12/12/2024: 8:18 am AEDT: Expanded Murchison Gold Project Feasibility Study

And: 1:05 pm AEDT: Murchison Feasibility Study Update Presentation

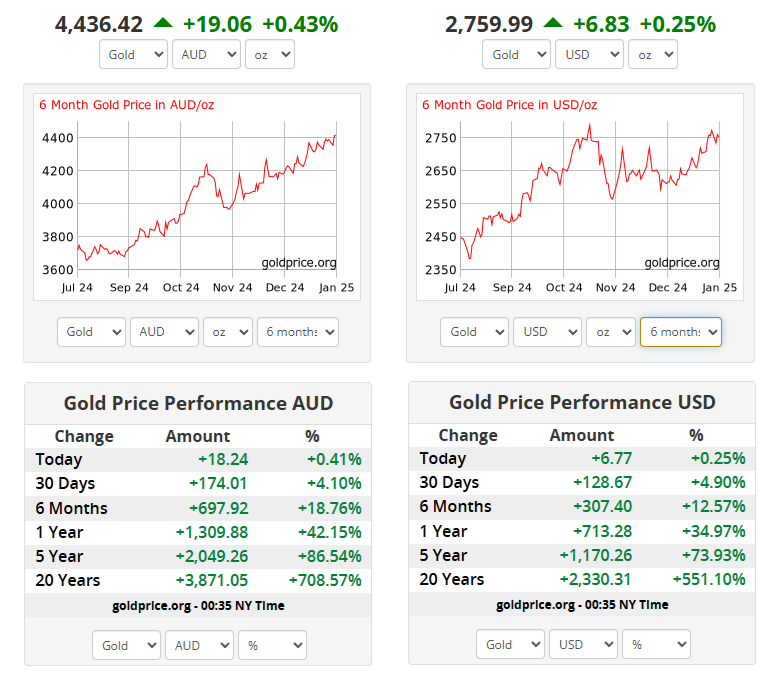

Here's the first 4 pages of the announcement (first link above) followed by some of the more important slides from the Presentation (2nd link above) including what's changed and why I hold MEK shares.

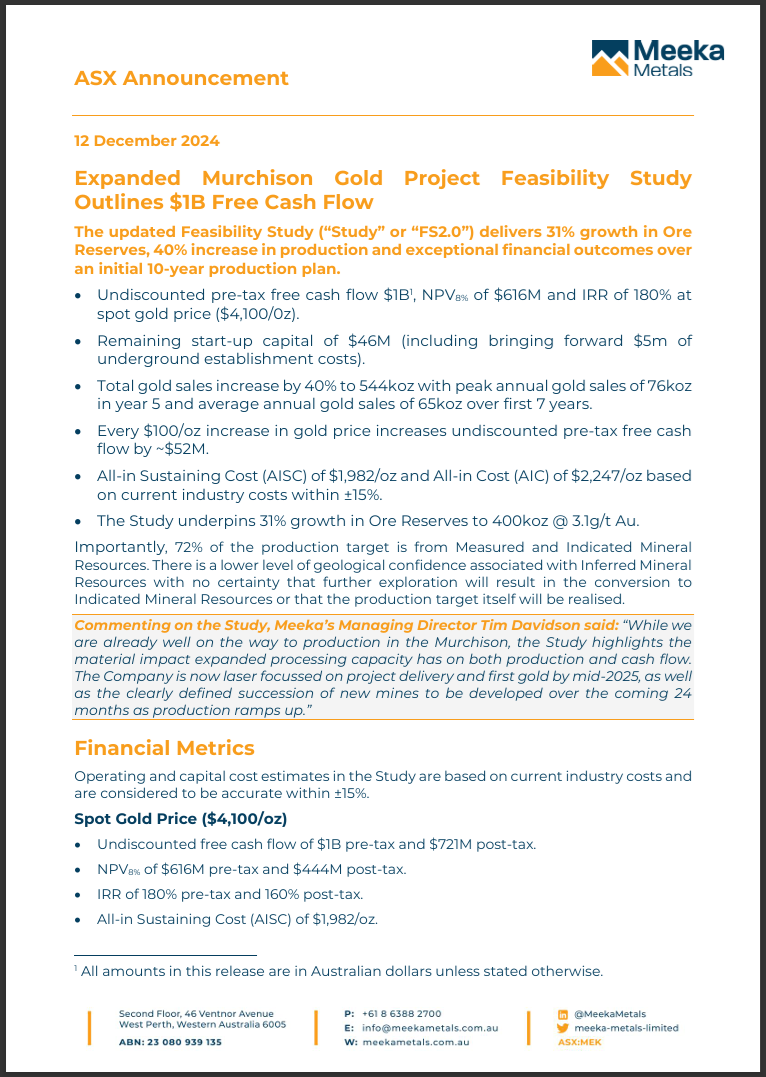

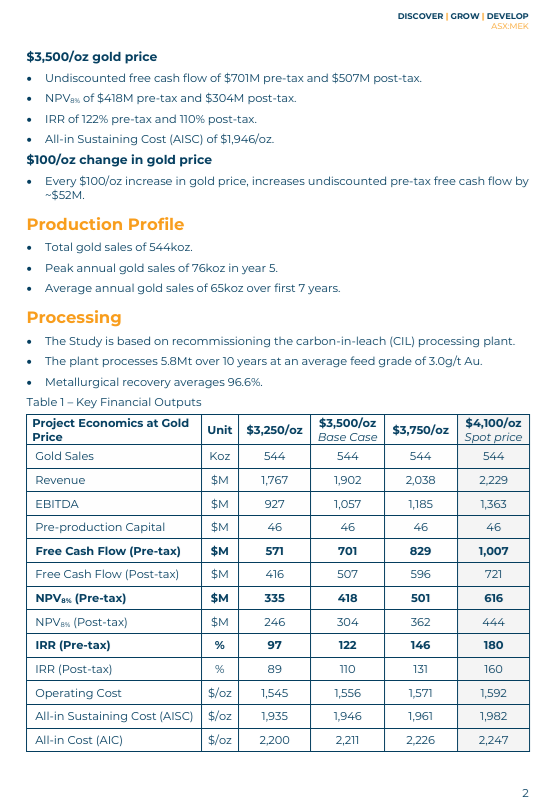

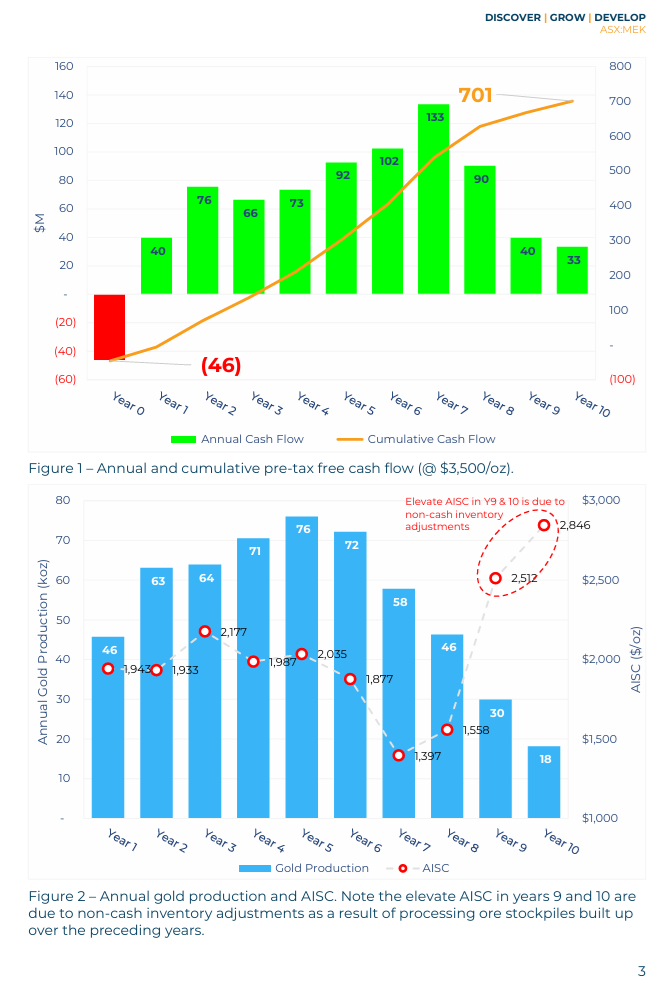

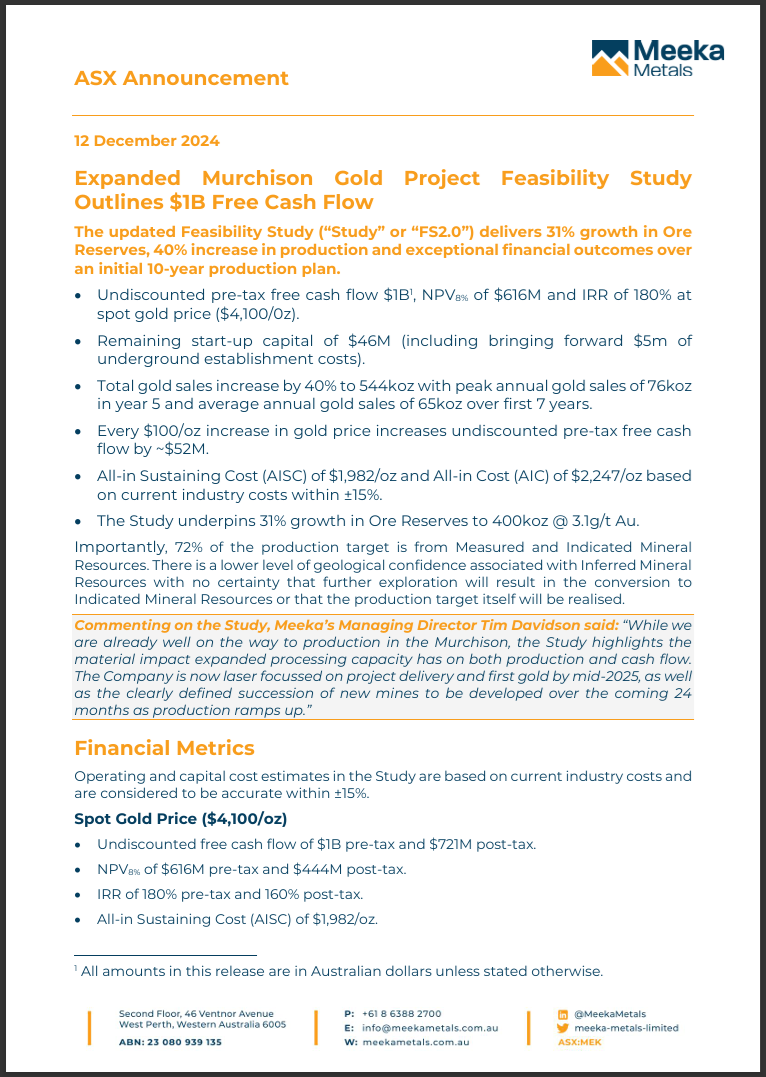

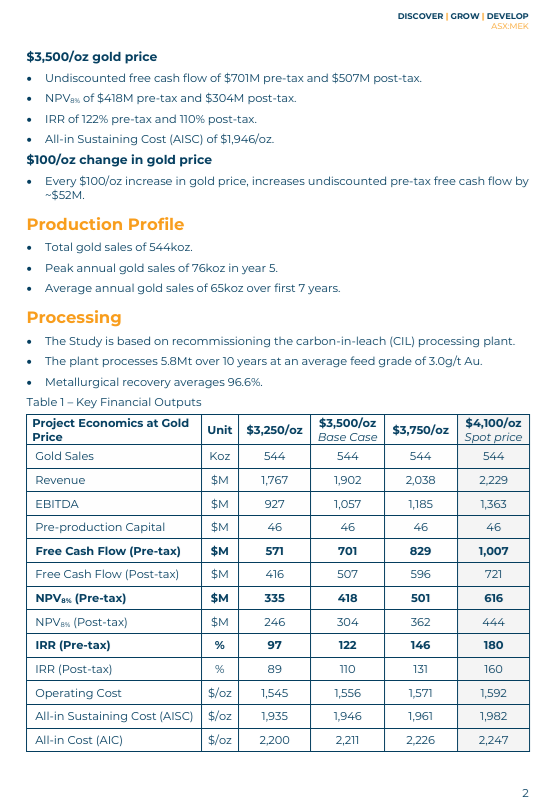

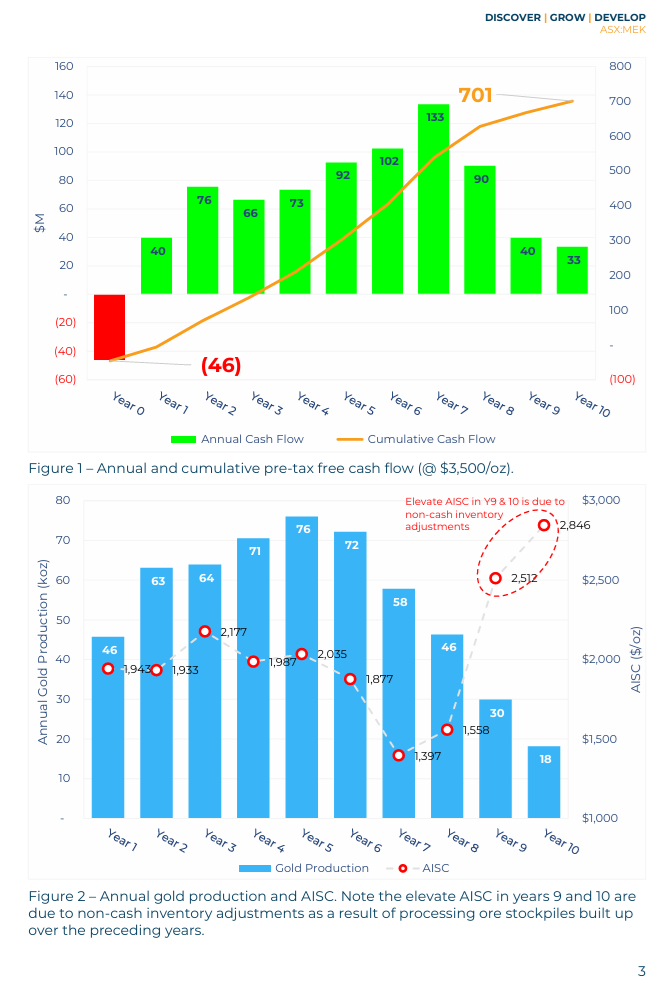

From the Announcement (first 4 pages):

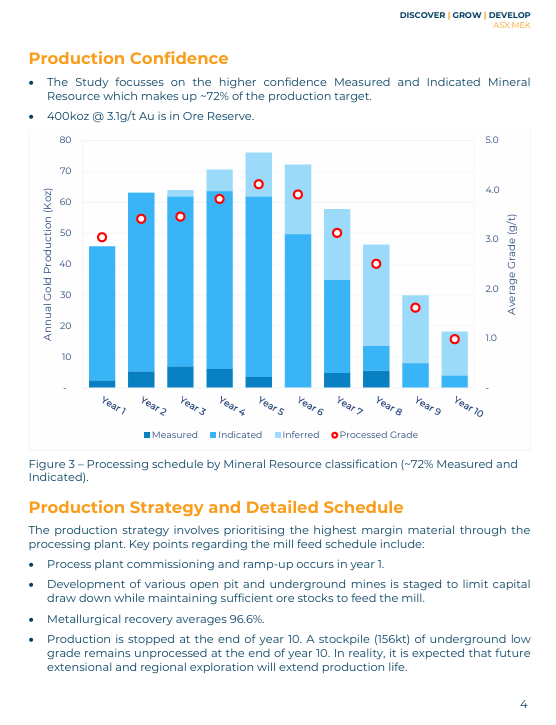

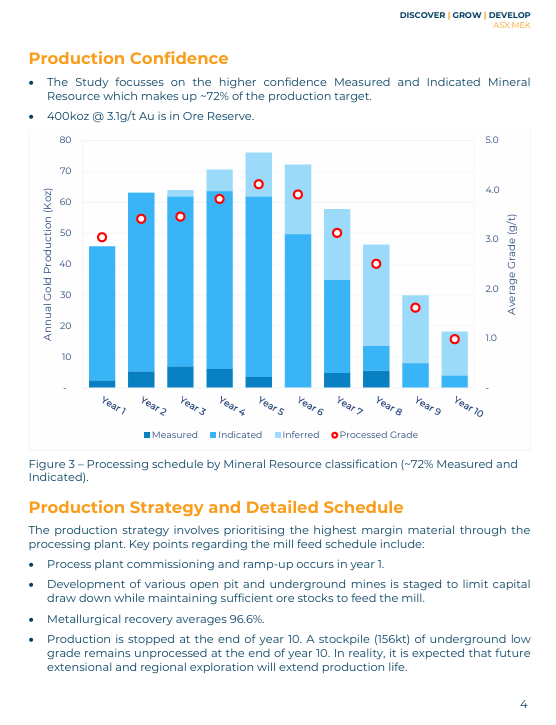

Source: Expanded Murchison Gold Project Feasibility Study [12-Dec-2024]

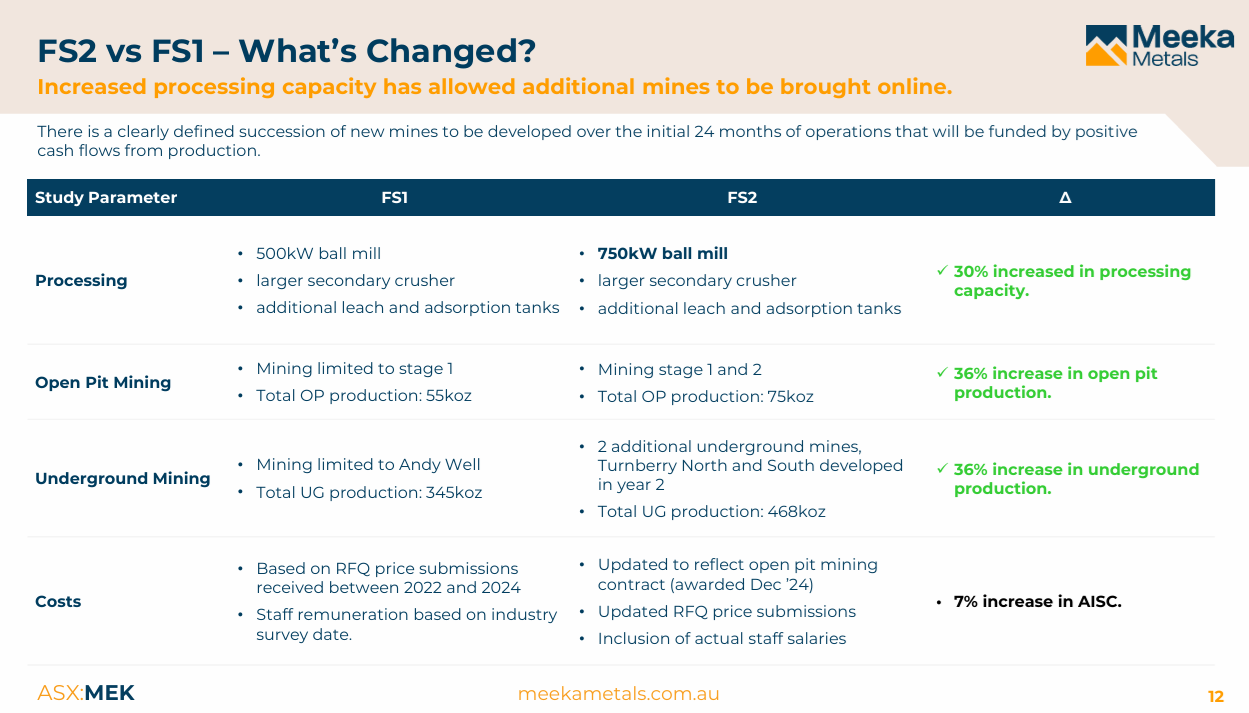

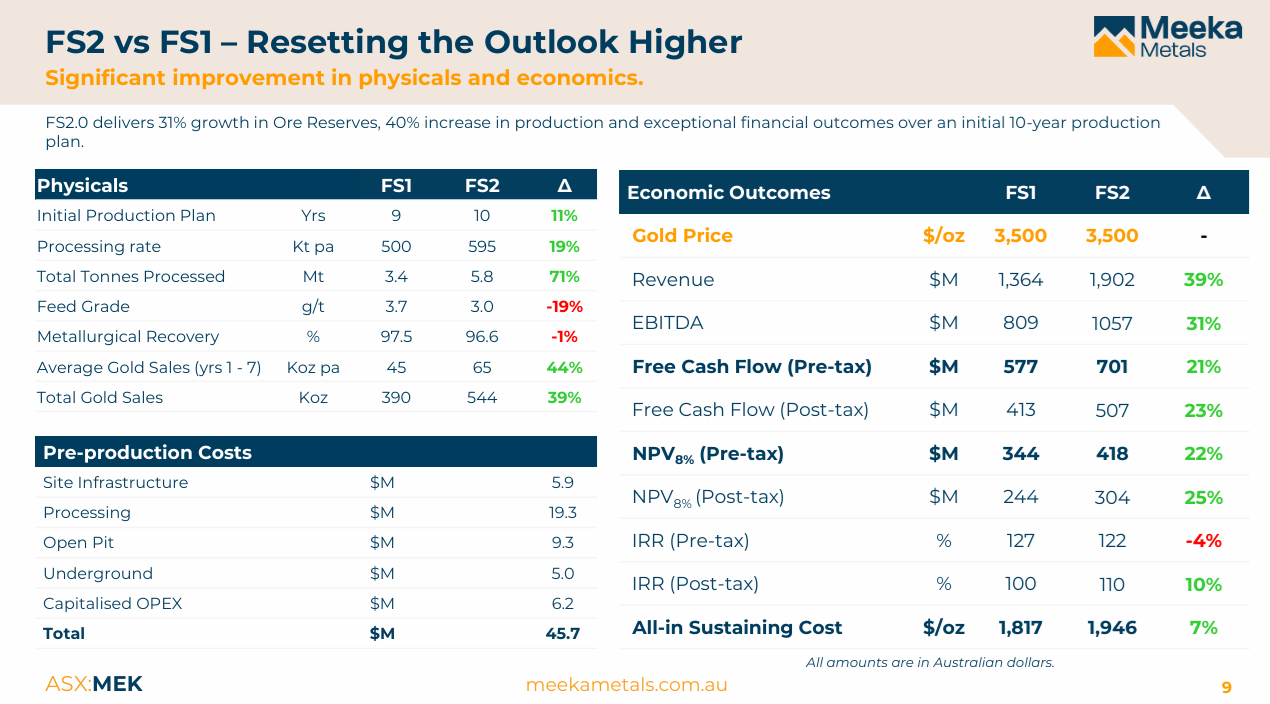

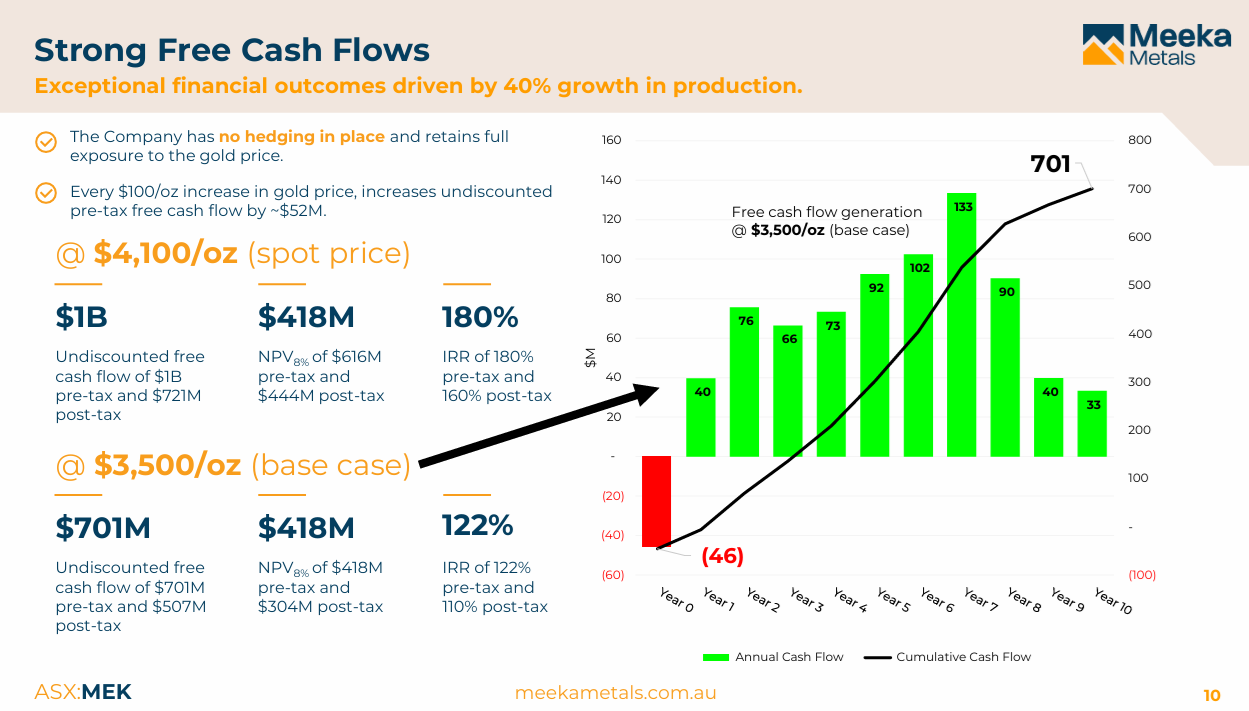

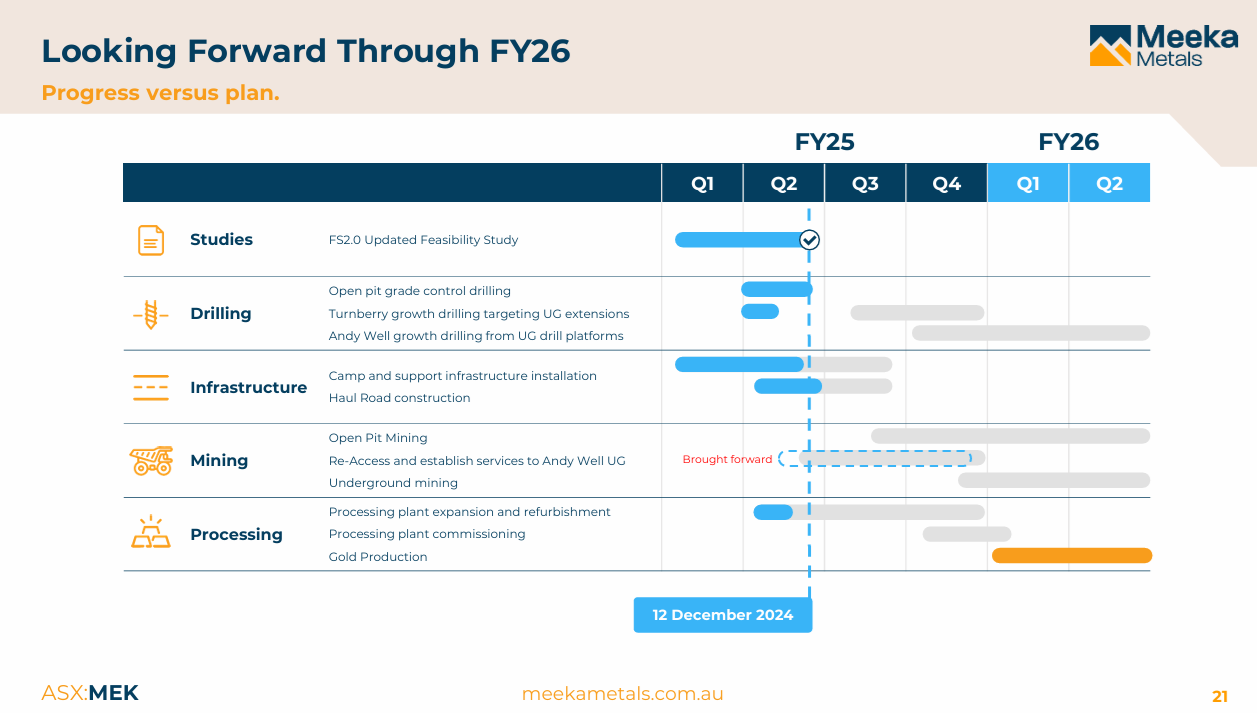

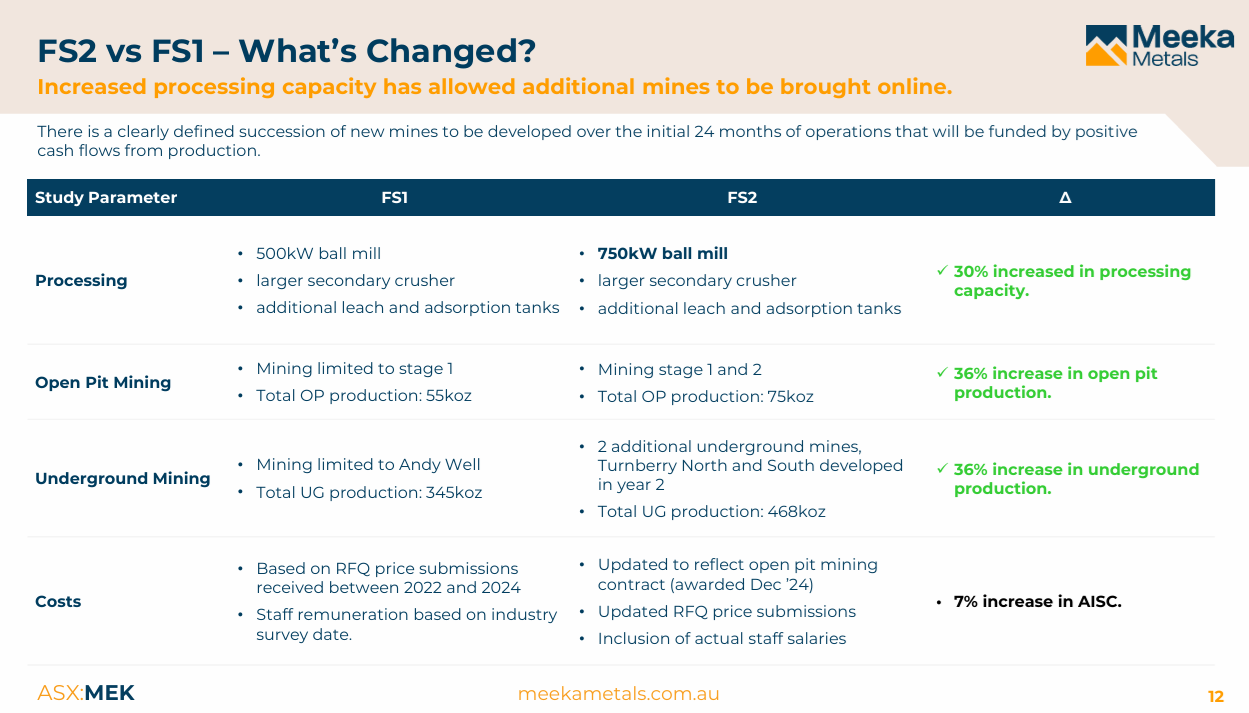

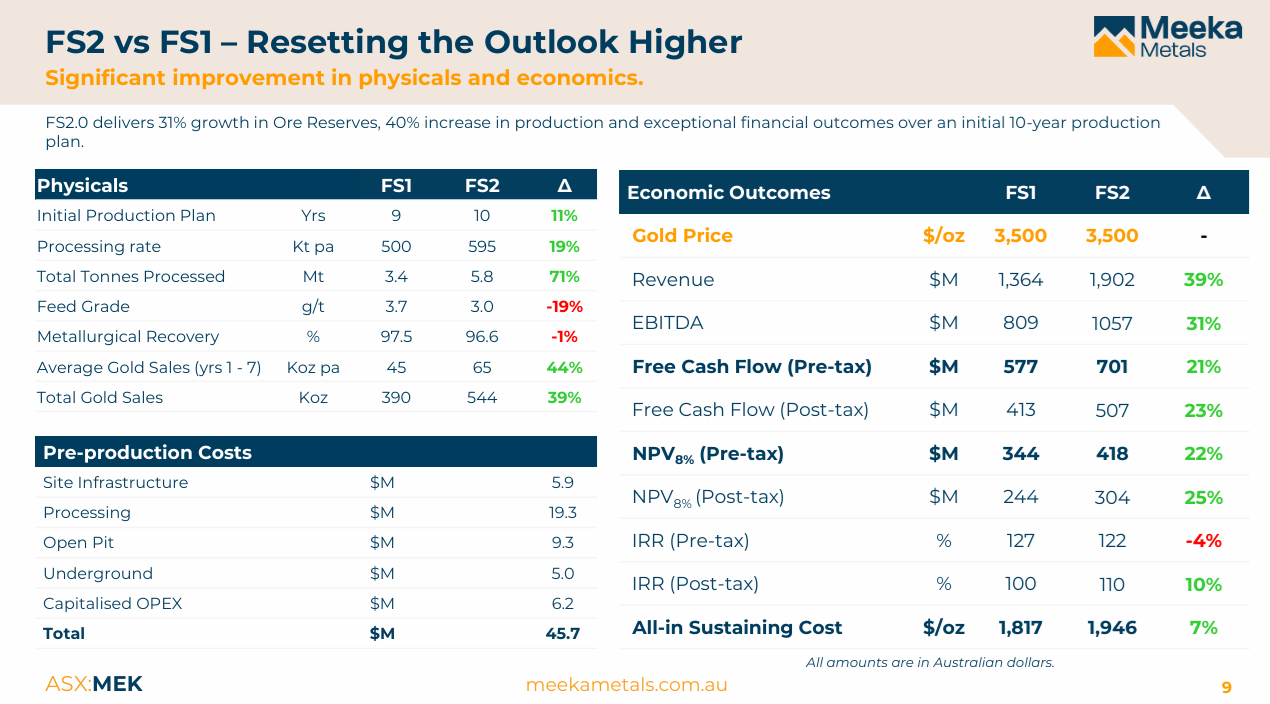

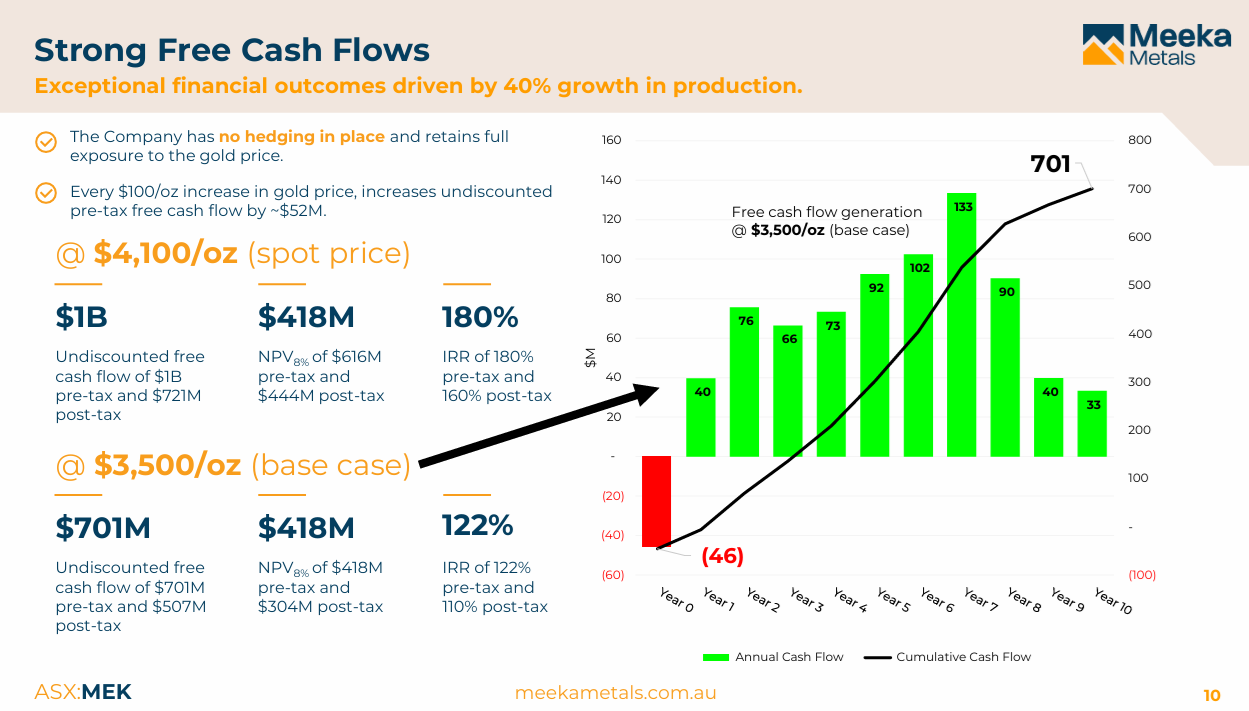

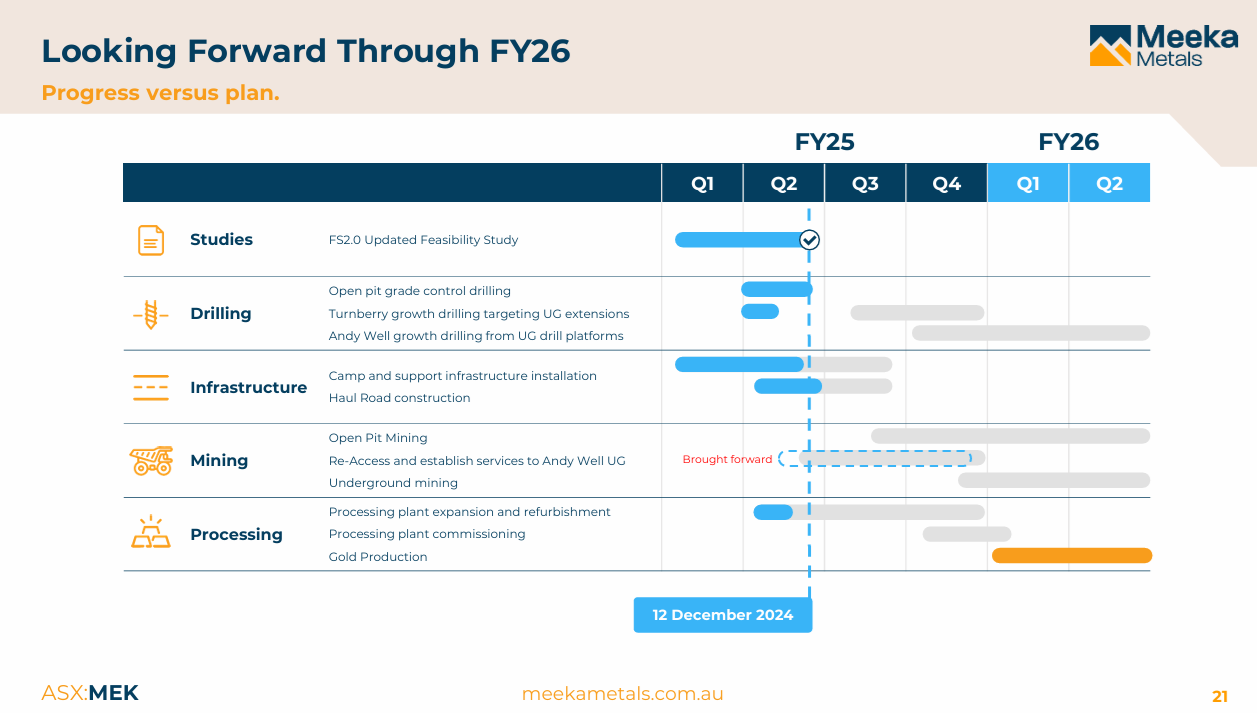

Below are some of the more interesting slides from their presentation today (Murchison Feasibility Study Update Presentation)

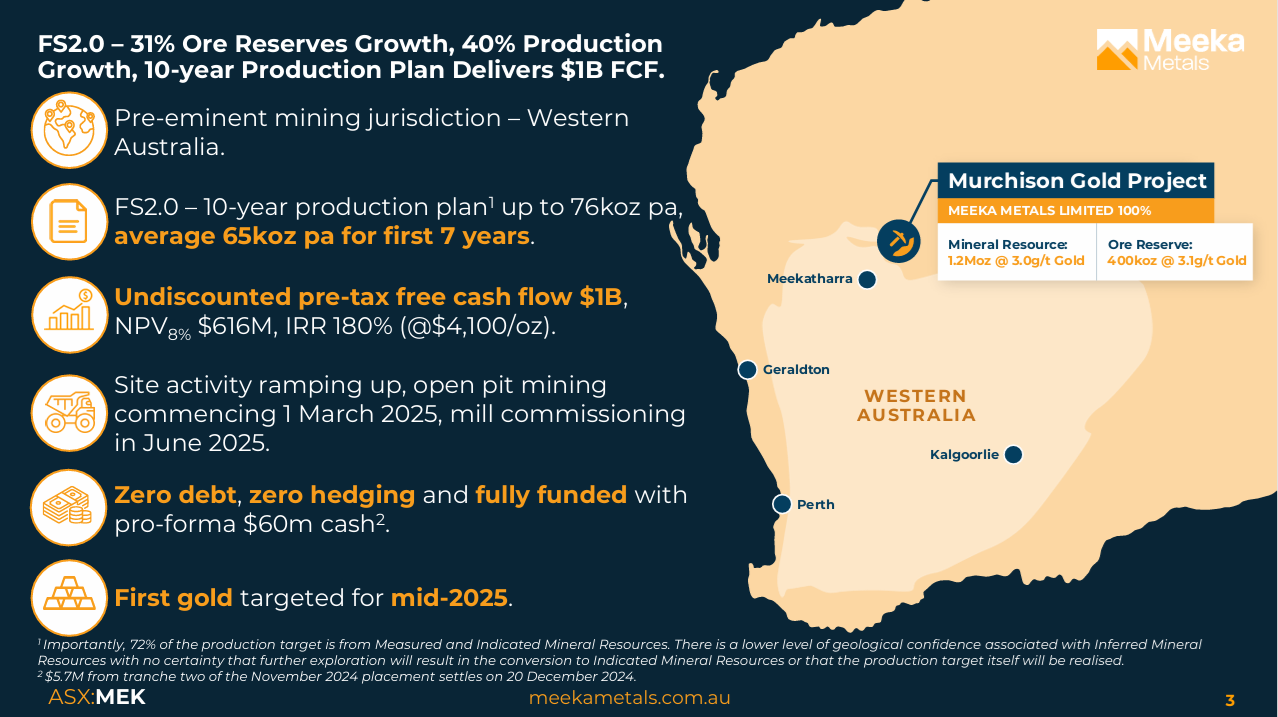

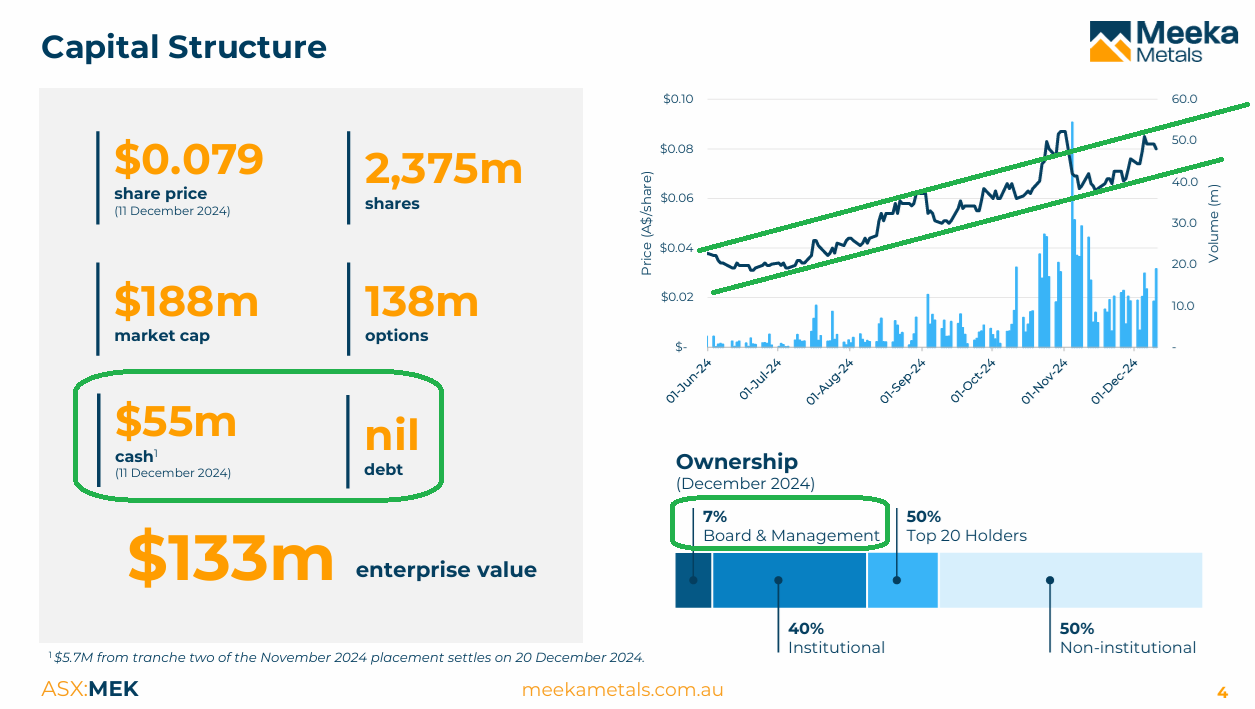

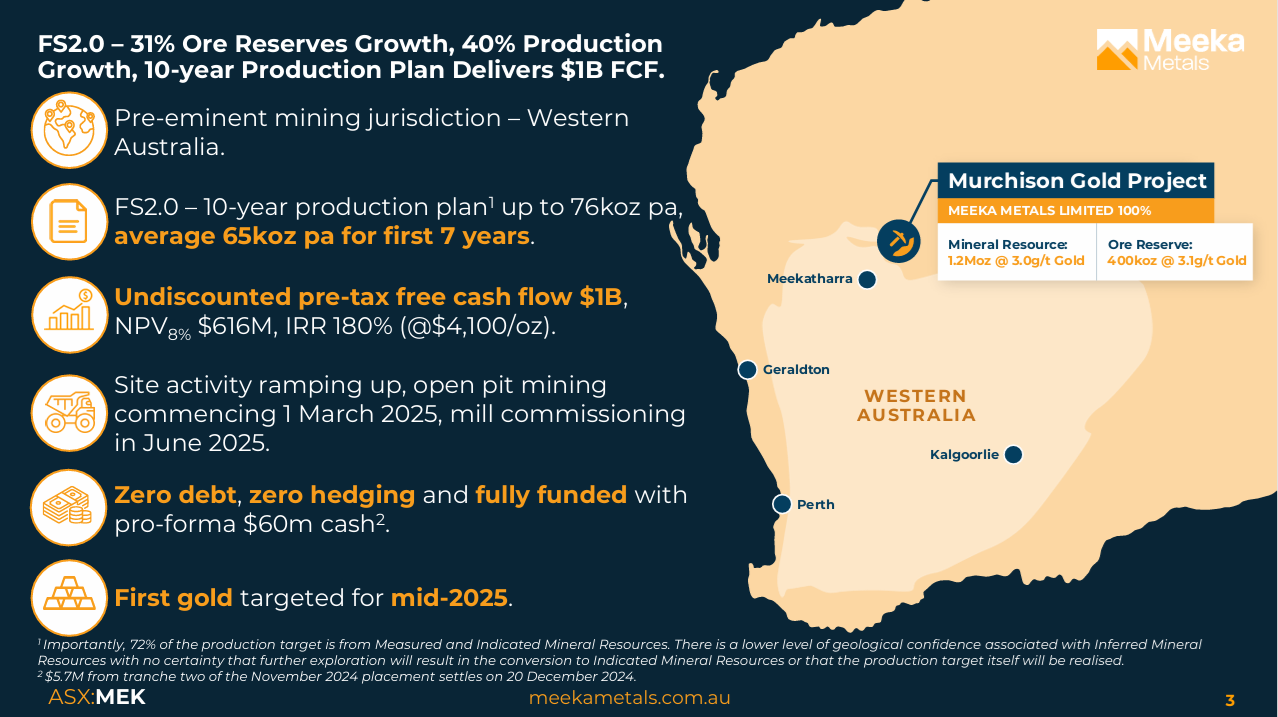

And here's why I hold Meeka Metals (MEK) Shares:

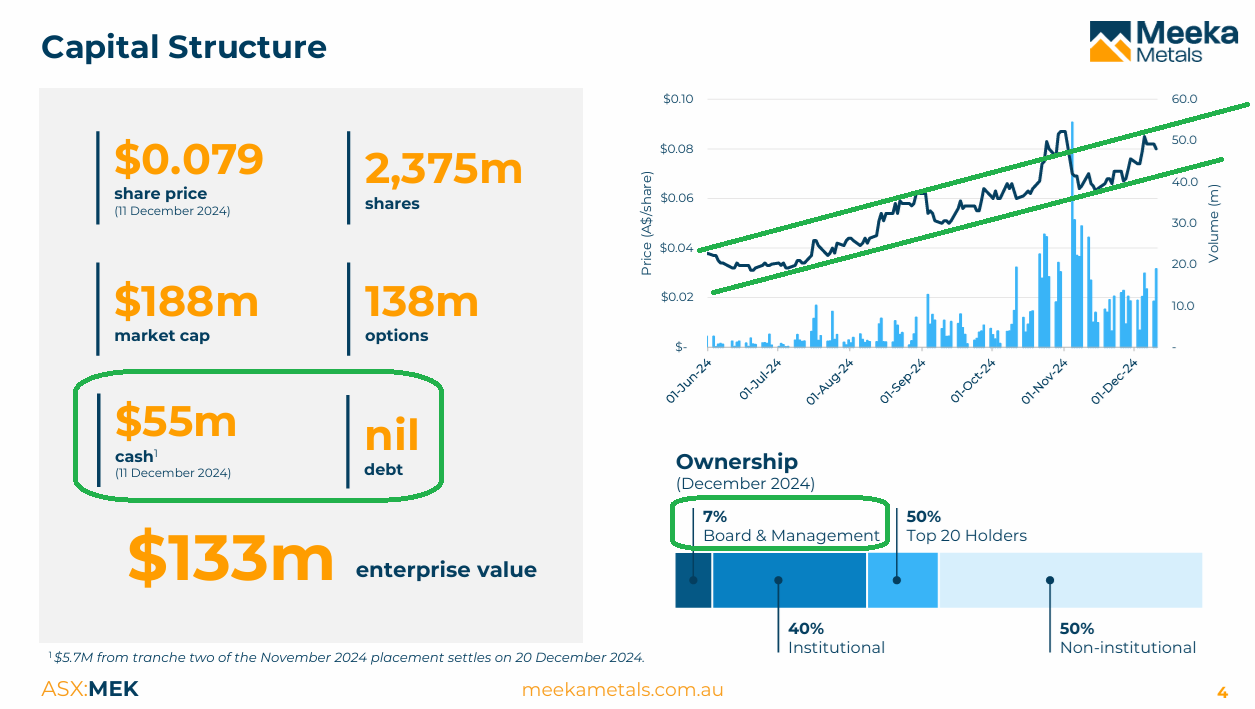

Fully Funded after their recent CR; Zero debt; 7% of the company held by their Board and Management. Rising share price. MEK closed up +3.8% today at 8.2 cps.

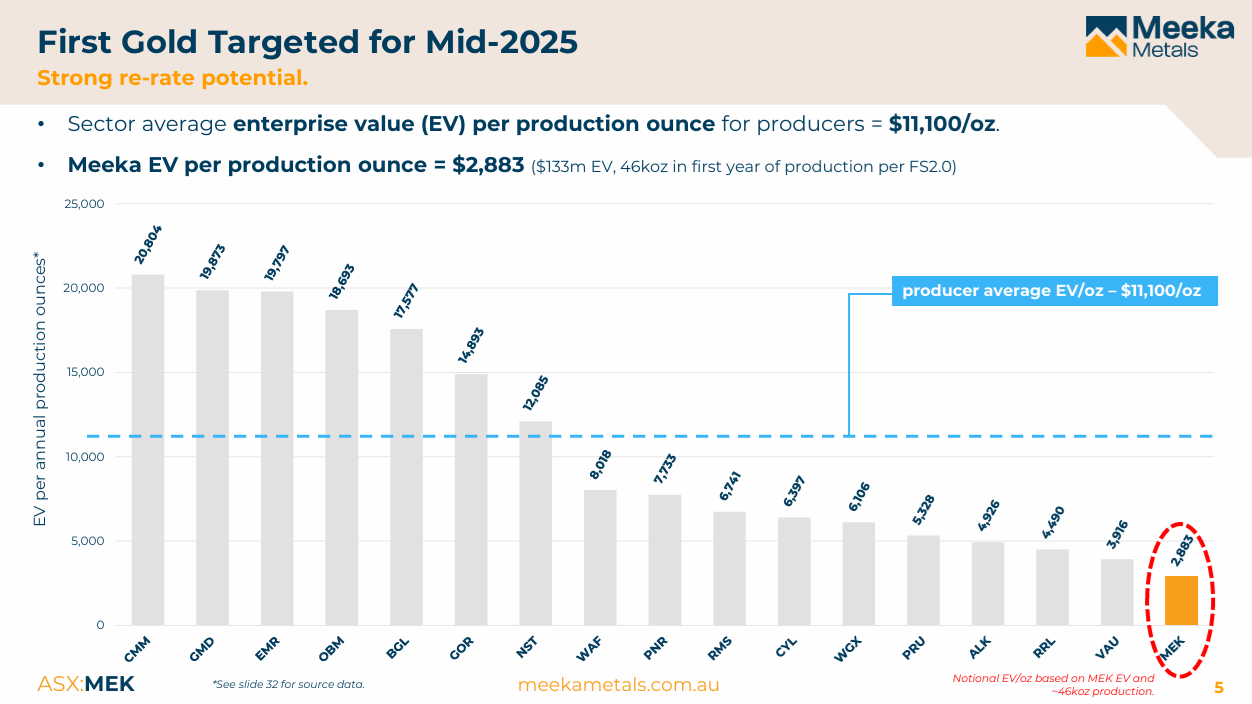

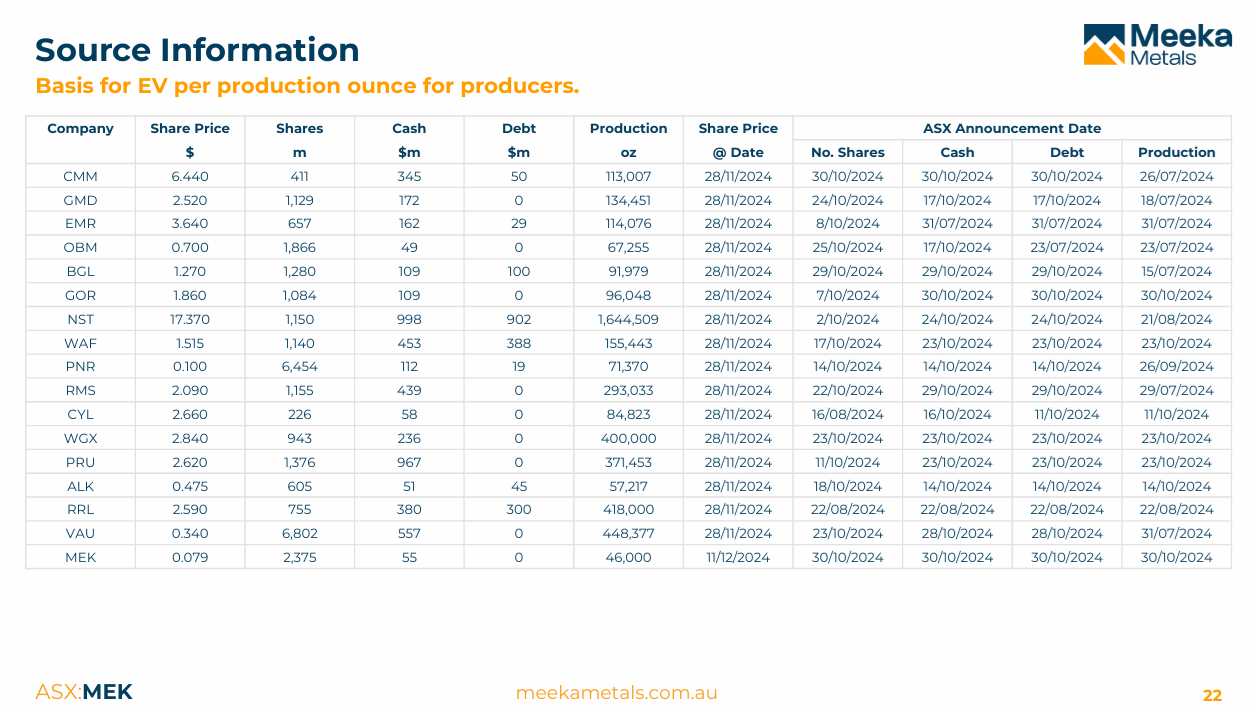

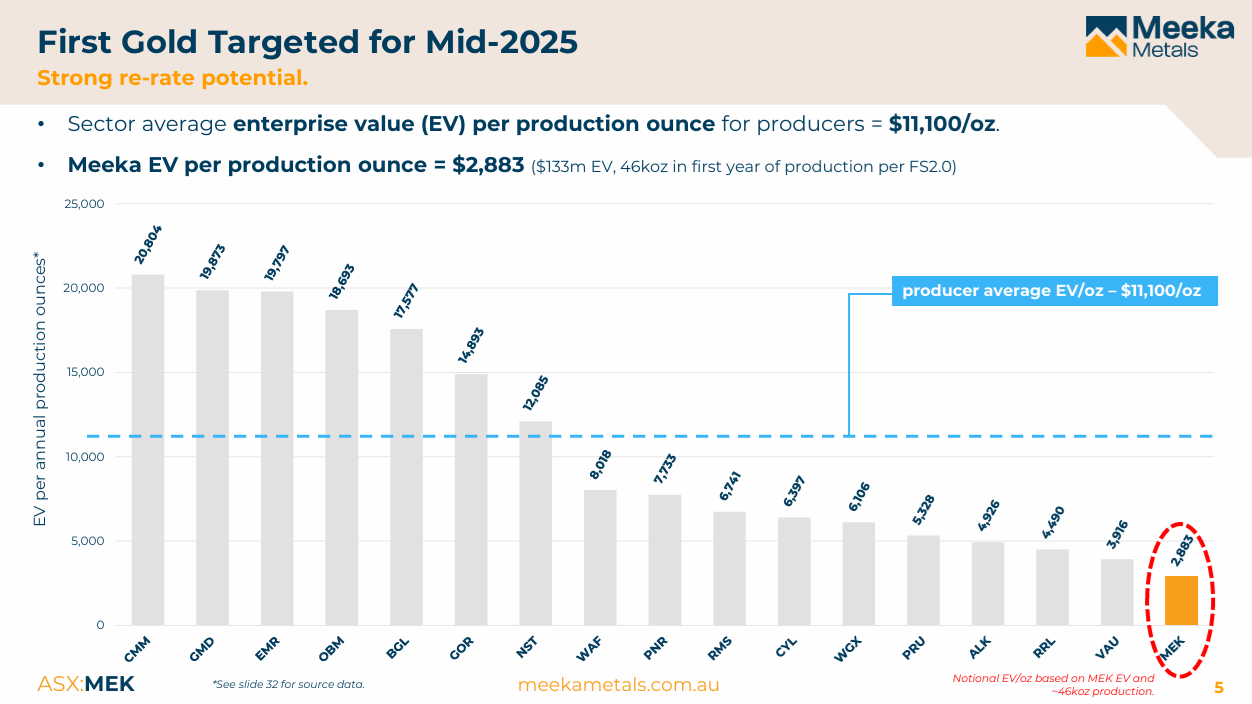

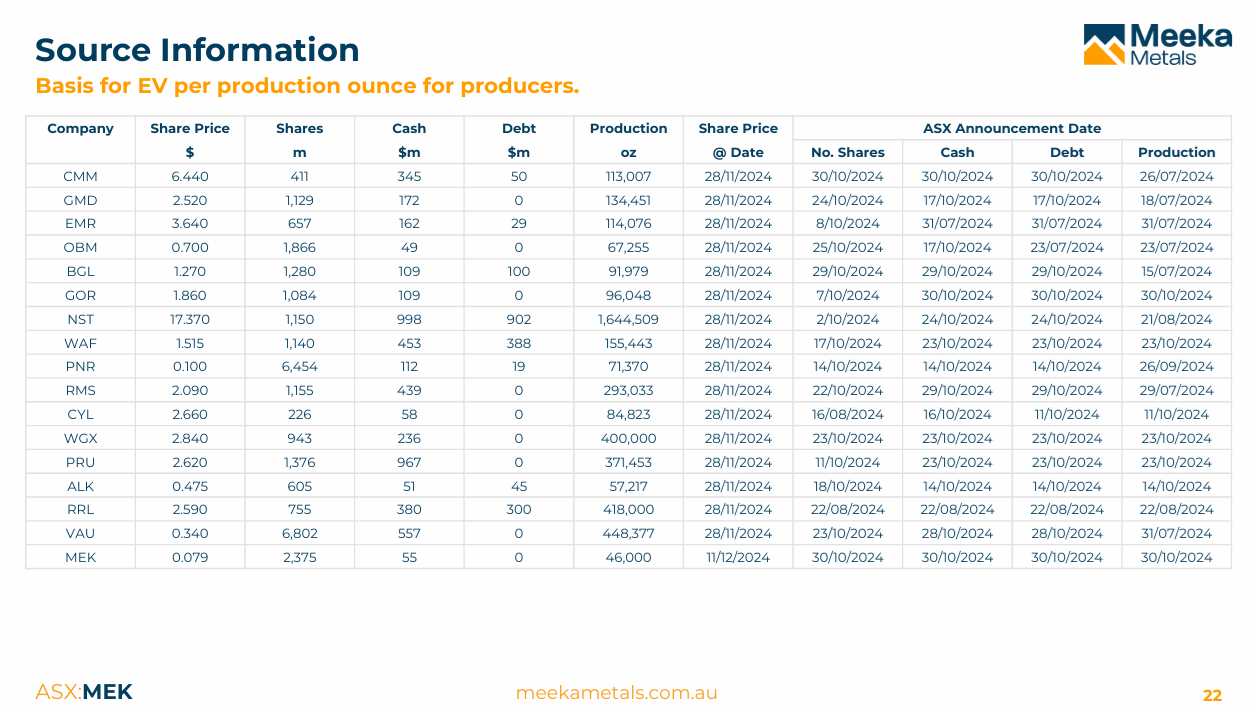

In terms of production ounces, they are still cheap (see below):

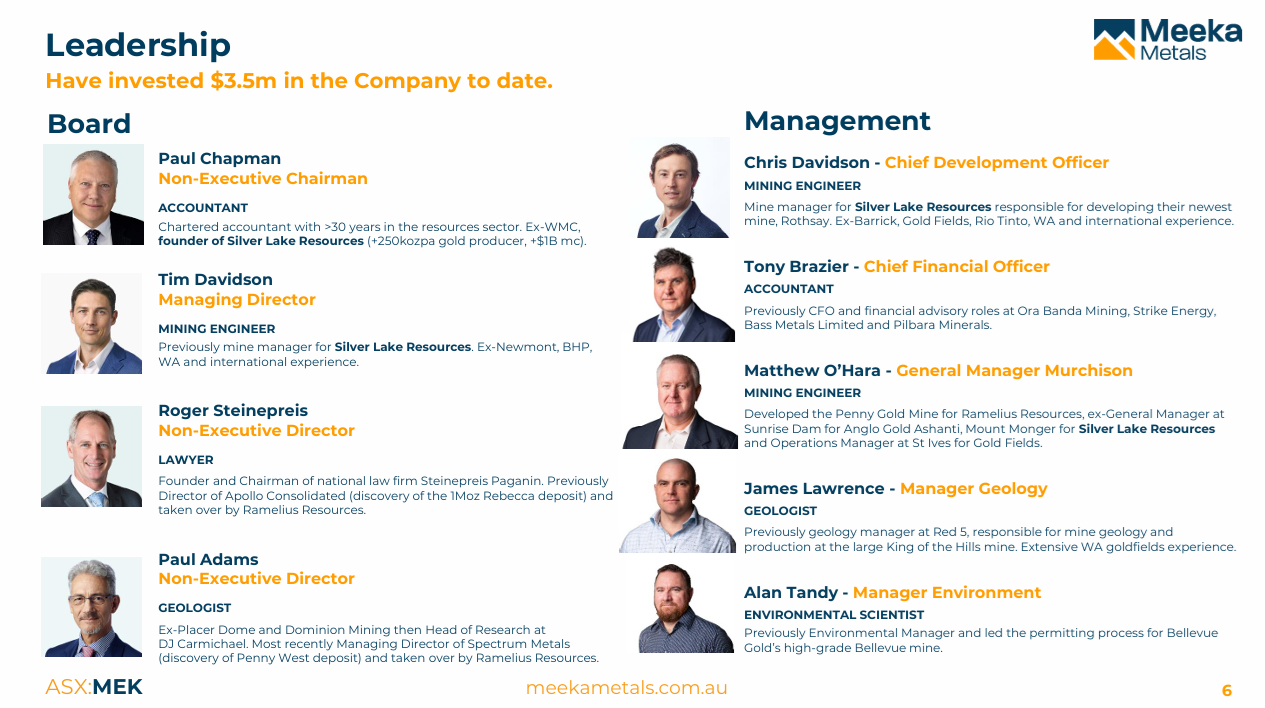

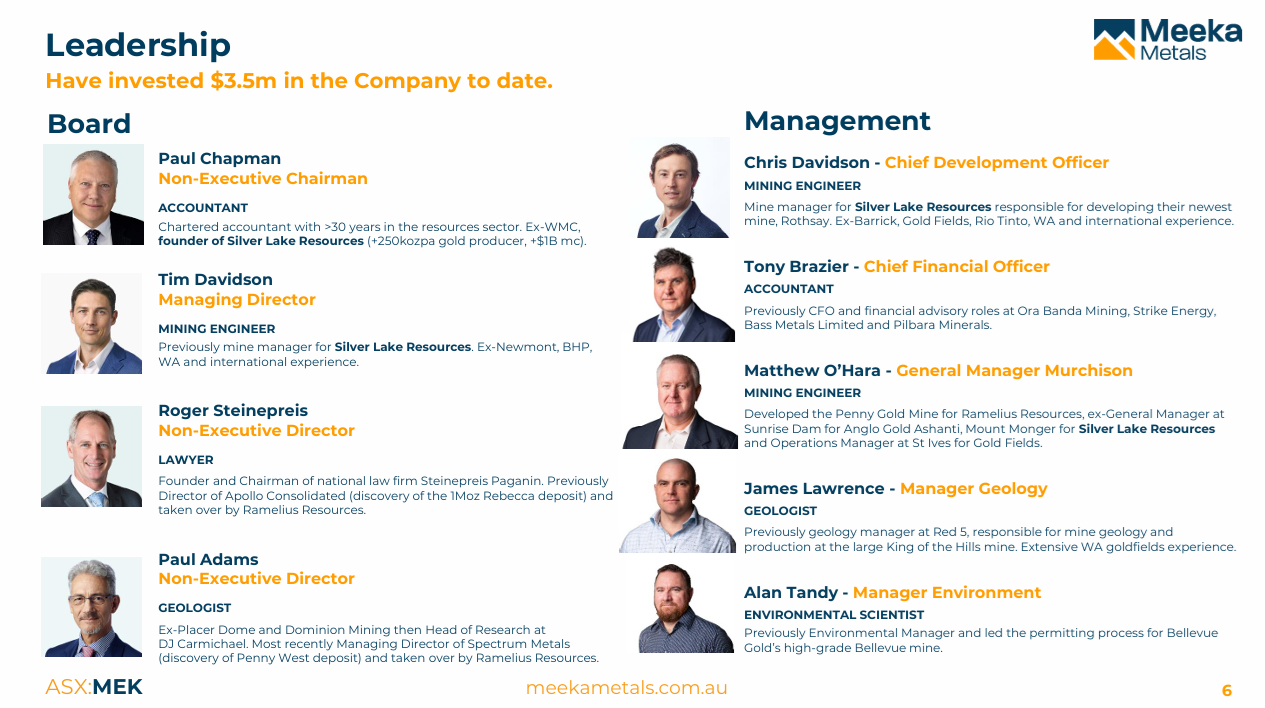

And they have experience. Four people below are from Silver Lake Resources - and Meeka's Chairman was at SLR before Luke Tonkin joined SLR in 2014 and took over the reigns. Paul Chapman, the Chair of Meeka was Ex-WMC (Western Mining Corporation, which was acquired by BHP), a founding shareholder of Silver Lake Resources and stayed for 11 years (from 2004, resigned in 2015, which was the year after Luke Tonkin moved to SLR), and has been involved in a number of other mining companies.

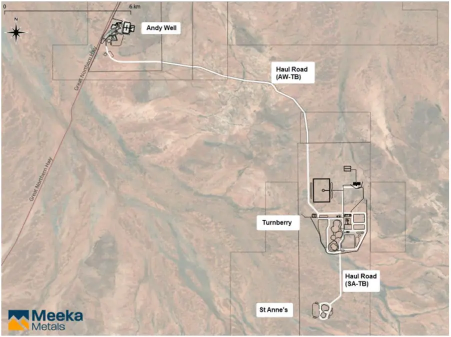

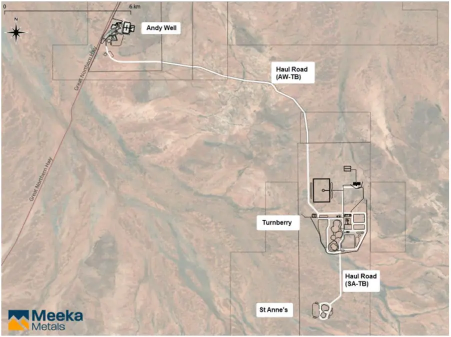

Tim Davidson and Chris Davidson were at SLR later, after Luke Tonkin took over, and something that's not written there above beside Chris' name is that he was the Senior Mining Engineer for Doray Minerals and was responsible for the Andy Well Mine through until SLR acquired Doray Minerals and then Chris continued on working for SLR after that. Andy Well is the gold mill that Meeka are firing back up with ore sourced from Turnberry and from Andy Well Underground:

Prior to being the Mining Engineer responsible for Andy Well (for Doray and then SLR), Chris Davidson worked for RIO and before that spent 5 and a half years at Granny Smith gold mine working for Gold Fields Ltd. He's now Meeka's Chief Development Officer (CDO). Nice.

Matthew O'Hara, Meeka's General Manager of their Murchison gold project, is the fourth ex-SLR guy there (was GM of Mount Monger for SLR for 4 years), but more importantly he's also developed Penny for RMS (3.5 years), was the GM at Sunrise Dam for Anglo Gold Ashanti, and was the Ops Manager at St Ives for Gold Fields Ltd. And he previously also worked for Barrick Gold.

I won't go through the rest of them individually, but their Environment Manager has worked for Bellevue Gold (BGL), their Geology Manager has worked at Red 5's KOTH (RED is now VAU - Vault Minerals - after the merger with SLR), and their CFO has worked for Ora Banda Mining (OBM) and Pilbara Minerals (PLS).

Main thing is that they ALL have relevant experience, including all 4 Board members having experience in gold mining.

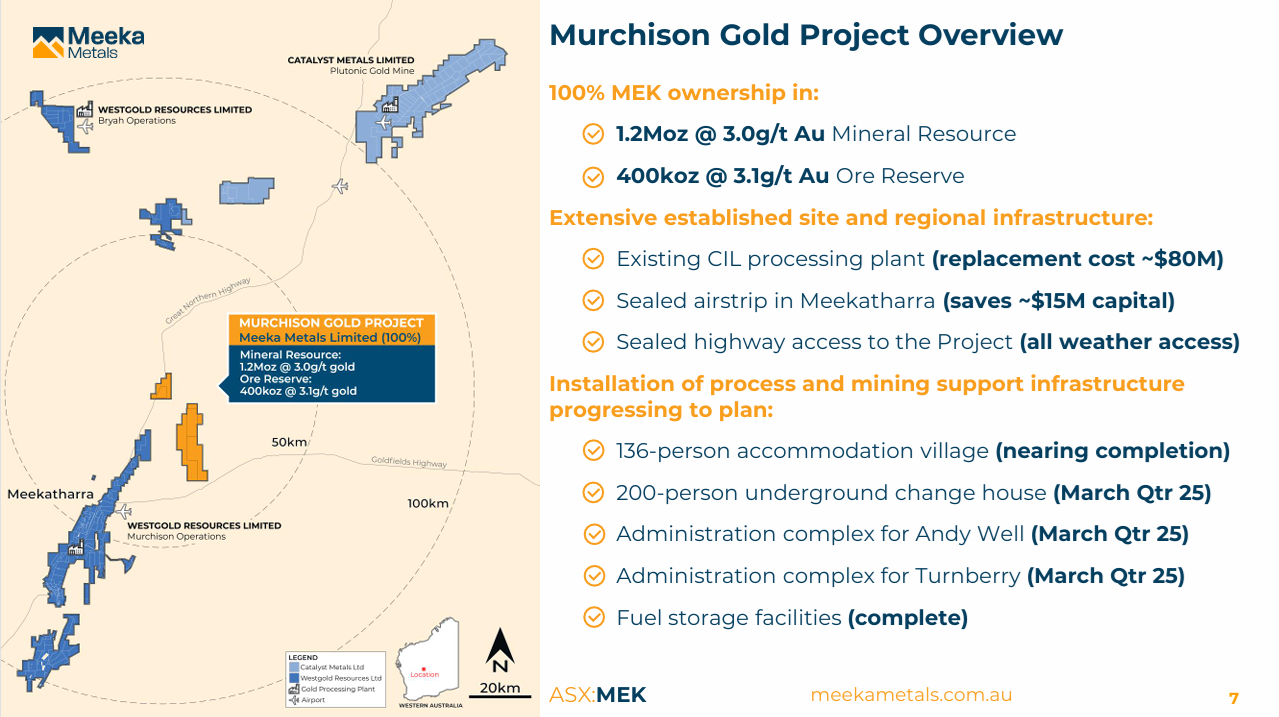

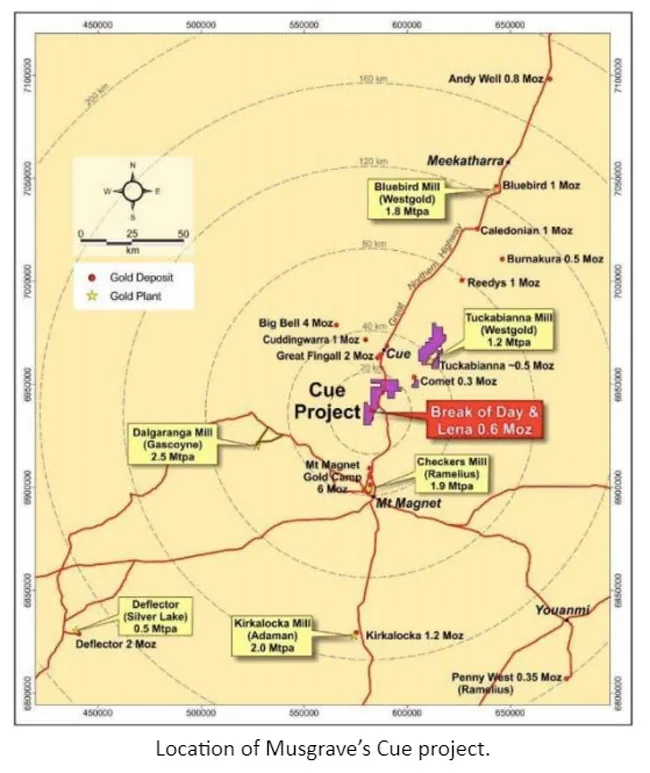

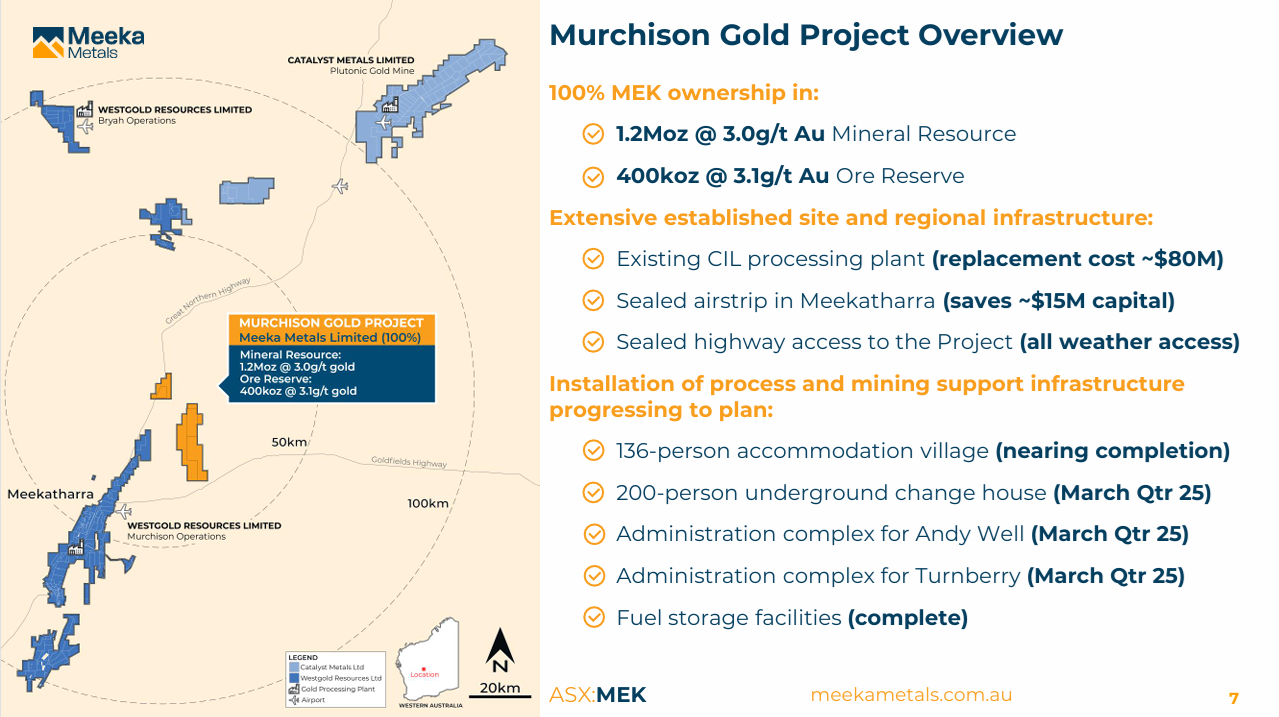

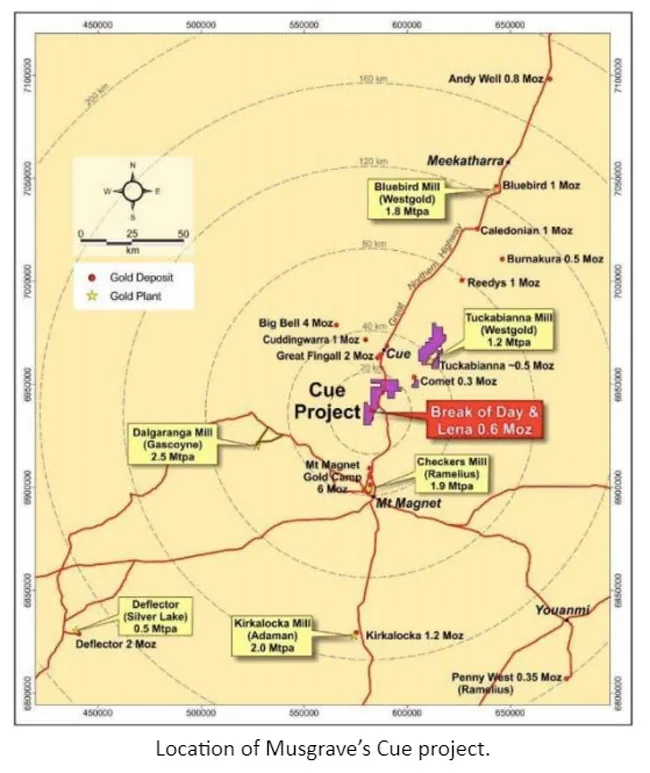

And I like where their project is. I used to hold Doray Minerals Shares when they were still mining Andy Well (when they first started mining it actually), so well before SLR acquired them, and I now own shares in Westgold (WGX) which is to the north west and the south west of Meeka's Murchison project (formerly known as Andy Well) on the map below. This week I also bought shares in Catalyst Metals (CYL), who are shown there to the north east of Meeka's Murchison Gold Project.

It's a good gold area.

And on the following map, which shows more to the south and west of that map above, you can see Ramelius isn't far away either. I also hold shares in Ramelius. The map (below) was from a Musgrave Minerals presentation a couple of years ago. Ramelius Resources (RMS) acquired Musgrave Minerals in September last year (2023) so RMS own the Cue project now, as well as Penny down in the bottom right corner below. You can see the Andy Well mill in the top right corner below - that's Meeka's Murchison project that this straw is all about.

Silver Lake is now part of Vault (VAU), Gascoyne has changed their name to Spartan (SPR).

Below is a more up-to-date map of Ramelius' assets - which extend beyond the map above.

Source: RMS: Penny Gold Mine Update [15-Sep-2023]

Anyway, back to Meeka Metals (MEK):

Source: Murchison Feasibility Study Update Presentation [12-Dec-2024]

Onward and upward.

Disclosure: I hold shares in MEK, RMS, WGX & CYL, which I've discussed in this straw, and of the other gold companies listed in the comparison tables on slides 5 and 22 above, I also hold shares in NST, GMD, EMR & VAU at this point in time in one of or both of my real money portfolios. I have a tiny PNR trading position here, but no Pantoro shares in real money portfolios. In my SM portfolio I also hold MEK, NST, GMD, RMS as well as smaller positions in EMR and CMM, all of which I hold in real money portfolios also except for CMM (I do not hold Capricorn Metals currently in a real money portfolio, but have previously held them and probably will do again one day).

Meeka look good here. Substantially de-risked, no debt, fully funded, progressing well, could easily be a takeover target, but should so very well all by themselves without any M&A interest.