Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

20-Nov-2025: 4m @ 27.8 g/t Au - Shallow High-Grade Gold at Andy Well UG.PDF

More on that announcement from Meeka today in a minute, but I should first mention that they also released a similarly positive announcement just 10 days ago:

10-Nov-2025: 8m @ 14.8 g/t Au - More High-Grade Gold at Turnberry South.PDF

OK, back to today's announcement: Here's the first page:

Green highlights and underlines added by me. And the news flow comment near the bottom above.

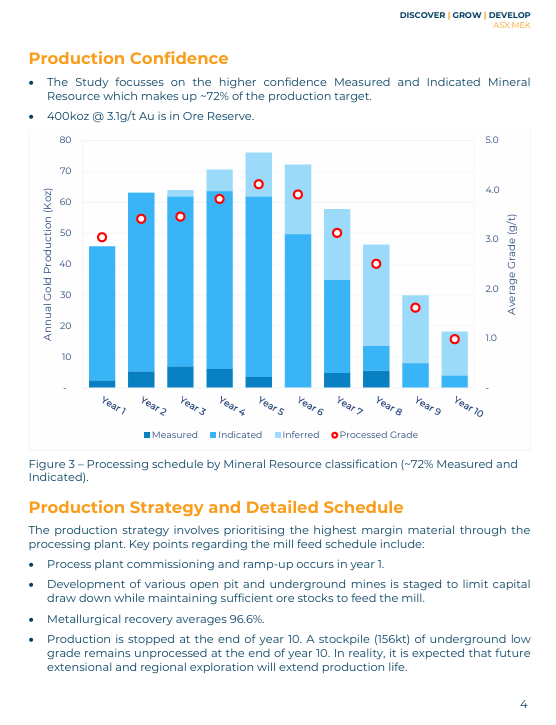

Below are the four Figures (images) from today's announcement:

Blue arrow and text added by me. Correction: Meekatharra is south-WEST of their mine and mill, not south-east as I have said there.

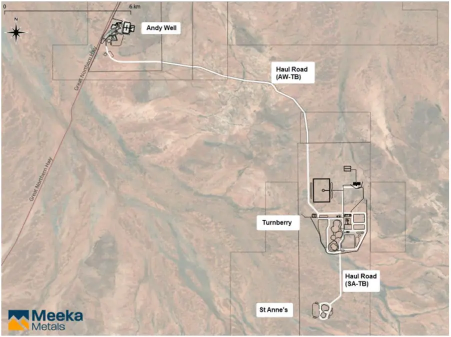

Located right on the Great Northern Highway, less than 50km from a decent town (Meekatharra), with other goldies operating to their north east and to to their south / south west, with their Murchison Mill ramp up beating expectations, and they're finding more gold both within their existing mine plans and outside of those mine plans, which certainly has the potential to extend their mine life, or lives if you regard Turnberry and St Anne's as separate mines to Andy Well Underground. They are separate but it's all being fed through the one mill.

And the gold they're finding is both shallow and high grade. Tick and Tick!

And they've got more newsflow to come:

Source: 4m @ 27.8 g/t Au - Shallow High-Grade Gold at Andy Well UG.PDF [Today: 20th November 2025]

Disclosure: Yep, I'm holding Meeka shares. Both here and in my RL speccy portfolio where they are the biggest position in that particular portfolio.

In the drilling update, Oct production is run-rate of ~45kozpa. First year is 50koz+ so tracking well in the final stages of ramp.

Scroll Down - latest thoughts and updates are at the bottom...

06-Jan-2025: Short term price target = 9.6 cps. Longer term, who knows - above 10 cps anyway. Plenty of potential.

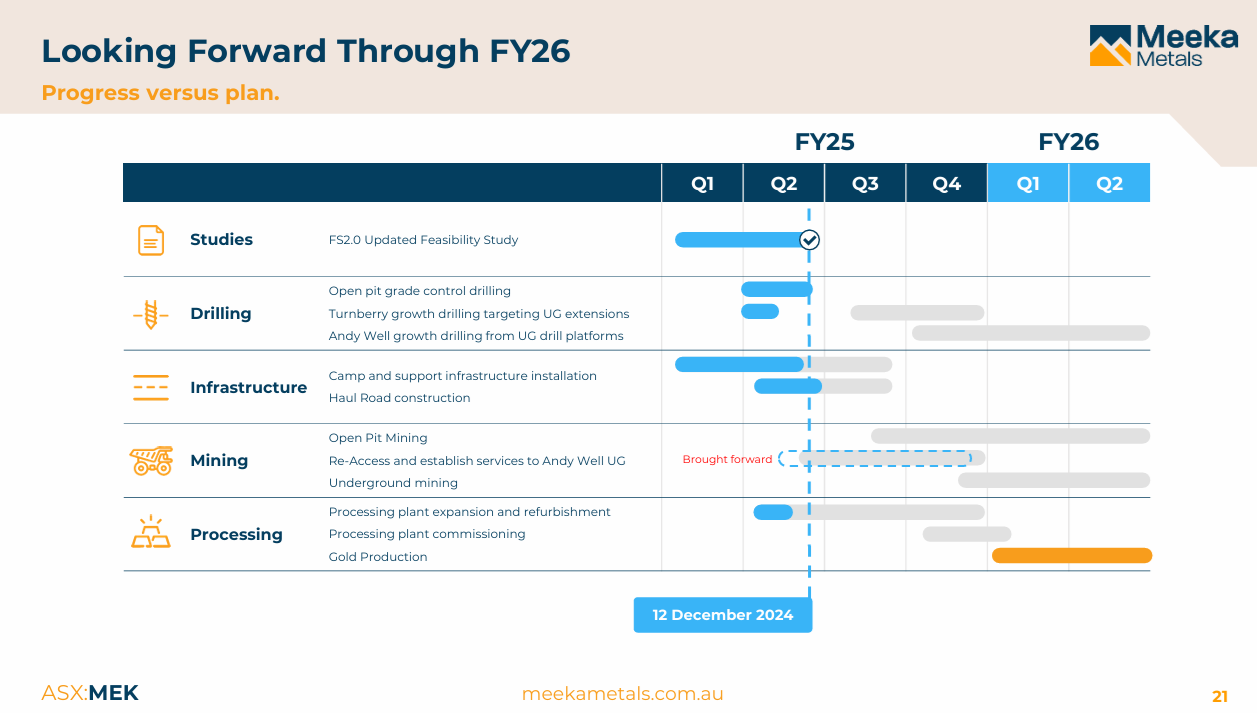

On December 31st (2024) they released this update: Murchison Development Update and that contained the following slide:

And based on that, I took some profits assuming there would likely be less news flow in January and February. I sold one quarter (25%) of my MEK position IRL, and around 44% here on SM.

And today they release this: 6m @ 26.47gt Au - Drilling Delivers at the Murchison [Gold Project] [06-Jan-2025]

Which contained this updated timeline:

So much for a quiet January and February...

Another nice share price rise this morning:

Plenty of buying there. On the basis of this latest update today, I'm setting a short term (3 month) price target of 9.6 cps (cents per share) for Meeka Metals (MEK) and believe they'll be over 10 cps within a year.

They are still high risk due to being project developers who are in the process of transitioning into gold producers, and also because even when they have become gold producers later this year they will still be a single mill producer, so no geographical or other diversification - just production from a single area through a single gold mill. They can and should still be very profitable, but the risk is that if something goes wrong at their Murchison gold project, they haven't got alternative income to get them through - all of their eggs will be in the one basket - in terms of production (they have other assets, but those are a long way from production; Murchison is getting very close to production now).

Because of those risks, despite the significant upside potential, my exposure to Meeka remains lower than to the lower-risk multi-mine gold producers that I also hold shares in. MEK are still worth having exposure to for sure (IMO), but I'm not throwing the farm at them. Solid and reliable multi-mine producers will always provide the bulk of and the backbone of my gold company exposure.

Nice drilling results reported by Meeka today:

So - plenty of boxes ticked with this company:

- Zero debt;

- Fully funded through to production, including generous contingency for extra costs;

- Good management, who are on the front foot with shareholder engagement but have so far not overpromised and underdelivered - they've done what they said they would do, or better;

- Finding more gold in close proximity to their mill;

- Will have reasonable costs that ensure profitability at lower gold prices than the current elevated gold price;

- Are fully WA (no overseas assets);

- Their share price is rising at a good clip; and

- They have provided details (i.e. their timelines, as shown above) of upcoming positive project development milestones, some of which should provide further positive catalysts to trigger further buying.

Oh, and they also have further exploration upside potential in terms of further positive drilling results.

So, yeah, I'm still holding Meeka Metals (MEK) shares.

May 10th, 2025: Update:

I have maintained my MEK position here on SM but have taken profits in my real money portfolio, including fully exiting the company at slightly higher levels than today's 14.5 cps, however I bought back into Meeka in the past few days to take advantage of that small pullback due to the very short-lived downtrend in the larger uptrend that the gold price is enjoying, so I'm back in MEK again - at 14.5 cents/share.

My new price target for MEK is 19.5 cps, which might seem high from here, but they've already tagged 17 cps, and they are not yet producing gold.

There is likely going to be some selling pressure when they revisit that 17 cent high, as shown in the orange square above - with quite a bit of volume for sale between 16 and 17.5 cps compared to levels above and below that. And there is less volume on the buy side currently, however Meeka's SP can be very news-driven, and we could be in a quiet month for the company, as shown in their indicative timetable below:

Source: Murchison Development Update - April 2025 [1st May 2025]

Last time I hinted that we could be in for a quiet month, they lobbed in some good drilling results and spiked up, so all I'm saying is that it could be a quiet month, ahead of their Mill commissioning commencing in June along with the underground mine commencing ore development + growth drilling - all scheduled for June as shown above.

They're getting close to production now!

Source: Murchison Development Update - April 2025 [1st May 2025]

Some interesting scuttlebutt on Meeka here: https://youtu.be/rYo5xpWvQ-k?t=1154 [Money of Mine: Mastering the Lassonde Curve’s Valley of Despair (Rick Squire, Portfolio Manager, Resources & Energy at Acorn Capital)]

Disc: Holding.

Gold Explorers and Developers held as at 10th May 2025: MEK, NMG, MM8.

Gold Producers Held: NST, GMD, RMS, EVN, GOR, BGL. All held IRL, some (4 or 5 of those 9) also held here on SM.

16/10/2025: Update:

Raised target price to 37 cps.

See here for reasons (forum posts by @BkrDzn and @SudMav).

Holding.

Update the val given gold price has marched a lot higher. Val now at A$5500/oz vs $4500/oz which gives NPV/sh of $0.272 vs $0.200 despite the dilution that has occurred since. This is +21% upside at the current SP of $0.22.

~11-12wks into commissioning and ramp and MEK has been oddly quiet although I would hazard and say that if anything was not going right in a significant way, it'd have leaked out. But instead the SP is hitting new highs and melting up with the gold sector.

Given the close of the valuation gap (i.e. SP to NAV has shrunk) despite the rise in the gold price, this is getting to fully valued territory imo. With the gap closing, MEK needs a nee fundamental driver (maybe good recs in the OP feed that drives higher production) otherwise the SP will be driven more as a proxy of gold price movements and relatively operating leverage (i.e. incremental margin expansion). As such, this is getting close to an area to consider booking profits and rotating into other gold names with value.

But what would I know as with the power of hindsight, I have been a bad seller of MEK.

NEW: NPV8 post-tax of A$778m assuming a flat price of A$5500/oz on the production profile published in FS2 (Dec 24), a fully diluted share count of 2.92b.

OLD: NPV8 post-tax of A$522m assuming a flat price of A$4500/oz on the production profile published in FS2 (Dec 24), a fully diluted share count of 2.67b and adjusted current cash for remaining capex spend.

12th June 2025: Meeka-Murchison-Process-Plant-Commissioning-Underway.PDF

Exciting times.

Meeka made an a new all-time high SP of 18.5 cps today and are currently trading at 18 cps, being +12.5% above yesterday's 16 cps (cents per share) close.

Disclosure: Yep, I hold MEK shares, both here and IRL.

I have been doing a little thinking and I think MEK may run be running a little closer to the sun than I am comfortable with. That and some scuttlebutt, leads me to believe that there is an elevated risk that MEK may have to raise. Quantum could be $10-20m which is easily doable in this market.

I have de-risked my position further and will look at any raise as a catalyst to re-buy. That said, I have been finding good opportunities amongst the gold developers cohort (AAR & MI6) and selective explorers (BNZ).

Thursday 1st May 2025: Murchison Development Update - April 2025

Excerpts from pages 3 and 5:

Getting close to production now, remembering that they're refurbing and upgrading the Andy Well processing plant, not building a new plant - this plant ran well for Doray Minerals back in the day, and it's going to be bigger and better under Meeka management, and while the share price has dropped to as low as 14.25 cents/share so far today, likely due to the fact that there is unlikely to be much in the way of further positive share price catalysts in May, until the plant commissioning begins in June (as shown in the timeline above), Meeka's SP remains within that rising channel, as shown below.

Disclosure: I hold Meeka Metals (MEK) shares both here and in my largest real money portfolio.

Meeka Metals (MEK) providing an update to the market today on the progress of their Murchison Project.

Larger Ball mill (750kW) has been installed which is the key point - all about that throughput once in operations and the ball mill is typically the bottleneck to most operations. All appears to be on track for this tidy little operation with production scheduled for Q1 FY26.

Yeah look, Meeka are not shy to provide an update (particularly a market sensitive announcement) to the market - they've been keeping everyone well and truly in the loop regarding how construction and development has been going.

Haven't really missed a beat (yet), construction and mining is notorious for throwing a curveball at you, so let's see how they go over the course of the next 1-2 quarters. This may get some more attention as it nears production, particularly with that of other struggling gold miners is in the news (cough, BGL, cough).

There has been lots of updates on this one from the other mining bros on SM which is all sensational work.

Held IRL and on SM.

Minimal company insight on this post. More so just to get my thoughts down on paper.

Recent SP increase on MEK has now pushed my IRL returns above 100% and SW position around 90%.

Initial thesis was to hold through to production and commencement of revenue to then reassess however the SP increase has been well ahead of expectation’s.

Actions for consideration now are:

- Do nothing. Continue with the thesis and accept there will likely be some ups and downs.

- Sell down profits for reinvestment and maintain a smaller allocation

- Sell it all and move on. Perhaps returning once they are in the swing of mining.

Current headspace for this weekends thinking is:

Point 1 is being mostly driven by the punting / too the moon headspace.

Point 2 is likely the option that provides the best outcome as both up and down sides are rescued.

Point 3 is sitting there based on really wondering how much higher can this price go. They could loose some of the gold SP frothiness and still be a well run company just at a lower price point.

TBH the more I write this the more now I’m even looking at Point 3 as the better long term pick.

Enjoy your weekend SM team while I continue to think on this.

31-Jan-2025: Murchison Development Update

Also: 29-Jan-2025: December 2024 Quarterly Activities Report plus December 2024 Quarterly Cashflow Report

It would be hard to argue that Meeka Metals' management aren't communicating regularly with their shareholders and prospective shareholders. Plenty of updates, and heaps of info plus photos in today's update. LOTS of photos!

I sold the last of my real money MEK shares recently at 10.5 cps to lock in the substantial profit I was sitting on with the position, however I am still following them closely. If they drop back down a fair way I may jump back onboard because I think their MGP is going to be a nice little earner for them, and I'm impressed by their management so far both in terms of execution and communication.

I still hold a virtual MEK position here in my Strawman portfolio, but not currently any in real life, having locked in my profits at $0.105.

Here's their latest timeline, taken from today's update:

So there's plenty of further newsflow expected during the next 5 months, however it remains to be seen just how much further MEK's SP can run pre-production considering they don't currently expect to be producing any gold before FY26 (as shown above).

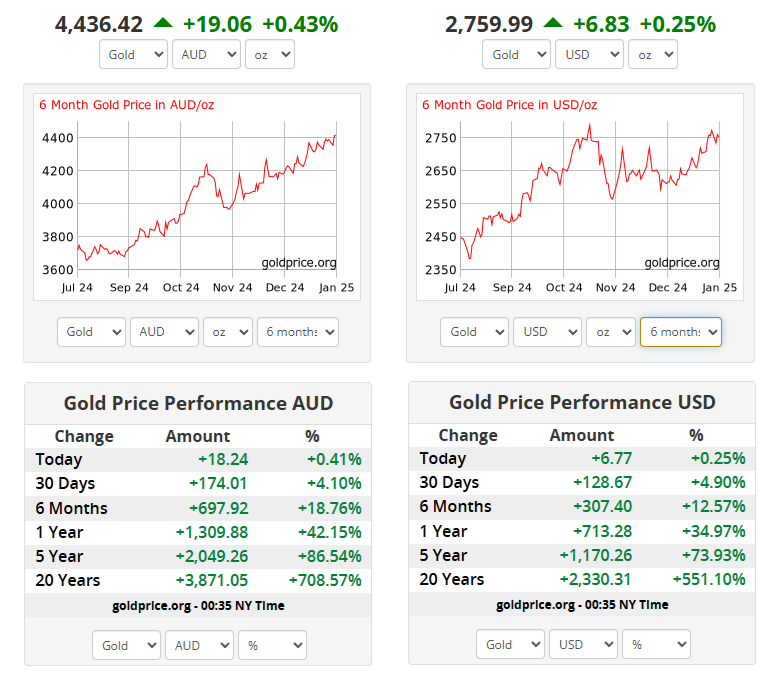

They have had a nice strong tailwind with the rising A$ gold price - below is a snapshot of the gold price that I took yesterday afternoon:

A$ gold prices on the left, US$ gold prices on the right.

Obviously, a project developer like MEK are likely to have a falling share price if the gold price falls significantly between now and when they start processing ore in FY26 and producing gold, so my preference is currently to retain exposure to Australia's best gold producers who are taking advantage of the A$4,400+/ounce gold price right now as I see elevated risk with explorers and developers compared to multi-mine or even single-mine producers.

Disc: Holding here on SM, not in real life, having sold out in the past 2 weeks at 10.5 cps.

31-Dec-2024: MEK released this: Murchison Development Update – December 2024 (.pdf file) before the market opened - and their share price closed flat (@ $0.077, i.e. 7.7 cps), however MEK are being bid up today (02-Jan-2025) on no news, so perhaps a delayed response?

The uptrend remains intact (/in place), in my opinion.

Here are the pics from page 2 of Tuesday's update:

There are more images on pages 3 and 4, plus plenty of other details on page 1, plus this timeline on page 5:

I hold MEK shares, and I've been happy with their share price rises recently, however looking at how much they have achieved in December, and that their next updates will probably occur in March and June, I'm expecting less newsflow in Jan & Feb, and that MEK's share price will likely now rise and fall much more in line with gold price movements, so I may lock in some profit here and let the rest ride.

18-Dec-2024: Drilling Results Strengthen Production Outlook.pdf

Page 1 of that announcement (below):

Source: https://api.investi.com.au/api/announcements/mek/a2c0d091-a67.pdf

I'm holding MEK shares both here and in my largest portfolio outside of my SMSF, and they're doing well!

I note that despite the volume at the top of the bids being high for the offers (sellers) and low for the bids (buyers), there are twice as many bids (85) as there are offers (42) and the combined volume of the bids (13.3 million shares) is almost twice the combined volume of the offers (7.2 million shares), as highlighted above in the green box.

It's a nice uptrend! And they're not even cum-capital-raise, as they've just raised capital and extinguished their debt, leaving them fully funded through to production, which should be in July or August 2025. The start up and commissioning should also be fairly straightforward as they are giving the old Andy Well gold mill a refurb and an upgrade and firing it back up, which is not nearly as risky / problematic as building a new mill from scratch.

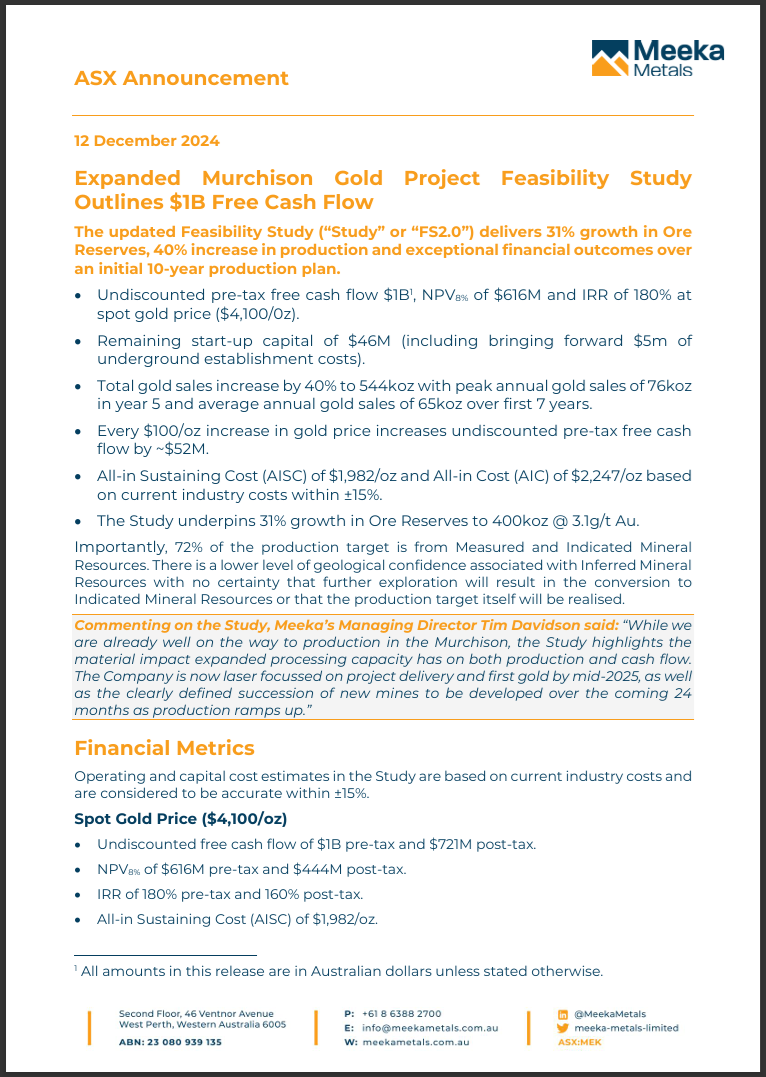

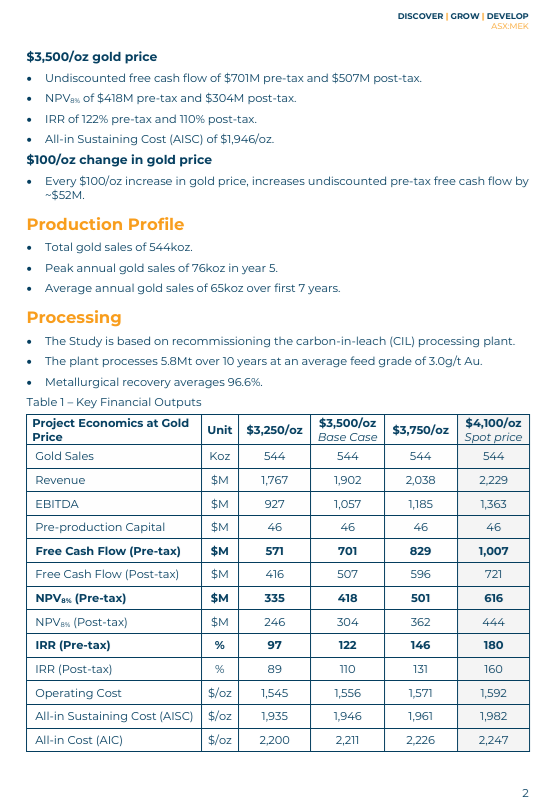

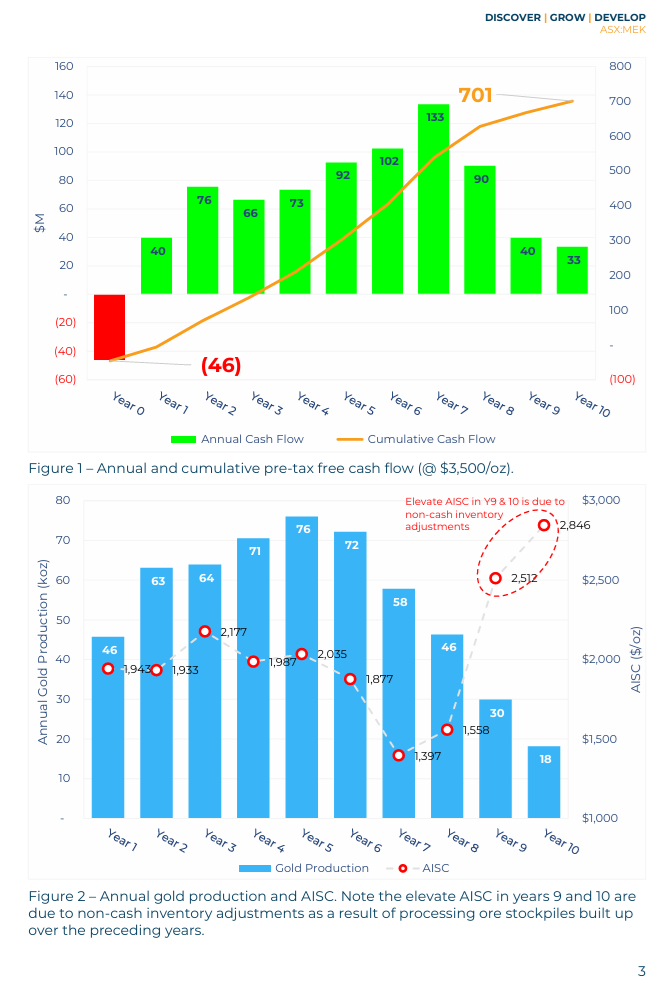

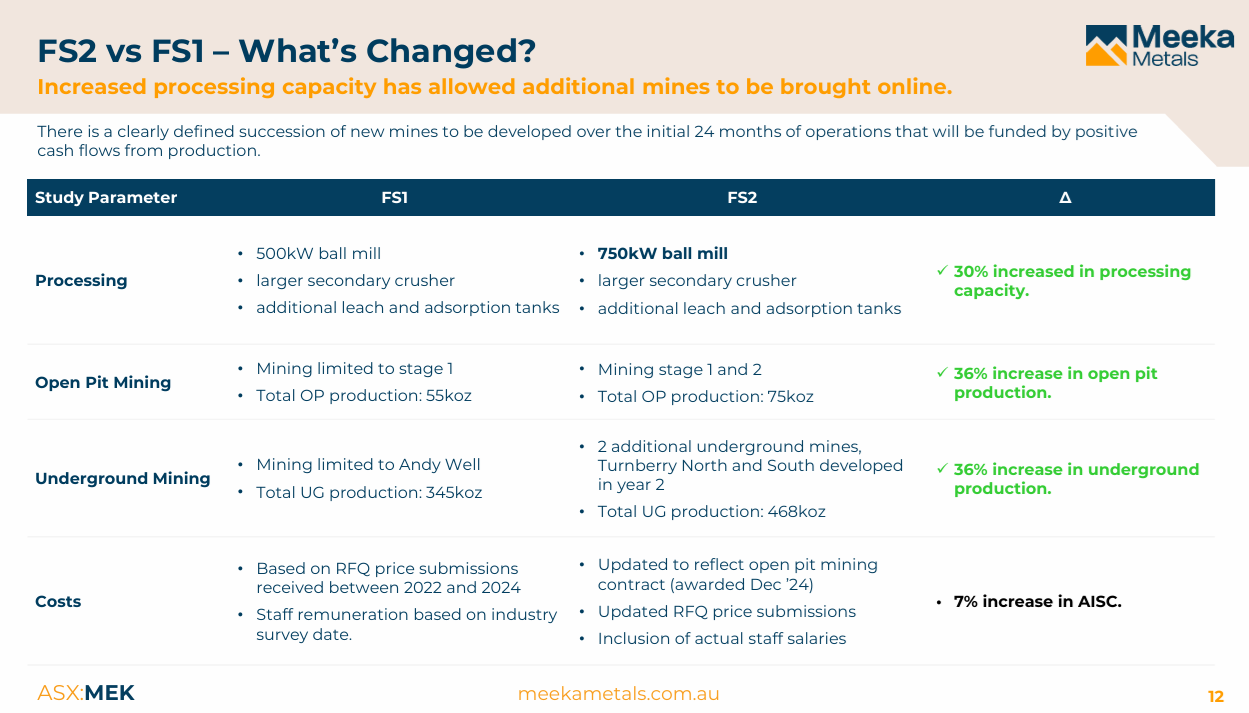

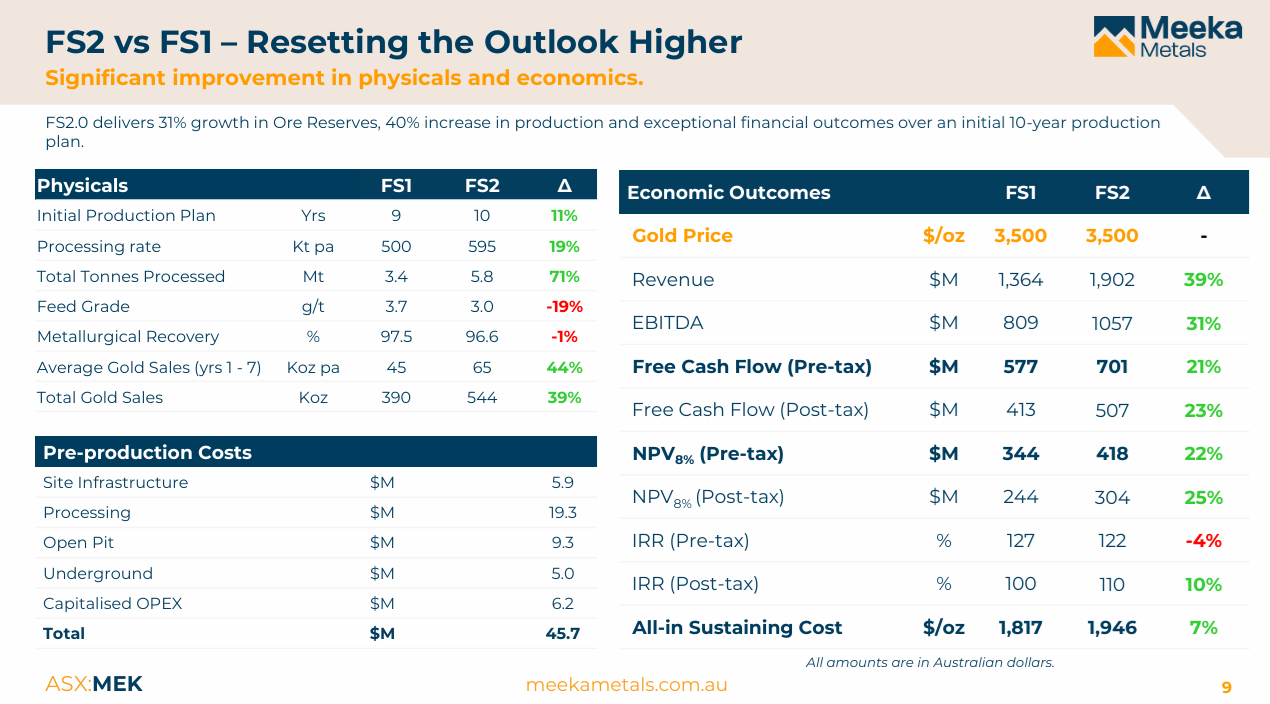

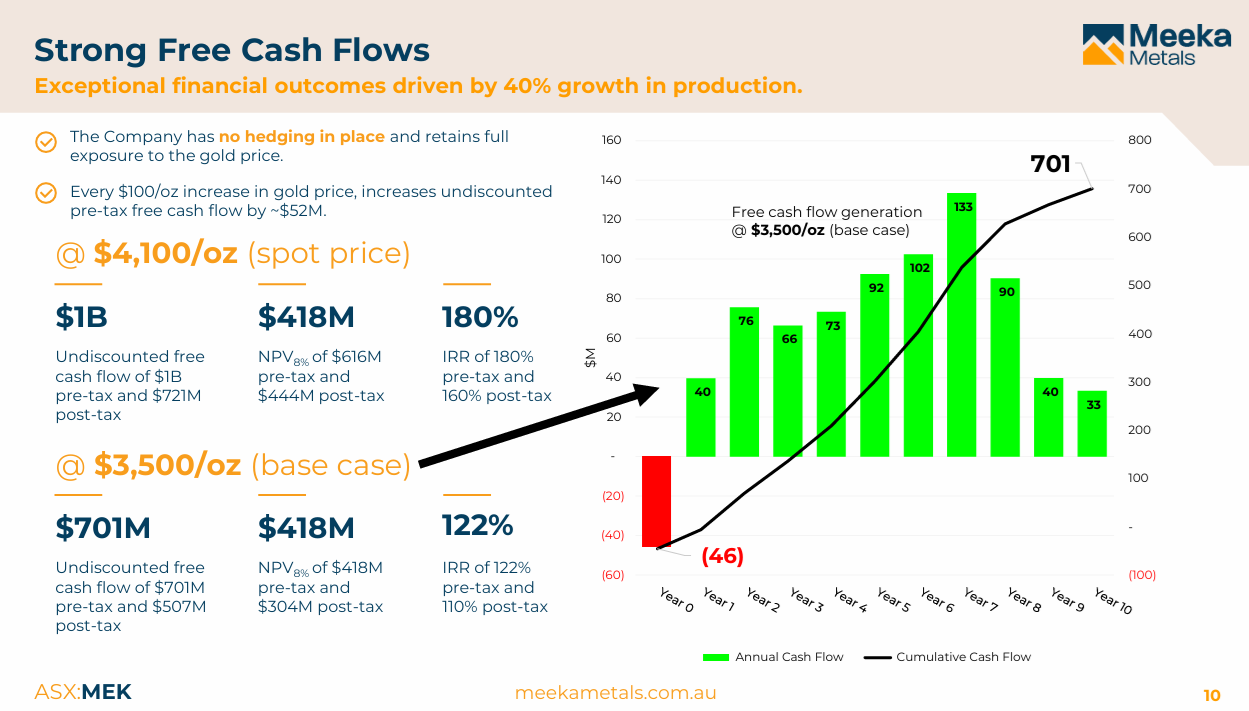

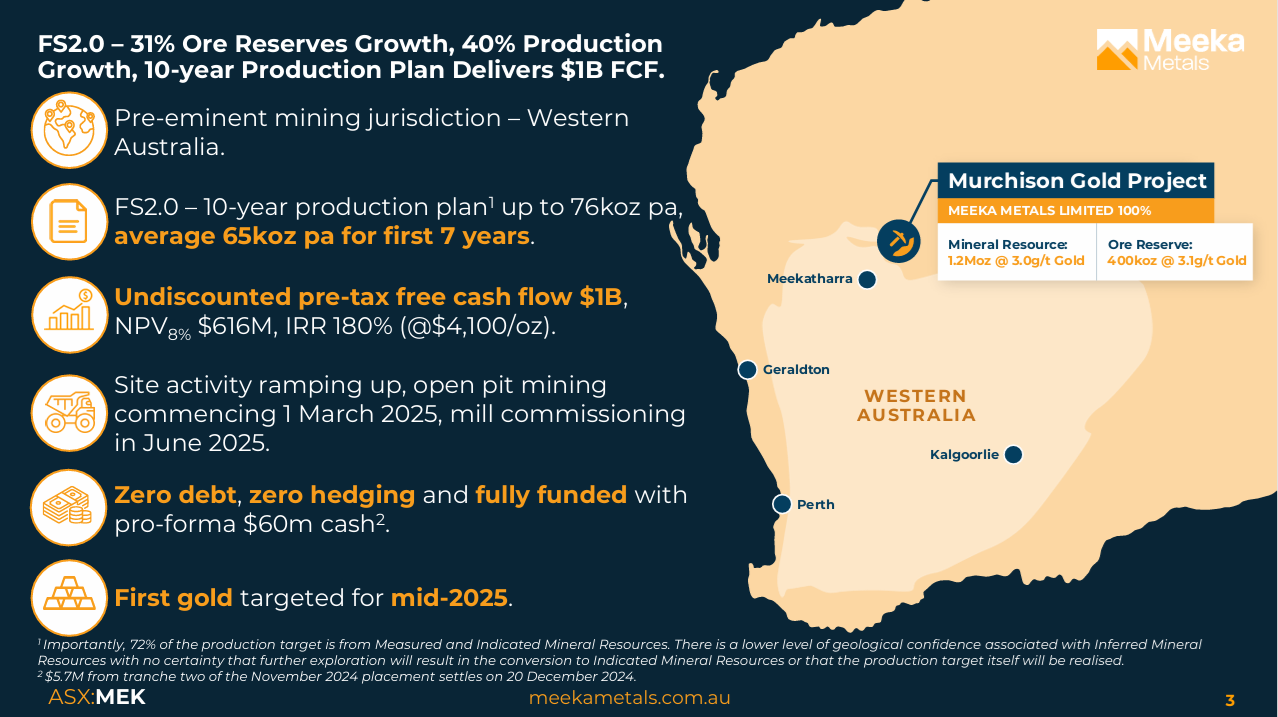

12/12/2024: 8:18 am AEDT: Expanded Murchison Gold Project Feasibility Study

And: 1:05 pm AEDT: Murchison Feasibility Study Update Presentation

Here's the first 4 pages of the announcement (first link above) followed by some of the more important slides from the Presentation (2nd link above) including what's changed and why I hold MEK shares.

From the Announcement (first 4 pages):

Source: Expanded Murchison Gold Project Feasibility Study [12-Dec-2024]

Below are some of the more interesting slides from their presentation today (Murchison Feasibility Study Update Presentation)

And here's why I hold Meeka Metals (MEK) Shares:

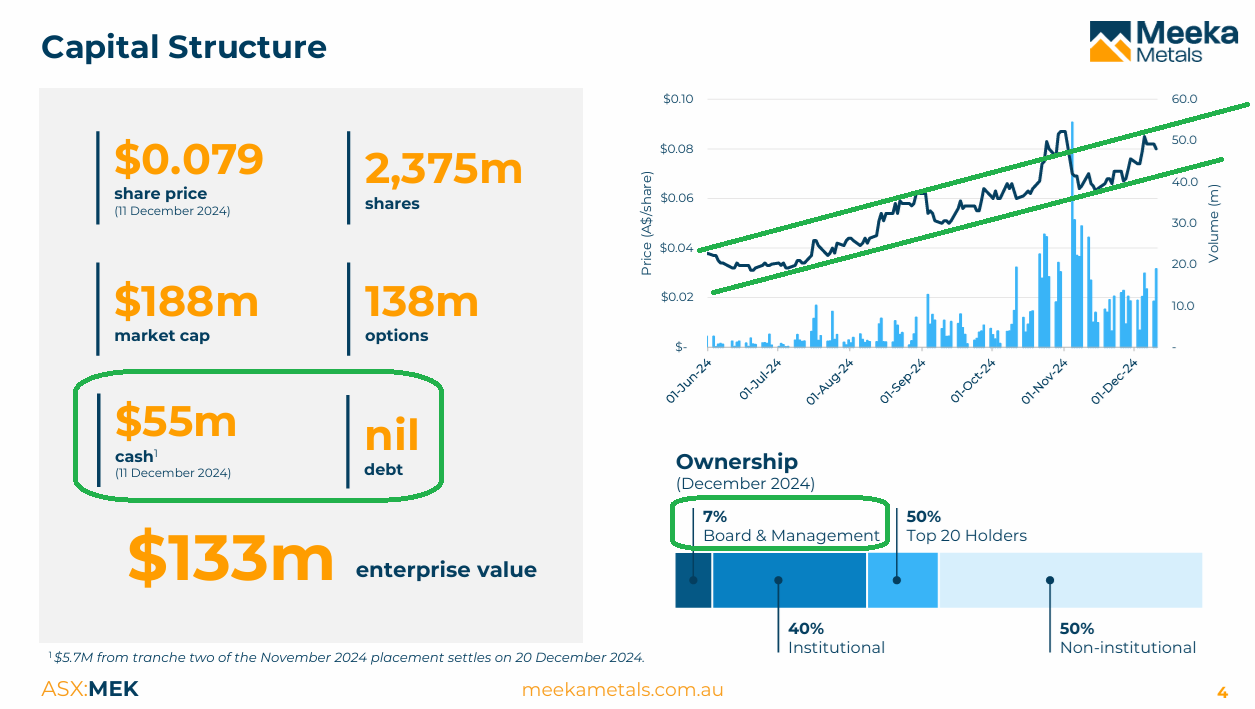

Fully Funded after their recent CR; Zero debt; 7% of the company held by their Board and Management. Rising share price. MEK closed up +3.8% today at 8.2 cps.

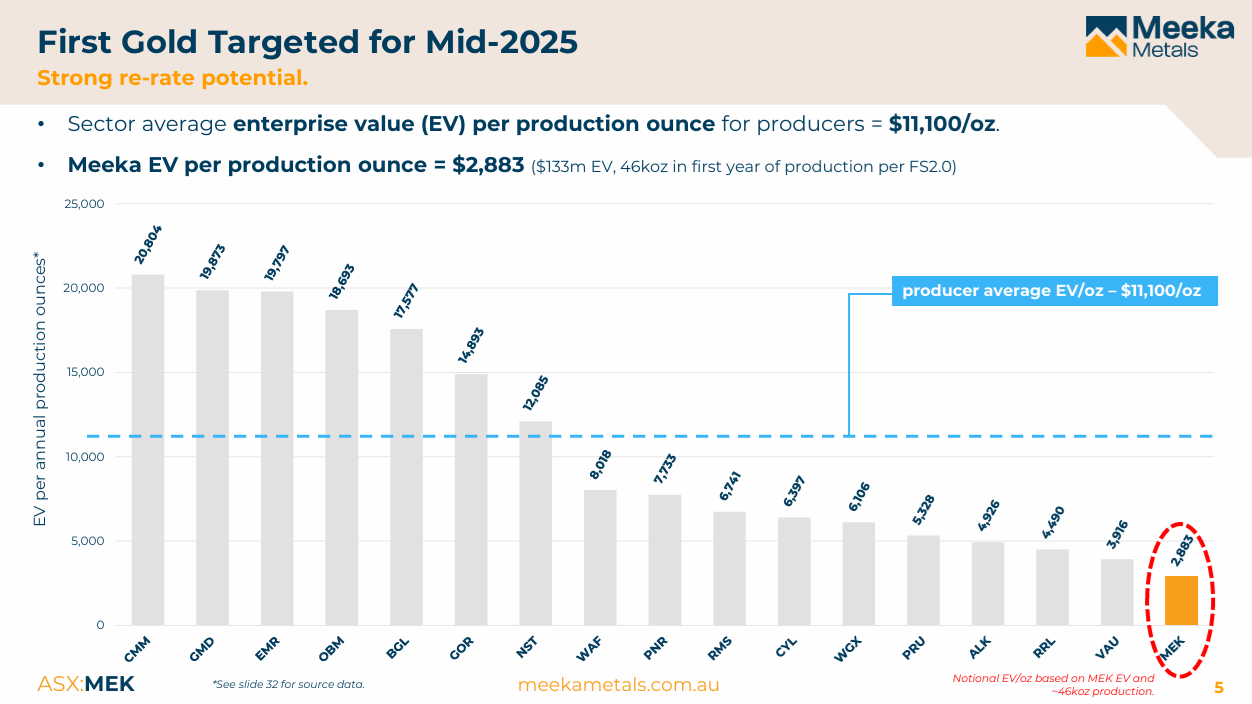

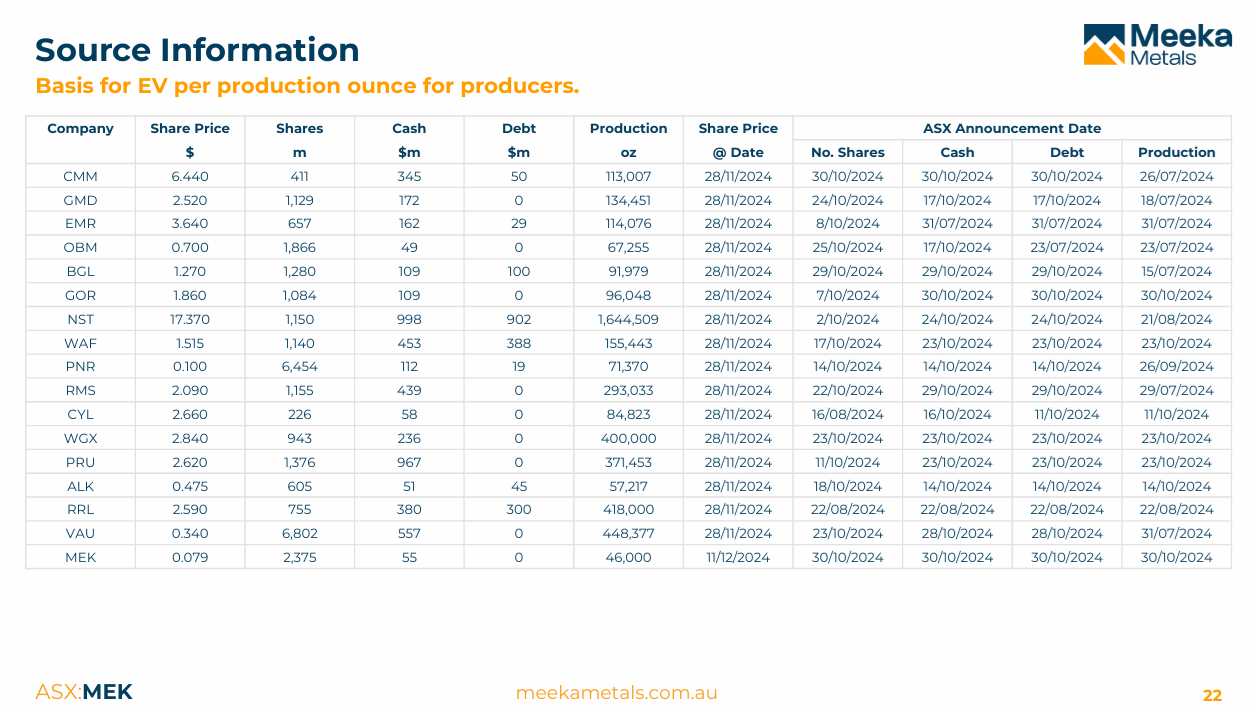

In terms of production ounces, they are still cheap (see below):

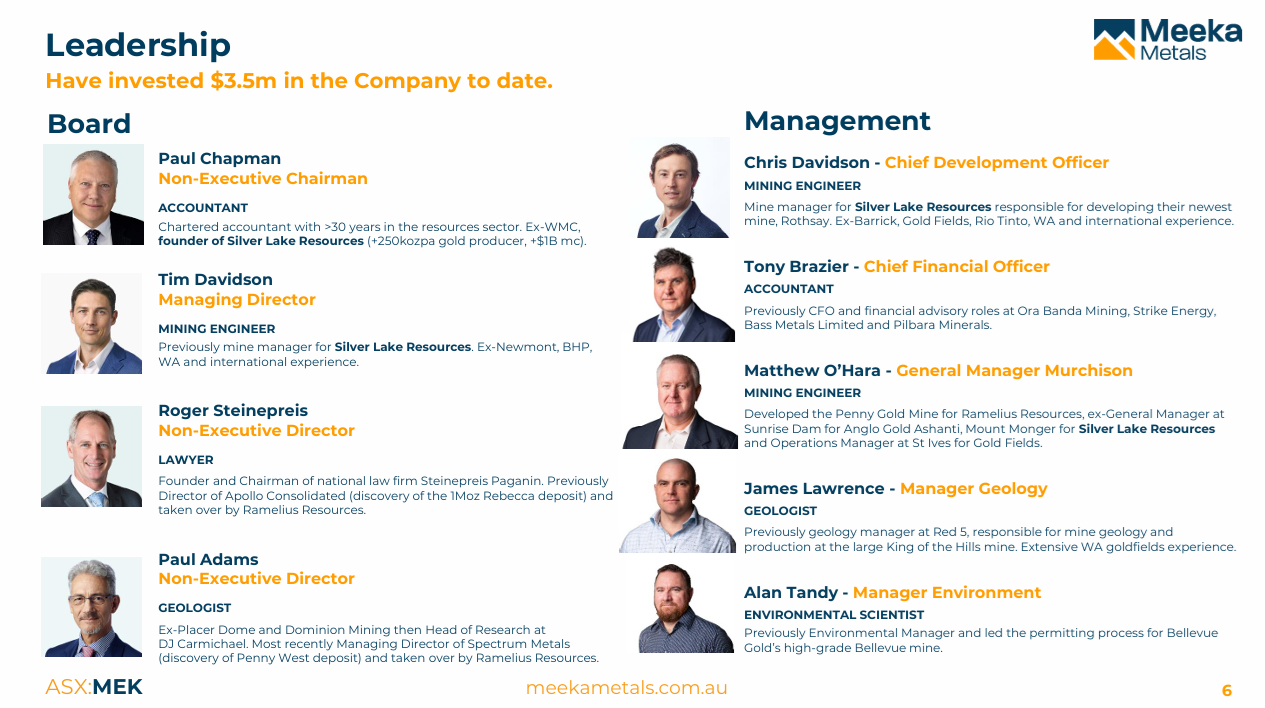

And they have experience. Four people below are from Silver Lake Resources - and Meeka's Chairman was at SLR before Luke Tonkin joined SLR in 2014 and took over the reigns. Paul Chapman, the Chair of Meeka was Ex-WMC (Western Mining Corporation, which was acquired by BHP), a founding shareholder of Silver Lake Resources and stayed for 11 years (from 2004, resigned in 2015, which was the year after Luke Tonkin moved to SLR), and has been involved in a number of other mining companies.

Tim Davidson and Chris Davidson were at SLR later, after Luke Tonkin took over, and something that's not written there above beside Chris' name is that he was the Senior Mining Engineer for Doray Minerals and was responsible for the Andy Well Mine through until SLR acquired Doray Minerals and then Chris continued on working for SLR after that. Andy Well is the gold mill that Meeka are firing back up with ore sourced from Turnberry and from Andy Well Underground:

Prior to being the Mining Engineer responsible for Andy Well (for Doray and then SLR), Chris Davidson worked for RIO and before that spent 5 and a half years at Granny Smith gold mine working for Gold Fields Ltd. He's now Meeka's Chief Development Officer (CDO). Nice.

Matthew O'Hara, Meeka's General Manager of their Murchison gold project, is the fourth ex-SLR guy there (was GM of Mount Monger for SLR for 4 years), but more importantly he's also developed Penny for RMS (3.5 years), was the GM at Sunrise Dam for Anglo Gold Ashanti, and was the Ops Manager at St Ives for Gold Fields Ltd. And he previously also worked for Barrick Gold.

I won't go through the rest of them individually, but their Environment Manager has worked for Bellevue Gold (BGL), their Geology Manager has worked at Red 5's KOTH (RED is now VAU - Vault Minerals - after the merger with SLR), and their CFO has worked for Ora Banda Mining (OBM) and Pilbara Minerals (PLS).

Main thing is that they ALL have relevant experience, including all 4 Board members having experience in gold mining.

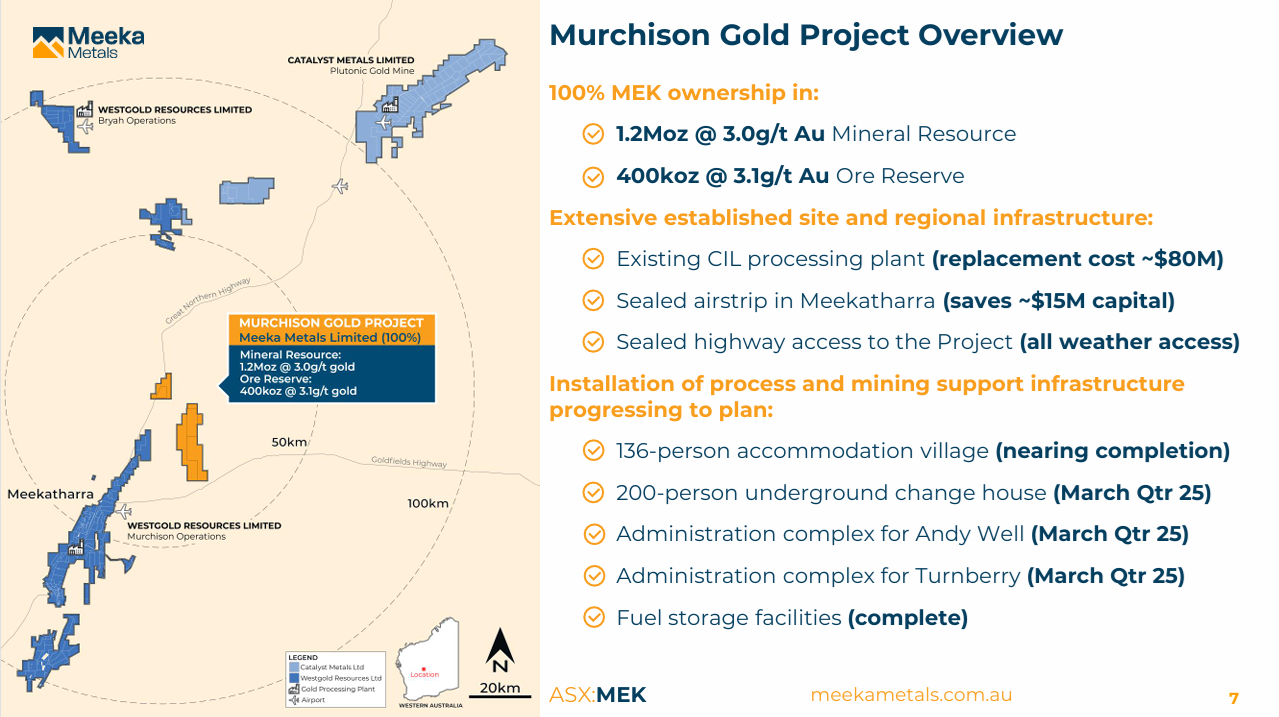

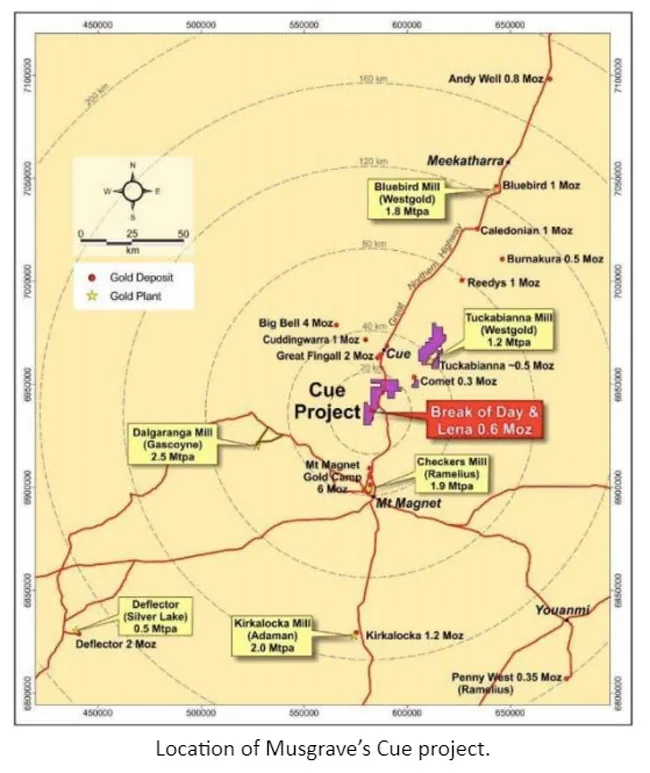

And I like where their project is. I used to hold Doray Minerals Shares when they were still mining Andy Well (when they first started mining it actually), so well before SLR acquired them, and I now own shares in Westgold (WGX) which is to the north west and the south west of Meeka's Murchison project (formerly known as Andy Well) on the map below. This week I also bought shares in Catalyst Metals (CYL), who are shown there to the north east of Meeka's Murchison Gold Project.

It's a good gold area.

And on the following map, which shows more to the south and west of that map above, you can see Ramelius isn't far away either. I also hold shares in Ramelius. The map (below) was from a Musgrave Minerals presentation a couple of years ago. Ramelius Resources (RMS) acquired Musgrave Minerals in September last year (2023) so RMS own the Cue project now, as well as Penny down in the bottom right corner below. You can see the Andy Well mill in the top right corner below - that's Meeka's Murchison project that this straw is all about.

Silver Lake is now part of Vault (VAU), Gascoyne has changed their name to Spartan (SPR).

Below is a more up-to-date map of Ramelius' assets - which extend beyond the map above.

Source: RMS: Penny Gold Mine Update [15-Sep-2023]

Anyway, back to Meeka Metals (MEK):

Source: Murchison Feasibility Study Update Presentation [12-Dec-2024]

Onward and upward.

Disclosure: I hold shares in MEK, RMS, WGX & CYL, which I've discussed in this straw, and of the other gold companies listed in the comparison tables on slides 5 and 22 above, I also hold shares in NST, GMD, EMR & VAU at this point in time in one of or both of my real money portfolios. I have a tiny PNR trading position here, but no Pantoro shares in real money portfolios. In my SM portfolio I also hold MEK, NST, GMD, RMS as well as smaller positions in EMR and CMM, all of which I hold in real money portfolios also except for CMM (I do not hold Capricorn Metals currently in a real money portfolio, but have previously held them and probably will do again one day).

Meeka look good here. Substantially de-risked, no debt, fully funded, progressing well, could easily be a takeover target, but should so very well all by themselves without any M&A interest.

OK, Firstly, check out this from the team at Money of Mine (podcast):

Source: https://www.moneyofmine.com/p/look-every-advanced-gold-project-australia [last week]

You can subscribe to their daily "Director's Special" newsletter for free here: https://www.moneyofmine.com/

You may notice that there are only TWO projects on the whole list that have progressed to DFS (definitive feasibility study) level: De Grey's (DEG's) Hemi and Meeka Metals' (MEK's) Murchison gold project. And DEG's market cap is getting up towards $3 billion, (currently circa $2.75 billion) which means there's a LOT baked into their valuation considering they are still just project DEVELOPERS, NOT producers.

Meeka Metals' (MEK's) m/cap is just over $50 million. And they have a good lot of infrastructure already in place, which is why their Initial Capex requirements in the table above are just $44m vs Hemi's capex of $2.9 billion - which could easily blow out from here and become substantially higher than that. I think there's too much risk associated with DEG's high valuation, which suggests that they have an enormous amount of gold at Hemi. They do have a lot, but I'm not buying into that valuation at this early stage.

Almost every Aussie gold company presented at Diggers and Dealers in Kalgoorlie this week, but I couldn't find a presso from Meeka amongst them - see here: https://www.youtube.com/@diggersndealers2023/videos

That link has "2023" in it, but it does contain all of the 2024 D&D pressos that they've uploaded this week as well.

No, Meeka are just getting on with it - see here: https://meekametals.com.au/investor-dashboard/

Links to their most recent announcements are on that page (just scroll down a little).

Meeka's most recent presso that I can find is from late May and it was their DFS Pathway to Production presso: https://www.investi.com.au/api/announcements/mek/5a738e78-bca.pdf

More Presentations here: https://meekametals.com.au/presentations/

Their biggest advantage is the project's location and existing infrastructure:

Source: https://stockhead.com.au/resources/meeka-metals-confirms-shallow-oxide-gold-at-st-annes-part-of-its-bigger-murchison-gold-project/ [17-Jan-2024]

https://meekametals.com.au/murchison-gold-project/

The Murchison Gold Project (MEK 100%) covers the northern extent of the highly prospective Mount Magnet and Youanmi Shear Zones in the prolific Murchison Gold Fields of Western Australia.

The project is located adjacent to several multi-million ounce gold mines and includes 281km² of granted Mining Leases and Exploration Licences. The project hosts a high grade 1.2Moz Mineral Resource with all Mineral Resources located on granted Mining Leases, hence there are minimal impediments to production.

Drill Core image source: https://www.proactiveinvestors.com.au/companies/news/1008753/meeka-metals-confirms-high-grade-gold-up-to-8-20-g-t-at-st-anne-s-within-murchison-project-1008753.html [13-March-2023]

Meeka have been on this for a while, and they're closer than ever to becoming producers now. Be warned that they are likely to need to raise more capital this year, and they currently have no income, as they are not yet producers; they are still gold project developers, but as Aussie gold projects go, this is the most advanced project I can find at this point that is not already producing, so that's why I've taken a small position in this one.

High risk, high reward, so small position size, as is appropriate due to the elvated risk associated with any company that is pre-revenue, and these companies are always more of a gamble than an investment, as all pre-revenue companies are to be honest, so they won't suit many people at all.

But if you're going to bring a new Australian gold project online with minimal capex requirements, there's probably never been a better time to do it.

Source: https://goldprice.org/

Belated update on y'day's release. Essentially production rate will be increased with 38koz in stockpiles processed upfront so net+ to NPV and an additional 113koz at ~A$1500/oz margin to be included over yrs2-7 from reserves not previously included. So a step change in the economics expected to come once mineplan reoptimisation is completed next qtr.

Another one that piqued my interest

Looks reasonable at $50m but small project about 1m Oz resource and maybe around 400Koz reserve I think it will require lots of work before this lands on investor radars.

RIU roundup (https://www.investi.com.au/api/announcements/mek/fa9cb36d-5e8.pdf)