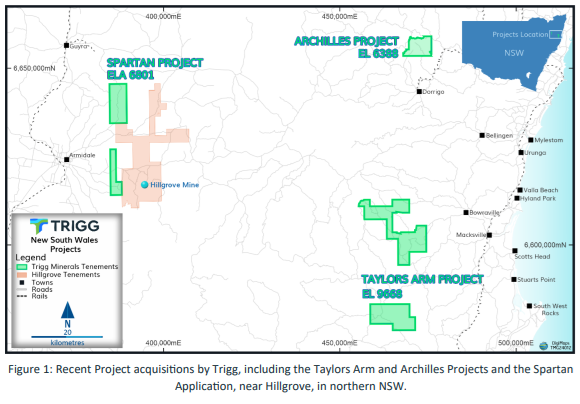

30-Sep-2024: TRIGG ACQUIRES GLOBALLY SIGNIFICANT HIGH GRADE & HIGH TONNAGE ANTIMONY PROJECT It's an acquisition of the "Achilles Project" in north-eastern NSW - see map below - which contains the globally significant high-grade and high-tonnage Wild Cattle Creek (WCC) Antimony Deposit. They say WCC is Australia highest grade undeveloped Antimony deposit and ranks among the highest-grade antimony deposits globally. Yet the price they are paying is only $450K plus a 1% net smelter return (NSR) royalty on all minerals extracted from the tenement area, as governed by a Royalty Deed to be entered into at completion. Apparently they haven't got land access rights yet, and so $250K of the $450K will be paid on shareholder approval with the other $200K to be paid once they have secured the land access rights.

Seems cheap if it's as good as they say - so maybe there are a few wrinkles that need to be ironed out, securing land access being a big one. Permitting could also be a tad difficult considering Wild Cattle Creek is a State Forest within the Nymboi-Binderay National Park, see here: https://www.environment.nsw.gov.au/savingourspeciesapp/managementsite/3403

Wild Cattle Creek Waterfall:

Nymboi-Binderay National Park (above and below)

Above: Wild Cattle Creek Campground. Below: Wild Cattle Creek State Forest:

This is inland from Coffs Harbour and north of Dorrigo. Good luck getting permission to stick a mine in there!

TMG-Proposed-issue-of-securities.PDF [also on 30-Sep] They are going to be issuing around 19,565,217 Trigg shares to pay for this acquisition, so as I suspected the trading halt was to lock in their higher share price after the recent SP spike, meaning they don't need to issue as many shares compared to if their own share price was lower.

This was also interesting: TMG-Application-for-quotation-of-securities-25-Sep-2024.PDF (from 9 days ago) - Subject to shareholder approval at their next meeting, Trigg intend to issue 30 million TMGOD options to a company called Bullseye Analytics to pay for Investor Relations Services, which the notice is valuing at $0.004 each (or $120 K for all 30m options). The options are exercisable at $0.03 each and expire on 30-June-2026. TMG closed yesterday down two tenths of a cent (or -5.56%) @ $0.034. Those options to be issued to Bullseye Analytics will be escrowed until the earlier of either (a) 12 months from the date of issue or (b) the next time TMG issue any options, as explained in that notice.

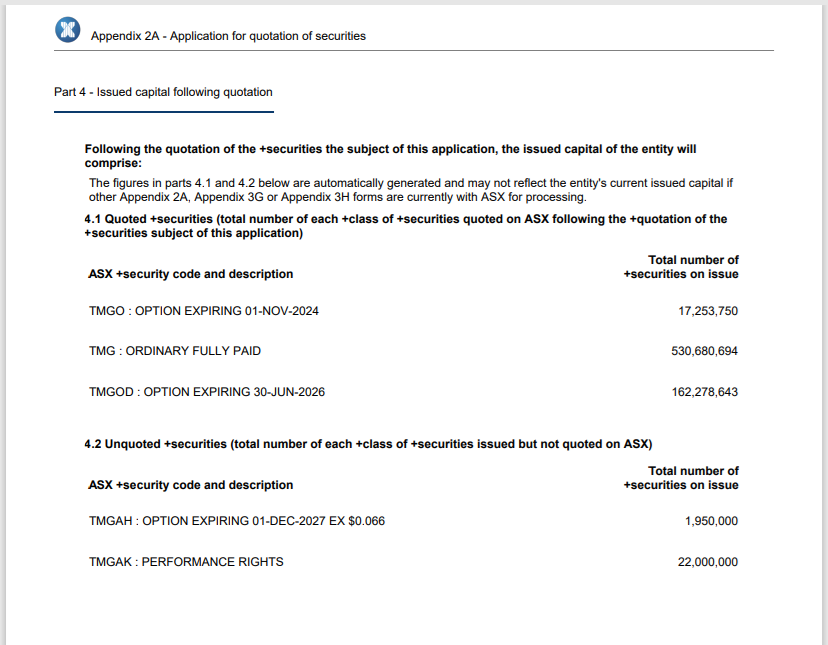

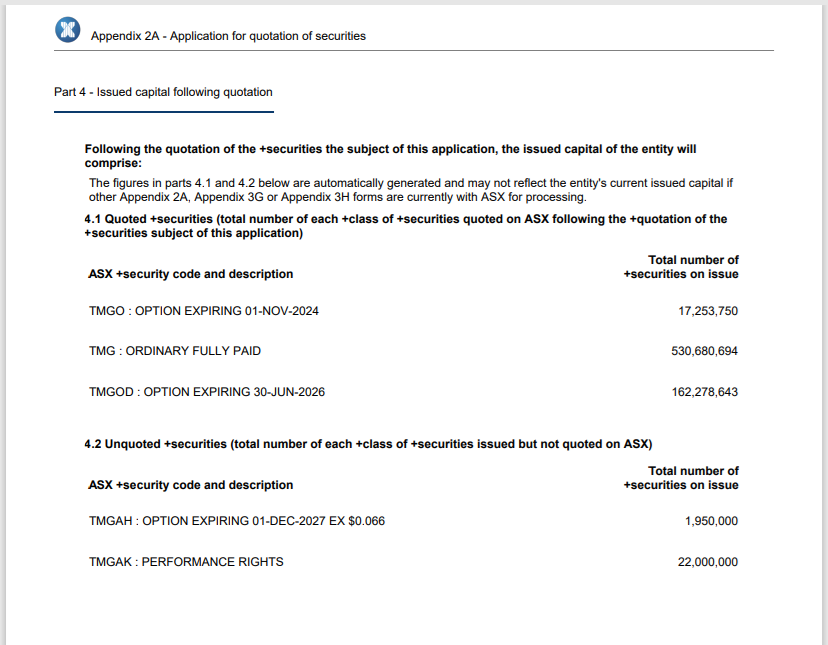

They will then have the following ordinary shares and options issued (note - does not include the additional ~19.565m TMG shares to be issues for that Achilles Project acquisition that includes Wild Cattle Creek that I've discussed above because that notice about the acquisition shares was lodged AFTER the one about the options issue - which I've reproduced a short excerpt from below to show the oustanding options):

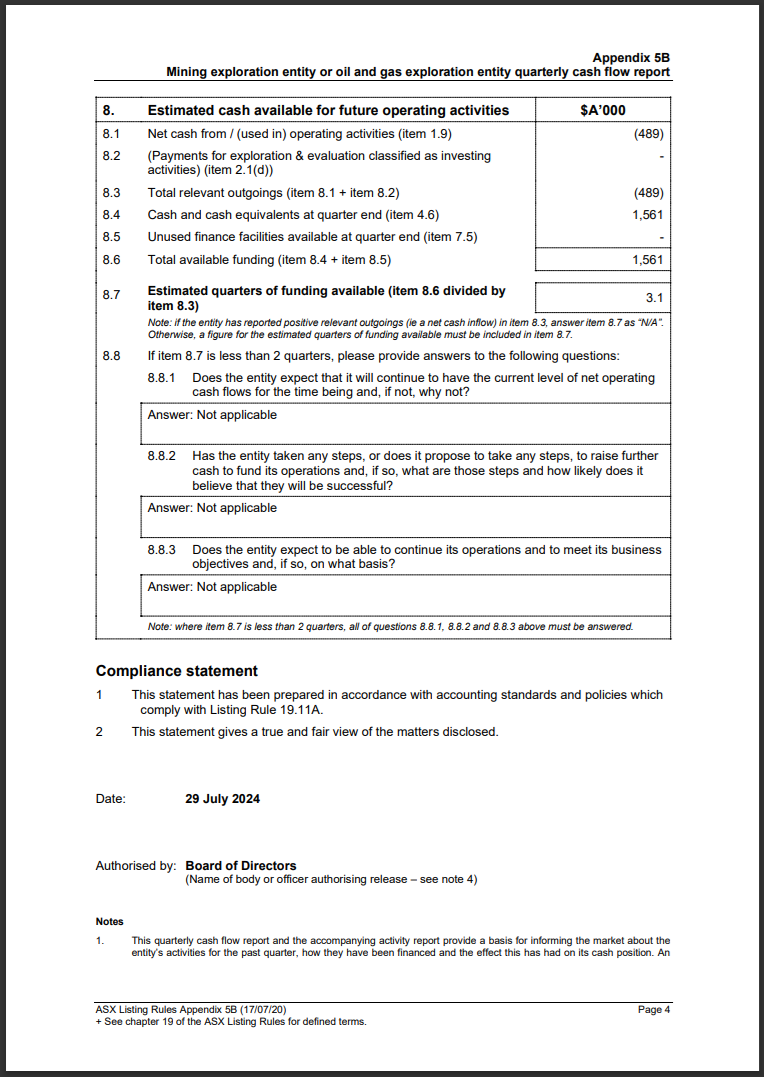

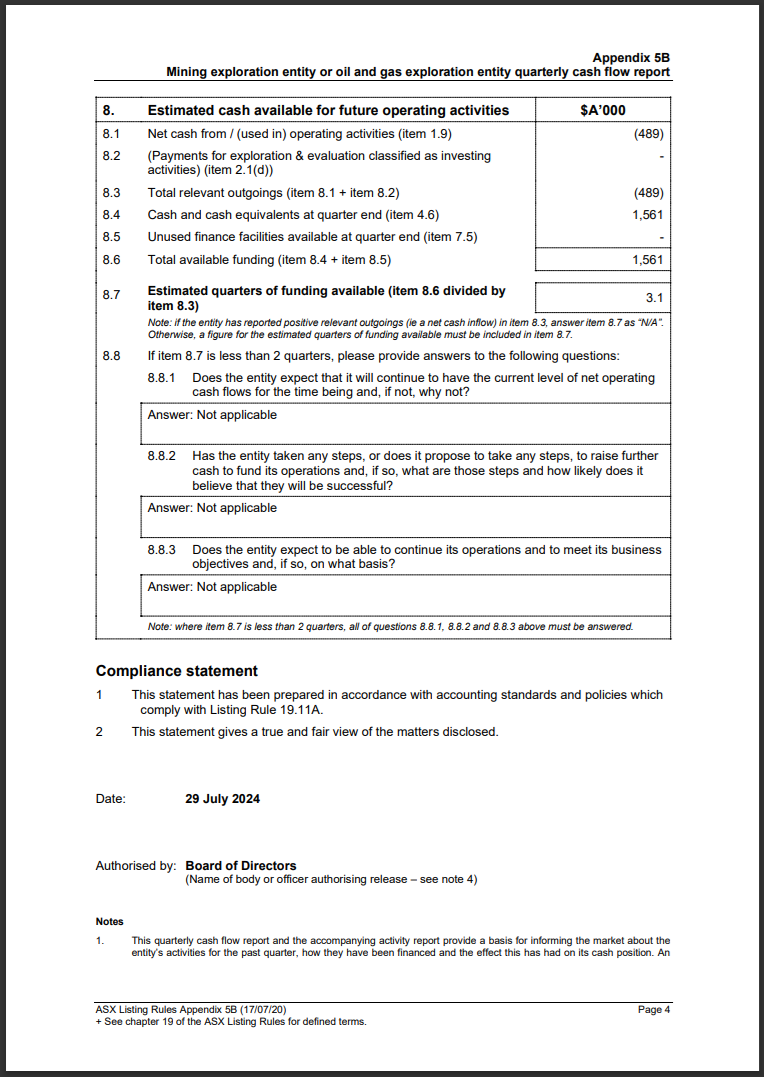

It's interesting that they are paying for everything via shares or options, but not really surprising when you look at page 4 of their last quarterly report (for the June 2024 quarter):

Zero income other than $18K of interest from their bank, almost half a million cash burn for the June quarter, and around three quarters of cash left at that burn rate, so their cash balance was down to just under $1.6 million, as shown above.

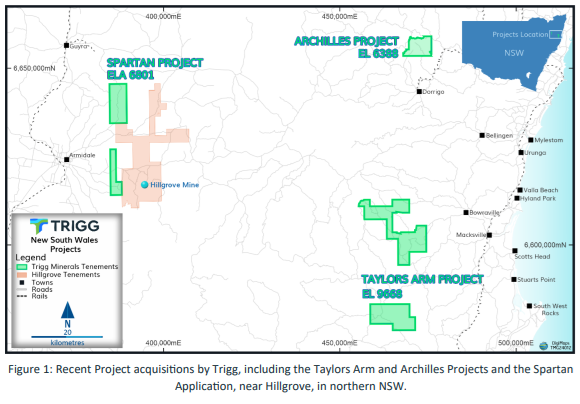

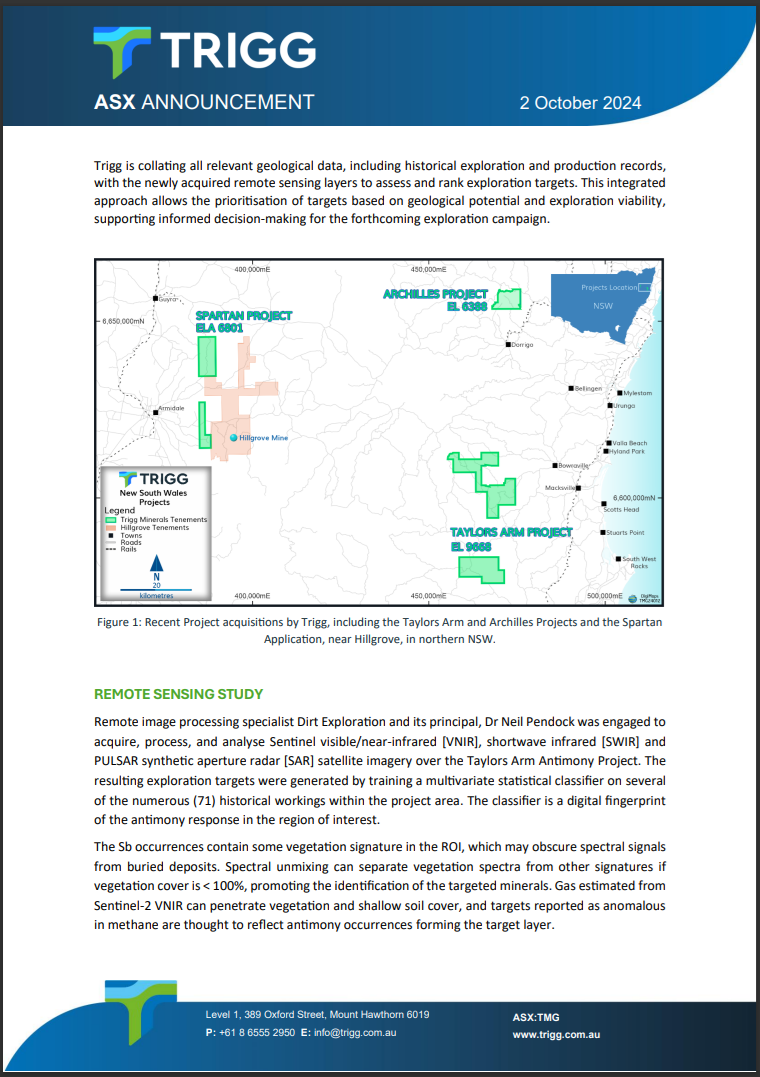

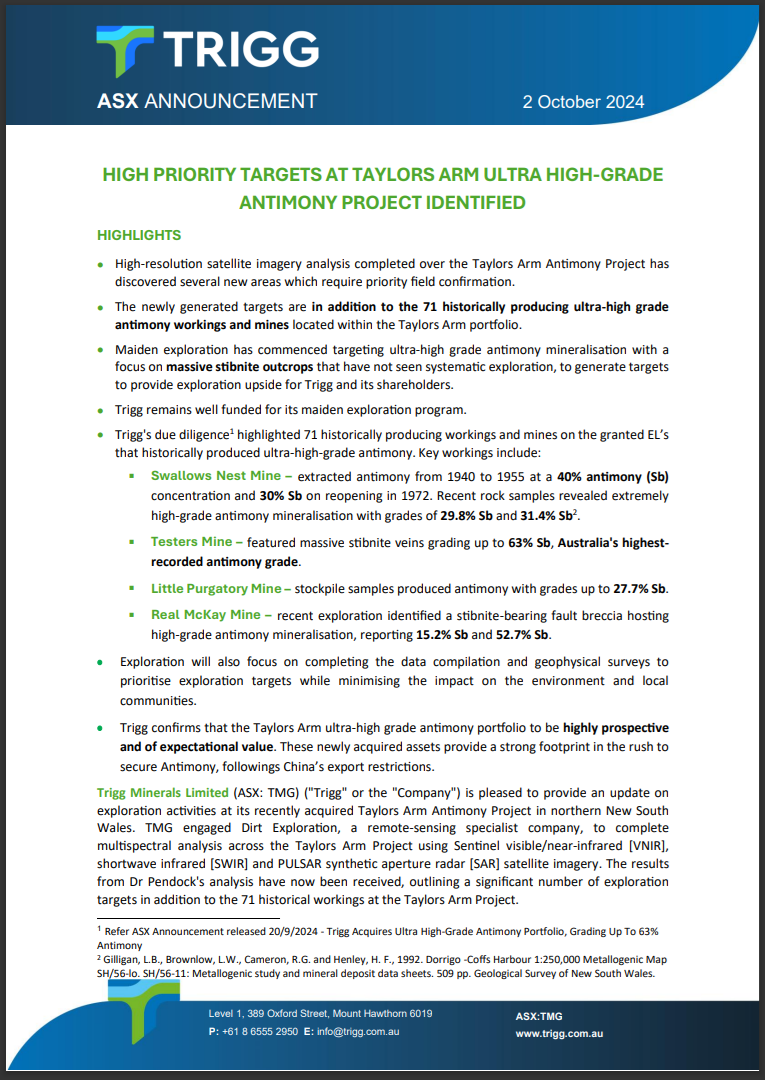

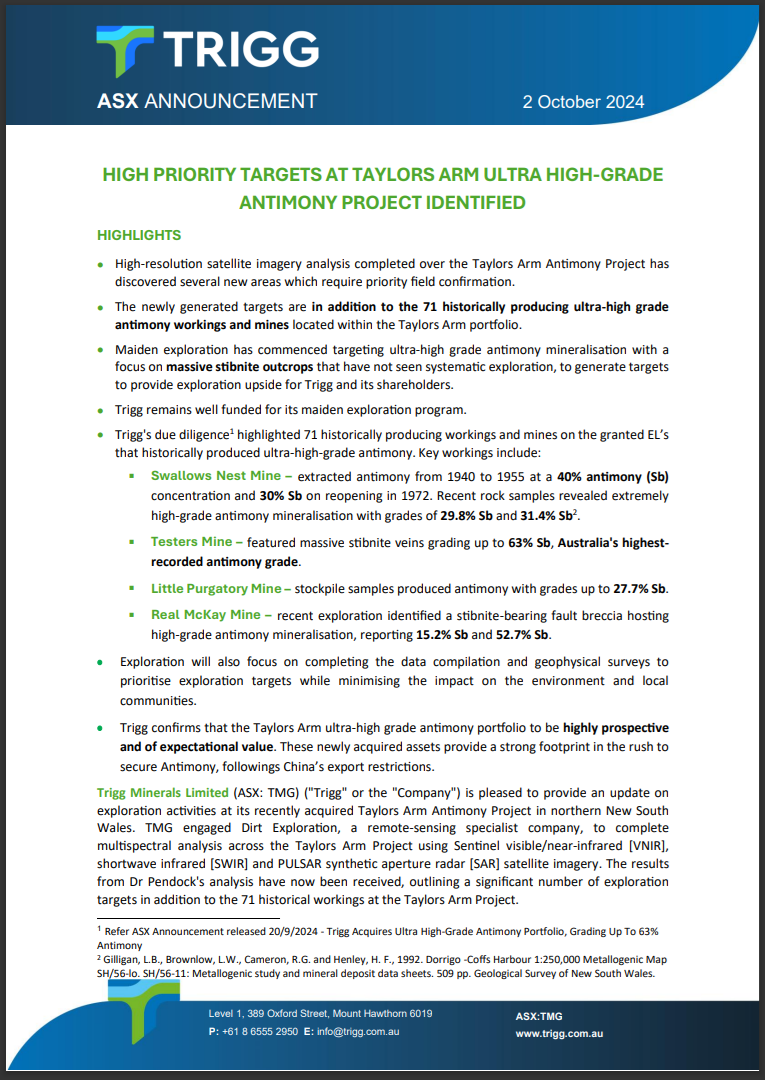

They also released this two days ago (on October 2nd): HIGH PRIORITY TARGETS AT TAYLORS ARM ULTRA HIGH-GRADE ANTIMONY PROJECT IDENTIFIED

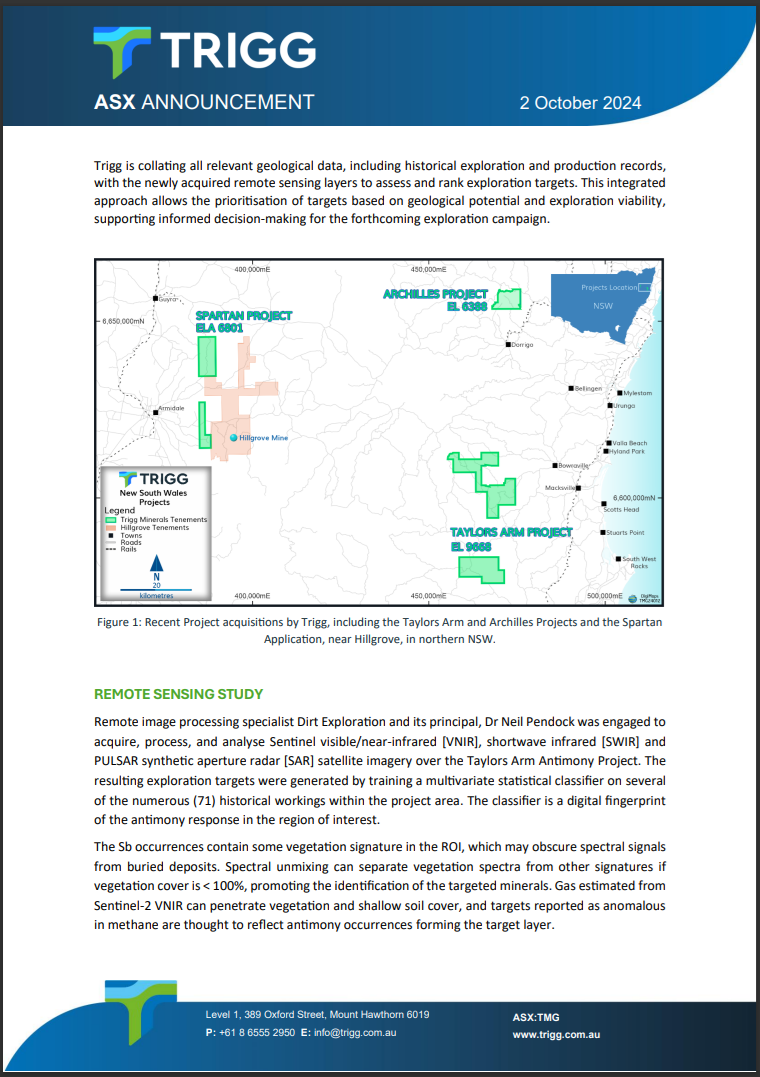

It's all about that Antimony (Chemical Symbol = Sb) @Eand and that Oct 2nd announcement contained this map:

From page 2:

Page 1 was all about the grades (see below), but Trigg are very early stage, and it's way more of a punt (gamble) than an investment in my view, FWIW. [I do not hold]

Antimony is one of the more recent "critical minerals" to become more valuable due to so much of it coming from China and China restricting exports from mid-September - see here: https://www.lowyinstitute.org/the-interpreter/antimony-hidden-metal-fuelling-global-competition

Excerpt:

With China’s recent announcement of export restrictions on this metal, the challenges of balancing supply and demand are intensifying, raising concerns over supply chain vulnerabilities and fuelling a new form of competition among great powers.

Antimony, a lustrous silvery-grey metalloid, is scarce in nature and unevenly distributed globally. It is, however, critical for producing high-tech and defence products, including flame-retardant materials, certain semiconductors, and superhard materials. As with many critical minerals, China dominates the global antimony supply chain. The country holds the world’s largest deposit, accounting for approximately 32% of global antimony resources, yet it produces more than 48% of global output.

China’s move to restrict the export of antimony, ostensibly to safeguard “national security and interests”, was to take effect from 15 September (2024). While these restrictions are not explicitly targeted at any specific country, the geopolitical implications are significant. China has gradually reduced its antimony production over the past few years to limit strategic stockpiling. As a result, the announcement has driven up prices, potentially disrupting global supply chains. The impact is particularly acute for the United States, which sourced 63% of its antimony imports from China.

--- end of excerpt ---

Decent website: https://trigg.com.au/ ...for a $19m company, but perhaps that and their slick presentations is why they've just given Bullseye Analytics 30m TMGOD options for Investor Relations Services.

There's no doubt TMG (Trigg Minerals) are positioning themselves to be a leading antimony play here in Australia, but the announcement of this acquisition is more hype than substance in my opinion because I've got far more chance of winning Powerball than Trigg have of getting permission to bulldoze roads through a NSW National Park and conservation area and build a mine in the middle of it. I haven't had a look at their other sites but that one is unlikley to be developed any time soon. IMO.