Atlas Pearls specializes in production of premium South Sea pearls, which are among the most valuable and sought-after pearls in the world. They operate across eight farming locations in the South Seas, they employ more than 1,200 individuals and harvests between 500,000 to 600,000 pearls annually.

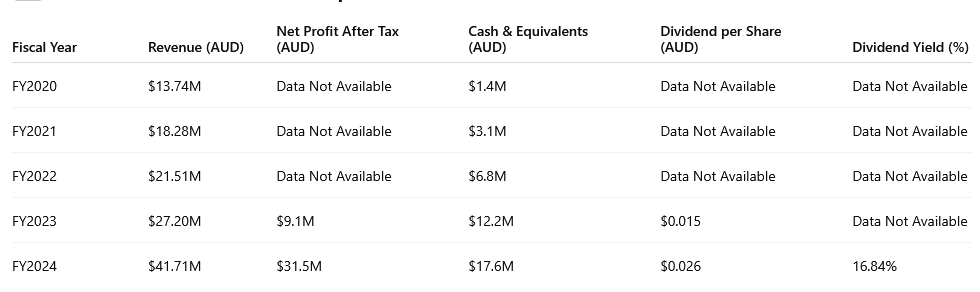

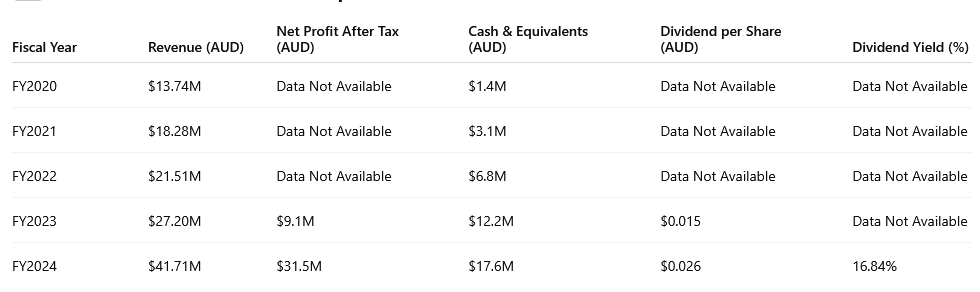

With a current Market Cap of $61m, FY24 revenue of $41m, FY24 NPAT of $31.5m, 75% profit margin, $20m cash, and no debt; the company is currently trading at a PE Ratio of only 2-3x. NOTE: FY24 was a record year for Atlas with a high volume of pearls sold and much higher that average sale price.

I expect slightly less revenue and NPAT for FY25 due to a decrease in the average price per pearl. However, the amount of pearls produced and sold are growing. Once the average pearl price normalizes and If they can continue growing earnings (as they have been since 2020) then its possible the market may re-rate the company with a higher PE ratio, (maybe 6-10x?).

Below is a snapshot of H1 25:

- Revenue: $19.1 million, a 29% increase compared to H2 FY24.

- Normalised EBITDA: $7.1 million, up 21% from H2 FY24.

- Net Profit After Tax (NPAT): $12.7 million

- Cash and Cash Equivalents: $19.4 million, representing a 10% increase from FY24.

- Operating Cash Inflow: $5.5 million.

- Dividends: An interim and special dividend totaling 1.00 cent per share (unfranked) was declared.

Key Observations:

- Consistent Growth: They have demonstrated a steady increase in cash reserves over the past five years, demonstrating good operational performance and cash management.

- Strategic Positioning: The accumulation of cash positions means the company is well positioned for future investments, potential special dividends, and navigating market fluctuations.

- Expansion in direct sales & B2B relationships: while still primarily a wholesaler, Atlas has:

- Begun developing direct sales channels (improve pricing power and reduce reliance on middlemen).

- Strengthened relationships with key jewelry and luxury buyers.

- Weaker AUD compared to USD and JPY (major buying currencies for pearls) has improved revenue when international sales are converted back into AUD

Risks:

There are so many risks with the company:

- Environmental Factors: Pearl farming is sensitive to environmental changes. Climate change and oceanic conditions can impact oyster health and pearl quality .

- Production Cycle: The maturation period for South Sea pearls ranges from 3 to 5 years, requiring long-term planning and posing challenges in responding to sudden market demand shifts.

- Market Volatility: Fluctuations in global luxury goods demand, influenced by economic conditions, can affect sales and profitability.

Let me know if anyone has any thoughts on this company.