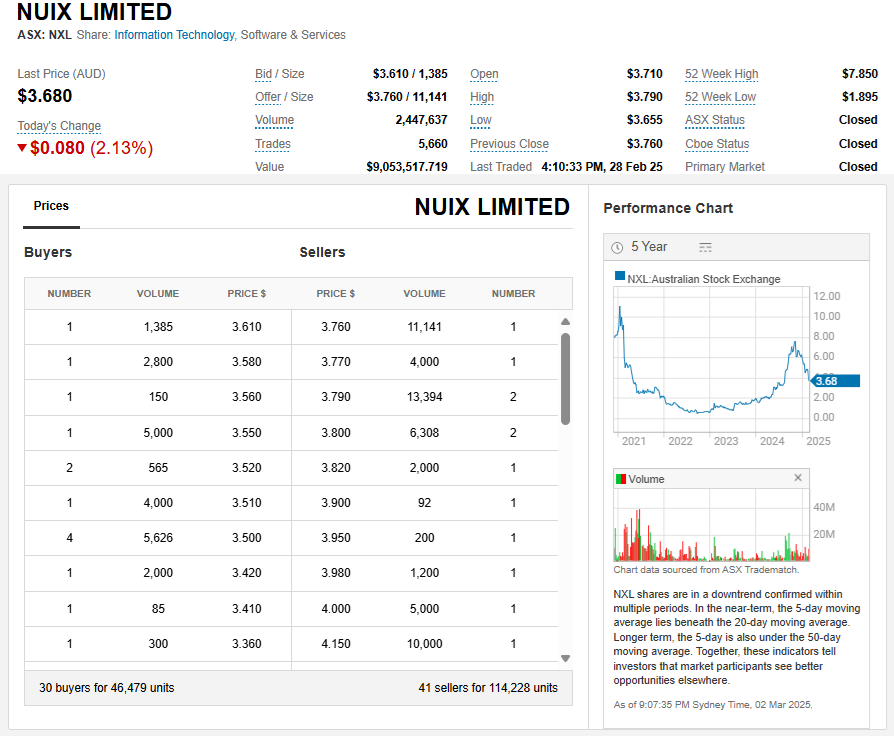

02-March-2025: Nuix (NXL) is a turnaround that DID turn around, then in the past few months they've done another U-turn and headed back south again.

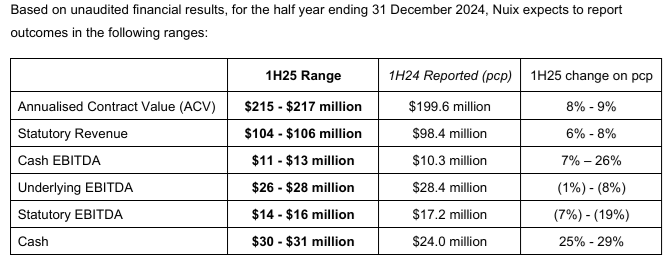

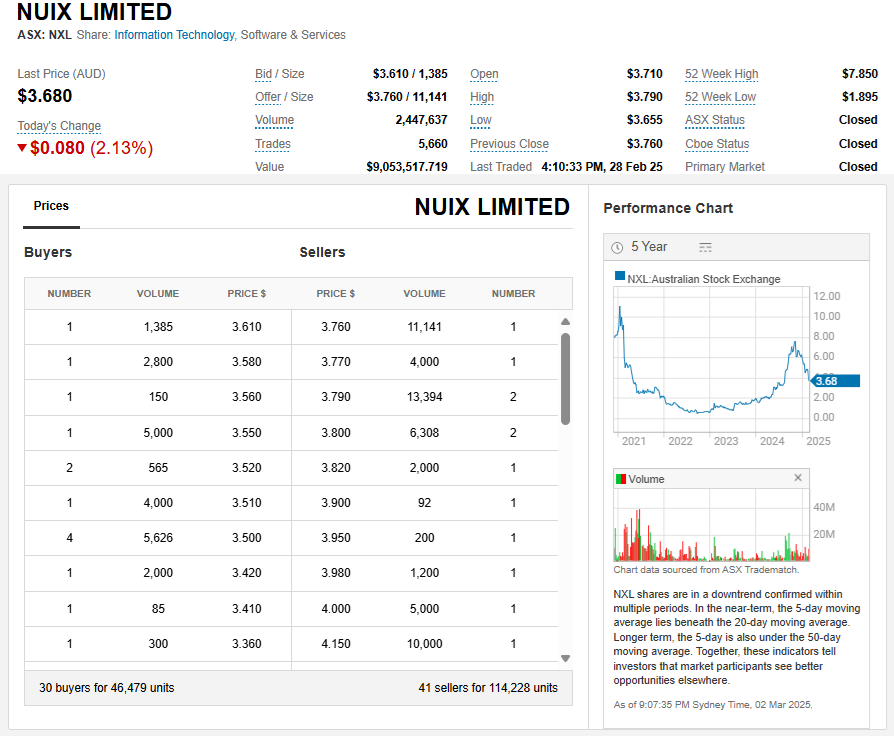

You can see on that 5 year chart (above, right) that they were powering back up at a very good clip, and then they had their AGM on 13-Nov-2024 and that was the end of that. Their SP dropped -22% on that day, then another -20% on 28th Jan (2025) when they released this: NXL-1H25-Results-Update-28-Jan-2025.PDF - Here's a snippet from that:

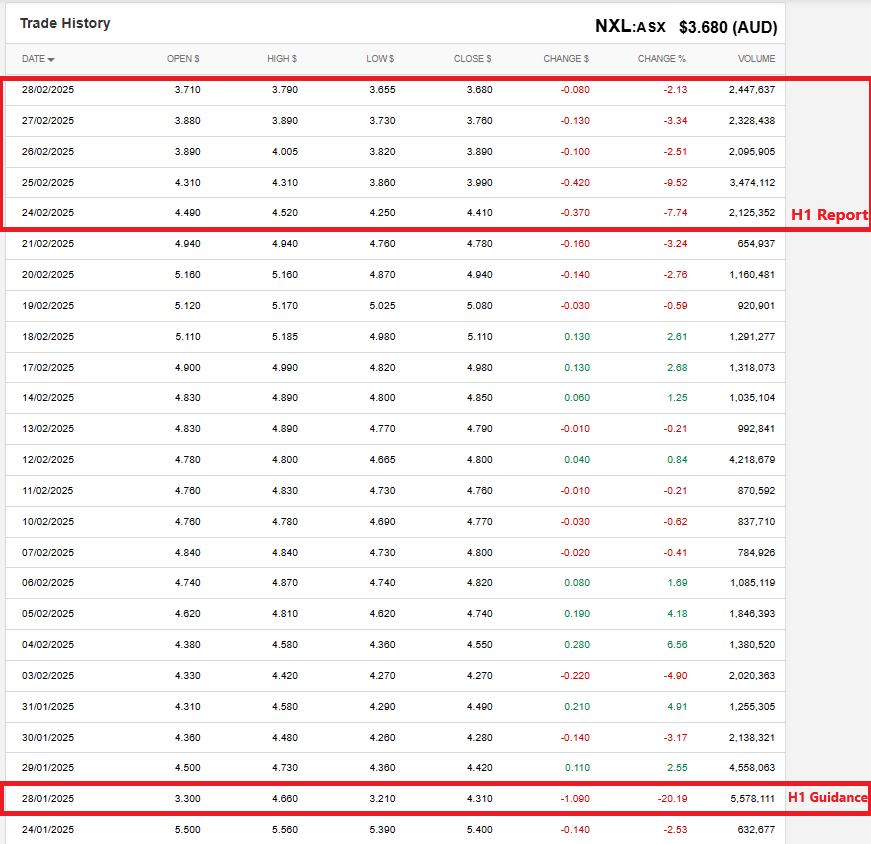

And after dropping -20% on that guidance downgrade in late January, they managed to drop again on the day they actually reported (24th Feb) and on every day since then as well:

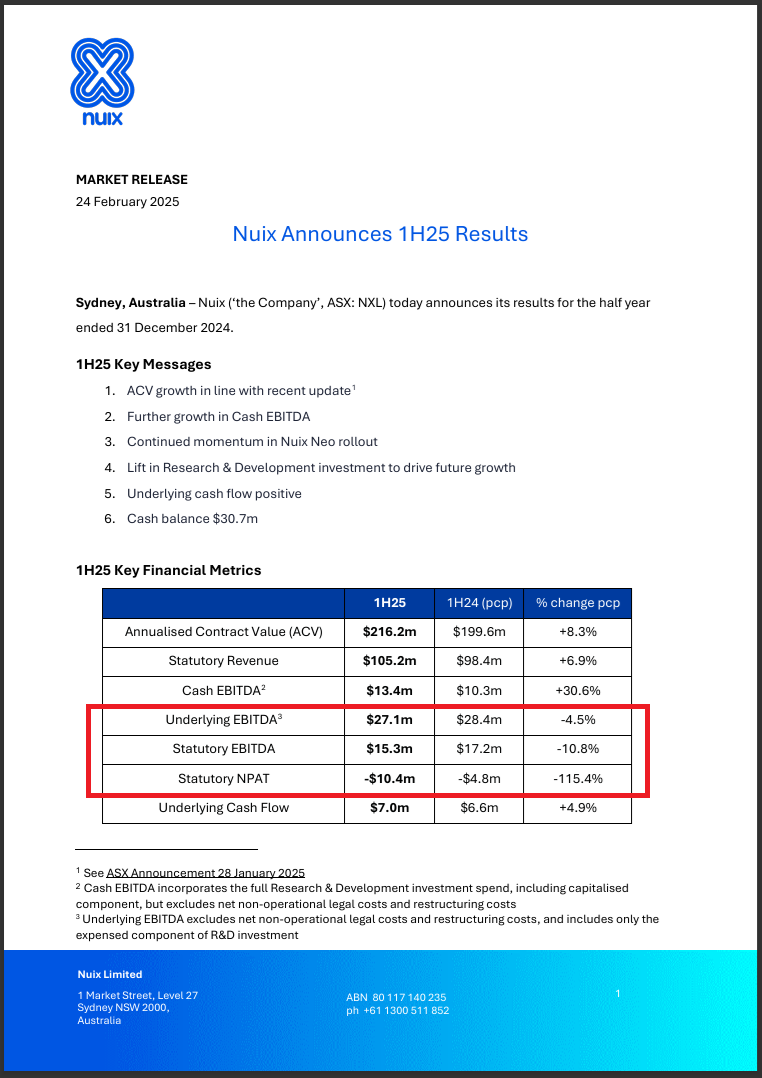

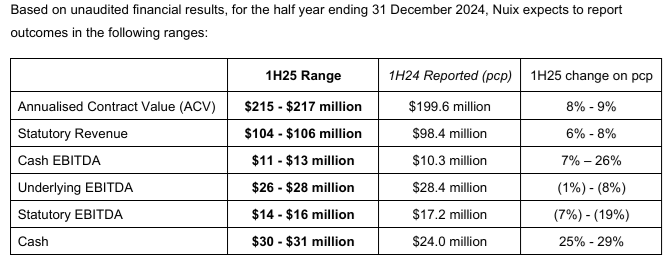

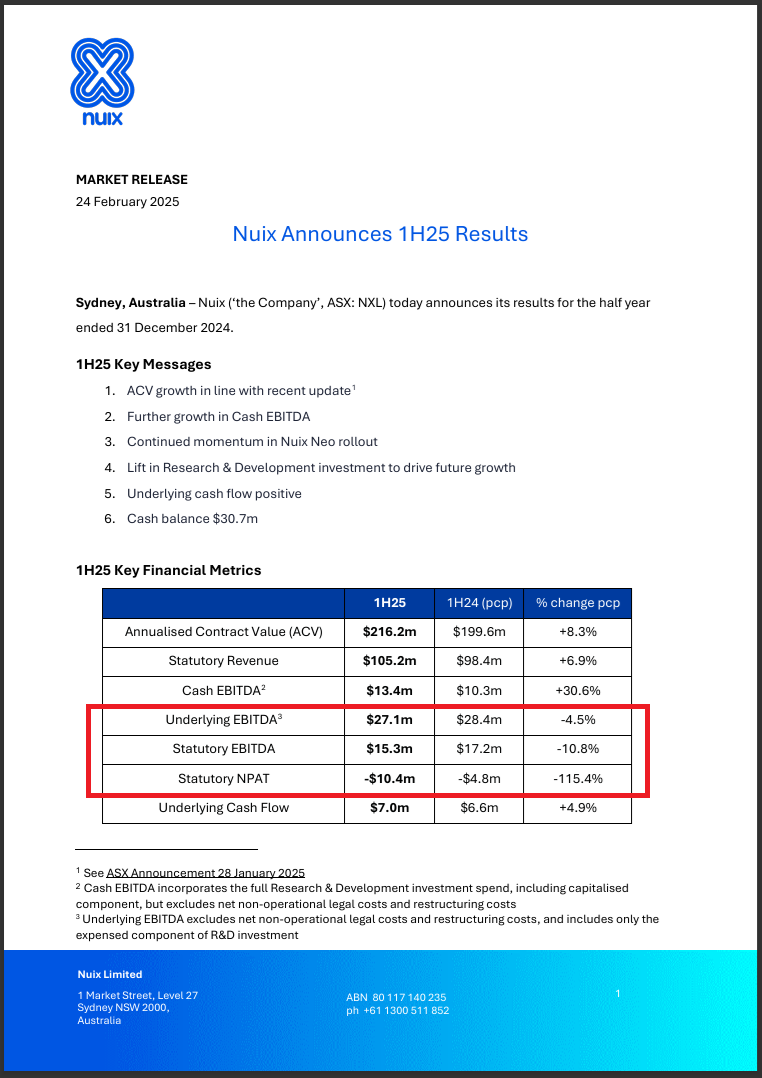

Was it really that bad? Well, it wasn't good:

Source: Page 1 of NXL-1H25-Results.PDF

They managed to land within the guidance ranges they provided in late January, except for narrowly exceeding their $11 to $13 million Cash EBITDA guidance (by 0.4m), but importantly that particular number does NOT include legal costs and restructuring costs, and they've got a few class actions ongoing, so there are substantial legal costs. And restructuring costs.

The thing that everybody is focusing on NOW, and rightly so, is the Statutory NPAT, i.e. bottom line profit number, and it was a 10.4 million LOSS, a whopping -115.4% WORSE than the $4.8 million LOSS that they had reported 12 months ago for H1 of FY2024 (the p.c.p.).

You may note that they did NOT given any Statutory NPAT guidance in January - they did give guidance for the 5 metrics above that one, but not that one, which, coincidentally, happens to be the WORST one, both in terms of comparisons with the previous corresponding period, and also in terms of how the business is travelling right now. Which is... not good.

To make matters even worse, as if it wasn't bad enough already, their "Outlook" Statement was...

As you can see, that consists entirely of "STRATEGIC TARGETS", rather than any substantive guidance. In other words, "this is what we'd like to happen, and what we're working towards, but we can't tell you what the odds are of us achieving any of these targets, but obviously we'll give it a red hot go". [paraphrasing]

Bottom line, they're still losing money, and they have not been great at setting realistic targets and achieving them over the past few years, so with every additional disappointing result, and guidance downgrade, they shake off even more of whatever true believers they've got left clinging on in the hope that there is a decent company among all of the rubbish management. It increasingly looks like even if there is, this management are going to run it into the ground anyway.

They might get some traders jumping on them when they're in an uptrend, but it seems that they go up mostly on hot air and then gravity brings them back down.

Still, if you look at them over the past 3 years against a couple of other companies that were also supposed to be turning around and heading north again, Retail Food Group (RFG) and Appen (APX), at least Nuix are still ahead of where they were 3 years ago; those other two are not:

The Orange line is the ASX200 Accumulation or Total Return (TR) Index (XJO.asx), which is the baseline ETF return.

From a starting point of 3 years ago - beginning of March 2022 - Nuix was bouncing along with a negative return and then went from -43% down on July 12th, 2023 to +463% up on the last day of October 2024, and despite it being all downhill from there, they're still trading at levels that are +167.6% higher than 3 years ago, but, that being said, they're also back in a strong downtrend, so... there's that.

Nuix's positive turnaround was clearly unsustainable.

Disc: Not holding these.