Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Atlas Pearls specializes in production of premium South Sea pearls, which are among the most valuable and sought-after pearls in the world. They operate across eight farming locations in the South Seas, they employ more than 1,200 individuals and harvests between 500,000 to 600,000 pearls annually.

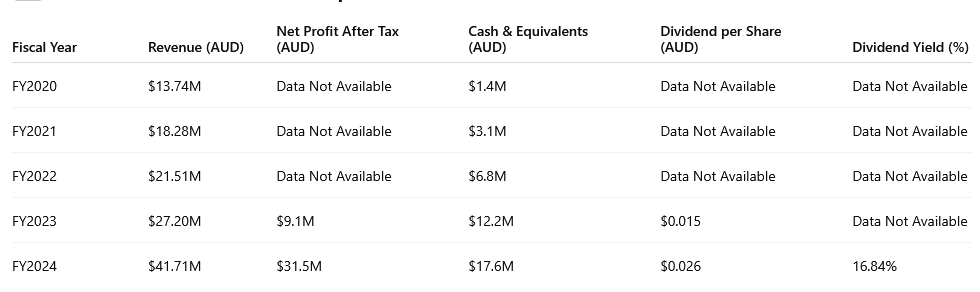

With a current Market Cap of $61m, FY24 revenue of $41m, FY24 NPAT of $31.5m, 75% profit margin, $20m cash, and no debt; the company is currently trading at a PE Ratio of only 2-3x. NOTE: FY24 was a record year for Atlas with a high volume of pearls sold and much higher that average sale price.

I expect slightly less revenue and NPAT for FY25 due to a decrease in the average price per pearl. However, the amount of pearls produced and sold are growing. Once the average pearl price normalizes and If they can continue growing earnings (as they have been since 2020) then its possible the market may re-rate the company with a higher PE ratio, (maybe 6-10x?).

Below is a snapshot of H1 25:

- Revenue: $19.1 million, a 29% increase compared to H2 FY24.

- Normalised EBITDA: $7.1 million, up 21% from H2 FY24.

- Net Profit After Tax (NPAT): $12.7 million

- Cash and Cash Equivalents: $19.4 million, representing a 10% increase from FY24.

- Operating Cash Inflow: $5.5 million.

- Dividends: An interim and special dividend totaling 1.00 cent per share (unfranked) was declared.

Key Observations:

- Consistent Growth: They have demonstrated a steady increase in cash reserves over the past five years, demonstrating good operational performance and cash management.

- Strategic Positioning: The accumulation of cash positions means the company is well positioned for future investments, potential special dividends, and navigating market fluctuations.

- Expansion in direct sales & B2B relationships: while still primarily a wholesaler, Atlas has:

- Begun developing direct sales channels (improve pricing power and reduce reliance on middlemen).

- Strengthened relationships with key jewelry and luxury buyers.

- Weaker AUD compared to USD and JPY (major buying currencies for pearls) has improved revenue when international sales are converted back into AUD

Risks:

There are so many risks with the company:

- Environmental Factors: Pearl farming is sensitive to environmental changes. Climate change and oceanic conditions can impact oyster health and pearl quality .

- Production Cycle: The maturation period for South Sea pearls ranges from 3 to 5 years, requiring long-term planning and posing challenges in responding to sudden market demand shifts.

- Market Volatility: Fluctuations in global luxury goods demand, influenced by economic conditions, can affect sales and profitability.

Let me know if anyone has any thoughts on this company.

April 24

Updated valuation based on Kobe auction results and a quicker than previously thought reversion back to normalised pearl prices.

December 23

Update to valuation based on current sales to 19c. See YTD sales straw for more detail.

September 23

Use FCF adjusted for greater tax rate and 10% drop to account for better prices to give an approximate FCF of $4m. Cash on hand $7.8m

Valuation = 8 X FCF + net cash = $39.8m or 9.3c per share

If I used a more conservative FCF of $3m:

Valuation = $31.8m or 7.4c per share

NTA = 8c.

Therefore, about the average of these I'll put my valuation at 8c

March 23

I'm going to conservatively assume a FCF of $2.5m and a multiple of 8 for EV. Therefore, target EV = $20m and target MC = $23m. Per share value = 5.4c

NTA = 6.4c. So still under "book" value though, could be considered worthless if suddenly not producing (for example affected by a natural disaster).

My key points from today's announcement of the YTD sales and Kobe auction results (link here):

- Pearl prices have retraced back to $68.60/piece at the latest Kobe auction. Down from record highs of $112 in November.

- Atlas did not sell all pearls available as they believe some of the bids were too low/"opportunistic". Given their strong cash position they can hold on to inventory now, compared to in the past where they needed to sell inventory as it became available. Company will look to maximise profits through its sales strategy. However, I would be worried that pearl prices will continue to fall.

- Demand for high quality pearls is still strong, however, lower grades are showing weakness.

- Quality index of pearls produced continue to improve thanks to the genetics initiative. Results from the auction show how important improved quality is for maximising revenues and profits in the future.

- $16.5 mil cash position as of 19/4/24.

Looks like I got out just in time, continuing to monitor in case the market allows me to pick this up again sub 7c ish. Down approximately 35-38% on open to around 10-11c.

At around 18-20c I believe the full value of Atlas Pearls has been reached. Recent sell down to 13c and now recovery to around previous highs (minus dividend payment) means I want to take profits while they are still there. I don't see significant upside, but stronger potential for downside at 18-20c share price on a probability basis.

Original thesis was a value play and got extra lucky with the significant price rise in pearl prices, therefore, thesis has played out and full stretched valuation reached = time to sell out. If this were a mid/large cap I would still be holding and just riding the momentum till it tips the other way, however, given the nature of such a small cap stock I would rather just take profits at a reasonable level.

Sold out in SM and IRL.

Overview Comment:

An extremely strong result due to high pearl prices that are up more than 100% from this time last year. Looking to slowly exit and take profits to remove the downside risk of falling pearl prices as I believe the value play of the original thesis has essentially played out.

General notes:

- NTA 12.1c.

- 257k oysters harvested during the half. Total of 1.9 million juvenile and mature oysters, which increased by 12%.

Positives:

- Revenue $26.8m, $12.5m in PCP. Large increase due to average pearl price moving from $38/pearl to $103/pearl

- NPAT $20.4m, $3.6m in PCP. Notes this includes approximately $9m in asset revaluations of the Oysters due to higher prices.

- "Normalised EBITDA" $16.7m

- Special dividend of 1.5c.

- Pearl quality continues to improve.

- My FCF estimate = $10m

- Cash on hand = $20.8m, $6.5m of this to be paid out via the special dividend and there is tax payments to be made between $3-5m.

Negatives:

- No guidance or outlook on pearl price given, however, understandable given the unpredictable nature.

Has the thesis been broken?

- No, thesis isn't "broken", however, thesis as a value play has effectively played out. I don't have any insight that the high pearl price will continue forever and would guess that current prices will not be maintained. Therefore, I think the current share price is fair value. Will be looking to sell down over the next half with a goal of taking profits. A downgrade in outlook for pearl prices from current levels could instantly decrease the share price. May keep a small position into next reporting season.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Pearl price to remain elevated for the next half at least, then to decrease.

- What is management going to do with the cash? Continuing to pay dividends or invest in the company?

Atlas announced this week YTD sales of $26.1m after recent Kobe pearl auction. Average price per a pearl for the auction was around $113 and YTD average price per pearl was $102. This is basically 100% increase from the previous year's average. There is strong demand for pearls from Chinese and Japanese buyers driving the price increases. The hard part now is determining how long the is strong demand lasts for, is it a quick fad or an ongoing normal? Pearls take two years to produce so the market can't be flooded in the very short term with new stock. Atlas also noted in the announcement that the pearls sold are improving in quality but is still below long-term averages so there is another factor to the upside for Atlas.

Valuation:

Valuation is complicated by the increased prices and making a call as to the long-term prices. Expenses shouldn't be increasing at anywhere near the rate that pearls have so there is a lot of operating leverage. I am now estimating a NPAT of at least $20m for this FY, and if the $100+ average can be maintained then an NPAT of $25 is possible. My working thesis was a $4m FCF so current results are far better than expected.

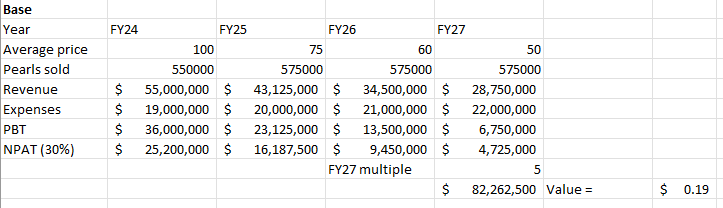

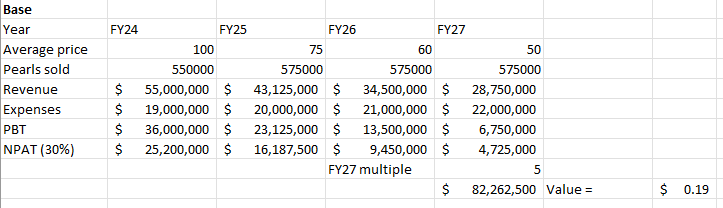

My very simple base case valuation:

This assumes pearl prices are having a one-off price increase due to strong demand then this demand weakens.

Position thoughts:

I have previously trimmed about 1/3 of my position at 11c IRL. Will continue to hold as I wait and see where the pearl market goes from here. If the elevated prices for pearls remain for more than one year, there is significant upside still available. Thesis has well and truly played out already, but I still see the potential for more upside at this point in time that justifies continuing to hold.

In recent times I have been focusing on finding reasonably priced long term compounder companies rather than cheap value. Atlas has shown that I should continue to look for these cheap companies as a part of a multi-strategy approach. However, I need to buy these companies when there is an upgrade cycle/catalyst occurring and be a shorter term (few years) trade. In saying all that, I must acknowledge there has been a lot of luck with this one....

Disclosure: Held in IRL and Strawman

Overview Comment:

An unexpectedly very strong result from Atlas Pearls. However, future stator results are not expected to be maintained at this level. This result is well beyond what my thesis required. Thesis is playing out as expected. Mangement looking at opportunities to continue to grow the business, just need to make sure this isn't a spending spree. Great cash generation this FY. Still undervalued in my opinion.

General notes:

- "High prices for South Sea pearls was the major contributor to the great performance. Company also contributes wider reach and more competitive online sale platform. Which resulted in prices two to three times higher than in the recent past."

- "Results could have been improved if quality matched internal quality index." Quality issues were due to size not imperfections. Quality low point was reached in the middle of the year, with stabilization and modest growth since.

- Mangement looking to hire some key personnel, buy a new vessel and commencing negotiations to acquire a new farm site. New vessel will allow crew to move between sites and lower the capital costs of setting up a new farm in the future.

- No dividend policy due to the uncertainties of aquaculture. Special dividends will be paid as the board sees fit.

- Genetics project will take 5-8 years before it can drive substantial change and improvement.

- Need to consider the role off of carry forward losses into the future.

- Average selling price of pearls was up 38%. With average pearl size down approximately 12%.

Positives:

- NPAT = $9.1m up 98% (statutory) - this was assisted by the changes in capitalisation of oyster costs and increase of oyster valuation of $641k. Company used brought forward losses so tax impact on profit is not at the standard tax rate. Approximately $9m of tax losses still available to carry forward.

- My FCF = $6.1m. I was only expecting/requiring $2.5m

- Revenue = $27.2m up 26%

- Special dividend of 0.35c

- NTA per share 8c increased from 5.7c.

- Cash balance $7.8m and debt free.

Negatives:

- Company notes FY23 results are not sustainable as they were coming of a low cost COVID model.

- Pearl production was down on FY22 to 547,755 pearls. Nucleated oysters are up 17% from 2019 to 1,349,236.

Has the thesis been broken?

- No. Strengthened bought more on announcement of results as it showed Atlas Pearls is still very cheap at current valuation.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Now they have cash do they invest it wisely? Do they need the extra managers? Will the new boat actually help productivity?

- Continue to take screenshots of prices of jewellery sold on their website to see what the price action is doing.

- NPAT will decrease as carry forward losses are used up.

- Do not expect FY24 to beat FY23. Going forward looking for a FCF of $3m+.

- Look at sensitivity analysis below to see effects of changes as they occur:

Expectations:

- No release date announced as of 7th August. Last year results were released on 31st August.

- If value proposition still holds. Continue to add to position as per previous buying plan.

- As per recent trading update:

- Revenues between $26-28m.

- Pearls sold approximately the same as FY23. 629k were "harvested" in FY22.

- EBITDA to be improved over FY22. FY22 normalised EBITDA was $4.2m

- Expecting a free cash flow of $2.5m as per thesis. Hoping for better, more like at least $3m.

Questions to be answered:

- Previous trading update talked about the size and quality of the current half's pearls being below that of FY22. The increase in prices have saved the company from going backwards. What is the market outlook for FY24?

- Any further update on the genetics programs?

- Any significant changes in asset values?

- Check "are things going ok" KPIs from thesis:

- Is profitability/FCF maintained or higher than previous FY.

- Is the number of available pearls being maintained?

- Any sign the profits wont be returned to shareholders?

- Any strong pearl market pressures present?

Atlas Pearls has released a corporate update covering the following main points on developments:

- YTD sales "have been buoyed by continued strong global demand for South Sea pearls" and "continued positive results".

- Improved data analytics have been used to understand quality issues with pearl production relating to smaller pearl sizes. The issue was a batch of oysters from a particular hatchery, the last of this cohort is being harvested. Samples have been sent for genetic testing to improve future production.

- Non-executive director, Jose Martins added to the board. Appears to be an addition to improve governance practices and help with experience working with offshore operations.

- New CFO with current CFO leaving after 5 years in the role. The replacement is the current financial controller of the company who has been in the role under the current CFO for the last 5 years.

Overview:

Atlas Pearls is a South Sea Pearl Farmer with 7 farms based in Indonesia. The Pearls are sold to trade and consumers. During COVID they pivoted to a new channel of sales through online direct to consumers while trade shows were not able to occur. This has created additional sales that have in recent times have enabled the company to operate on a profitable basis. This purchase is based on a value buy/bet with Atlas Pearls trading at very low single digit multiples, if current profitability can be maintained a high return should be expected in terms of dividend yield (if money is returned to shareholders). While the potential return appears very attractive, given the agricultural nature of the business it is not without high potential risk.

Main Thesis Summary:

- Value play. Company is undervalued at it's current value based on the profitability. This company will never operate at a high multiple but at current profitability provides highly attractive "owner earnings" in terms of return. The asset backing is strong reference to the valuation, though it must be remembered that the book valuation could be considered as "on paper" only given the assets could be destroyed through one natural disaster event.

- Has demonstrated free cash flow paying down director loan which was used to get the company through the initial COVID downturn.

- Cheap valuation provides a margin of safety.

Positives:

- Strong insider ownership.

- Base valuation is very cheap:

- EV/EBIT = approx. 2.5x

- PE = approx. 4x.

- ROE 20% over past 2 years

- NTA/share = 6.4c

- Net cash

Negatives/Risks:

- Some of the management works "part time".

- Indonesia base.

- Agricultural related risks.

- Natural disaster event could wipe out assets.

- Very illiquid stock.

- COVID tailwinds subside.

- Insiders run the business for their benefit only.

- Australian based management with ops in Indonesia.

- The pearls being grown run on a two-year cycle.

- Market price takers. If value of pearls decrease margins will be hit.

How I expect this will play out:

If things went wrong:

- Slipped back to become unprofitable and sell.

- Natural disaster

If things go right:

- Company continues at current levels of profitability.

- Market values company at a higher multiple as a result. Or

- Insiders distribute earnings to shareholders providing a high yield return.

When to get out:

When the following KPIs indicate something might be wrong:

- The number of available pearls keeps falling.

- Profitability is not maintained.

- Risks above are realised and will have a significant impact.

- Company doesn't return profitability to shareholders.