AAR Note Strawman

With a window of time, I am looking to catch up on thesis on my new gold positions which includes AAR.

AAR’s key project is Mandilla (located in WA) which hosts 42mot at 1.1gpt for 1.43moz, whilst global resource base post MXR acquisition is 50mt at 1.1gpt for 1.76moz, noting that MZR’s Spargoville project abuts the Mandilla project.

Focusing on the Mandilla project, the scoping study released in Sept 2023 will go a long way to warp your held around the mining potential of the project and gives a good baseline to the adjustments I have modelled to try and work out what the PFS could look like. Key thing to note about the deposit is that whilst rade is “low” the ore body’s characteristics leads to a modest strip of ~7x LOM, coarse grind (P80 150um) and clean met with recoveries close to 96%. These are very good characteristics to have and whilst you need a bull market to fund new projects, it is not a bull market asset.

Marc’s preso at the RIU conference is key to understanding how the PFS will look compared to the SS. Deck & Recording. The key points are

- MXR saved them ~$30m haulage costs essentially around better waste dump design unhindered by tenement boundaries. Essentially the MXR ounces were free.

- o This means the can have more than 160mt of waste thus helps put more ounces into the mine plan at lower cost

- o 50mt of ore (with ~305mt of waste) at an overall strip of 6.1x, noting Theia strip is 5.5:1.0 in the PFS and is core of the mine plan

- ·Recent JORC update optimises resources at A$3500/oz. As such, conversion is expected to be high. Current is 42mt for 1.43moz with 90% into prod target, becoming ~37.8mt for 1.28moz

- Says resource update uses cost inputs from the PFS.

- o This implies update had mining down 10% to $4.2/t from ~$4.7/t, moved and base processing up 15% to ~$20/t or closer to ~$22.9/t including haulage (picked up in the JORC table). Given the PFS isn’t out, it is hard to know total kms in haulage particularly given the comments around that on the MXR acquisition

- o Opex neutral as mining is down and processing is up whilst they pump out 50%+ more ounces

- o G&A and Sus capex should be similar at this stage and no reason to think otherwise.

- o Net net, total cost on a $/t basis should be similar to the SS whilst they pump out 50%+ more ounces. This will lead to a big upgrade over the SS operationally and especially financially when a higher gold prices is used in the NPV

- Regs should be simple with no Fed review and no WA EPA (path for referral). Just with DEMIRS and DOWA at 6 and 9mths respectively.

- When talking about Feysville and Spargoville, indicates higher grade ore that can lift output (ounces) LOM to maximise the PFS. Looking at those resources, grades are 1.2-1.4gpt vs 1.1gpt so it may be marginal uplift so not modelled atm.

- Stated funded to FID with $22m cash and $6m from oppies in Oct 2025.

- PFS still on due this quarter

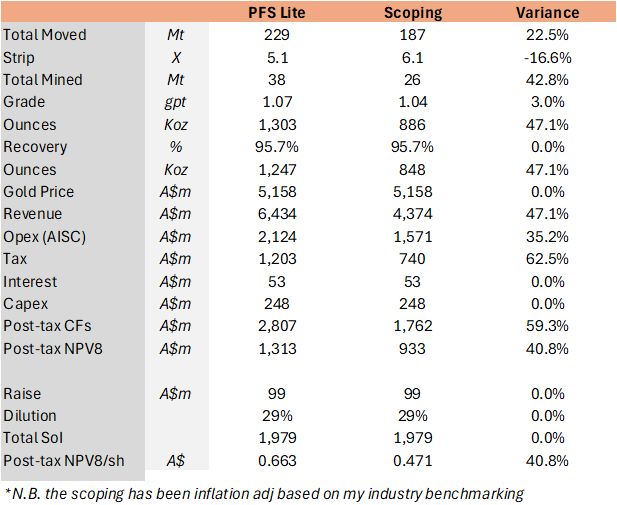

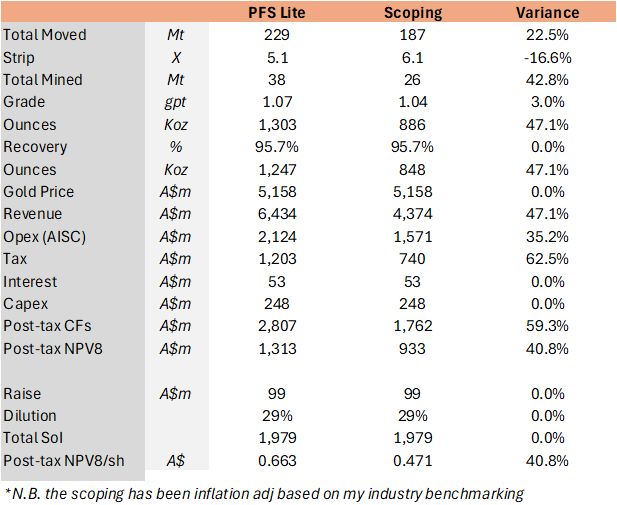

The valuation work is simple, take the SS mine plan and upgrade it to what is implied by the PFS which means years’ 9-13 have to be bootlegged given processing is expected to remain at 2.5mpta. Here I estimate an additional 11.4mt of ore at 1.04gpt for 381koz which is evenly split over the 5yrs. Waste is estimated at 83.6mt which makes incremental strip of 6.0x (mostly from Thea which is 5.5x). This creates a mine plan which mines a total of 37.8mt at 1.07gpt for 1.25Moz over 13yrs (processing over 17yrs). To avoid detailing the minutia in writing, the table below summarises the mining model outputs for the PFS Lite model and compared against the scoping output.

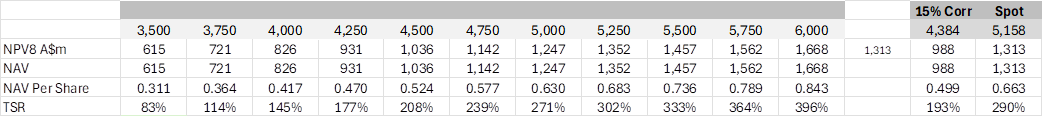

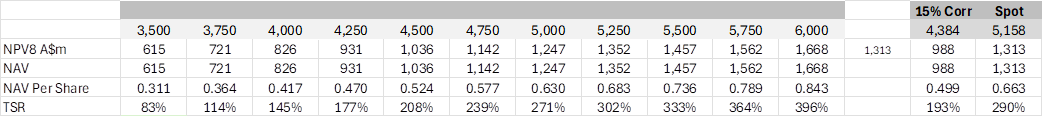

Below is the sensitivity table for PFS Lite, which is the same format as I have used in my analysis if MEK. Returns are very asymmetric at this stage.

The takeaway is that the PFS will be a big upgrade in a strong gold market and I would expect AAR to re-rate off the back of that. Experienced mining investors will say but “what about the Lassonde curve?”. I think in a strong gold market like this, with investor appetite to go down the dev curve, I think the Lassonde curve will flatten or be ignored and my evidence for that is BGD. BGD did a SS in Nov 24 and in CY25 released updates on that, JORC and presented giving titbits away leading into the form release early May. BGD is step behind being at SS level still but that has not stopped a strong re-rate as economics are reported and improved upon.

If anyone can tell me how to attach a copy of the model I will do it so people can have it to suss.

EDIT: Link to the model