Atlas announced this week YTD sales of $26.1m after recent Kobe pearl auction. Average price per a pearl for the auction was around $113 and YTD average price per pearl was $102. This is basically 100% increase from the previous year's average. There is strong demand for pearls from Chinese and Japanese buyers driving the price increases. The hard part now is determining how long the is strong demand lasts for, is it a quick fad or an ongoing normal? Pearls take two years to produce so the market can't be flooded in the very short term with new stock. Atlas also noted in the announcement that the pearls sold are improving in quality but is still below long-term averages so there is another factor to the upside for Atlas.

Valuation:

Valuation is complicated by the increased prices and making a call as to the long-term prices. Expenses shouldn't be increasing at anywhere near the rate that pearls have so there is a lot of operating leverage. I am now estimating a NPAT of at least $20m for this FY, and if the $100+ average can be maintained then an NPAT of $25 is possible. My working thesis was a $4m FCF so current results are far better than expected.

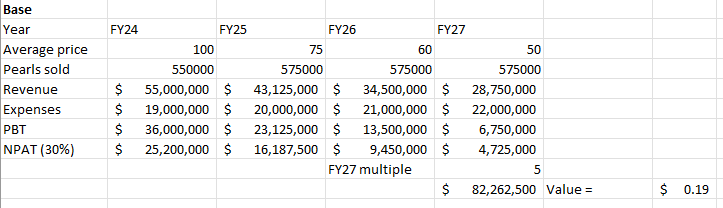

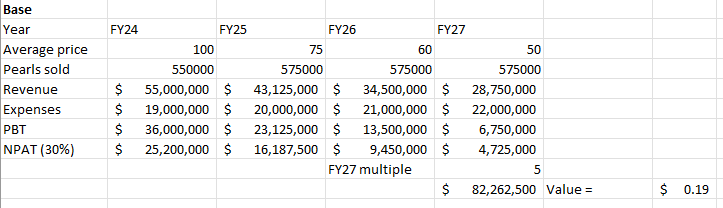

My very simple base case valuation:

This assumes pearl prices are having a one-off price increase due to strong demand then this demand weakens.

Position thoughts:

I have previously trimmed about 1/3 of my position at 11c IRL. Will continue to hold as I wait and see where the pearl market goes from here. If the elevated prices for pearls remain for more than one year, there is significant upside still available. Thesis has well and truly played out already, but I still see the potential for more upside at this point in time that justifies continuing to hold.

In recent times I have been focusing on finding reasonably priced long term compounder companies rather than cheap value. Atlas has shown that I should continue to look for these cheap companies as a part of a multi-strategy approach. However, I need to buy these companies when there is an upgrade cycle/catalyst occurring and be a shorter term (few years) trade. In saying all that, I must acknowledge there has been a lot of luck with this one....

Disclosure: Held in IRL and Strawman