Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Regenerative medicine company $AVH has announced that CEO Jim Corbett is leaving his positions as CEO and Board Member, being replaced as CEO by Chair Cary Vance. The sting in this particular tail is that preliminary 3Q revenue will be approx. $US$17m.

My Assessment

No explanation is given, and there is no message from Jim. He is thanked for his service, in essence.

Let's just recap the last 4Qs of revenue: US$19.5m, US$18.4m, US$18.5m and US$18.4m.

Whatever contribution we have started to see from Permeaderm and CoHealyx, has presumably been swamped by the ongoing woes of the CMS coding debacle for ReCell.

I expressed some scepticism at management's statements last quarter that things were underway to correct this. And I pointed out that once hospitals take it off the order list (because they don't get paid), who's to say when it goes back on the list. And if it ain't on the list, doctors can't reorder it. And, as we know, there are plenty of alternative products with large sales teams and strong clinical data out there. Afterall, the likes of $ARX and $PNV are growing revenue nicely at 15% - 30% p.a., taking share in a category which is still probably growing at high single digits % p.a.

We're not told why Jim is leaving, but I'd speculate that the FALL in revenue is the final straw. At 3Q results guidance will be updated, and I expect it will be ugly.

Lenders OrbiMed are once more relaxing their revenue covenants and are "in discussions" about restructuring future covenants. So, there will be a price to pay for that, revenue growth get's pushed further out, and therefore the potential for needing new capital at some future stage increases. Hitting anything near the projections in my valuation cases seems to be moving ever further out into the future.

And so, while a CEO search is underway, shareholders now have the Chair of an underperforming Board step in as Interim CEO on $0.7m salary, with a guaranteed element of his cash bonus. Nice that for some the returns are guaranteed!

Then there's the ongoing legal investigation into whether Avita and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices. I know these are commonplace in the US and there is no indication that there has been any wrongdoing. But it just does add to the pile of potential issues we'll face in future.

Investment Decision

I took a modest RL speculative position in $AVH earlier this year (2.5% in RL, which I increased on SP weakness to 3.5%). At the time my intention was to signficantly increase the position if the "one stop shop" strategy showed early progress or "run for the hills" if it didn't.

I have stuck to my initial plan. Today, I have turned and run for the hills.

This business continues to make strategies and communicate plans that it cannot execute. I had to have a long think about this on my run this morning, because the CMS coding issue was genuinely something completely outside of the company's control or influence. And yes, once more today's SP probably represents a low point, and therefore a bad time to sell.

But I asked myself, what confidence do I have that the company can get back onto a strong revenue growth trajectory? And my asnwer was that I have no confidence, but at best hope. And hope is not a valid investment thesis. There are too many questions, and I have too many other places in my portfolio I'd rather put the capital in due course.

So, I exited my entire RL position at $1.35 this morning, a painful 23% loss. I should really know better by now!

Disc: Not held.

Not marked as SP sensitive, the market clearly disagrees as the following announcement provides a nice revenue kicker for ReCell in the US in non-burn applications.

Basically, $AVH announced that from October 1, 2025 to September 30, 2026, U.S. hospitals will be eligible for New Technology Add-on Payment (NTAP) reimbursement of up to $4,875 per case when using RECELL to treat acute, non-burn trauma and surgical full-thickness wounds. The NTAP, granted under CMS’s alternative pathway for FDA Breakthrough Devices, highlights RECELL’s clinical value and innovation.

RECELL enables clinicians to create a Spray-On Skin™ cell suspension from a small patient skin sample, reducing donor skin needs compared with standard grafting. A 2024 randomized trial showed RECELL achieved equivalent wound closure outcomes while using 27% less donor skin, lowering donor site complications such as pain, delayed healing, infection risk, and scarring. The new reimbursement is expected to improve hospital access and expand patient use.

My Assessment

Perhaps because the market is awaiting news on the remediation of the CMS coding debacle for RECELL, the company has decided not to flag this as price sensitive. In any event, I didn't have this on my radar screen before today.

The top-up is significant, with the cost of the RECELL component of a 10-20% surface area wound being in the range $6,500-$13,000. However, it is hard to translate this into a potential revenue impact, partly because I don't know what proportion of the sales are eligible. So, afterall, perhaps it is not material at a group revenue level.

Maybe I am drawing too long a bow, but if CMS has granted this priority payment, you'd think they'd have applied themselves to working with their payment contractors to get the re-coding issue sort out. That's the news I am really waiting for, i.e., 1) is the coding issue sorted out and 2) have the hospitals and surgeons that stopped ordering in Q1 and Q2, started again.

I expect we'll have to wait another month or so for that update, when $AVH reports its quarterly.

Don't get me wrong - I'll take today's good news!

Disc: Held in RL and SM

At last!

Today’s CE Mark approval for RECELL GO unlocks AVITA Medical’s long-planned entry into Europe.

Rather than building its own salesforce, AVITA will commercialize the product through third-party distributors, a lower-cost strategy that leverages existing specialist networks. Distribution agreements are already in place across Germany, Austria, Switzerland (via PolyMedics), Benelux, the Nordics, the U.K. and Ireland, with Italy, Spain and Portugal close behind. This coverage secures AVITA a footprint across nearly all major Western European healthcare markets.

The maturity of the sales plans highlights the delay in getting the CE Mark, which CEO Jim Corbett repeatedly blamed in the past on "bureaucratic delays", but which I have previously cited as evidence that the company consistently sets expectations and targets that it then fails to deliver on - albeit several strictly being beyond its control.

The company’s marketing approach outside the US emphasizes ease of adoption. Unlike earlier RECELL versions, RECELL GO requires less training and case support, making it easier for European hospitals to integrate. AVITA expects its distributors to drive uptake through established hospital relationships, with reimbursement supported by national health systems. However, management has cautioned that international revenue contributions in 2025 will be modest, given reliance on distributor-led rollouts and the time needed for value analysis and reimbursement processes. In my view, it will likely be 2027 before revenue contributions outside the US are material.

With CE Mark approval, the company transitions from being a U.S.-centric player to one with a scalable global platform in acute wound care. While near-term sales will be limited, the groundwork is laid for Europe to become a significant revenue stream from 2026 (or 2027?) onward, particularly in high-volume trauma and burn markets.

Referring back to last week's post, this timing could not be better (accepting that it is delayed) given the recent presentation at the Europe Burns Conference on the reduced time in hospital for patients treated by Recell. This will both assist with reimbursement and be a boon to marketing efforts.

My Assessment

This is good news for the medium to longer term prospects for $AVH. In my view, the CE Mark decision was always a question of "when" and not "if".

Following the distributor model is the right thing. $AVH has to steward its cash carefully, and CEO Jim Corbett knows that getting to profitability and postive cashflow is key to creating some investor confidence around this company. He is wise to be focused on that.

While this good news might create some long-absent positive sentiment for this beaten up biotech, the major SP re-rate will await the 3Q result at the end of October, and any news of how sales in the US are progressing, and whether the CMS coding debacle has been resolved and to what extent hospitals are ordering again. For me, that is an vital test of management's credibility, given their detailed descriptions of what went wrong in Q1 and Q2. From my perspective, Q3 and Q4 have to deliver.

I still believe that $AVH's time will come, soon, so I am a HOLD for now.

Disc: Held in RL and SM

I attended the $AVH webinar this morning. @jcmleng I assume you saw it too?

While there wasn't much new information from last week's results, I found it useful and have 2 additional significant takeaways:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

2. Additional Insights on Cash Position - even though there is every likelohood (based on my analysis) that management misses Q2 2026 cash breakeven, the $30m funding should be ample, unless revenue growth only makes the bottom end of guidance. Some details disclosed by the CFO really helped me to firm up my own model and foreacsts.

In detail then:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

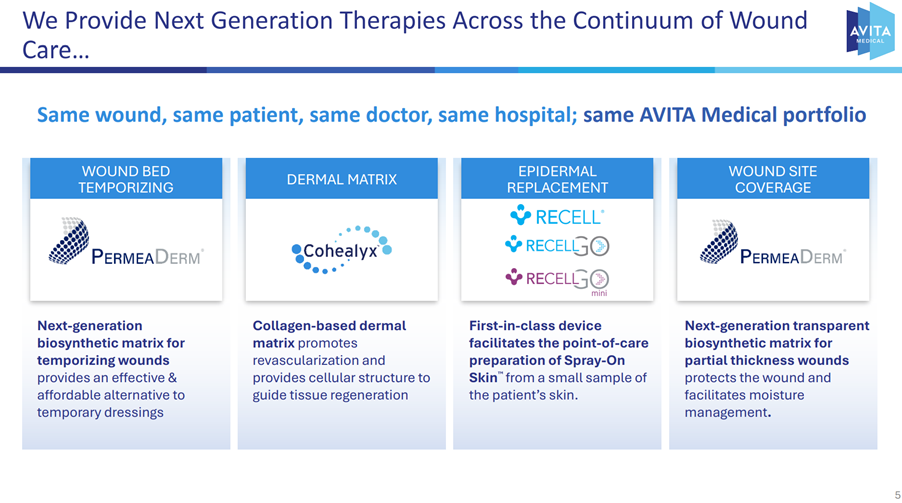

I think it was the best (clearest) summary I've heard Jim give of the products from a surgeon's/patient's perspective, as well as restating the economics.I've dropped a couple of the key slides at the end of this Straw. (If they don't publish a recording of the webinar and if there isnt a transcript, then I can post a link to an audio recording I made if anyone wants it.)

With the focused (i.e. small) clinical studies for Cohealyx (# days better than competing dermal matrices) and Permaderm (cost vs. allograft standard of care) and the recent British Burns Association study on 6300 patient for the -36% less time in hospital for ReCell (to drive burns market penetration up from 20-30% to much higher), the sales reps are going to be armed with compelling data to convert accounts across all levels of burns and trauma acute care. $AVH really could pull off a very potent "one stop shop".

There are significant risks here for $IART and $PNV. $ARX is less exposed (as they have a more diversified product range and have more for internal reconstruction as well as more chronic wound management). Of course, each of these are driving and will be promoting their own clinical data. However, I think $AVH might overall have the edge here.

The emerging $AVH clinical strength combined with the slowing $PNV international sales has significantly undermined any chance I have of a developing a renewed thesis in $PNV. Initially, given 2H stabilising growth in Q2, I was open to taking a fresh look when I get to see the FY financials in a week or two, given that $PNV is now starting to through off cash. But I'm not sure I can have any conviction until I see evidence that Cohealyx doesn't start making headway in the US!

Returning to the $AVH webinar, there were a few positive nuggets (June = highest quarter-end month; July best first-month-in-a-Q in a year) as well as the e-ordering frequency for the large Cohealyx account is a positive (i.e., it wasn't just initial stocking of a new product, the surgeons are using it.) Remember, Cohealyx is only getting started.

2. Additional Insights on Cash Position

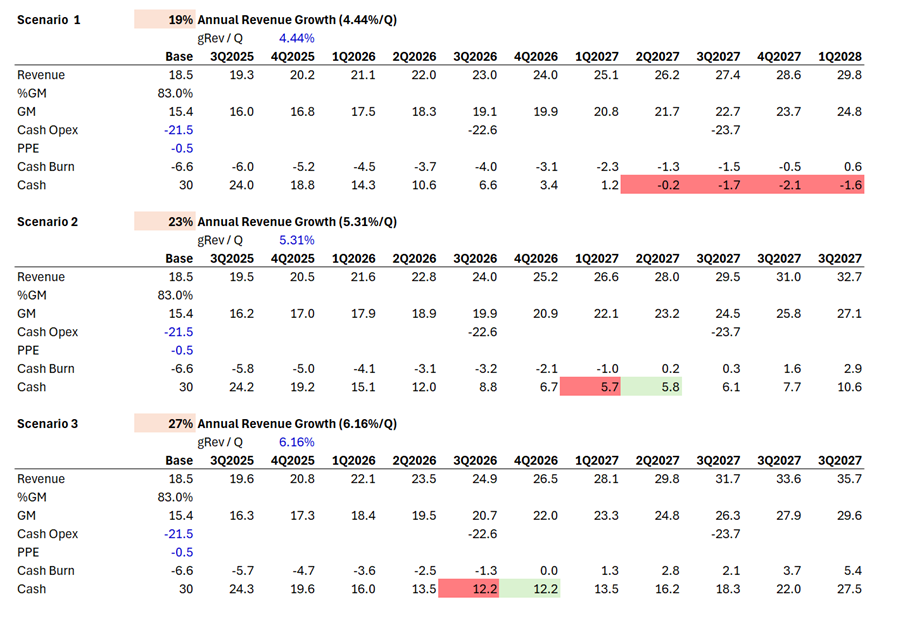

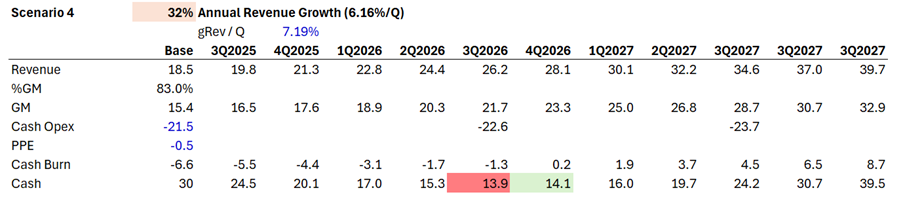

On cash, the CFO gave a nice simple calculation on cash flow as follows:

Rev. $18.5m/Q at %GM 83% (midpoint) = $15.4m as the starting point for last Q.

Cash Expenses: $21.5,/Q - holding steady for the next year, (but I'll then escalate by 5% from Q3 2026 and again by 5% from Q3 2027)

To this, I've added an allowance for investing cash of $0.5m per Q, which is lower than historical, but my sense is that they are really tightening the screws. (CFO was slient on this). For example, putting on ice altogether a go-to-market for vitligo, for which they have FDA approval. That to me is a measure of how focussed they now are.

From this, I've generated a few simple scenarios for quaterly cash burn as follows, with the bottom line of each table shoing cash balance. I've ignored them throwing in $9-10m receivables into the mix, because every business needs working capital!

It is possible that I've been a bit bearish on %GM, but I think that as Cohealyx and Permaderm grow, as licensed products, they will drag down the %GM, as we saw in this Q with the pressure on Recell sales.

The CFO today allowed me to sharpen up my own view, which says they'll make CF break even some time between 4Q 2026 and 1Q 2028.

This confirms my ingoing bias, that they don't leave a lot of fat in their guidance calculations (hence, the set-up for disappointments) .

Now that said, it is entirely possible that revenue growth EXCEEDS the guidance range. If you are bullish on the clinical data and their ability to sell that into their US customers, then a 32% revenue CAGR would not be out of line with this sector, and it pulls CF break even forward by another quarter.

Management are saying they will ge tto CF breakeven earlier than all of these scenarios. So what do I have to believe to trust that? Any of the following will do:

- They are even tighter in screwing down investing capex

- Revenue rebounds more strongly in Q3 2025 and Q4 2025 after the CMS/MACs reimbursement issue is solved

- As Recell rebounds, they get a higher %GM, more like 85% in line with history

- I've not accounted for price rises being pushed through in 2026 and 2027, so this is a material lever (e.g., $PNV pushed through +10% last year, but they are much cheaper per treatment and having more pricing headroom.) i.e. my modelling is unbalanced, as I've put 5% annual inflation on Opex.

OR

- Management are rubbish at giving guidance and will miss this one again.

In any event, a $30m cash position looks good in all but the lowest of the scenarios I've generated.

My Key Takeways

It was good to get a second soak of this information today. I've sharpened my view on their cash flows, and amassing $30m is probably going to be god enough.

For me the upside catalysts in the Q3 2025 report will be:

- Revenue growth rebounds, above guidance midpoint with anecdotes of acceleration

- Confirmation that CMS/MACs remediation is complete

- Progress on recruitment in Cohealyx and Permaderm mini-trials

- Some further quantification on early uptake/ account conversion / re-ordering of Cohealyx, including material orders (e.g., $0.3m per account in a month)

A positive report on the above would - I strongly believe - mark a significant, tangible step forward in the "turnaround". Absence of good news on 3 out of 4 would likely trigger my exit.

Disc: Held in SM and RL

----------------------------------------------------------------

Appendix - 2 Key Slides Explaining the Product Portfolio from the Surgeons/Patient's Perspective

As @jcmleng and I pointed out last week, $AVH is raising capital, given the slippage in their revenue trajectory and the 6 months+ delay to achieving breakeven, based on their current view.

Well, that statement should have been in the past tense... they've raised capital and, at a price of $1.32 per CDI, that's no too much of a discount, given that's almost as low as the SP got on the recent bad news.

At $23m the raise is somewhat lower than we expected, adding 17.2 million ASX CDIs or 3.44 million NASDAQ shares. So with 26.6m shares, that's a dilution of c. 13% - far some ideal, but there you have it.

My valuation basis week included a 20% dilution up to my target date of FY28. Given their share-based compensation running at 1-2% p.a., I'm still in the ballpark PROVIDED they achieve the target of breakeven in Q2 2026. And that's the rub of course with this management team. You really can't pay any attention to their forecasts, and have to form your own view, based on track record.

(I'm don't mean to be unduly negative. All I am saying is that my investment thesis is NOT reliant on management hitting their targets! I discount what they say based on their track record over years.)

Today, SP is up 11-12% on the news, which I guess is market relief that the liquidity risk is eased,... for now.

There will be an investor webinar at 9am, tomorrow. (Link to Register)

I've already posted my question for tomorrow, along the lines of: "What is the basis for your statement "national harmonization expected across all MACs; RECELL demand expected to recover in H2"? What visibility do you have into the engagement between CMS, MACs and the providers on this matter?"

Held in RL and SM

Mamma Mia! Here We (ReCell)-Go Again

I came to this morning’s 2Q FY2025 earnings call for dermal repair company Avita Medical ($AVH on the ASX; $RCEL on the NASDAQ) with low expectations, and some trepidation. I wasn’t disappointed.

I’ve followed this company for nearly six years. And among all the players in the dermal repair space, $AVH wins my special award for most consistently setting high expectations, missing them, and then confidently explaining why it was either outside management’s control..

So why am I still here? Why (knowing what I know) did I choose in May to allocate precious capital to this serial underperformer? I’ll get to the answer. But first, the results.

$AVH’s “Highlights”

Financial Results

- Commercial Revenue: $18.4 million — up 21% YoY

- Net Loss: $9.9 million (–$0.38/share), improved from a $15.4 million loss (–$0.60/share) YoY

- Operating Expenses: $26.1 million, down from $28.7 million in Q2 2024

Business Update

- Significant revenue headwinds from a temporary reimbursement gap caused by delays in Medicare Administrative Contractor (MAC) payments for the ReCell® System. Multiple MACs began resolving these issues in July, with full resolution expected in Q3.

- Amended credit terms with OrbiMed: lowered revenue covenants and issued common stock in lieu of a cash payment.

- Appointed Michael Tarnoff, MD, FACS (former CEO of Tufts Medical Center and Medtronic/Covidien executive) to the Board.

Clinical Highlights

- Real-world burn registry analysis shows RECELL reduces hospital stays by 36%.

- CMS approves NTAP (New Technology Add-on Payment) for RECELL in trauma wound care.

- Early clinical results for Cohealyx™ show autograft readiness in as little as five days.

- PermeaDerm® featured in 10 U.S. burn conferences, including in a multi-center RCT.

My Analysis: The Heart of the Problem – Revenue

The market reaction (–15% at time of writing) was all about one issue: revenue.

This was a massive miss. Management attributed it to a major disruption in reimbursement stemming from new CMS CPT codes that took effect in January. According to CEO Jim Corbett, implementation by MACs (contractors to CMS) lagged, causing widespread delays in hospital reimbursements, and a cascade effect on ordering behavior.

“This is not a product issue,” Jim said. “It’s a claims processing issue, specifically around how the ReCell procedure is valued and reimbursed.”

Translation: hospitals ordered enthusiastically early in the year, but when reimbursement stopped flowing, reorders dried up. Jim estimates a six-month backlog and a $10 million hit to revenue, more than half of the total $18.4 million reported for the quarter.

More Detail on the MAC Issue

CMS changed the reimbursement model: instead of assigning fixed prices, it delegated pricing decisions to MACs under a “Contractor Pricing” model. This created widespread confusion and an adjudication backlog—not denials, just… silence. Hospitals didn’t get paid. So they stopped ordering.

Jim claims SAVH only realised the extent of the issue in Q2. But while ReCell demand from surgeons remained strong, provider uncertainty “dampened utilisation.” AVH now estimates a $10 million revenue impact in H1, with $5 million lost from just their top 10 accounts.

Efforts to resolve the problem are underway across the industry. Multiple MACs recently announced intentions to resume adjudication. Jim expects a resolution in Q3 and a rebound in demand through Q4.

But This "Bump" Has Material Consequences

- Revenue guidance for FY2025 slashed from $100–106 million to $76–81 million — a ~$25m downgrade.

- Implied revenue growth falls from 55–65% to just 19–27%.

- Loan covenant waiver required from lender OrbiMed, in exchange for 400,000 $AVH shares.

- Cash burn remains an issue: cash and equivalents fell from $25.8m (Q1) to $15.7m at 30 June.

- Breakeven pushed out: previously H2 2025, now Q2 2026.

$AVH must maintain at least $10m cash under its OrbiMed covenant. They can raise ~$5.7m via a 3.8 million share issuance under their current mandate. If revenue rebounds strongly, that may suffice—but further dilution is likely.

Track Record: A History of Overpromising

Throughout my time following $AVH, this has been a company that routinely misses its own targets: product approvals, breakeven timelines, revenue forecasts, loan covenants, you name it. This pattern has continued under Jim Corbett’s leadership since September 2022.

There seems to be a systematic failure to factor in real-world risks, or to differentiate between internal stretch targets and externally-guided expectations. Or maybe they’ve just been extremely unlucky. The CMS-MAC issue is genuinely unusual, but not without precedent.

And so, while I do believe the reimbursement problem will be resolved, I don’t believe the timeline. I’m not confident it’ll be fixed this quarter, or even next. And that uncertainty means more dilution. Fortunately, OrbiMed seems supportive, for now and at a price.

Product Progress: A Glimmer of Hope

However, today’s presentation contained some very encouraging clinical news that could reshape $AVH’s market standing over time, both for ReCell and the newly launched Cohealyx.

ReCell

A new, large-scale real-world study of ReCell shows a 36% reduction in length of stay for burn patients. Based on burn size (TBSA), median LOS savings equated to nearly 6 days, or ~$48,000 in hospital cost savings for a $10–20k treatment.

ReCell is already widely adopted in U.S. burn centers. These new outcomes data are likely to accelerate adoption. $PNV's David Williams has said on mulitple occasions that ReCell complements Novosorb BTM, indicating synergy with dermal substitutes.

Cohealyx

Launched in April, Cohealyx (licensed from Regenity Biosciences) achieved autograft readiness in just 5–7 days in early studies, compared to 2–4 weeks for competitors like Integra’s DRT and Kerecis GraftGuide.

A 40-patient post-market clinical trial (Cohealyx1) is underway, with results expected in 2026.

But the market doesn't appear to be waiting for these results. Early signals are promising, with 25% of U.S. burn centers submitting Cohealyx to their Value Analysis Committees (VACs). July saw $300k in orders from the largest account.

If this trend continues, I expect positive updates in Q3 and meaningful revenue contribution in Q4.

Final Thoughts

Taken at face value, today’s revenue result was dreadful, flat QoQ revenue and declining gross margins due to product mix. Under normal circumstances, management would deserve criticism and $AVH would fail the "moment of truth" I declared when I initiated by position in May of this year.

But this time is different. $AVH had no control - and likely no visibility - over the CMS implementation delays. Still, the consequences were real and severe, and shareholders will bear the cost through dilution and delayed breakeven.

That said, I found Jim’s explanation credible. The reimbursement issue is temporary. What isn’t temporary is the mounting clinical evidence and competitive momentum behind ReCell and Cohealyx.

I remain deeply sceptical of management’s timelines. But I also see a company with a growing product portfolio, US$75m annual run-rate revenue, and a differentiated strategy built around full-spectrum treatment for burns and trauma.

Execution remains the Achilles’ heel. But if reimbursement recovers and Cohealyx gains traction, $AVH may finally begin to fulfil its promise.

Valuation

Today, I ran a quick turn of the handle on my model.

I’ve assumed:

- A further 20% dilution over time.

- That 2025 revenue guidance is missed, albeit narrowly.

- However, I’ve also factored in strong revenue growth from 2026 through 2028, and I acknowledge that management has exercised commendable cost control over the past year.

With these inputs, and applying a 10% discount rate, my model yields 2028 valuations of:

- $4.49 / $5.24 / $5.98 at P/E multiples of 30 / 35 / 40, respectively.

By 2028, I expect today’s reimbursement issues will be firmly in the rear-view mirror—and EPS growth should be significant.

However, given the continued execution risk and repeated underperformance, I’m applying an additional margin of safety - and unusually for me - using a 20% discount rate. That’s the minimum return I want for taking on this risk.

On that basis, my valuation range compresses to:

- $1.88 / $2.19 / $2.50 at the same P/E multiples.

Conclusion and Investment Decision

I’ve always believed that in business, it's often darkest before the dawn. I thought the darkest hour came in May, when I initiated my position in $AVH at a 2.5% portfolio allocation in my RL ASX portfolio.

At that point, I said Q2 would be “make or break” for the company. And based solely on the headline earnings result, I should have exited today.

But I didn't.

And that’s because I believe the only factor driving today’s miss is external, uncontrollable, and temporary. The market understandably focused on the revenue shortfall—but overlooked what I see as compelling new data that positions $AVH to become one of the long-term winners in dermal repair… assuming it doesn’t get acquired first, which I now see as the biggest near-term risk.

Today, I added a further 30% to my RL position. Yes, my total holding is now down 23% on it's cost basis. But my conviction is growing - not shrinking - that this company has a real shot at success.

I just wish management would stop giving forward guidance.

Disc: Held in RL and SM (will top up SM on Monday)

Interesting article on Stockhead today, also covered in The Australian.

The interesting piece from my perspective is the extract I've listed below.

First, it supports my point of view, often repeated here over the last year or so, that competitive intensity in dermal repair is increasing, as we see more product-on-product competition. But it also supports my thesis for why I believe $AVH - as a multiproduct firm, with distinct offerings at all layers of wound covering, epidermal repair and deep dermal repeair - will be advantaged.

They've established a sales and marketing footprint predicated on Recell Go and recell Go Mini, which is growing sufficiently that it should get to breakeven. But then they can sell licensed-in Permeaderm and Cohealyx as icing on the cake, with essentially zero incremental field support costs.

Thus, they can fight for share to take a chunk of the market from the established competitors in the dermal scaffold market, where they are essentially the new entrant. That's not great news for $IART, $PNV, and $ARX, particularly as $AVH pretty much now have full coverage of all the high value burns accounts, so there won't be any delay to the selling pressure kicking in. Oh, and there are comparison studies under way which should read out over the coming year.

To be honest, I am not sure what this market looks like long term anymore, but I think $AVH's SP is beaten up sufficiently that if they get any kind of traction with Cohealyx, they will push through into profitability in the next couple of years, which will see a re-rating.

So, I guess my investment horizon for this one is 2-3 years.

Fun times ahead!

... from the article.

Go low to go high

If Avita’s management is cowed by having so many rivals, it’s not letting on.

“We believe Cohealyx will be the real winner for the company,” chief financial officer David O’Toole says.

“We are going to price it to gain market share”.

O’Toole says rival products typically sell for US$15 ($24) per square centimetre.

“We will sell it for US$10 if [a hospital’s] value analysis committee wants it that low,” he says.

“But we don’t think we have to go that low because it is a superior product.”

Naturelement!

Avita envisages a consignment model, by which product is shipped to the hospitals and then only paid for when used. While not good for the company’s cash flow, the hospital bean counters should love it.

Avita also is undertaking post-market clinical studies to demonstrate the product’s efficacy and economic relevance.

That’s code for “we need data to help hospitals justify buying this stuff”.

Disc: Held in RL and SM

Dermal repair company $AVH has received the setback of a delay on FDA approval for their RECELL-GO device, which was under FDA review under the breathrough device 180-day review process, stopping the clock for 4-6 months while the company considers its response.

The SP has reacted sharply and is still down 19% at time of writing, taking it back to levels last seen prior to the approvals for full-thickness skins defects and vitiligo treatment earlier this year.

The RECELL-GO device, which operates with single use cartrdiges, promises to significantly expand adoption of RECELL in the US market.

$AVH have recently significantly expanded their sales and marketing footprint following the FDA approvals, hence most recent financial performance is not too great (a bit like $PNV), however, market consensus is for strong revenue growth in FY23 of $80m up from $51m in FY22, putting it on a similar trajectory to $PNV.

Given the sales momentum and the investment in sales force, as well as the likely temporary nature of the setback, there's probably a good short term trade to be done on this news. However, I'm not a trader, so its not for me.

Disc: I've held $AVH in the past, but my preferred stock in the rapidly growing dermal repair segment is $PNV. However a pullback like this is tempting, as its likely overdone.

Post a valuation or endorse another member's valuation.