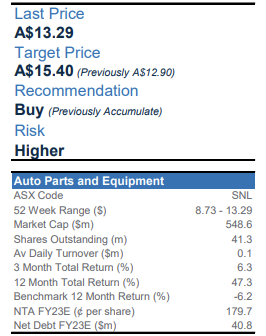

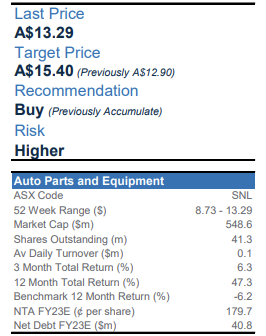

27-May-2023: Ord Minnett: Supply Network, "Trucking on", raises TP from $12.90 to $15.40, and upgrades their recommendation from "Accumulate" to "Buy". Supply-Network-Limited-cr-27-05-23.pdf

Excerpt from broker report:

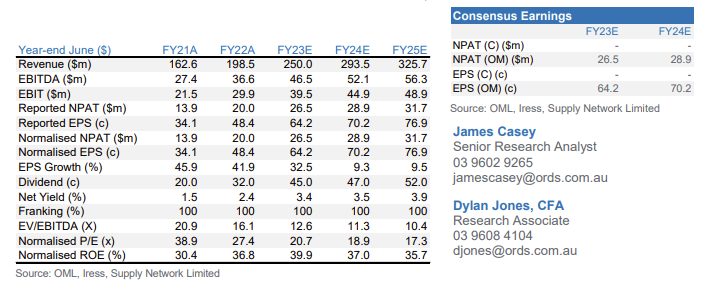

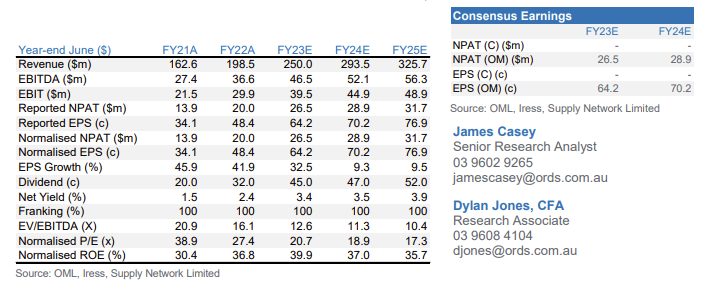

Supply Network Ltd (SNL) provided a trading update and guidance for its FY23 result. Sales are expected to increase c. 26% in FY23 to $250m. Underlying NPAT is expected to increase 33% to $26.5m. Its financial performance was well above our forecast. As such we upgrade our earnings by c. 14% for the next two years. We upgrade to Buy from Accumulate, with a price target of $15.40.

FY23 guidance is well above our expectations

Supply Network provided a positive trading update, with an exceptionally strong 2H23 financial performance expected. SNL expects to achieve FY23 sales of $250m, up 26% on the pcp and 7% above our $234.1m forecast. The company expects to report an FY23 NPAT of $26.5m, up 33% on the pcp and 11% ahead of our $23.9m forecast. Sales have accelerated in 2H23, with 2H23 sales up 28.1%, versus 23.6% in 1H23. SNL’s earnings guidance implies a 2H23 operating margin of 15.8%, only 10 basis points lower than the record 15.9% achieved in 1H23.

Near term outlook remains positive

In terms of outlook, strong demand from commercial vehicle customers for parts continues to be driven by industry tailwinds such as an ageing vehicle fleet, increasing freight task and the increasing complexity of vehicles. Management expects growth “will remain above the long-term trend for at least the next year”. As such, SNL is bringing forward capacity-related investments, which include the doubling of capacity at its new Victorian Distribution Centre and branch at Truganina in Victoria. SNL also plans the opening of a new branch in Yatala, Southeast Queensland. While both projects have experienced delays, it has had little effect on performance.

Investment view

The outlook for SNL remains positive with market demand robust, supported by strong activity in all regions. SNL’s future earnings growth will continue to be driven by a combination of robust underlying industry growth supported by further investment into the company’s branch network. We upgrade to Buy, from Accumulate, with a 12-month target of $15.40, up from $12.90 previously.

--- click on the link at the top to access the full report ---

Disclosure: I do not currently hold SNL shares, but I have previously, and may do so again.

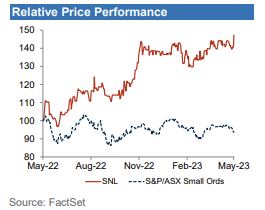

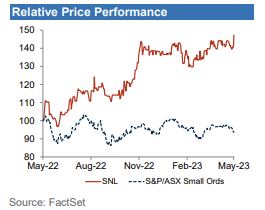

They are a proven outperformer: