Summary

Following $ACAD 2Q Results in Aug and recent conference presentations in September also by $ACAD, I have firmed up on my recent valuation ($24, $12-$46), and am getting more comfortable with the future US sales trajectory for DAYBUE.

As a result, I've added back most of the shares I sold in May at yesterday's price, which I consider a bargain.

I consider that today the market is offering $NEU on a "two for the price of one" basis, ... or thereabouts.

Context

With all the focus on ASX reporting over recent weeks, I’m only now catching up with some of the wider research opportunities in my portfolio. One area I am giving some focus is $NEU. I’ll not repeat information here from earlier straws and posts, but in summary, this business has two important things going on:

1) DAYBUE being sold under licence by $ACAD in the US, with work underway to gain approval in Canada (likely end-24/early-25) and EU & Japan (approvals likely only in 2026+)

2) NNZ-2591 has completed Phase 2 studies in three neurological conditions, with an end of Phase 2 meeting with the FDA for Phelan-McDermid syndrome due this month. (This is likely the first indication to advance to Phase 3, given the US market potential of 17,000-32,000 patients. While there's still clincal development risk, it's potentially much bigger than DAYBUE)

We’ve covered NNZ-2591 in other recent straws/posts. My focus here is to consider my view on DAYBUE in the light of recent communications from $ACAD, including over the Summer Conference season in the US.

I’ve given a rough valuation of $NEU as $24.00. Being $16.00 due to DAYBUE and $16.00 due to NNZ-2591, risked at 50%. In my normal way of presenting valuations, I have this down as $24 ($12-$46).

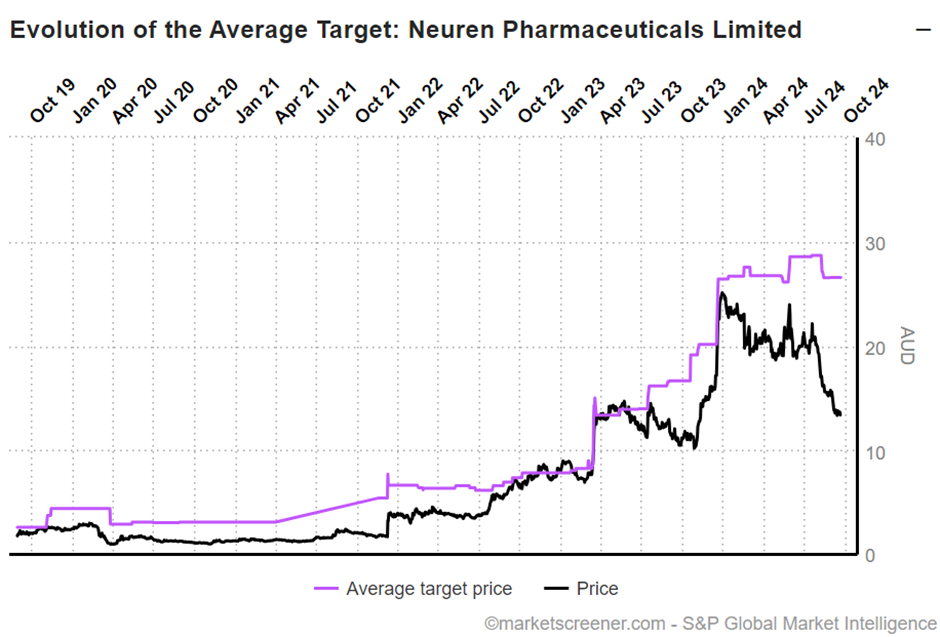

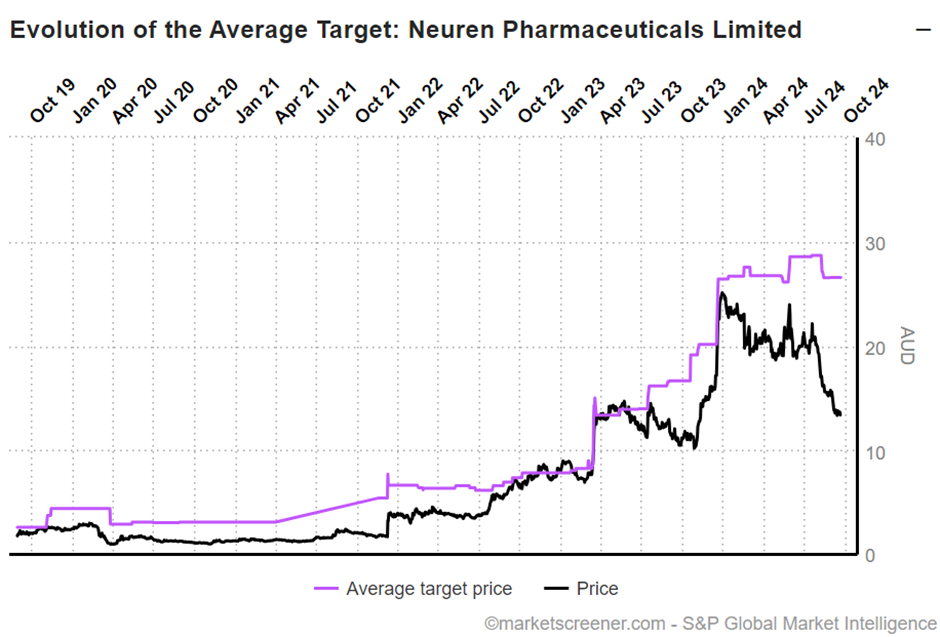

This compares with analyst views of $26.56 ($22.90 - $29.90, n=6).

This picture below shows the SP progression relative to the consensus view, which suffered a modest downgrade in August, due to $ACAD downgrading guidance for 2024 DAYBUE sales.

So, we all know that momentum players in the market hate downgrade cycles, and so a very large gap has opened up between valuations of the business and the SP.

Hence the title of this straw: I view that with $NEU you are essentially getting a DAYBUE business (which I see as worth $16) and a success case for NNZ-2591 (which I see as worth $16 unrisked) for $13.59 at the time of writing. The analysts agree – two for the price of one!

The reason I sold down 1/3rd of my RL holding in $NEU on 15-May was that I was concerned about the 1Q report from $ACAD. According to my model, $ACAD were never going to hit 2024 guidance for DAYBUE, and I didn’t buy the offered story about a harsh winter causing clinics to shut down. But as importantly, I became suspicious of management – having prematurely offered annual guidance, and then spinning a 1Q story and acting as though things were on track for the year.

Roll forward to the 2Q report in August. While sales began to recover, guidance was indeed finally lowered, and that pushed many ASX shareholders into a funk with shares sliding from c. $18 to $13-$14.

To put this in context, you can buy $NEU today for less that you could at the launch of DAYBUE, which pre-dated the stream of positive newsflow on NNZ-2591.

So, What Can We Say About DAYBUE?

Having gone back over the $ACAD 2Q Results call (8-Aug), the Morgan Stanley Healthcare Conference (4-Sept) and the Baird Conference (11-Sept), I have firmed up my view on what is happening with DAYBUE. (BTW, recordings of both conferences are accessible on the $ACAD website.)

It is now clear to me that what happened following the launch of DAYBUE: $ACAD were completely surprised by the demand in the first 5-6 months. In retrospect, this should not have been surprising. Rett Syndrome is a very challenging condition, and there is a strong global Rett community. With no pre-existing treatments on the market, there is a well-established specialist support network via Rett Centres of Excellence that support about 25% of US Rett patients. Highly motivated patients, including the parents of sufferers who carry the burden of care, quickly accessed their HCPs requesting the product as soon as it was launched.

This drove strong initial sales in Q3 and Q4 2023, and it led $ACAD to prematurely issue what now turns out to be overly-optimistic guidance (… which was clear to me as early as May).

But as we know, DAYBUE is not well tolerated by many patients. So Q1 and Q2 2024 saw two things happen. 1) The initial “surge” from "c. 25%" of the potential market subsided and 2) discontinuations from this initial “bolus” swamped new patient adds. Aaaaah! DAYBUE has stopped growing! Sell!

This complex dynamic made the interpretation of data from Q2 very challenging. But as a new normal in net patient adds began to establish itself, $ACAD were able to reset 2024 guidance to a more realistic level.

Why Am I So Interested in What $ACAD have been saying in September?

With the “panic spin” of the 2023/24 winter behind us, I have been forensically examining $ACAD's statements throughout September, to test them against what was said in August. I can bring myself to overlook what I consider as “Winter Spin” because, indeed, the dynamic – while easy to model after the fact – must have been very disorientating at the time. And who knows, maybe winter clinic closures and delays in reimbursement renewals for refills created a genuine “winter fog”. Management word salad didn't help, but perhaps I was too quick to judge.

What matters is the future and whether $ACAD are properly characterising the current performance, and the path ahead.

So Where Are we Now?

Throughout the last three public disclosures, a consistent picture is emerging. Here are the key points.

Persistency in the real world remains about 10% ahead of clinical trials. This has been a consistent story for 2024. The best estimate of long-term persistency remains around 50%

Patient adds are net positive, and they are coming into line with the patterns $ACAD say they more typically expect to see in rare disease treatments

A consistent picture is emerging for each of the HCP segments:

1. COEs (25% patients) – 50% penetrated, 1/3rd of prescriptions to date. Major area of focus, as these continue to attract new patients. (My thesis is that the availbility of a treatment might increase diagnoses, expanding the market from 5,000 current to the 6,000-9,000 estimated prevalence. CoEs will likely attract an outsized share of new diagnoses.)

2. High volume non-COEs (60% patients) – “good penetration” and the current area of focus

3. Low volume HCPs (25%) – many treating only 1 or 2 Rett patients – large number of HCPs.

Overall, c. 30% of the total diagnosed Rett populated has started treatment on DAYBUE and, by my calculations, Q2 revenue represents an annual revenue run-rate of c. US$340m.

Against the updated (downgraded) guidance for 2024 Revenue ($340-$370m), $ACAD have said at the September conferences that they are tracking to “just below the midpoint of guidance” which I interpret as being c.$350m.

They’ve also said that they see “more upside than downside” from here, which says to me that they are seeing the guidance offered in early August as still appropriate, and we are now getting to the closing phase of the year.

My Analysis

The message consistency across three presentations spanning 5 weeks, indicates to me that $ACAD have got to grips with DAYBUE sales performance. Things seem stable.

I see the journey of the 16 months since launch in three clear phases:

Phase 1: The Pent-up Demand “Bolus Surprise" - April-October 2023

Phase 2: “Winter of Discontent”: Early Patient Discontinuations swamp new scripts - Nov 2023 – March 2024

Phase 3: “Stabilisation” – Normal Market Penetration and Steady Growth - April 2024 onwards

Looking further ahead, while, based on my model, $NEU are unlikely to get their 2025 $500m US milestone, this is likely to come in during 1H 2026. Canada might give 2025 royalties a bit of a push, as it experiences its own “mini-bolus”, and then hopefully Japan and EU will add new impetus to revenue with milestones and royalties in FY26 and FY27.

So, overall, I’m increasingly comfortable about the downside floor to the SP being in the $low-teens. Which is where we are today!

So, my original investment thesis is intact. Today, I can buy $NEU for less than the fair value of DAYBUE, with the free option of the upside of NNZ-2591.

Investment Decision

My valuation remains as published previously. However, yesterday in RL I have added some $NEU to my portfolio, getting back to 94% of my original position. I’ll potentially add some more, but at just over 5% in RL, I’d also be happy to settle here.

Near term upcoming news flow is:

- Readout from September FDA meeting on NNZ-2591

- $ACAD Q3 results in mid-October

Disc: Held in RL and SM