Opthea $OPT presents at the EURetina Symposium 2024.

https://opthealimited.gcs-web.com/static-files/371402e4-3124-44bb-a2d0-f7a4c33e1aae

Presenter: Dr Arshad Khanani, Dr Adnan Tufail, Dr Gemmy Chueng- financial conflicts of interest ($OPT options or paid consultancies). Dr Anat Lowenstein directs

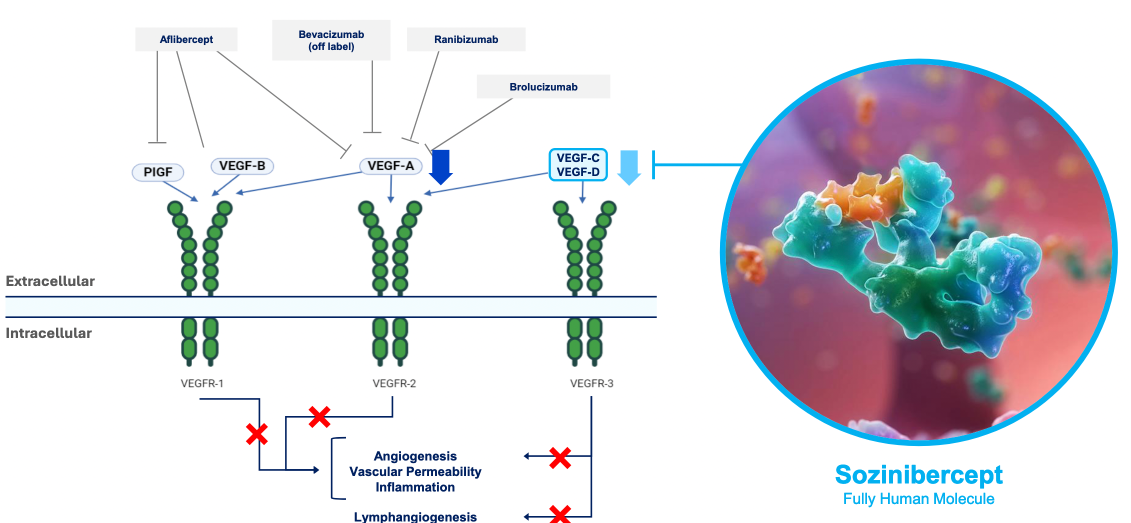

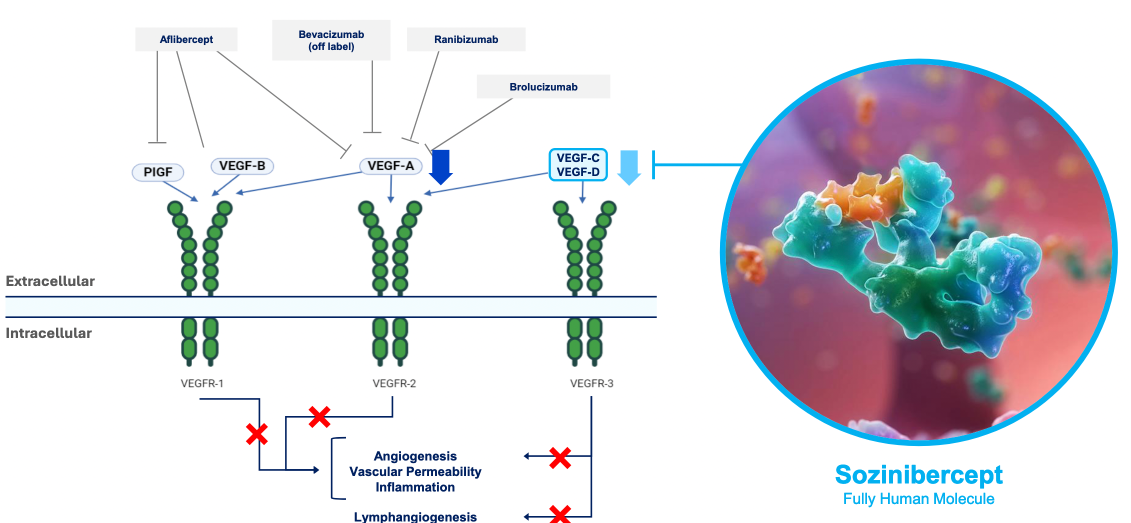

- Outlines the scientific basis for OPT therapy targetting VEGF-C and VEGF-D pathways

- Established that current therapies (targeting mainly VEGF-A) result in suboptimal visual outcomes after 5 years, despite this therapy being best currently available

- 25% further vision decline

- 45% do not have vision improvement

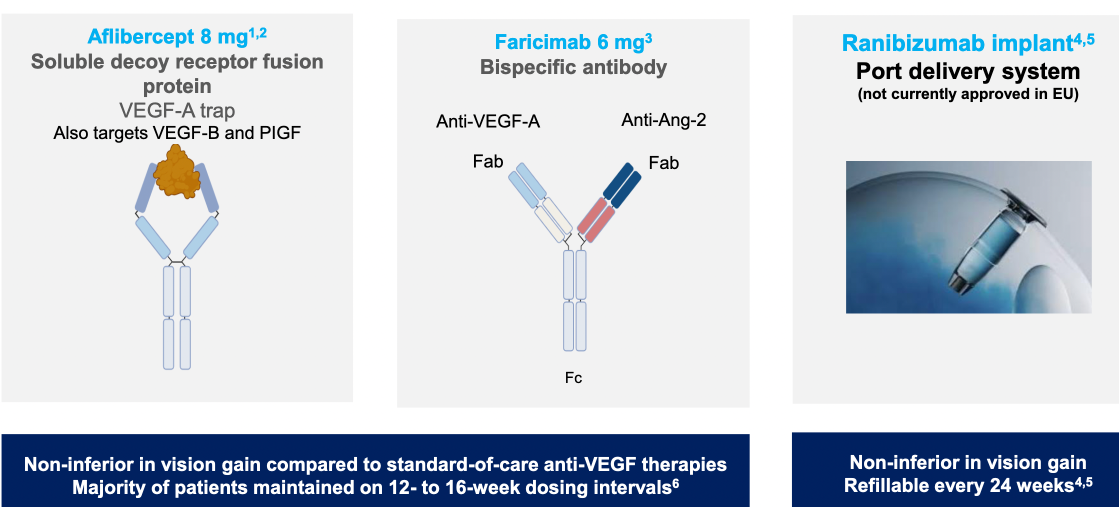

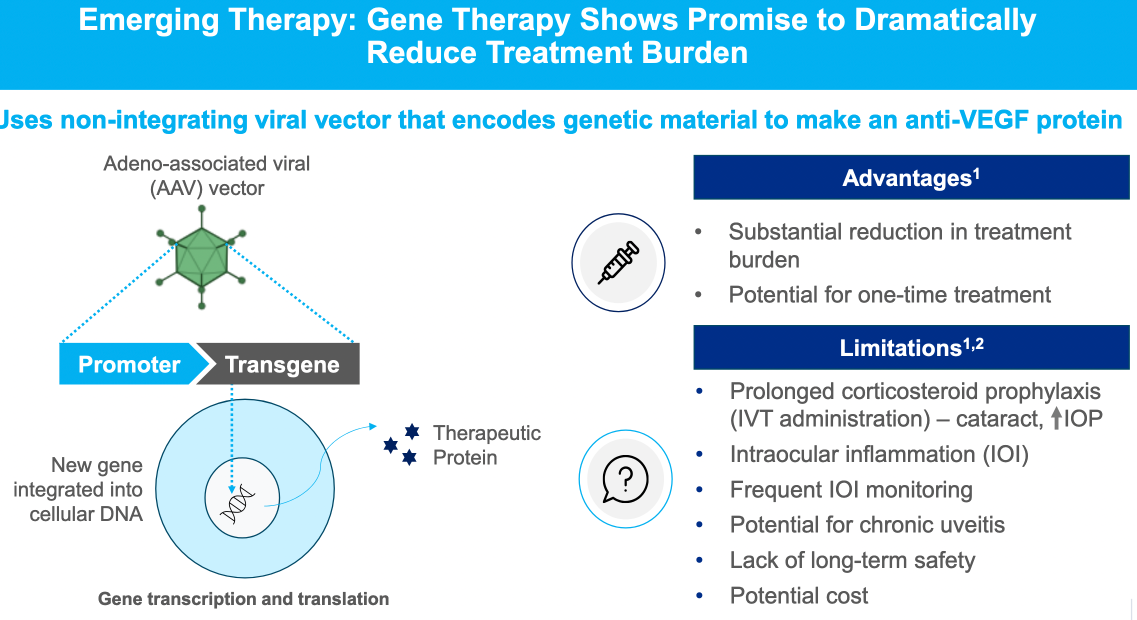

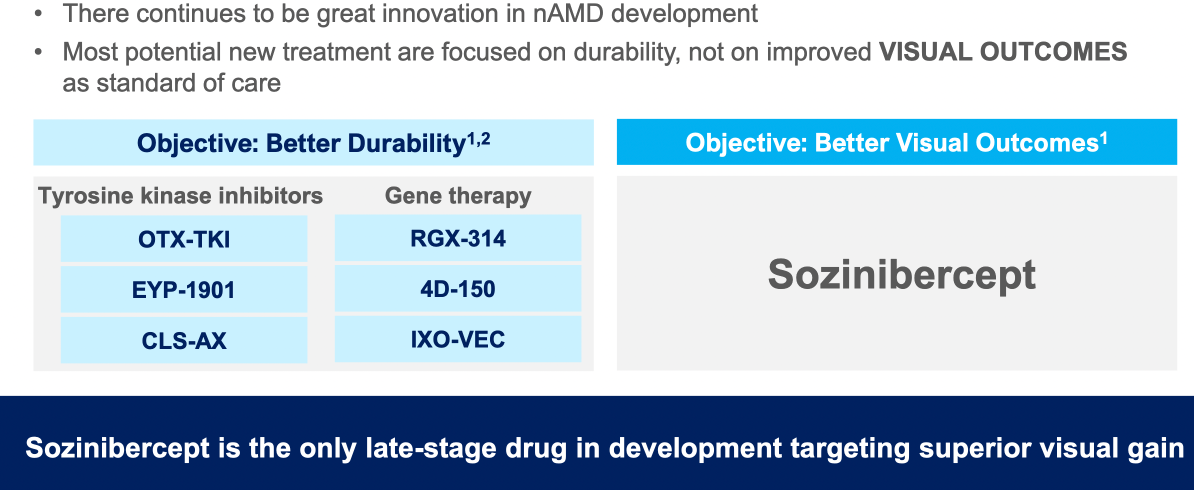

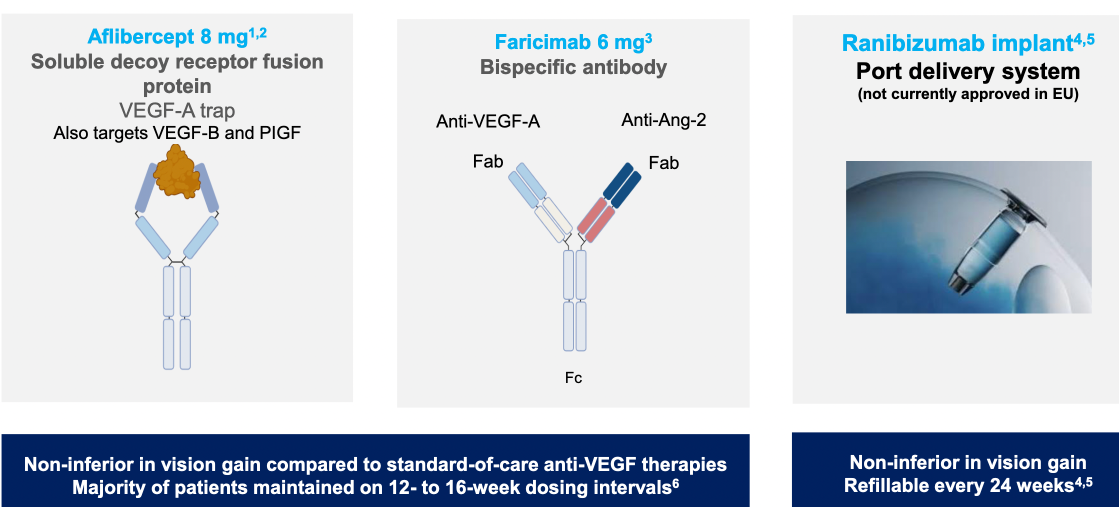

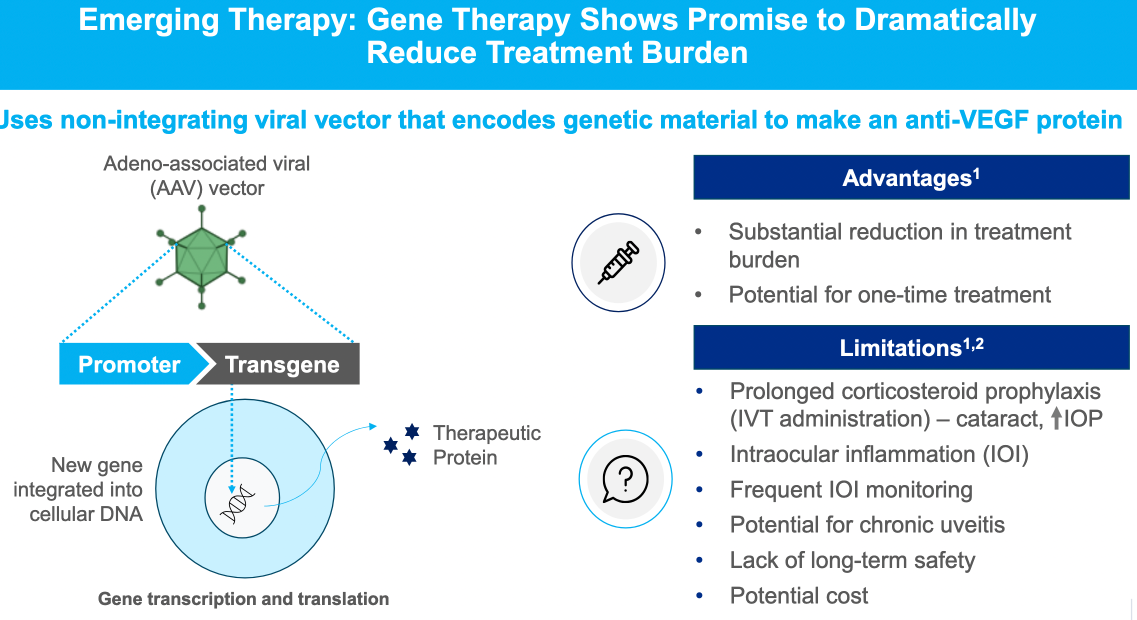

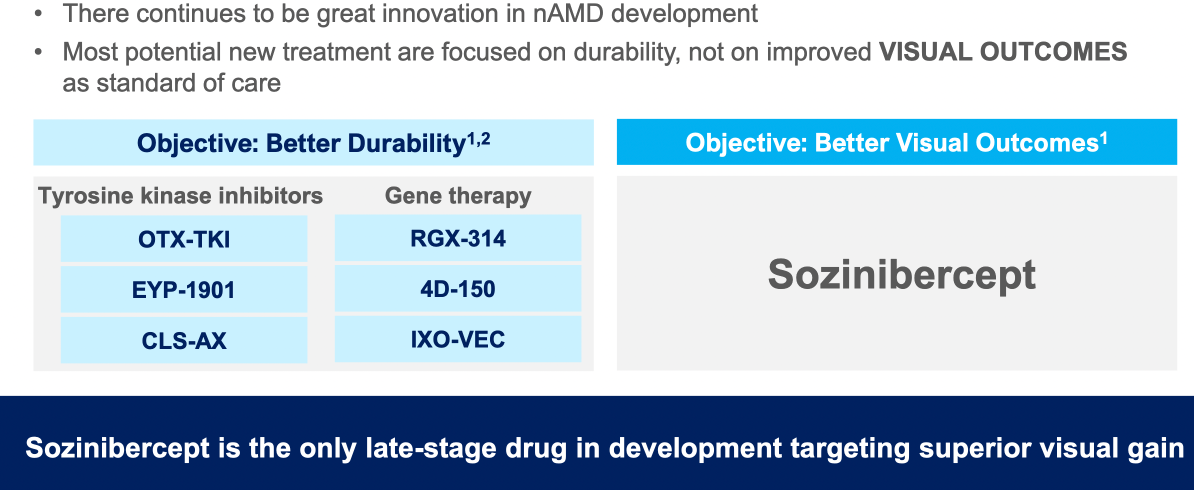

Alternative therapies to standard anti-VEGF A treatments were outlined (including monoclonal antibody therapy, gene therapy using a virus vector to inroduce coding against VEGF-A, tyrosine kinase inhibitors)

$OPT SOZINIBERCEPT is the only current late-stage R&D drug in AMD to address the visual outcomes of AMD patients:

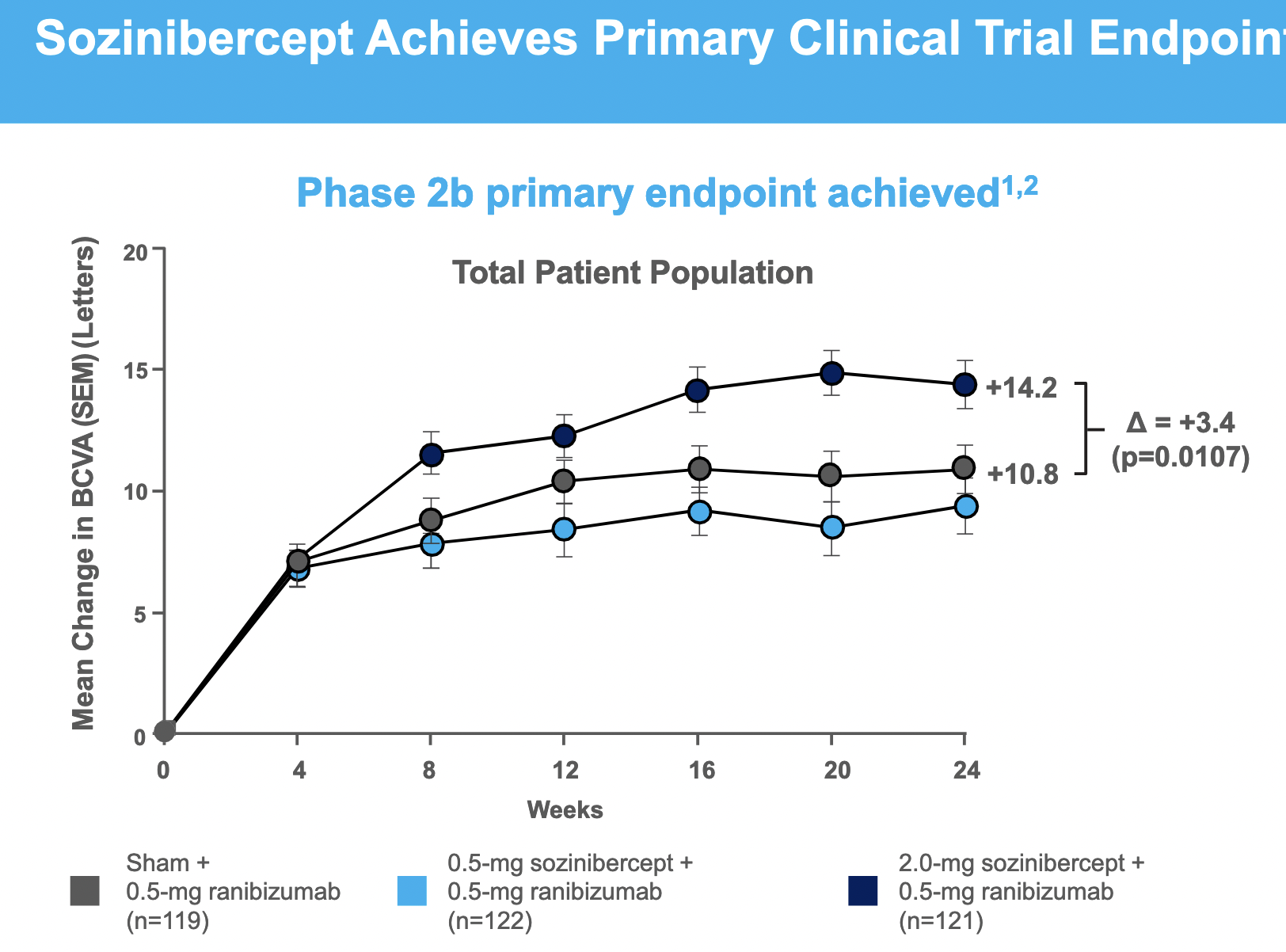

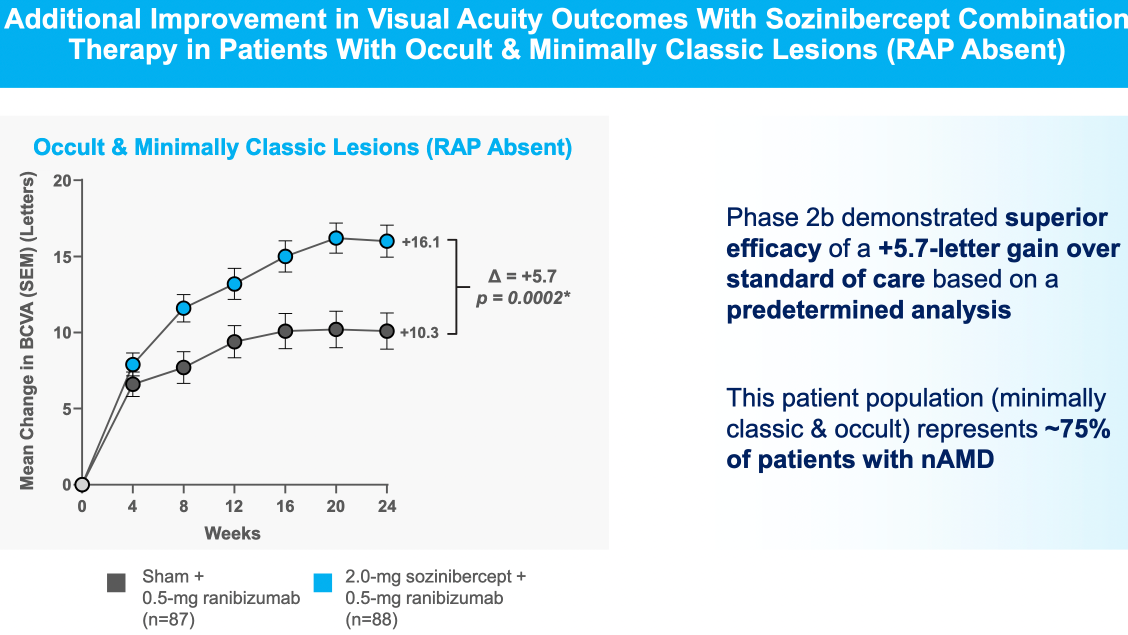

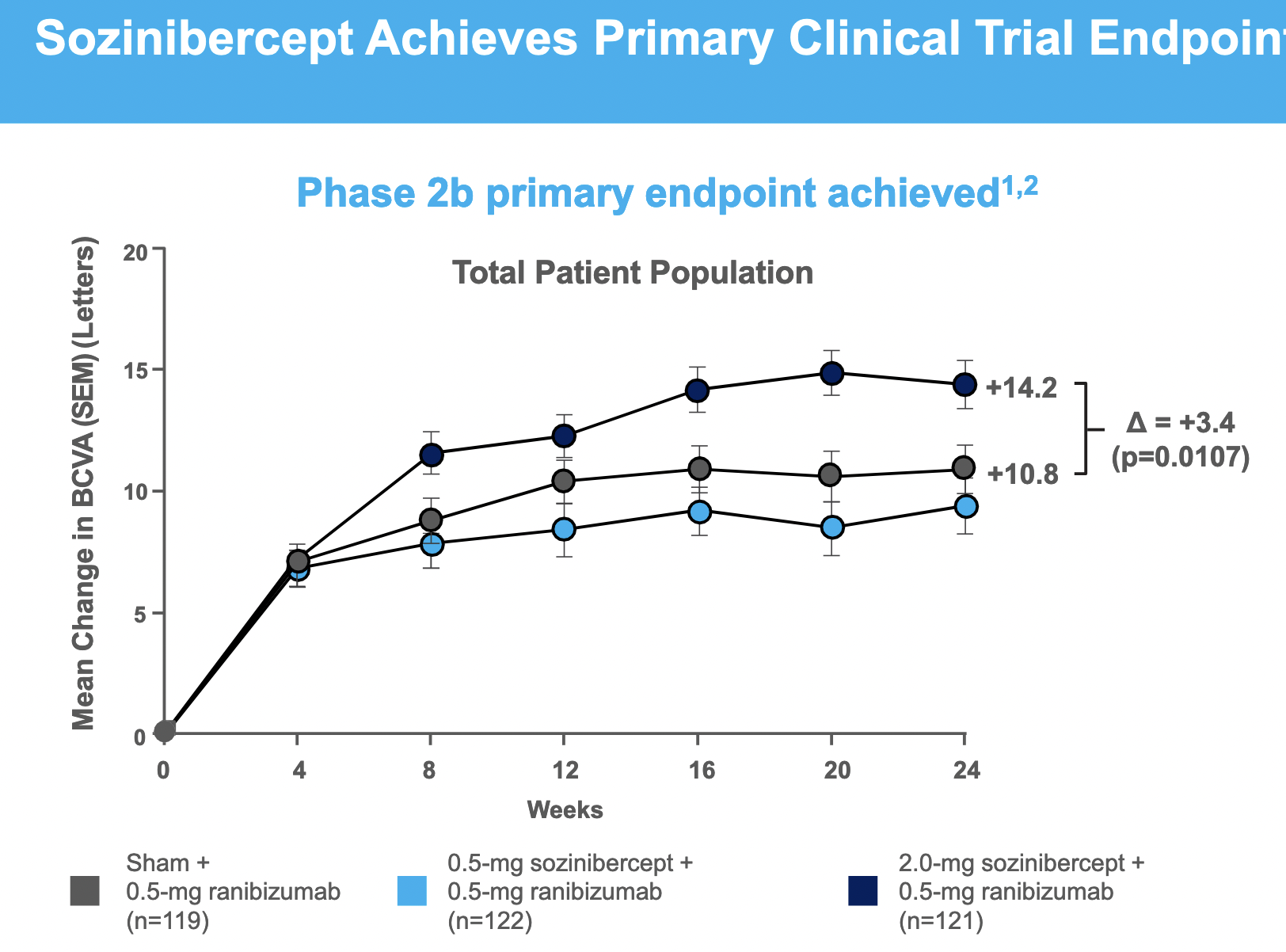

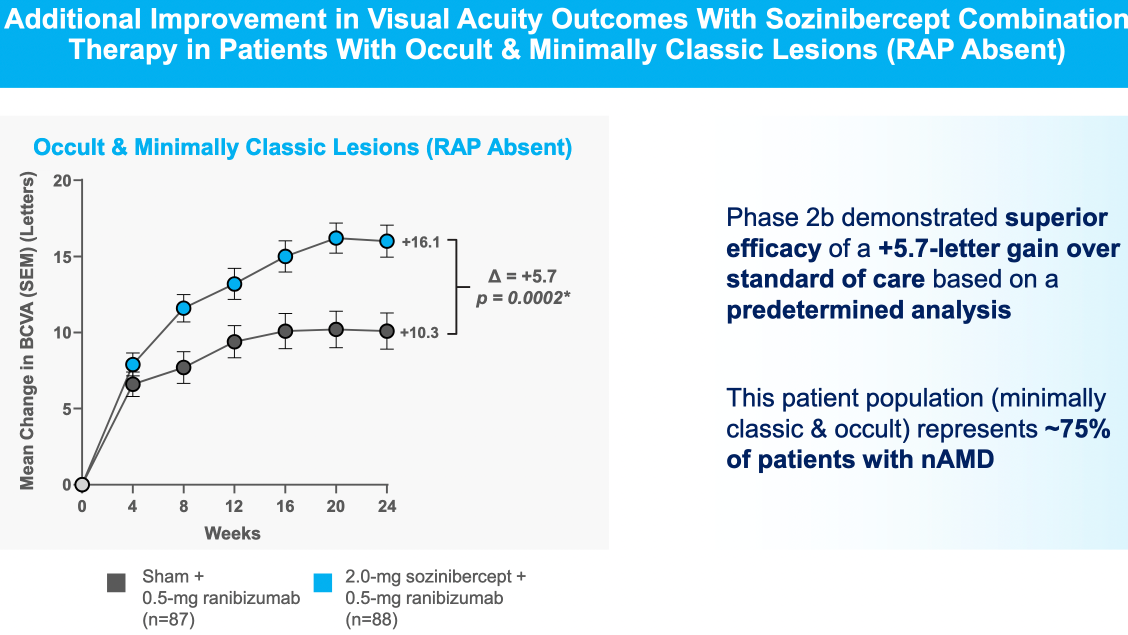

Sozinibercept achieves clinical superiority in Phase 2B trial in result which is statistically significant but borderline clinically meaningful in most patients, but is more convincing in the most common sub-type ("occult or minimally classic lesions")