Australia's ELMO Software agrees near-$500m takeover offer from U.S. firm - Software - CRN Australia

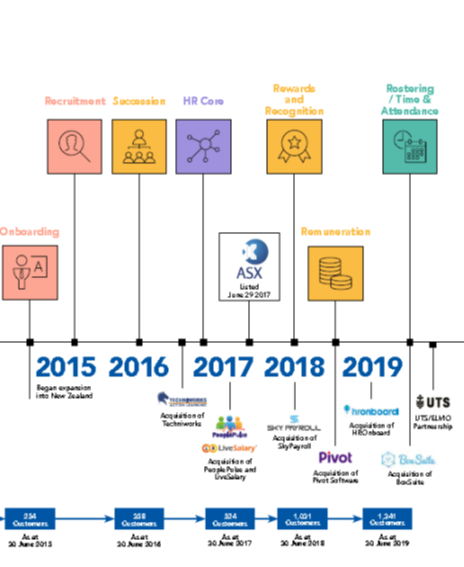

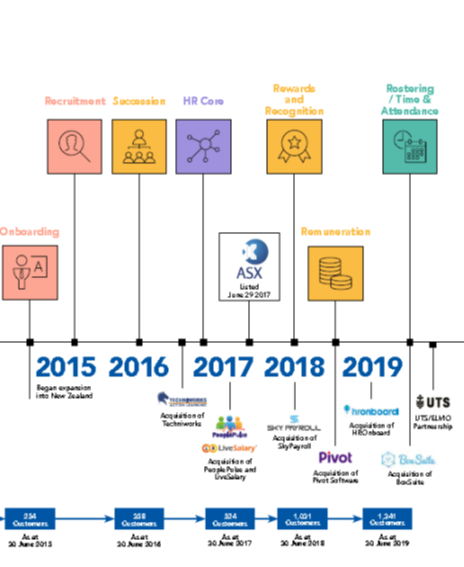

Michael Wayne tipped ELMO back in October 2019 (see link in previous post in this thread) and they were acquired by Los Angeles-based K1 Investment Management in late 2022 for $4.85/share, a substantial 100.4% premium to the closing share price on Oct 12 2022, the day before ELMO announced it had received approaches expressing interest in a takeover. ELMO's shares had been down by around 27% in 2022 ahead of the takeover.

I had a look at them and produced an investment thesis for ELO (Elmo) back in October 2019, after reading Michael Wayne's article, however ELO was trading at $6.64/share at that point, with a market value of $498 million, and I concluded that there was already a premium built into their share price, and that they were relying too much on acquisitive growth, and were not achieving significant organic growth. I did source and read a variety of alternative views to MW's including this one from the AFR: Losses widen as ELMO Software invests in growth (afr.com)

As it turned out, I could have invested in ELMO (ELO) at that point and watched the share price rise to as high as $8.39 in Feb, 2020, then down to $3.66 just six weeks later (in March 2020) after they released this Covid-19-related guidance downgrade: ELO-March-2020-Business-update.pdf, then get down to just $2.20/share in July 2022, before receiving that takeover offer priced at $4.85, being 27% less than my theoretical entry point (of $6.64). [I chose NOT to invest in ELO]

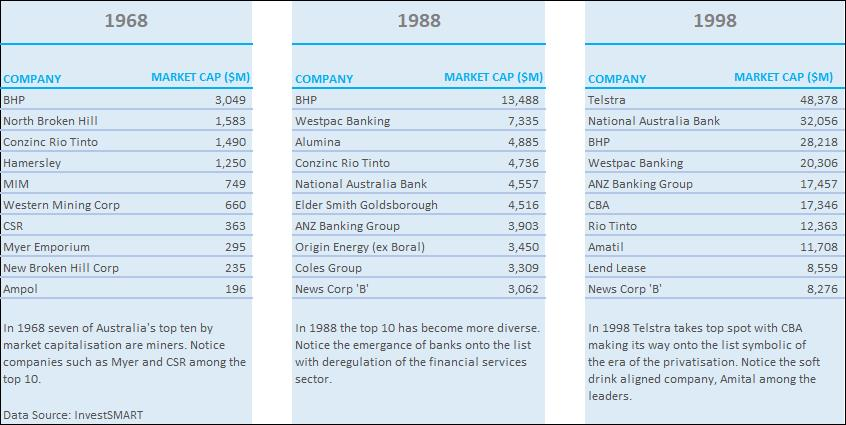

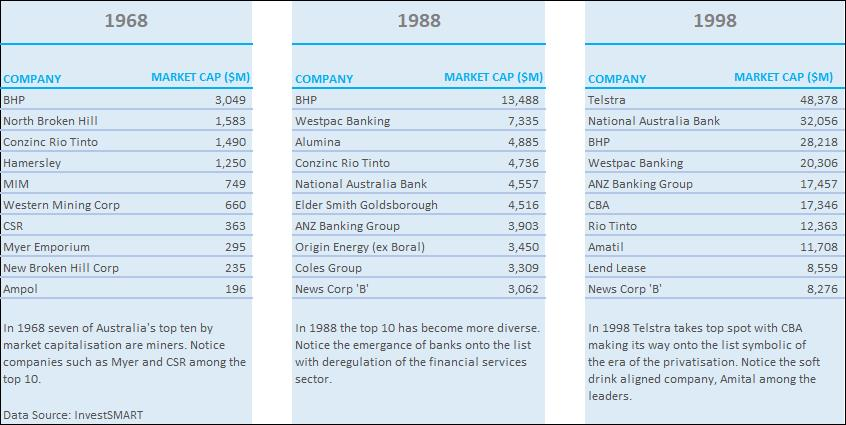

They ended up with the same market cap (around $500m) at the point of takeover (as they had in late 2019), but with more shares on issue (and a lower share price). It would still have been a significant loss for anybody that invested in ELMO (ELO) in October 2019 around the time Michael Wayne picked them (ELMO) in that article that kicked off with how Australia's ASX-top-10 companies had changed over time:

The inferrence was of course that you needed to identify the qualities of the companies that were more likely to head up the list and approach that top 10, given time, and to invest in those companies, and to also look at the ones that had fallen from grace, and why, and try to avoid those companies.

MW talked about the "Innovation Gap" and "Value v Growth" and also "Traits of ‘Quality’ Growth Businesses". He suggested such traits included the following:

- Capital Light

- Intangible assets

- Low Churn

- High Margins

- High Free Cash Flow

- Sacrifice Profitability for Growth

And that ELMO ticked all of those boxes. He closed with: "Opportunity Ahead: Overall, ELMO is consistently growing their offerings and customer base, both organically and through targeted acquisitions. Given their steadily growing footprint, large market opportunity and quality offering with extremely high customer retention, we [Medallion Financial Group] are more than happy to hold positions in this quality SaaS business at a price which is approximately 25% off the 12-month high of $8.51 at the time of writing."

Today, while browsing through old forum threads here, I came across my link to MW's article in this "Value vs Growth" thread (in the post above this one) and thought I'd check out how ELMO (formerly ASX: ELO) had worked out for those who did invest in them at around that time. Not well.

We all get calls wrong at times. Speaking for myself, a glaring example is that I chose Swoop (ASX: SWP) as one of three companies I tipped should do well in the current (almost ended) financial year (FY2023) back when I kicked off the "FY23 Stock (Company) Picks" forum 10 months ago. I tipped SWP, MAH and FMG. FMG is up, and in the top 5 best performers of all of those companies that were picked by the members here, however MAH is -21.2% (16.5 cps down to 13 cps) and SWP is down a whopping -53.4% (44 cps to 20.5 cps, having been as low as 17.5cps). And I'm still holding all three both here and in real life because I think there is significant upside potential with all three, however that was also my view 10 months ago (in August) when I tipped them as three companies who should outperform in FY23, and two of them certainly have NOT outperformed... yet... and there's virtually zero chance that SWP will be able to reverse that underperformance during the final fortnight of June 2023 - unless they get a generous takeover offer. In fact, tax-loss selling will most likely drive the share prices of SWP and MAH even further South over the next two weeks. So, yeah, we all make bad calls sometimes.

If a company never lives up to that perceived potential upside, or they get taken out (acquired) before that potential upside is realised and experienced, then the paper losses can become actual losses, as happened with this ELMO example.

In ELMO's case, I chose not to invest in them because I felt that (a) they didn't have enough organic growth and they were relying too much on M&A for growth, in an operating environment with a LOT of other players, some of them being a lot bigger than ELMO, (b) I could not identify that ELMO had any significant competitive advantages over their peers (other companies operating in the same space as ELMO here in Australia), and (c) I had a phone conversation with Darryl Garber, who was their "Chief Commercial Officer" back then (late 2019) - and was also the son of one of the two founders of ELMO (founders were Manuel Garber and Danny Lessem, who owned 32.4% of ELMO's shares on issue between them at the time) - and I asked him about their main competitors in the market (he said most of the serious competition was US-based HR SaaS companies that were much larger than ELMO) and moats (competitive advantages) and I came away from that call without a strong sense of why ELMO was likely to outperform their competitors.

Danny was emphasising that they were outperforming within the section of their addressable market that they were targeting, which he indicated was medium-sized enterprises here in Australia. However Michael Wayne had listed some of ELMO's clients as the Australian Government, IBM, Kmart, Healthscope, Sonic Healthcare, RMIT, Macquarie University, Komatsu, Cbus, Toshiba, Hyundai and Fujitsu.

By Australian standards, some of those names are larger than "Medium-sized".

Another thing that Danny Garber told me was that a lot of Australian companies preferred that their employee data (and other data) was stored locally (here in Australia) and that their HR SaaS provider was Australian and was able to be reached during business hours here in Australia for support. That made sense, however apart from US companies and other overseas-based companies that operate in the space - like WorkDay, Monday.com, Remote, TalentHR, Symphony Talent, iCIMS, Cornerstone, BambooHR, First Advantage, Empuls, Engagedly, Inc., ADP, Administrate, Ultimate Software, HRSoft, Paychex, Paycom, Paycor, Paylocity, Namely, Gusto, Trinet, UKG, Xceleration, QGenda, Loxo, WeSpire, SimPRO-owned ClockShark, Sage HR, TeamViewer, Sapience Analytics, BizMerlinHR, Lever, Beamery and Bob (or HiBob) - ELMO also have competition here in Australia from Australian-based companies like Employment Hero, JobAdder, Aussie Timesheets, Payroller, Worknice, and Deputy, which the company I currently work for uses. Also, there's IntelliHR, which was ASX-listed but has been taken private with their acquisition by PE-backed HumanForce - see here: Humanforce-IntelliHR takeover: Cashed up Australian tech firm eyes global deals (afr.com).

Further Reading: Deputy goes from near-death to near-unicorn (afr.com) [March 2021]

So there is plenty of Australian-based competition here in addition to the mountain of overseas players in the HR space. Apart from some customer reviews citing good customer support and positive initial software implementation experiences (one such review is linked to at the end of this post below, under "Further Reading"), there was little there to convince me that ELMO was head-and-shoulders above their Australian-based peers, and was therefore in a very good position to outperform those peers. It seemed more like a lottery to me at the time (in late 2019) and there were investments available elsewhere (outside of that sector) that had better odds - in my opinion - so where my investment thesis/theses (ITs) for those other companies playing out in my favour looked to be more likely than it would have been with ELMO. ELMO seemed to have too much uncertainty - so the ELMO IT (investment thesis) was really based more on hope than on facts, in my opinion.

MW wrote (in October 2019): "ELMO also boasts a low churn rate with an impressive customer retention rate of 92.1%. Of equal, if not greater importance is the 110.8% customer dollar retention aided by gross profit margins of 86.6%."

I also had concerns about aspects of that. A Churn rate of 7.9% is actually fairly high in my experience for good SaaS companies. Also, a gross profit margin of almost 87% signals to me that there is likely to be further competition in the space, because the company is over-earning. On top of that, despite the high gross profit margin, the company was still posting losses. The argument is that they were only posting losses because they were sacrificing profitability for growth, which is fair enough, however that's been one of the most obvious changes in my view over the past few years - investors growing weary of companies that could clearly be profitable but choose instead to continue to "invest in growth" when that investment is mostly via M&A, and often results in write-offs of the carrying value of those businesses or of the intangible assets that were acquired with those businesses - basically, multi-million-dollar write-downs in subsequent years after acquisitions that, with the benefit of hindsight, were overpaid for.

Punters have also become less trusting of companies' estimates of future savings and synergies that will result from acquisitions, especially when the same company has been very wrong about such estimates when making prior acquisitions.

The shortest way of summarising this change is probably that investors are now far more: "Show Me The Money!"

Which is partly a shift from that Growth focus to more of a Value focus now.

Or a combination of both growth and value, so rather than "Growth At All Costs", we're now looking for "sustainable growth available at a decent price" (i.e. value).

And backing ASX-listed cloud-based SaaS companies with a history of growth via acquisition isn't always going to deliver the results you're looking for, as this ELMO story has proven.

We need to dig a little deeper than that.

ELMO had some warning signs IMO, and I personally couldn't identify a clear moat - meaning one or more competitive advantage(s) over their peers, and they were operating in a crowded and very competitive market with a management team that seemed to me to be a little muddled in their understanding and communication of their opportunity and business plan.

Plenty of hype, but the opportunity wasn't really there when you dug down a little (scraped the surface).

Mind you, you would have done alright if you had bought them near their $2.20/share lows in July 2022, but we don't often pick the bottom with companies like these.

Further Reading: Delisted.com.au: https://www.delisted.com.au/company/elmo-software-limited/

Australia's ELMO Software agrees near-$500m takeover offer from U.S. firm - Software - CRN Australia [Oct 2022]

ELMO Software backs takeover offer, Danny Lessem to cash out $16m from K1 takeover (afr.com) [26-Oct-2022]

ELMO Software Review: simplistic HR system - YouTube [mid-2022]

ELMO Software Review: ELMO HRIS: Review Snap-shot - YouTube [mid-2022]

ELMO Software Pricing, Alternatives & More 2023 | Capterra

The Top 25 HR Software Companies of 2021 | The Software Report

Web-based Human Resources Software | GetApp