Pinned straw:

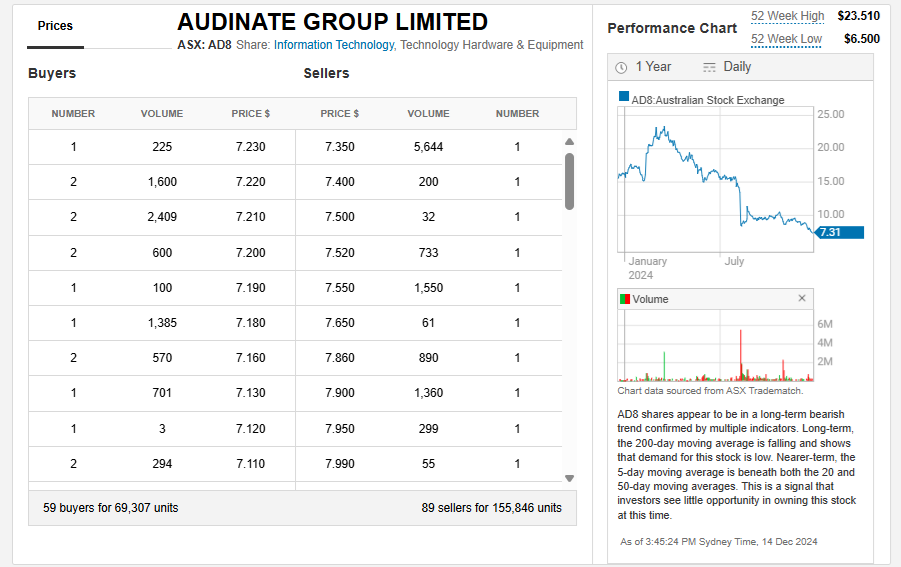

Yes @Clio Good to see fundies buying shares in Audinate. I'm still on the sidelines because I think they could drift south east for a further 6 to 12 months before the issues that have been discussed here work through and customers who had previously overstocked run their stocks down and start purchasing from Audinate again. There will be a fair whack of prospective investors who may well wait for the tide to turn as evidenced by improved reports from AD8 - which could be a couple of 6-monthly reports away yet. Great company, but I feel that for the market to turn positive on them again, the market needs to feel like their sales are growing again at a good clip. Until then, I feel the current share price trajectory may continue, probably not at such a steep angle but still south east.

Also, it's no biggy, but remember that AustralianSuper is Australia's largest super fund, and it's one of a bunch of industry super funds that allow members to directly invest in ASX300 companies with up to 80% of their super balance, subject to rules including no more than 20% of their balance in any single company. In their case, they call that option "Member Direct". In my industry super fund, CBUS, they call it "Self Managed". AustralianSuper have A$341 billion of FUM and over 3.4 million members (as at Sep 30, 2024), so they will pop up all over the place as "Subs" for various ASX300 companies due to their members holding those companies in their AS Member Direct accounts and those shares being held in the name of AustralianSuper not the individual members' names. This usually applies more to ex-100 companies (coz ASX100 companies tend to have market caps that are too large for AS to show up as "Subs" unless AustralianSuper make an intentional active investment in those companies as part of their managed fund strategy).

In my experience, the majority of times when AustralianSuper pop up as substantial holders for a company in the lower two thirds of the ASX300 - such as AD8 who are in the ASX200 but not the ASX100 - it is usually due to their members choosing to hold those companies, not due to decisions made by AustralianSuper themselves, particularly when there are trades listed on almost every trading day in the lower part of these "Change of..." or "Becoming..." or "Ceasing..." notices.

It's still positive, because it means there are individual investors who want to hold these companies in their super fund, but it isn't always down to a decision by a fund manager.

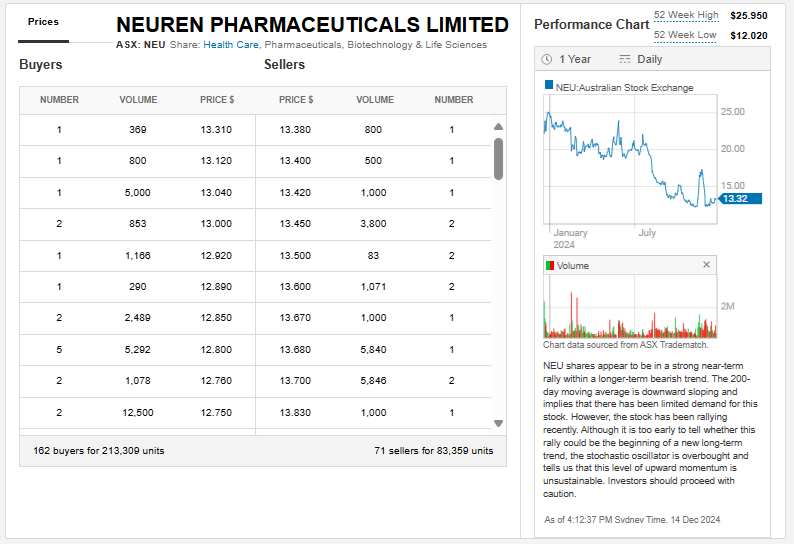

Just on me not holding AD8 currently, but intending to get back in when they are back in an uptrend once more, I bought back into NEU (Neuren Pharmaceuticals) in my own super yesterday after holding them earlier in the year and selling out at over $20/share. I could be wrong, but it looks to me like the selling pressure on NEU has dissipated and I have noted that NEU has risen a bit on some of the market's "down" days recently, so I feel they may have bottomed for now, which has been helped by some positive newsflow, so I reckon it's time for me to get back in.

I'm just wary of opportunity cost when holding companies that are still in downtrends. NEU could fall further, but I feel they are more likely to go up from here.

On the other hand I think AD8 probably will fall further in the absence of positive newsflow. There's no evidence of the AD8 graph flattening out or the trend reversing yet, and no reason to expect it to go back into an uptrend yet IMO until their sales start improving again in terms of getting back to the sort of growth they were exhibiting before the customer overstocking issues earlier this year.

I like both companies, but I don't feel I need to always hold every company I like. I can be selective about when I hold them, and during a sustained downtrend isn't a preference.

I have been buying IRL since 2021 (Lowest $5.88 & Highest $15.85 & a lot of in-between shots). I am a little underwater now with any gains and have totally accepted that I can no longer even guess the psychology driving the trades. Have switched to HOLD-and-SEE mode.

great post. Or maybe I just like it because of confirmation bias. I’m dropping more into this one as it falls also so nice to hear the institutional money is seeing things the same.