Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Yesterday at 10:41am Opthea (OPT) released it much anticipated results its Phase 3 trial of the drug Sozinibercept for the treatment of wet Age-related Macular Degeneration. The Phase 2 results had been very strong, so there was in the market high expectation the Phase 3 results would be positive.

Instead it was a shocker, with not even the positive secondary end points to give shareholders a glimmer of hope. It is so bad the $730m market cap company (at 60 cents the last close last week) reported: “There was no numerical difference observed in the key secondary endpoints. Sozinibercept combination therapy was well tolerated.”

I don’t know about the second sentence, because after reading Scoonie had to be helped back on his chair after suffering a brain spasm.

Whilst OPT currently has around US$110m of cash, the cost of the trials have been so high and raising cash over the years so onerous, OPT have ended up with an obligation to their financiers of around $1b. So it looks like curtains for OPT.

This has all been reported today in the AFR:

This will be a wake-up call for any self-assured investors in biotechs with drugs in clinical trial. Particularly harmful in the current risk off environment.

The largest OPT shareholder was Regal, headed by Phil King with a holding of around 30%, who now looks to be sitting on losses of around $220m. If you are around Regal HQ in Macquarie Place in Sydney today and you see an overweight, balding elderly man with a rat-fucked look in his eye, that will be Phil. Or Scoonie.

Trading halt

Earlier than expected

I hope that is a good thing?

Probably find out tomorrow

Nervous wait

New (premium) member

This stock seems "underloved" on Strawman, with only a few posts and only 5 people holding (including me)

I bought in a couple of months ago at around 75 cents

I am not going to post the full investment case. @Aaronfzr has already laid it all out - some good information there.

In short this company basically has one (very) promising drug potentially treating macular degeneration. There was a phase 2 trial around 5 years ago involving over 200 patients, which showed strong statistically-significant improvements when added to current standard-of-case treatment. Phase 3 trials (which will be definitive one way or the other) are due to report soon.

The reason that I am excited about this company is that I believe that there is a fairly high chance of success in the phase 3 trials. The current market cap is $1.25 billion AUD. Even if the trials only show a marginal benefit, or perhaps a benefit in certain subgroups, the company is almost certainly worth multiples of the current price. If there is a large benefit for a majority of patients with macular degeneration, it is possible to end up somewhere near the valuation that @Aaronfzr came up with.

Unfortunately the obvious big risk is that the trials do not show a benefit, in which case the company would be worth very little.

I'm not sure that articulating a precise valuation is useful. However the current price seems to imply a high chance of failure. Even moderately successful results would result in large gains and the best case would end up in the ballpark of $35.

I am not an ophthalmologist, but I do work in medicine and am used to interpreting clinical trial results. For what it is worth, I would personally rate the likelihood of some form of phase 3 success at 50-75%

On that basis, I believe that OPT is clearly undervalued

$OPT has shared details of a recent peer-reviewed publication - a phase 1B trial of 9 patients in diabetic macular oedema. These positive results add the potential for expanded indications for sozinibercept, which so far has only been tested in age-related macula oedema.

An expected and logical development, but welcome nonetheless. OPT is holding investor days in New York and Sydney which may provide a minor catalyst for interest, in advance of important trial readouts in early/mid-25.

Vanguard Group - Becoming a Substantial Shareholder

Having acquired 62,130,152 shares, Vanguard holds 5.047% of voting power.

Vanguard have been accumulating since 31/05, with a pause through July and August, before resuming accumulations in September.

Opthea $OPT presents at the EURetina Symposium 2024.

https://opthealimited.gcs-web.com/static-files/371402e4-3124-44bb-a2d0-f7a4c33e1aae

Presenter: Dr Arshad Khanani, Dr Adnan Tufail, Dr Gemmy Chueng- financial conflicts of interest ($OPT options or paid consultancies). Dr Anat Lowenstein directs

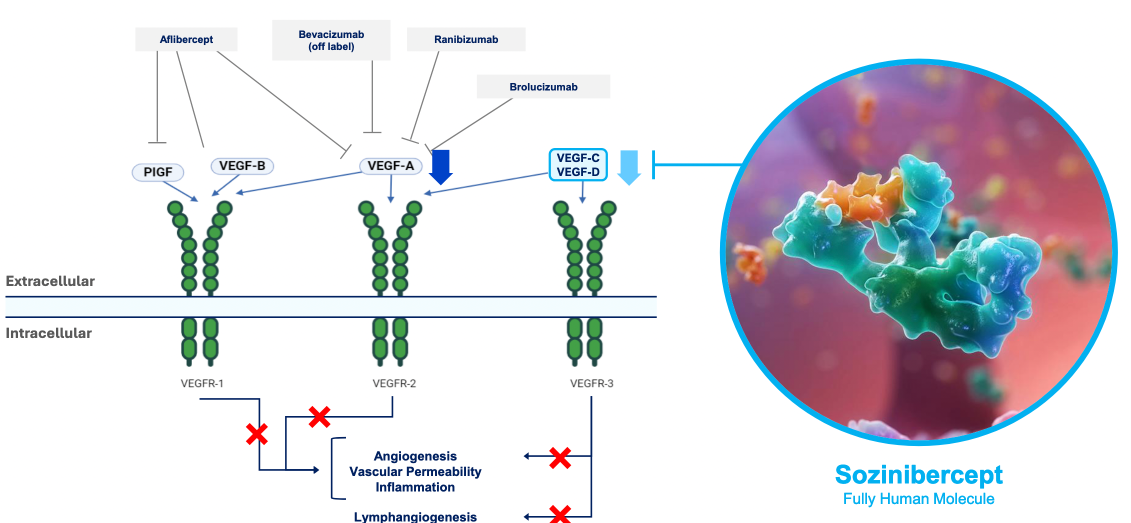

- Outlines the scientific basis for OPT therapy targetting VEGF-C and VEGF-D pathways

- Established that current therapies (targeting mainly VEGF-A) result in suboptimal visual outcomes after 5 years, despite this therapy being best currently available

- 25% further vision decline

- 45% do not have vision improvement

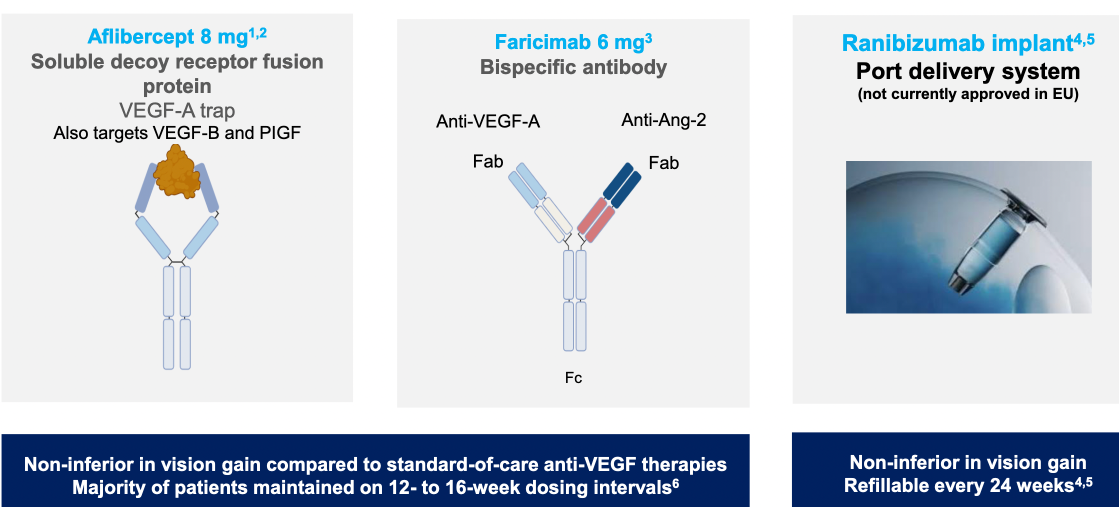

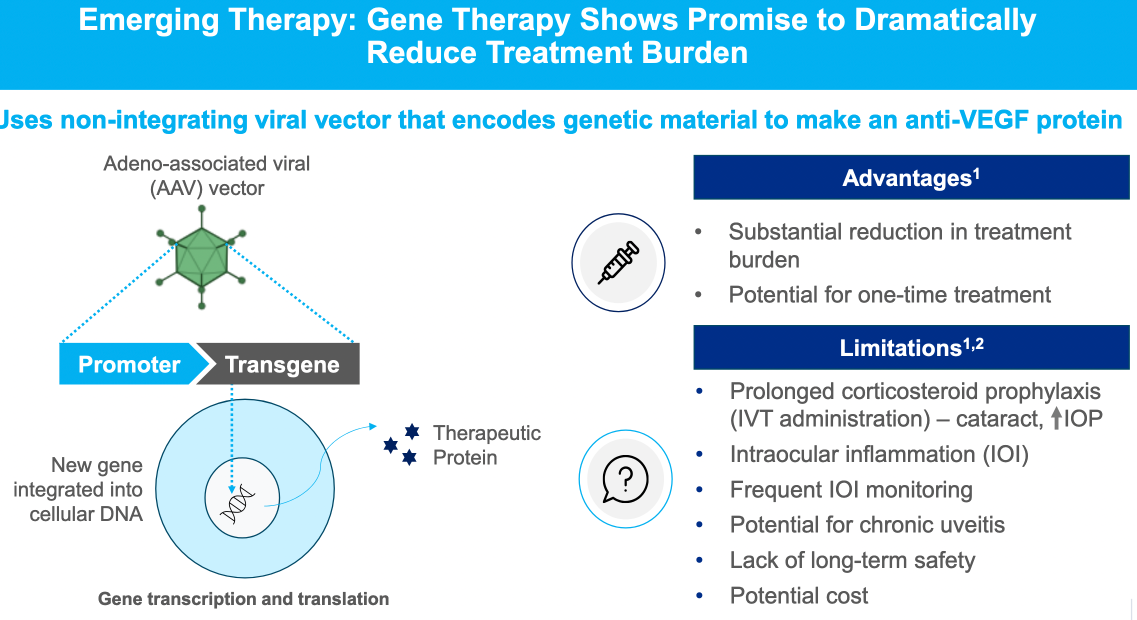

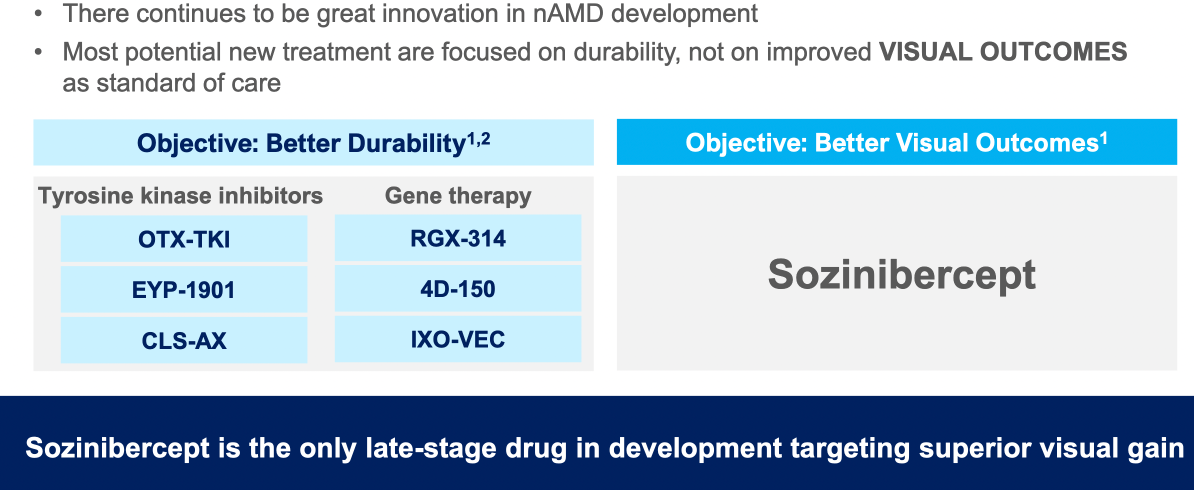

Alternative therapies to standard anti-VEGF A treatments were outlined (including monoclonal antibody therapy, gene therapy using a virus vector to inroduce coding against VEGF-A, tyrosine kinase inhibitors)

$OPT SOZINIBERCEPT is the only current late-stage R&D drug in AMD to address the visual outcomes of AMD patients:

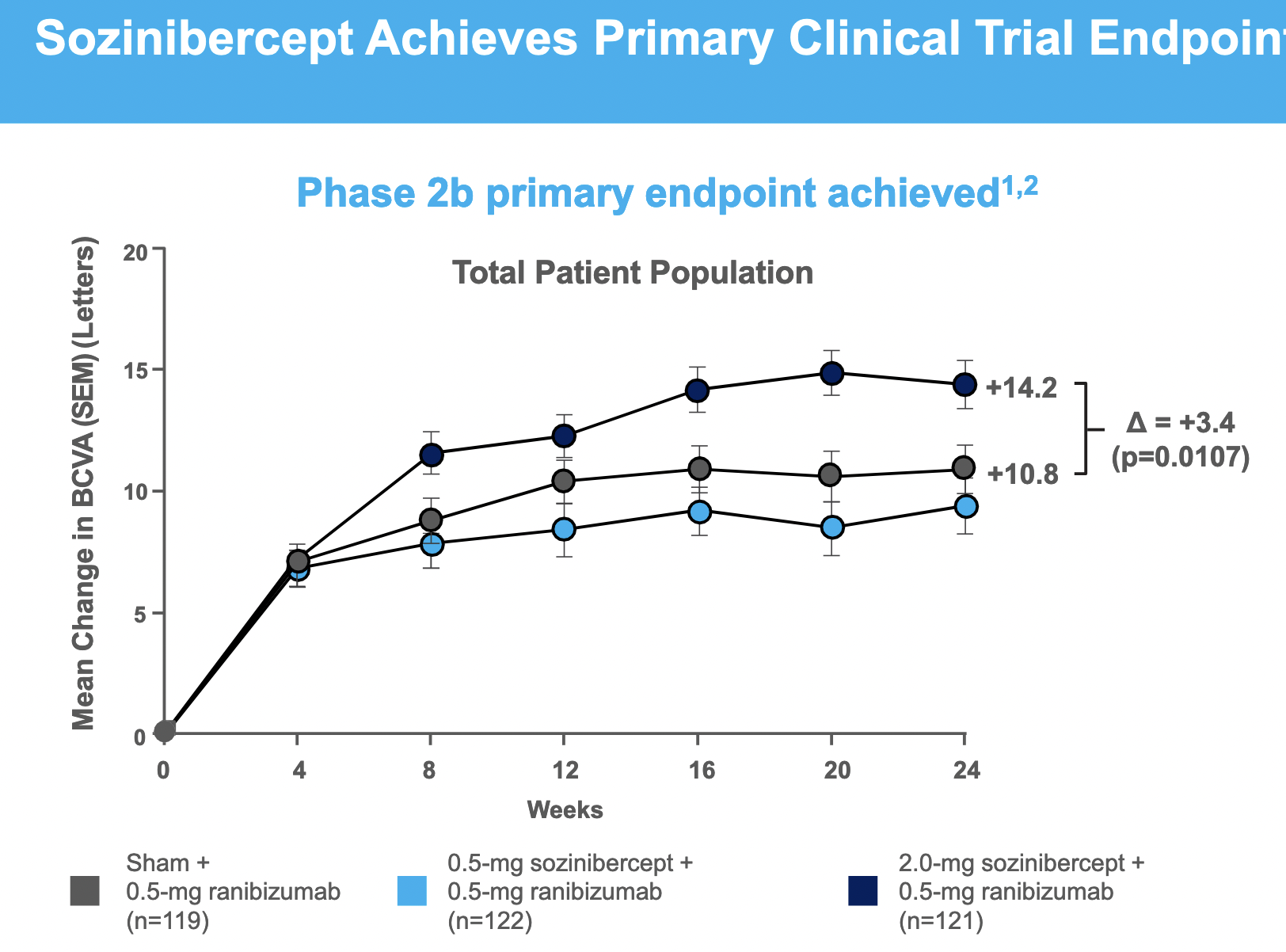

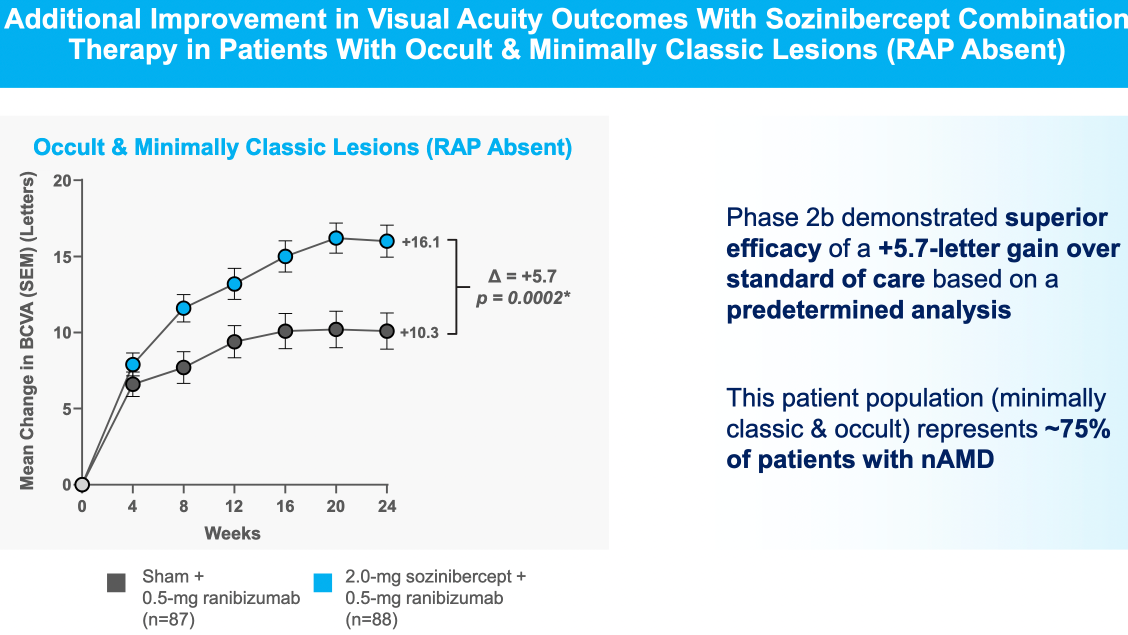

Sozinibercept achieves clinical superiority in Phase 2B trial in result which is statistically significant but borderline clinically meaningful in most patients, but is more convincing in the most common sub-type ("occult or minimally classic lesions")

OPT completes 3 commercial-grade batches of sozinibercept demonstrating potential for production licensing.

"The successful completion of the drug substance PPQ campaign is an important step towards de-risking the program and a potential biologics license application (BLA) filing of sozinibercept in wet AMD,”

Encouraging, but of course somewhat irrelevant without positive results from the 2 Phase III trials, awaited Q1/Q2 next year. However, these data are consistent with a firm anticipating commercialisation

More detailed update later, but OPT is joining the ASX300 after the Sept 23 index rebalance.

Nanosonics relegated to the ASX300 from A200, CU6 promoted to the A300 as well.

OPT announced several senior personnel changes today - these appear (on face value) as appropriate as the firm moves from R&D to clinical/commercialisation phase of sozinibercept.

Dan Geffken - new hire CFO, replacing Peter Lang who seems to be leaving 9/9.

Mike Campbell - new hire Chief Commercial Officer, draws on background in similar role at Genentech for Lucentis, the first anti-VEGF A drug which OPT aims to augment. He replaces Judith Robertson, who will stay on during transition.

Jen Watts - VP Global Clinical Operations. 2 decades experience at VP level in clinical stage biopharmaceuticals, plus clinical research director in ophthalmology.

My impression is that these changes are entirely consistent with a firm that expects to build the business towards commercialisation over next 24 months

See Company Report "Bull Case" 24/08/24 - commercialization prospects imply up to $35-70 per share at current conditions, albeit with high degree of uncertainty in results and execution

Opthea (ASX OPT, NDQ OPT) is an Australian-based, dual-listed biomedical research firm developing a drug to improve vision outcomes in age-related macula degeneration (AMD). The drug, sozinibercept, may augment existing therapies for AMD by being administered in combination with these existing therapies (preventing need for extra. injections).

The Medical Condition:

- The macula is a very small area on retina of the eye which allows us to see focused vision; we use the macula when looking at any "point" - reading, watching television, cooking.

- Age-related, "wet" macula degeneration (AMD) is a cause of vision impairment for 3 million patients across the US and EU with 200,000 newly-diagnosed patients each year. This is estimated as a $15bn pa market.

- Other important causes of macula degeneration include diabetes (DMD); this is a separate disease process representing additional potential clinical applications / patient populations

- AMD is currently treated with molecules designed to interrupt the development of new blood vessels and fluid within the macula. All current drugs for AMD interrupt vascular endothelial growth factor-A (VEGF-A), with very good but incomplete effects (45% do not respond significantly to anti-VEGF-A therapy, 25% continue to worsen)

- Anti-VEGF-A drugs currently include lucentis, vabysmo, avastin, eylea.

- Other drugs to augment anti-VEGF-A drugs are in development; these may improve the durability of effect of the VEGF-A inhibitors rather than improving the size of outcomes

- Currently, VEGF-B, -C, and -D are not targeted and allow ongoing macula degeneration in up to 25% of patients

The Drug

- Sozinibercept is a molecule targeting VEGF-C and VEGF-D pathways

- Administered by injection into the eye (as are existing anti-VEGF-A medications)

- It is designed to improve the visual outcomes of patients already receiving anti-VEGF-A therapy

- If given in combination with ANY VEGF-A inhibitor, it may inhibit 2/3 of VEGF signalling pathways. If combined specifically with EYLEA, it may inhibit all 3 potential VEGF signalling pathways.

Research Programme

- Phase 3 Research

- OPT has completed recruitment of 2x Phase-3 trials (COAST, ShORe) in AMD, with results due in early- and mid-CY25 respectively

- These appear to be high-quality studies

- Ready to commence Phase 3 trial in Diabetic macula degeneration (DMD)

- Phase 2b Research Results

- Giving sozinibercept in addition to anti-VEGF-A therapy improves vision outcomes in ALL patients

- Best responders are in those with the most common lesion types (occult or minimally-classic, 75% of all wet AMD patients)

- Increases the total number of patients achieving a clinically-significant vision improvement of 10-15 letters on best-corrected visual acuity (BCVA)

- Early data shows no increase in adverse effects or safety implications

Comparable Firms

- Regeneron is the best model for Opthea, assuming successful launch of sozinibercept

- Regeneron owns/controls marketing for Eylea in the US and receives 50% of profits from ROW marketing by Bayer

- Eylea / Eylea HD US sales are $9.3bn (40% of Regeneron group sales, excluding ROW marketing)

- Current share price = $US 1,196

- EPS $11.56

- PE 31.6

- Net profit margin = 40.3%

Commercialization Potential

- Total Addressable Market ~ $15bn (3 million current US/EU patients, 200,000 new diagnoses per year)

- Sozinibercept is the first and only drug to demonstrate additional improvement in vision outcomes in addition to current standard-of-care (SOC) therapy

- Current cost of SOC in Australia

- Eylea is approx $1200 per prescription (roughly 3-10 per patient per year)

- Ranibizumab approx $1165 per prescription (3-10 per patient per year)

- These are ongoing treatments; no cure currently exists

- Currently 55,000 patients are receiving anti-VEGF-A therapy in Australia

- Sozinibercept may be appropriate for the 45% of patients who did not respond to anti-VEGF-A alone (25,000 patients)

- Sozinibercept may be appropriate for up to half of the patients who do initially respond (12,500)

Valuation

- Assuming similar revenue at $1,200 / prescription x 3-6 per year

- $202,500,000 pa revenue in Australia alone

- ?implies $2bn pa revenue in US

- $1.32bn pa profit (US/Au)

- EPS ~ $2.45

- At a P/E ~30, full commercialization in US / Au implies a price target of $35 - 75

- This is clearly an extremely unreliable forecast based on loose assumptions

- Successful phase 3 trials

- Does not incorporate costs of further FDA approvals and marketing investments

- Ability for OPT to achieve operating margins for sozinibercept similar to that of rivals producing anti-VEGF-A medications

- Cash flow or financing implications of further development and approvals

- No attempt to analyse outstanding shares across both ASX and NASDAQ to generate a differential EPS

- Management successfully pivoting from R&D to production and marketing