Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Assume management's growth outlook is accurate, what would that imply about revenue in 5 years?

According to the annual report, Supply Network Limited's management expects revenue growth in FY2024 to be close to or slightly above the company's 10-year average of 14%. The report also states that while it is difficult to estimate growth rates beyond FY2024, management is working on the assumption that continued strong growth is possible and that most of the new investments needed to support revenue of $350 million will be in place within 3 years.

Let's calculate the implied revenue in 5 years based on management's outlook, assuming the following growth rates:

FY2024: 14% (as per management's guidance)

FY2025 to FY2028: Assume a slightly lower growth rate of 12% per annum, considering the company's long-term average and the potential for continued strong growth.

Projected Revenue:

FY2023 (Actual): $252.3 million

FY2024: $252.3 million × (1 + 0.14) = $287.6 million

FY2025: $287.6 million × (1 + 0.12) = $322.1 million

FY2026: $322.1 million × (1 + 0.12) = $360.8 million

FY2027: $360.8 million × (1 + 0.12) = $404.1 million

FY2028: $404.1 million × (1 + 0.12) = $452.6 million

Based on these assumptions, if management's growth outlook proves to be accurate, Supply Network Limited's revenue could reach approximately $452.6 million in FY2028, which is five years from the latest financial report (FY2023).

This implies a compound annual growth rate (CAGR) of approximately 12.4% over the five-year period from FY2023 to FY2028

Ok great! what is a reasonable fair value estimate based on that forecast?

To estimate a fair value for Supply Network Limited's shares using the revenue forecast and assuming constant gross margins, we can use a discounted cash flow (DCF) valuation method. We'll use the same assumptions as in the previous valuation, but with the updated revenue projections based on management's outlook.

Assumptions:

Revenue Growth: Based on management's outlook, we assume the following revenue growth rates over the next five years: FY2024: 14.0% FY2025 to FY2028: 12.0% per annum

Gross Margin: We assume that the company's gross margin will remain steady at the FY2023 level of 42.3% (calculated as (Revenue - Changes in inventories) / Revenue).

EBIT Margin: We assume that the company's EBIT margin will remain stable at around 16.0% over the forecast period, based on its recent performance.

Tax Rate: We assume a corporate tax rate of 30%, consistent with the Australian statutory tax rate.

Discount Rate: We use a discount rate of 10%, which reflects the company's cost of capital and the risk associated with its future cash flows.

Terminal Growth Rate: Beyond the five-year forecast period, we assume a long-term growth rate of 2.5%, which is a conservative estimate of the expected growth in the broader economy.

Discounted Cash Flow (DCF) Valuation:

(in millions AUD, except per share data)

Year FY2024 FY2025 FY2026 FY2027 FY2028 Terminal

Revenue 287.6 322.1 360.8 404.1 452.6

Gross Profit 121.7 136.3 152.6 170.9 191.4

EBIT 46.0 51.5 57.7 64.7 72.4

Less: Tax @ 30% (13.8) (15.5) (17.3) (19.4) (21.7)

NOPAT 32.2 36.1 40.4 45.3 50.7

Free Cash Flow 32.2 36.1 40.4 45.3 50.7 519.9

Discount Factor @ 10% 0.909 0.826 0.751 0.683 0.621 0.621

Present Value of FCF 29.3 29.8 30.4 30.9 31.5 322.9

Sum of Present Values 474.8

Less: Net Debt (FY2023) (2.2)

Equity Value 472.6

Diluted Shares Outstanding 41.6

Fair Value per Share $11.36

Describe the best and worst parts of Supply Network's balance sheet:

Based on the balance sheet information provided in Supply Network Limited's 2023 Annual Report, here are the best and worst parts of the company's financial position:

Best Parts of the Balance Sheet:

1. Strong Cash Position: Supply Network had cash and cash equivalents of $7.8 million as of June 30, 2023, providing a solid liquidity buffer for the company's operations and future investments.

2. Growing Equity: The company's total equity increased from $59.3 million in FY2022 to $77.8 million in FY2023, driven by strong retained earnings growth and the issuance of new shares. This growth in equity reinforces the company's financial stability and capacity to fund future expansion.

3. Low Gearing: Supply Network's gearing ratio (excluding lease liabilities) decreased from 15.6% in FY2022 to 12.8% in FY2023. This low level of debt relative to equity indicates a conservative capital structure and ample borrowing capacity if needed for future growth initiatives.

4. Improved Net Assets: The company's net assets grew from $59.3 million in FY2022 to $77.8 million in FY2023, while net tangible assets per share increased from 145.3 cents to 187.2 cents over the same period. This growth in net assets and net tangible assets per share enhances the company's balance sheet strength and intrinsic value for shareholders.

Worst Parts of the Balance Sheet:

1. Rising Lease Liabilities: Supply Network's lease liabilities (current and non-current) increased from $36.9 million in FY2022 to $41.9 million in FY2023. While this increase is largely due to the company's expansion of its branch network and warehousing facilities, it does represent a growing long-term obligation that will require ongoing cash outflows.

2. Increase in Trade and Other Payables: The company's trade and other payables increased from $29.5 million in FY2022 to $35.7 million in FY2023. While this increase is likely due to the growth in the company's operations and inventory purchases, it does indicate a higher level of short-term liabilities that will need to be managed carefully to ensure adequate working capital.

3. Growing Inventories: Supply Network's inventories increased significantly from $63.3 million in FY2022 to $79.4 million in FY2023. While this growth in inventory is necessary to support the company's sales growth and branch expansion, it does tie up working capital and expose the company to potential obsolescence risks if demand patterns change.

Overall, Supply Network Limited's balance sheet appears to be in a strong position, with low gearing, a strong cash position, and growing equity. The company's increasing lease liabilities and inventory levels are areas to monitor, but they appear to be manageable in the context of the company's overall financial strength and growth trajectory. The increase in trade and other payables is also a potential concern, but it is likely a natural consequence of the company's growth and should be manageable with prudent working capital management. In summary, the best parts of Supply Network's balance sheet outweigh the worst parts, providing a solid foundation for the company's future growth and financial stability.

I have been playing around with Claude, the new AI from Anthropic. I was curious to see how it could be a useful tool for ASX research.

I uploaded the latest annual report and asked: give me an overview of the business:

Supply Network Limited is a publicly listed company that operates in the automotive aftermarket industry, specializing in the supply of replacement parts for the commercial vehicle market in Australia and New Zealand under the Multispares brand. The company has a rich history spanning over 35 years and has grown to become a leading player in its market niche through a focus on providing quality products, professional service, and a wide distribution network.

History and Background:

Supply Network was founded in 1986 as a supplier of replacement parts for the commercial vehicle market. Over the years, the company has steadily expanded its operations, product range, and branch network across Australia and into New Zealand. In 1987, Supply Network listed on the Australian Stock Exchange, providing a platform for further growth.

The 1990s saw Supply Network make several strategic acquisitions including Multispares Limited in 1991, which helped establish a presence in New Zealand. In the early 2000s, the company consolidated its business units under the Multispares brand. This unified brand identity has been key to Supply Network's market positioning and customer recognition.

Business Operations and Strategy:

Supply Network, through its Multispares trading entities, serves a diverse customer base in the road transport industry. The company's core business involves the provision of aftermarket parts for trucks, trailers, buses and other commercial vehicles. However, beyond just selling parts, Supply Network offers a suite of value-added services including parts interpreting, procurement, supply management and problem solving.

The company operates at the premium end of the market, focusing on quality products from established suppliers worldwide. Supply Network prides itself on long-term supplier relationships, reliable products and superior customer service aimed at reducing fleet downtime and operating costs for transport businesses.

A key aspect of Supply Network's strategy is its extensive branch network across major metropolitan and regional locations in Australia and New Zealand. As of 2023, the company has over 30 branches which serve as stockholding and distribution points to provide rapid parts supply to local customers. This decentralized network allows Supply Network to cater to the diverse needs of the transport industry across different regions and market segments.

In addition to its physical locations, Supply Network has invested significantly in its online capabilities, including e-commerce platforms and product databases. The company views technology as an enabler to provide better customer service, streamline processes and support its knowledgeable staff.

Future Outlook:

Looking ahead, Supply Network sees continued opportunity for organic growth in its core markets. The company aims to expand its branch footprint, product range and service capabilities in line with the evolving needs of the transport industry. Investments in technology, e-commerce and staff development are seen as ongoing priorities to maintain competitiveness.

While Supply Network's primary focus remains on organic growth, the company is open to strategic acquisition opportunities that can complement its existing business and provide an attractive return on investment for shareholders. With a robust financial position and an experienced leadership team, Supply Network is well-placed to pursue its growth ambitions and cement its position as a market leader in the years ahead.

Agm yesterday. Mgt feels capacity taps out at 350m rev (best case 400m). They aim to reach the 350m over 3 yrs. Also Nz not going well. Appears that next 3 yr cagr npat will be approx 13%. Too low for me compared to p/e.

Describe the financial performance of the business:

Based on the financial information provided in Supply Network Limited's 2023 Annual Report, the company has demonstrated strong financial performance and growth in recent years. Here is a summary of the key financial metrics and growth rates:

Revenue:

Supply Network's revenue has grown consistently over the past five years, from $123.9 million in FY2019 to $252.3 million in FY2023. The company recorded a significant 27.1% increase in revenue in FY2023 compared to the prior year.

The five-year revenue figures are as follows:

FY2023: $252.3 million

FY2022: $198.5 million

FY2021: $162.6 million

FY2020: $136.8 million

FY2019: $123.9 million

Using this data, the compound annual growth rate (CAGR) for revenue over the five-year period from FY2019 to FY2023 is approximately 19.5%.

Gross Profit and Gross Margin:

While the annual report does not explicitly state the gross profit figures, we can infer from the strong revenue growth and stable gross margins that gross profit has also increased significantly over the period.

The report mentions that gross margins remained relatively steady in FY2023, suggesting that the company has been able to maintain its pricing power and cost efficiency despite the challenging economic environment.

Operating Profit (EBIT):

The company's Earnings Before Interest and Tax (EBIT) has grown strongly over the past five years, demonstrating good operating leverage and cost management.

The five-year EBIT figures are as follows:

FY2023: $40.8 million

FY2022: $29.9 million

FY2021: $21.1 million

FY2020: $15.3 million

FY2019: $12.8 million

The CAGR for EBIT over the five-year period from FY2019 to FY2023 is approximately 33.6%, which is significantly higher than the revenue growth rate. This indicates that Supply Network has been successful in expanding its margins and controlling costs as the business has scaled up.

Profitability:

Supply Network's net profit after tax (NPAT) was $27.4 million in FY2023, up from $20.0 million in the prior year. The company's NPAT margin (NPAT/Revenue) was 10.9% in FY2023, a slight improvement from the previous year.

Overall, Supply Network Limited has delivered robust financial results with strong top-line growth, margin expansion and operating leverage. The company's five-year revenue CAGR of 19.5% and EBIT CAGR of 33.6% demonstrate the strength of its business model and market position. While the annual report does not provide detailed gross profit figures, the stable gross margins and impressive EBIT growth suggest that the company has managed its costs well while growing the business. These financial metrics indicate that Supply Network is well-positioned to continue its growth trajectory and deliver value to shareholders in the future.

Kinda like Bapcor in that they provide after-market parts, but with a focus on commercial vehicle fleets (trucks, buses etc)

Operating largely through the Multispares Brand, the company has nearly tripled per share earnings in the last 5 years

It has paid a consistent and rising dividend, with a giant special dividend in 2015. Actually, it’s paid $1.74 in dividends since 2013. So if you bought shares back then your entire cost base has been covered. (could have bought at $1.50)

Of course your shares have gone up more then 5x since then too.

Sales up 18% in the last year, and has proven to be a very resliant business (they are critical to road transport supply chains)

The increasing diversity of the national commercial vehicle fleet, and long and complex supply chains, while challenging actually provides a competitive advantage to those with scale and strong inventory management, as SNL do.

They have recently invested into even more into capacity recently, and will soon have distribution centres able to accommodate $250m in annual turnover (compared to $150m at present).

The company previously beat its latest 3 year plan, and for the next target they have set $200m in sales by FY24, which seems conservative from the current $163m.

Management and directors currently hold 10% or so of the business, but around 30% is held by the Forsyth family (i think it's the brothert of the current chairman).

One to keep on the watchlist.

Supply Networks has provided guidance for the first half ended Dec 31, 2019.

Unaudited results show revenue of $68m for the half, representing growth of ~13% from the previous corresponding period.

Net profit is expected to be $4.4m, which is growth of ~6.8% (please note that new accounting rules, which govern the treatmeant of leases, has reduced this figure -- but of course no change to cash flows. On a comparable basis, net profit would have been $4.8m, or growth of ~16.5%)

For the full year, SNL is expecting revenue of $136m and net profit of $8.8m (or $9.5m under old accounting rules). That represents growth of roughly 9.8% and 9.3% (respectively) on a comparable basis.

An interim dividend of 6.5c (fully franked) will be paid on April 2 -- an 8% increase on the pcp.

I quite like this business and think management is first class. Think of it like the Bapcor (ASX:BAP) of Trucks & buses.

Full ASX announcement here

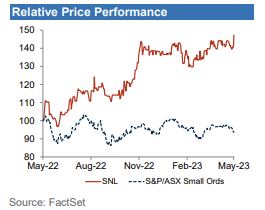

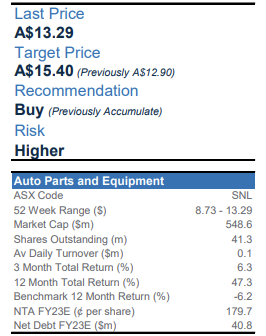

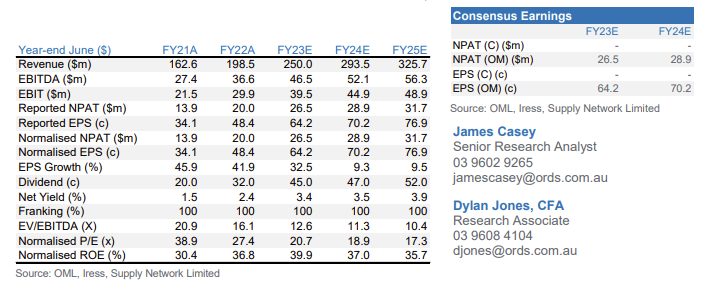

27-May-2023: Ord Minnett: Supply Network, "Trucking on", raises TP from $12.90 to $15.40, and upgrades their recommendation from "Accumulate" to "Buy". Supply-Network-Limited-cr-27-05-23.pdf

Excerpt from broker report:

Supply Network Ltd (SNL) provided a trading update and guidance for its FY23 result. Sales are expected to increase c. 26% in FY23 to $250m. Underlying NPAT is expected to increase 33% to $26.5m. Its financial performance was well above our forecast. As such we upgrade our earnings by c. 14% for the next two years. We upgrade to Buy from Accumulate, with a price target of $15.40.

FY23 guidance is well above our expectations

Supply Network provided a positive trading update, with an exceptionally strong 2H23 financial performance expected. SNL expects to achieve FY23 sales of $250m, up 26% on the pcp and 7% above our $234.1m forecast. The company expects to report an FY23 NPAT of $26.5m, up 33% on the pcp and 11% ahead of our $23.9m forecast. Sales have accelerated in 2H23, with 2H23 sales up 28.1%, versus 23.6% in 1H23. SNL’s earnings guidance implies a 2H23 operating margin of 15.8%, only 10 basis points lower than the record 15.9% achieved in 1H23.

Near term outlook remains positive

In terms of outlook, strong demand from commercial vehicle customers for parts continues to be driven by industry tailwinds such as an ageing vehicle fleet, increasing freight task and the increasing complexity of vehicles. Management expects growth “will remain above the long-term trend for at least the next year”. As such, SNL is bringing forward capacity-related investments, which include the doubling of capacity at its new Victorian Distribution Centre and branch at Truganina in Victoria. SNL also plans the opening of a new branch in Yatala, Southeast Queensland. While both projects have experienced delays, it has had little effect on performance.

Investment view

The outlook for SNL remains positive with market demand robust, supported by strong activity in all regions. SNL’s future earnings growth will continue to be driven by a combination of robust underlying industry growth supported by further investment into the company’s branch network. We upgrade to Buy, from Accumulate, with a 12-month target of $15.40, up from $12.90 previously.

--- click on the link at the top to access the full report ---

Disclosure: I do not currently hold SNL shares, but I have previously, and may do so again.

They are a proven outperformer: