This will be a long one but at the end it just wasn't worth the effort deep diving the valuation.

Firstly I understand why the high PE now.

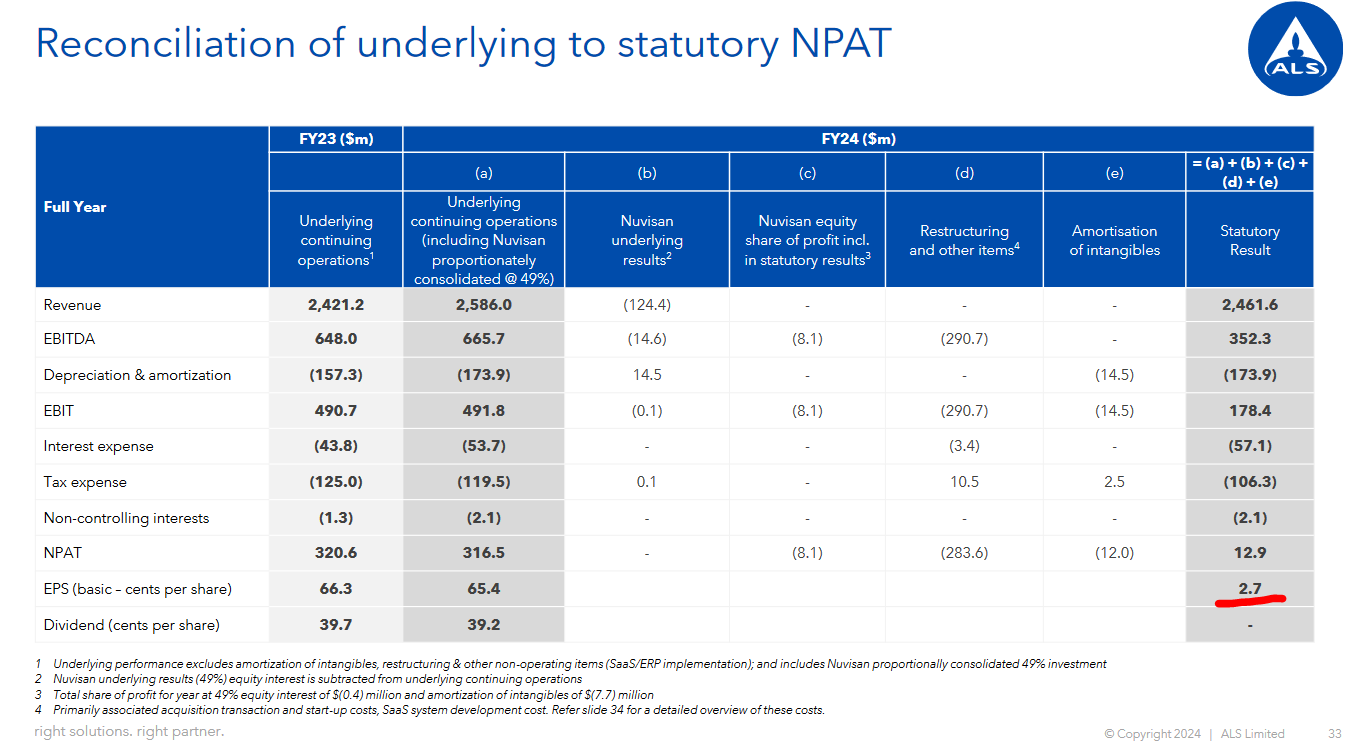

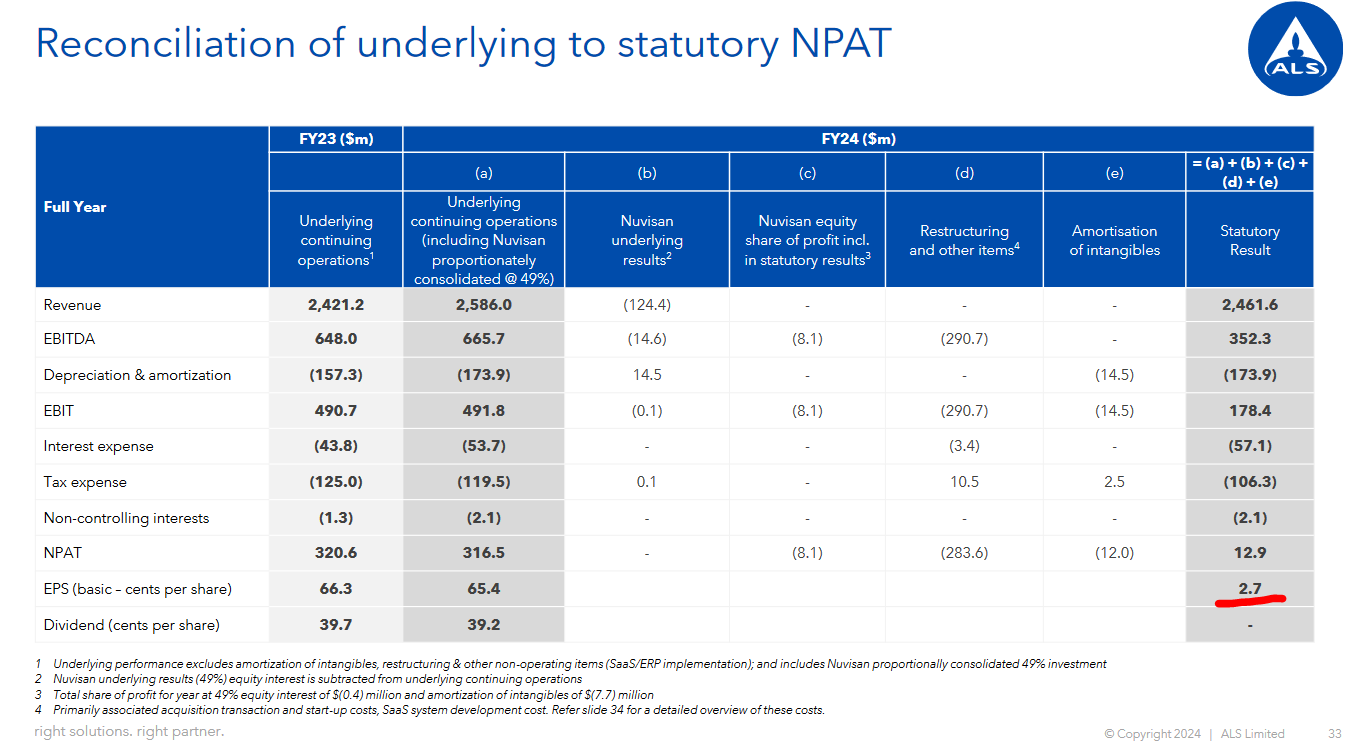

ALQ has split the statutory from the underlying EPS.

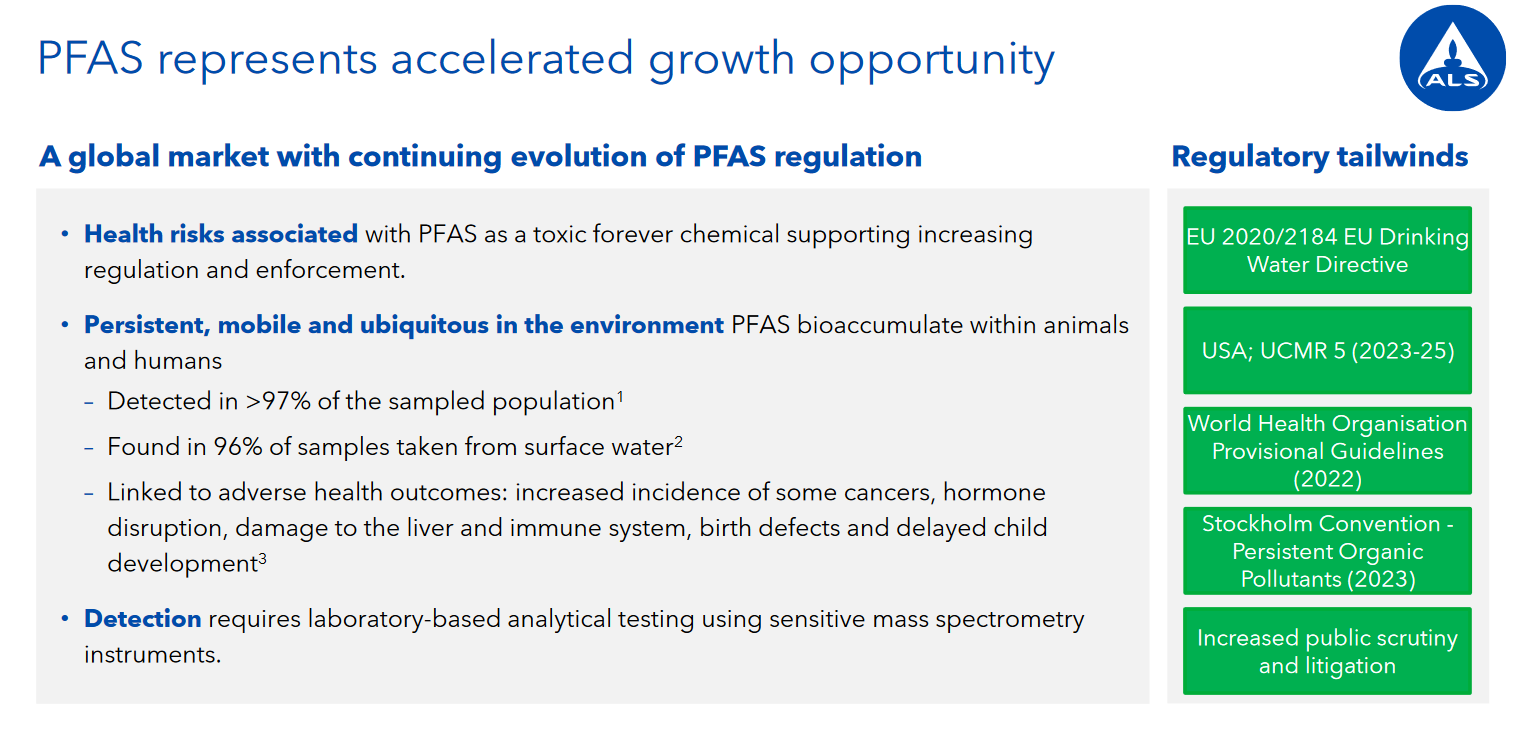

Looks like ALQ have convinced analysts that all the Nuvisan stuff is a one-off so they are willing to look past the abnormal result while highlighting the growth opportunity in Environmental testing, particularly with PFAS.

An example of this is from Goldman Sachs, May 21st

Goldman Sachs analyst Niraj Shah has maintained their bullish stance on CPBLF stock, giving a Buy rating on May 14.

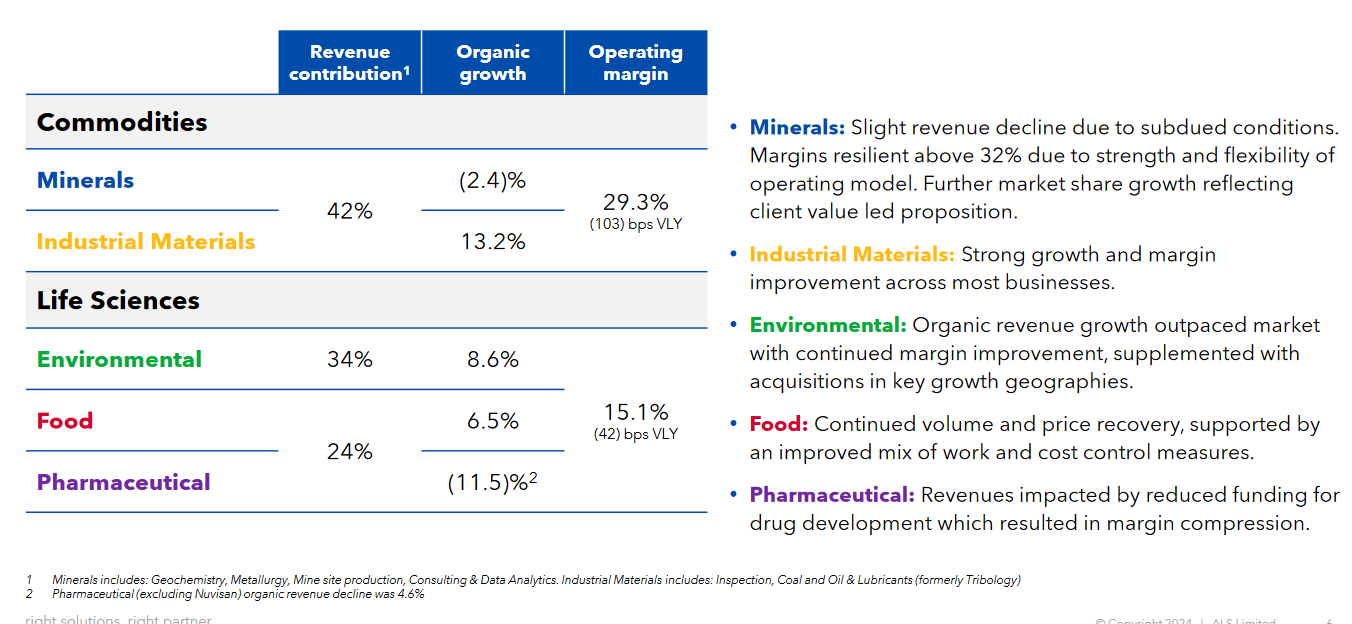

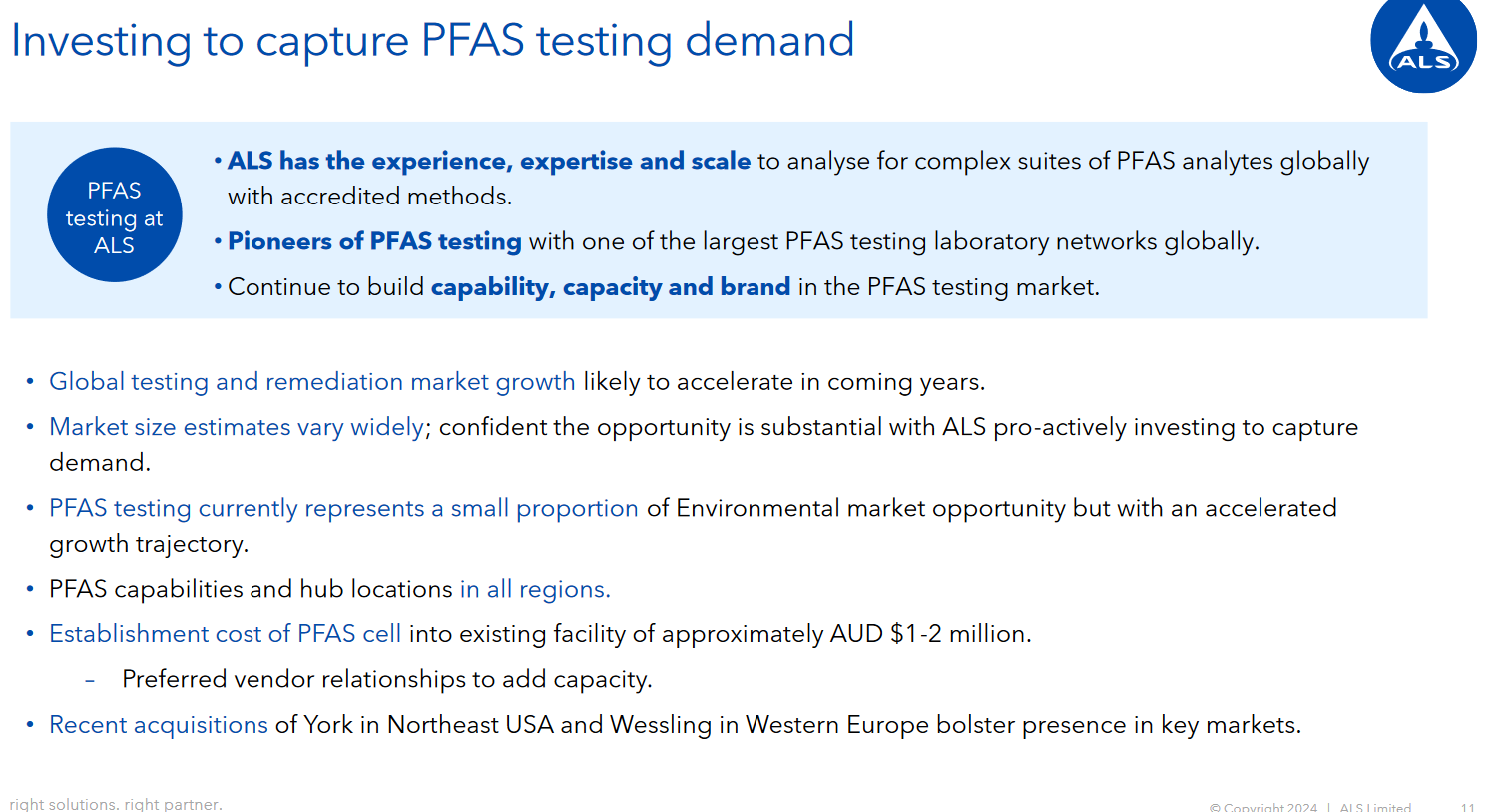

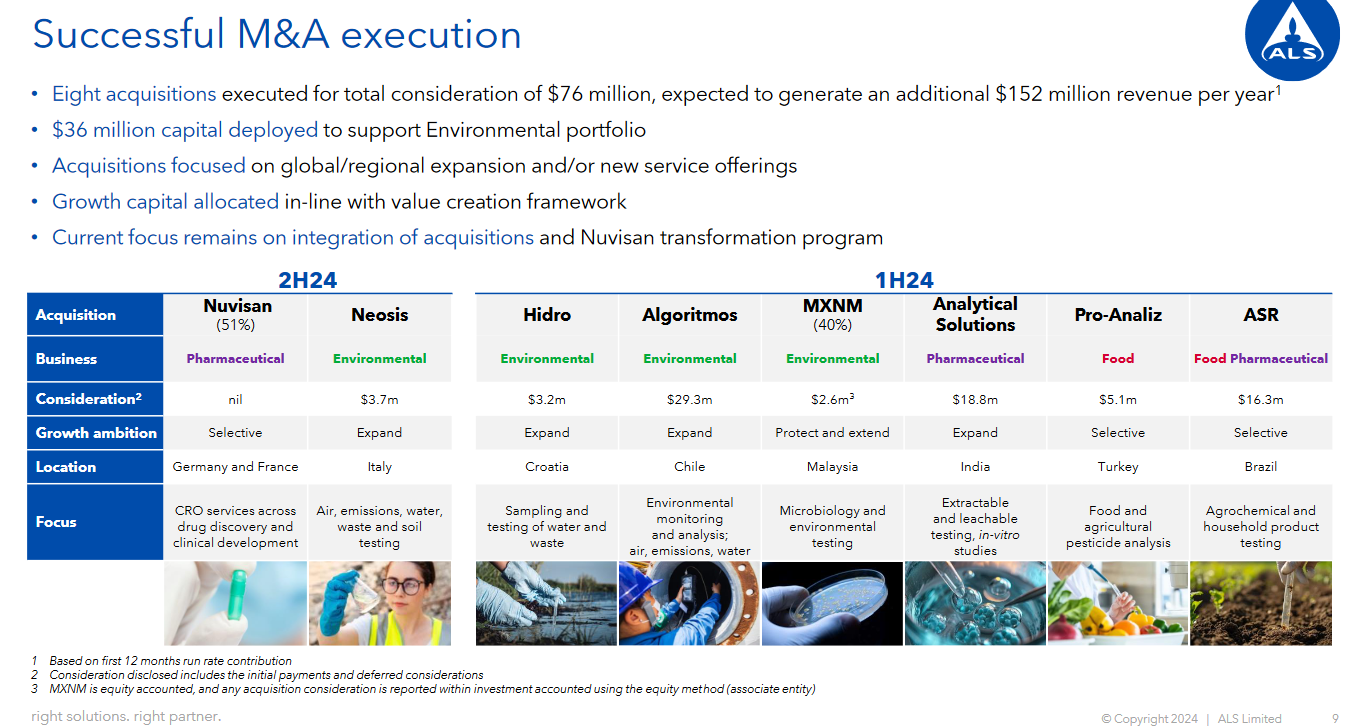

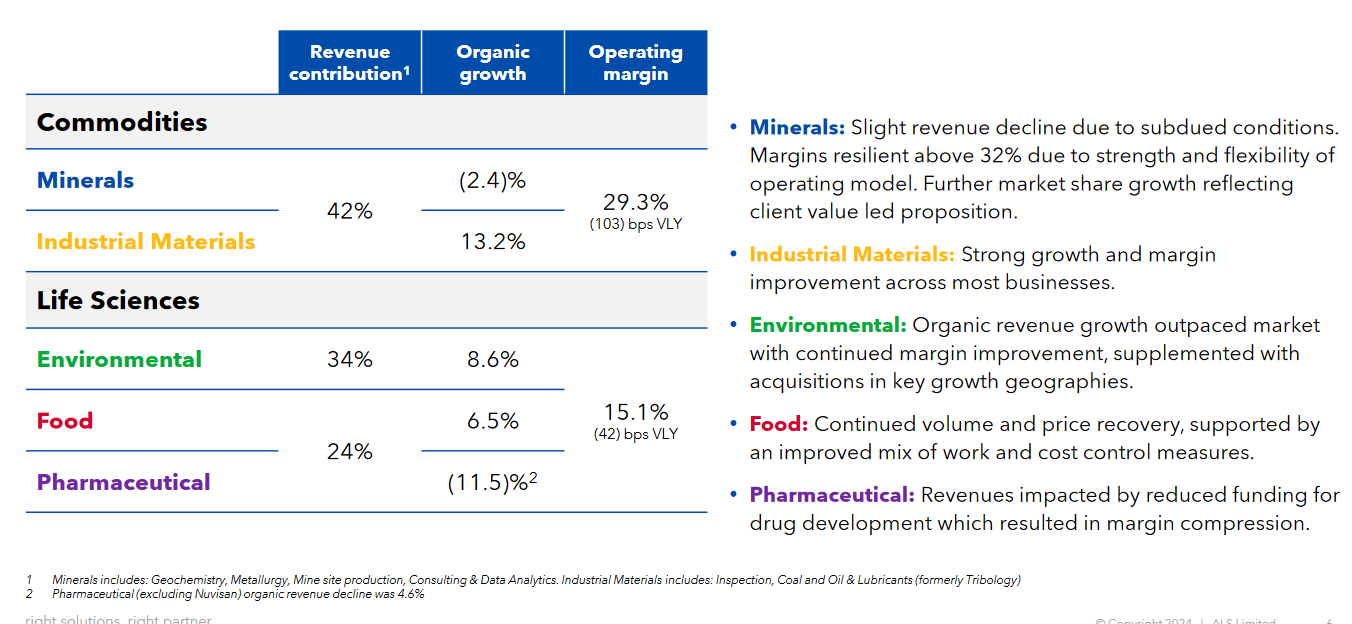

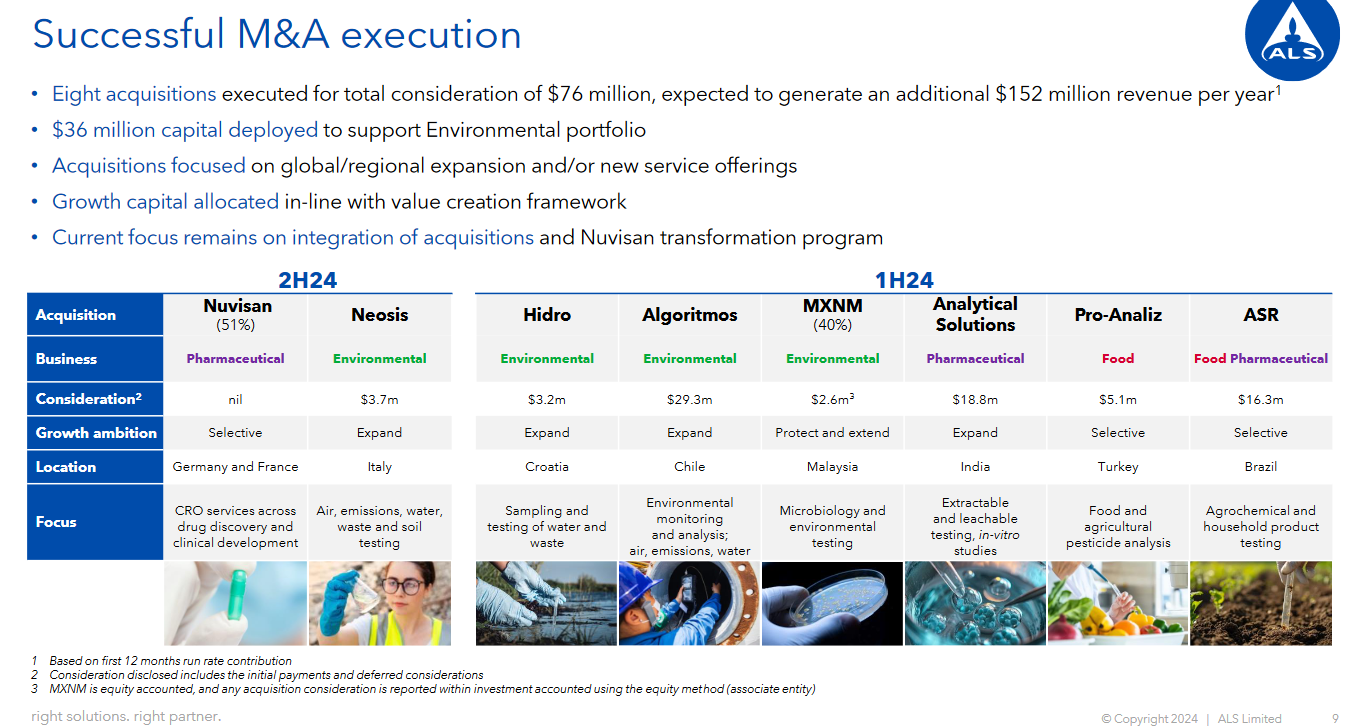

Niraj Shah has given his Buy rating due to a combination of factors, including ALS Ltd.’s resilient performance and strong future growth prospects. The company’s FY24 results were in line with expectations, and there is a moderate single-digit organic revenue growth forecasted for FY25. Life Sciences, a segment of ALS, has shown approximately 4% growth, which is believed to be partly due to the increasing demand for PFAS testing, while also benefiting from strategic scope growth. Additionally, the concerns surrounding Nuvisan are abating as the company initiates a transformation project, with a company-wide focus on the integration of recent acquisitions, which is expected to further strengthen its operational framework.

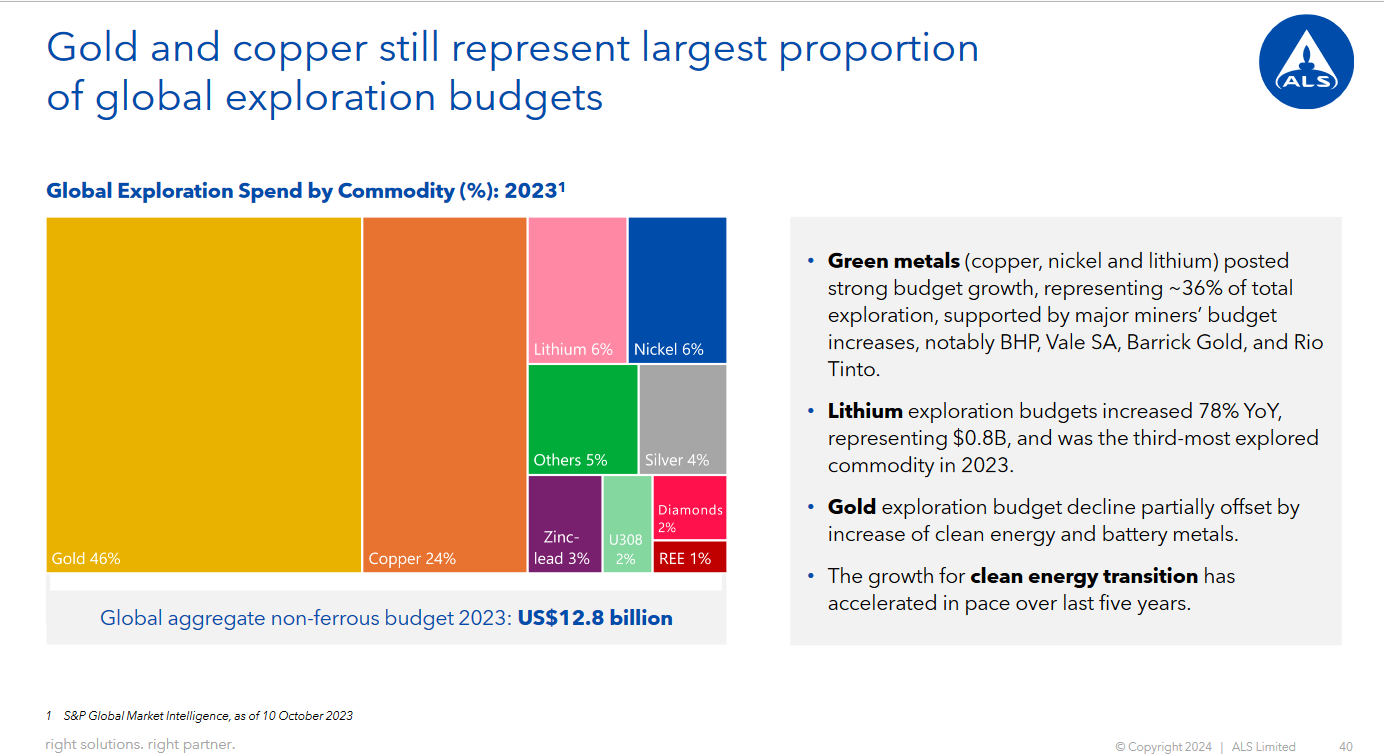

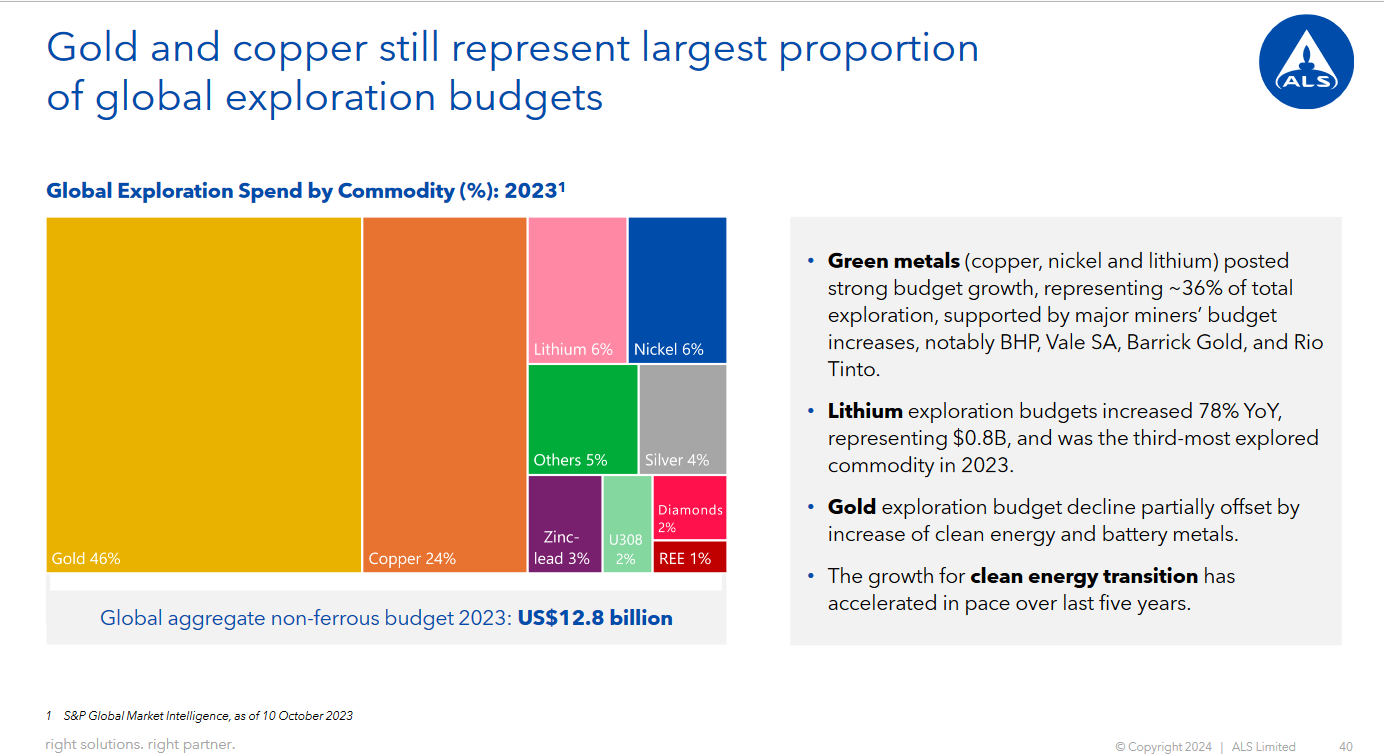

Furthermore, despite a decline in exploration activities, ALS’s Minerals segment demonstrated only a minor decrease in organic revenue and maintained robust EBIT margins, suggesting a stable and potentially higher margin baseline for the future. These factors, coupled with new service offerings and favorable market trends towards green metals, support the thesis of sustained margin expansion. With ALS Ltd. currently trading close to the median of its peer group, there appears to be potential for further margin growth. Shah’s upgraded earnings forecasts for the coming years, along with a valuation roll forward and multiple updates, have led to an increased twelve-month target price, reinforcing the Buy recommendation.

In another report released on May 14, Morgans also upgraded the stock to a Buy with a A$15.00 price target

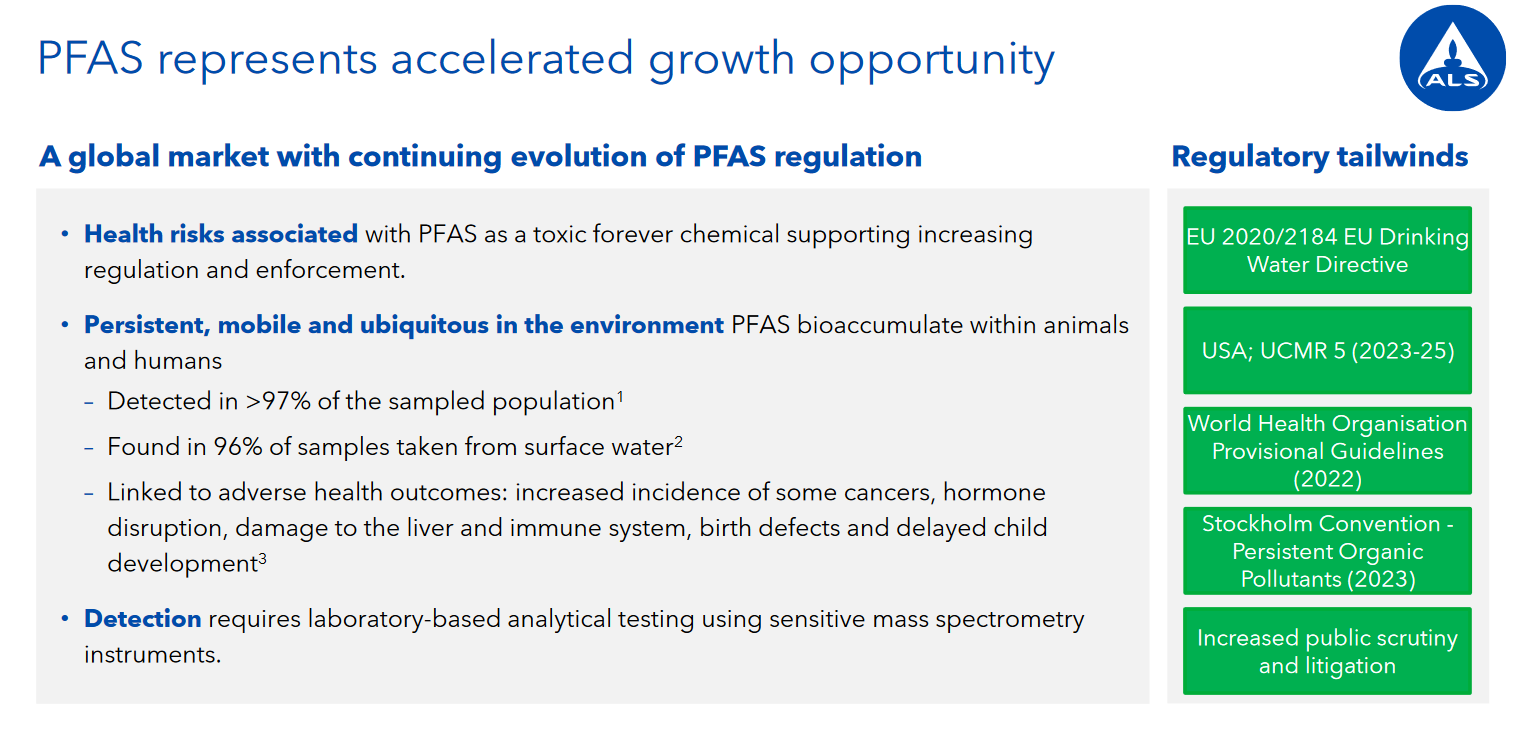

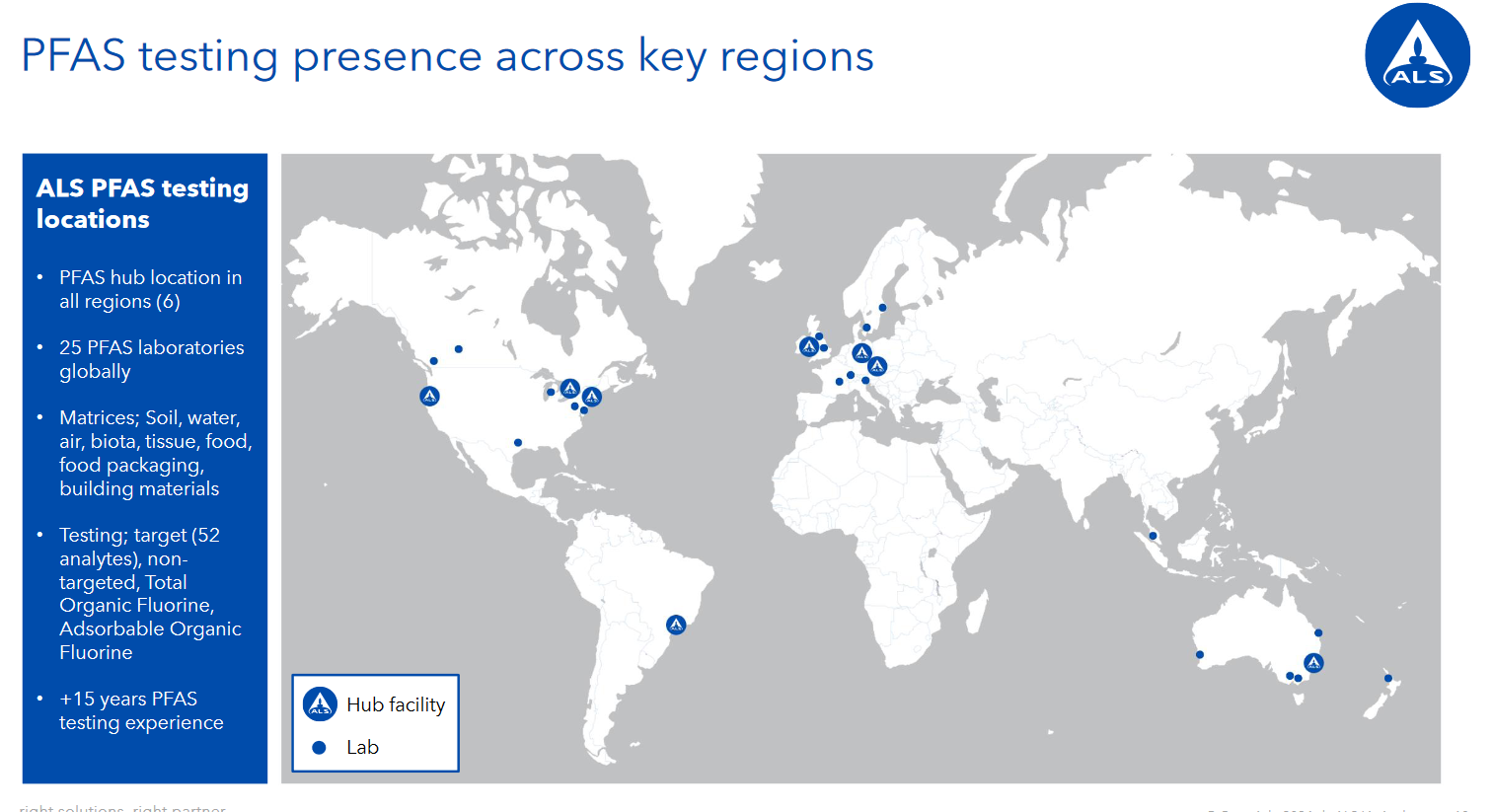

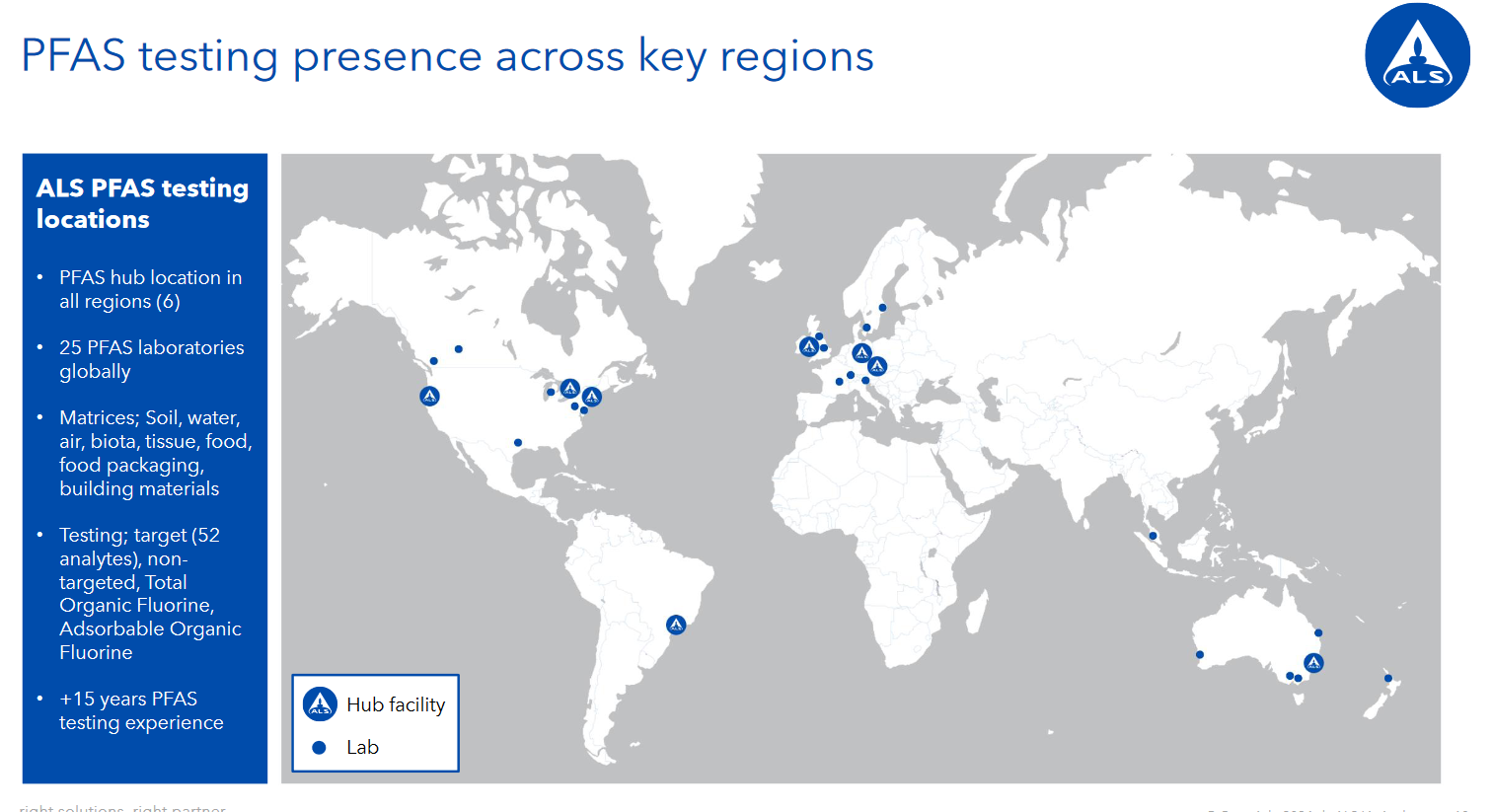

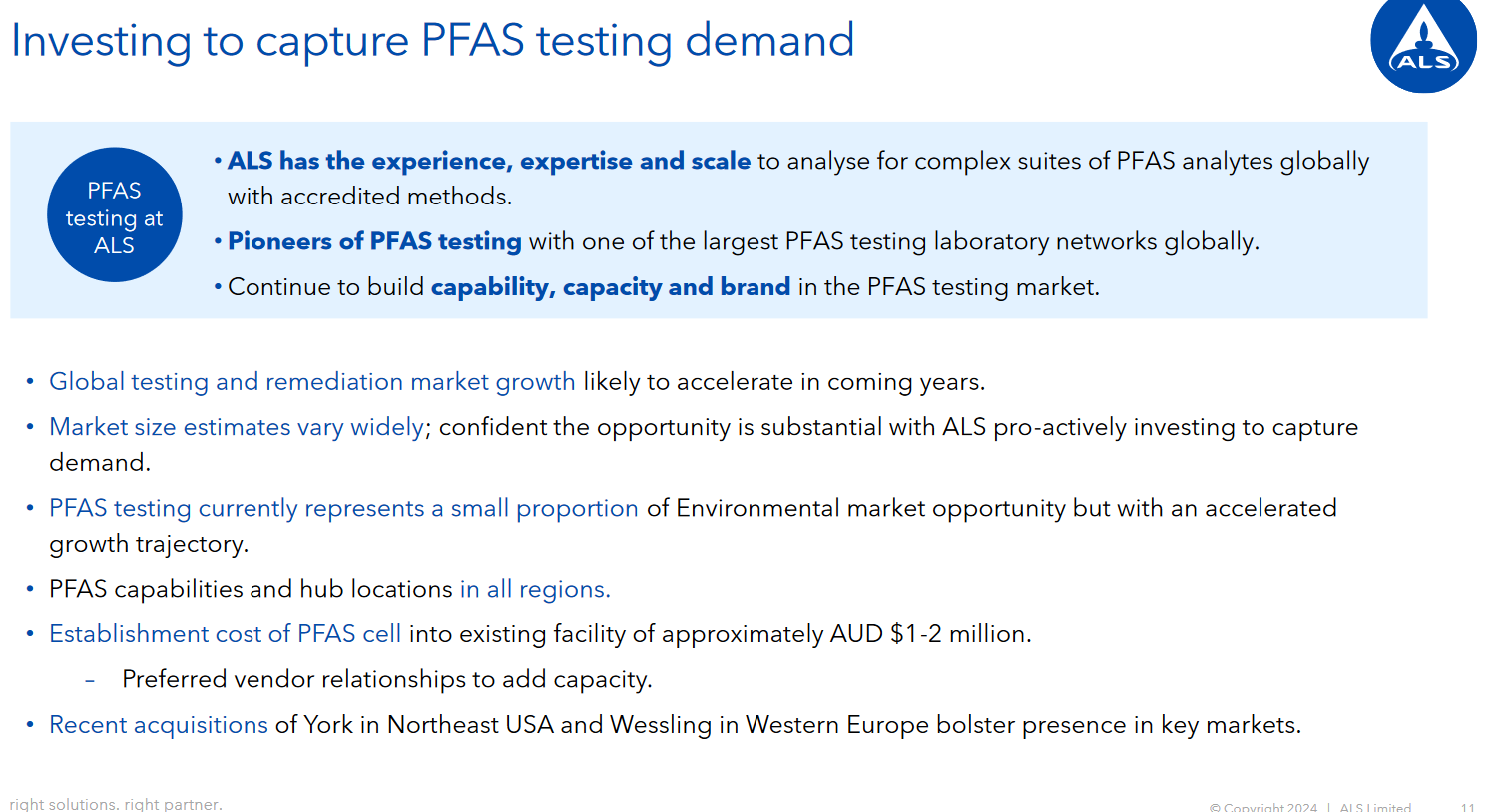

Below are some slides on the PFAS opportunity for ALS. Seems like a good story and I think the company has done well to convince the analysts.

Good story. But doing a Google search on PFAS testing or PFAS testing labs and there are quite a few providers, not just ALS.

I'm going to call out that ALS will need to do another acquisition or two to maintain market share.

That's why there is also a leverage ratio of around 1-2x

However that is just my view which I think it makes sense but there will be others that will think otherwise.

Finally one for the gold bugs...