Maybe found the reason why MXI refused the @Strawman meeting request

There was a recent capital raise to acquire more of Forsch and another company IP

Placement was done to complete the transaction

Details below:

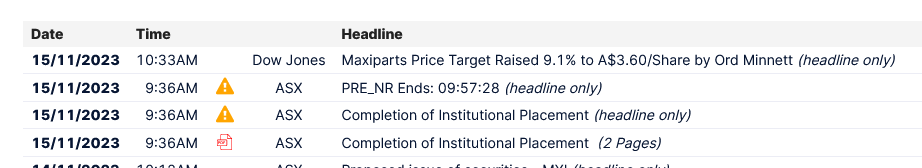

15 November 2023

New Shares under the Offer will be issued at a price of $2.46 per New Share (“Offer Price”), which represents a:

• 9.6% discount to the last traded price of $2.72 on 13 November 2023;

• 10.2% discount to 5-day VWAP of $2.74; and

• 9.2% discount to 10-day VWAP of $2.71.

Ord Minnett Limited and Canaccord Genuity (Australia) Limited are the Joint Lead Managers, Underwriters and Bookrunners to the Placement (“Joint Lead Managers”).

INSTITUTIONAL PLACEMENT

MaxiPARTS received strong support for the Placement from both existing and new shareholders, raising a total of approximately $17.2 million. Under the Placement, MaxiPARTS has agreed to issue approximately 7.0 million New Shares at the Offer Price to raise approximately $17.2 million. No shareholder approval is required for the Placement, as MaxiPARTS will utilise available placement capacity under Listing Rule 7.1.

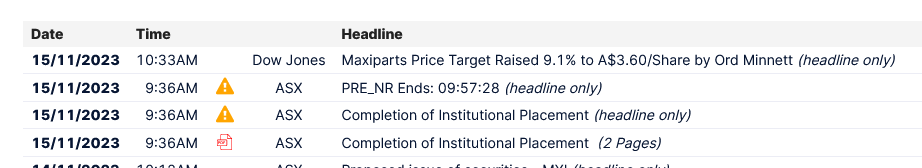

Interestingly there was a announcement on the day before about the placement being fully underwritten

14 November 2023

Equity Raising

MaxiPARTS also announces a fully underwritten $17.2 million institutional placement launching today (“Placement”) utilising the Company’s Listing Rule 7.1 Placement Capacity.

Furthermore Ord Minnett came up with a new price target raising to $3.60 p/sh

Looks like there is some conflict of interest here.

My other hunch is the underwriters have been selling stock although I am not certain. But there is that feel that underwriters had some issue moving these 7m shares and didn't want to hold too much.

Not sure if I want to top up here. But if you think this has value, stock is going at a discount right now, possibly caused by the underwriters.

I haven't had time to look at the acquisition more closely as talking about the events leading up to the underwritten placement is more interesting.

On the other hand I could be reading too much into the placement and the share price fall today.

[held]