Recently I looked at Waterco as there seems to be lots of news about clean water becoming more important as populations grow.

Although there is some details about commercial products on their website and recent acquisition about Davey, unfortunately there is not much detail about long term strategy such as expanding into new verticals outside of the swimming pool and leisure sector. There is a comment on new markets but that can mean just opening new distribution channels for pool products somewhere in Asia which Waterco are doing.

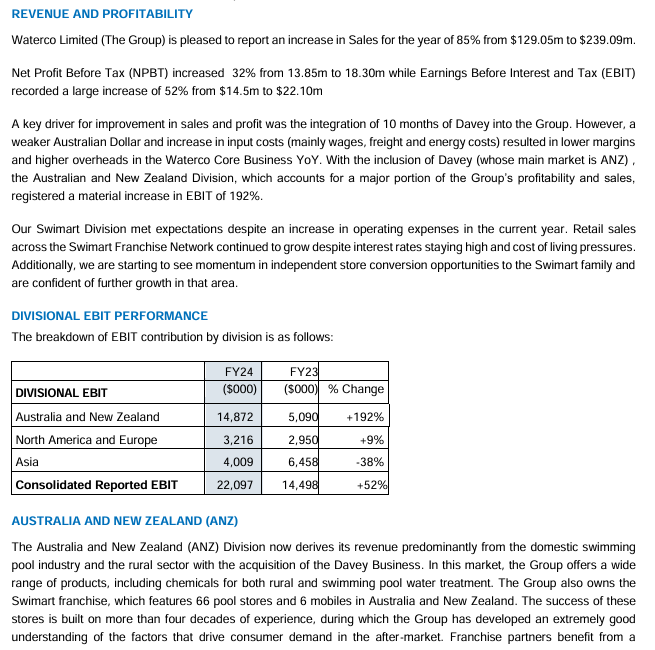

And the emphasis of pools is everywhere in this report so am a bit disappointed that they don't understand the "water theme" very well. You can see for yourself in the commentary.

I know I'm being a bit vague about the whole "water theme" but that is because I am still doing some research. For some clues, have a read of the Xylem sustainability reports and then work backwards from there and see if what they write could form an investment thesis.

Meanwhile the thought of finding a water company listed on the ASX (excluding Vysarn) that does not look at just water treatment or pool products goes begging. Even Rubicon water which listed recently can't get any traction.

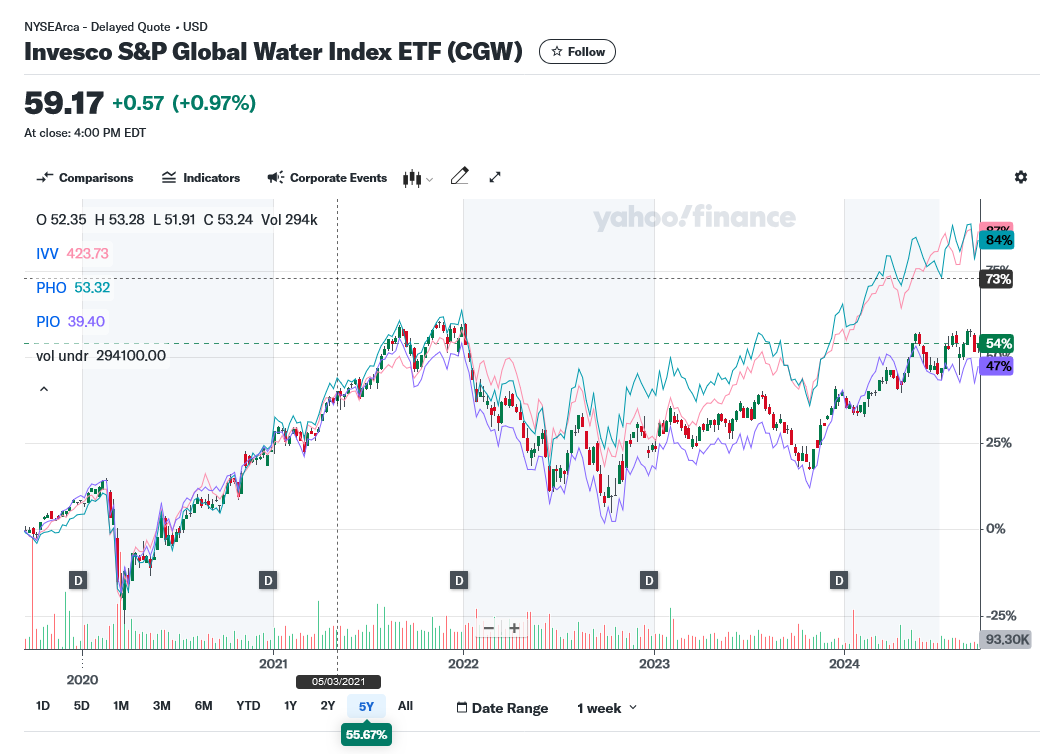

Finally, I'm also annoyed about is the lack of access to ETFs investing in water companies on the ASX as well although none of them can perform better than IVV (SP500 index). They can only be traded on the US market.

Meanwhile I'll give Waterco a pass until they can figure out what to do other than buybacks or dividends.