDA), in line with a traditional 55/45 split, however with upgraded full year earnings expectations. Nevertheless, we maintain our view of margins normalising in FY’22 and beyond in anticipation of abnormal COVID-19 operating conditions easing. As a result of these improvements we have upgraded our Valuation and Price Target.

Our investment case is predicated on CTI driving earnings growth through organic growth, operational efficiencies, and maximising asset utilisation. We believe if CTI can deliver on our earnings forecasts that the stock can trade up.

We maintain our Speculative Buy recommendation with an updated $0.94/sh. Price Target

Key points

- Financial highlights:

- $118.6m Revenue (+8.0% pcp)

- $19.8m Reported EBITDA (+75% pcp)

- $17.8m Norm. EBITDA (vs. $16.7m ESHL Estimate)

- $5.2m NPAT (+297% pcp)

- $3.5m Norm. NPAT

- Strong operating conditions broadly the result of continued growing demand for transport and logistics services across Australia

- CTI received $1.3m in JobKeeper during the H

- NTA increased 12.3% HoH to 73.1cps (from 65.1cps)

- 70.6cps Fully diluted (+12% HoH)

- CTI has declared a 2.0c fully franked dividend for the H (vs. previous 2.0cps FY’21 EHSL forecasts)

- Reduced net debt by $7.9m to $28.7m (ex. Lease liabilities), finished the H with:

- $6.3m Cash

- $35.0m Borrowing

- We maintain our Speculative Buy recommendation with an updated $0.94/sh. Price Target.

CTI Logistics Ltd, Year End: 30 June

- Share Price: 0.83 A$/sh (0.85 on 1-Apr-2021)

- Price Target: 0.94 A$/sh

- Valuation (DCF): 1.17 A$/sh

- WACC: 10.0%

- Terminal Growth: 2.5%

- Shares on issue: 78 m, diluted

- Market Capitalisation: 64.5 A$m

- Enterprise Value: 154.3 A$m

- Cash (1H): 6.3 A$m

- Debt (inc. Lease liab.): 96.1 A$m

Click on the link at the top for the full report, or open the attached file below.

30-Nov-2020: Euroz Hartleys Securities: CTI Logistics Limited (CLX): Speculative Buy - Initiation of Coverage

Analyst: Seth Lizee, Recommendation: Speculative Buy

- Share Price 0.75 A$/sh

- Price Target: 0.85 A$/sh

- Valuation (DCF): 1.07 A$/sh

- WACC: 10.0%

- Terminal Growth: 2.5%

- Shares on issue: 78 m, diluted

- Market Capitalisation: 58.3 A$m

- Enterprise Value 152.5 A$m

- Cash: 7.6 A$m

- Debt (inc. Lease liab.): 101.8 A$m

Initiation of Coverage

Investment case

CTI Logistics Ltd (“CTI”) is a Perth based transport and logistics company with a large WA exposure and a wider national presence. The company’s various brands provide everything from couriers and taxi trucks to warehousing and distribution solutions.

Our investment case is predicated on CTI driving earnings growth through organic growth, operational efficiencies, and maximising asset utilisation. We believe if CTI can deliver on our earnings forecasts that the stock can trade up.

We Initiate coverage of CTI Logistics Ltd with a Speculative Buy recommendation and $0.85/sh. Price Target, implying 13% upside.

Key points

- Earnings Growth – We are forecasting ~$3.0m in NPAT in 2021, a material step-up from $0.8m (adj. NPAT) in 2020. On balance we are expecting a flat 2022, however we forecast continued growth in 2023 and beyond. We see considerable earnings potential in the business, we believe management can achieve this through organic growth opportunities, greater efficiencies, and maximising asset utilisation.

- Leverage to WA Recovery – CTIs overweight exposure to WA leverages the business to an economic recovery in the state. Although, recent recovery turnaround was delayed as a result of COVID-19, we remain optimistic of positive operating conditions beyond the pandemic.

- Fixed Asset Backing –CTI has a 0.63/sh. NTA, this is supported by $0.87/sh (book value) in property and building assets held on the balance sheet. We view this fixed asset backing as backstop in the company’s value and share price. CTI trades at a minor premium to its NTA, although still below longer term levels.

- Discount to Valuation – CTI trades at a 12% discount to our $0.85/ sh. valuation. We believe our equally blended discount cash flow (DCF) valuation and NTA captures both the lower bounds of CTIs value, underpinned by hard property assets, whilst accounting for the longer-term value potential of the business.

--- click on the link at the top to view the full Euroz Hartleys initiation of coverage report on CTI (CLX) ---