Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

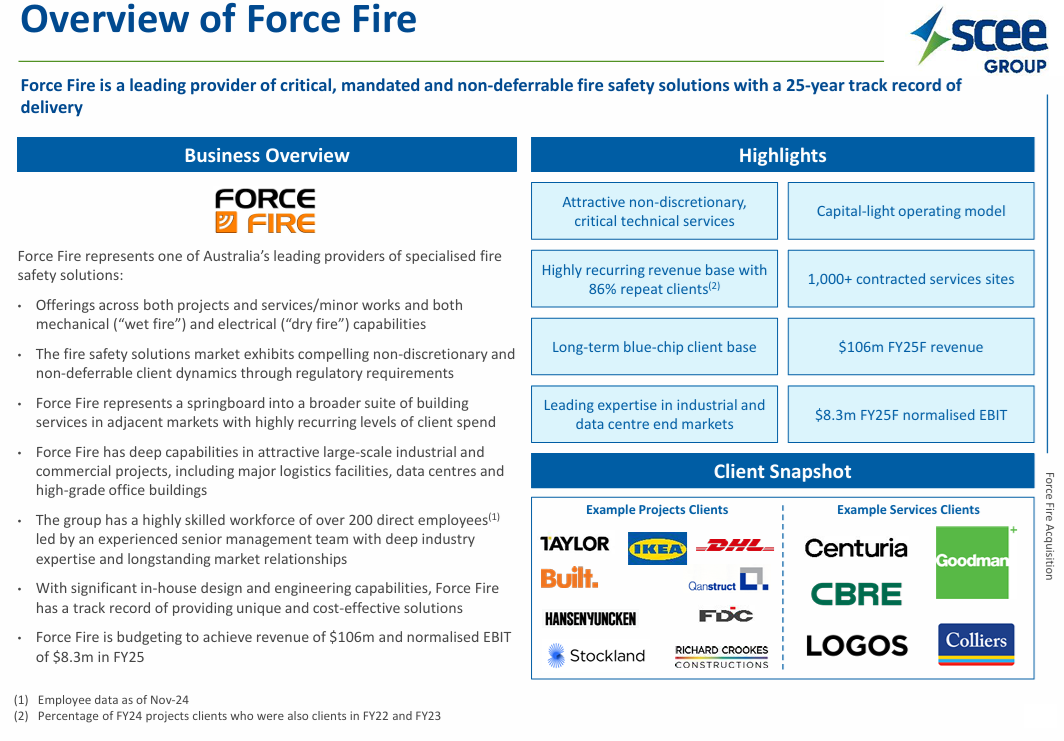

31-March-2025: Seems to be the day for announcing acquisitions - both SXE and EGL today.

SCEE (SXE): Acquisition-of-Force-Fire-Holdings.PDF

Also: Investor Presentation - Acquisition of Force Fire Holdings.PDF

Last week in his meeting with us, SCEE's CFO Chris Douglass said they are definitely acquisitive and looking to expand their capabilities through further acquisitions. He wasn't fibbing. Obviously they were all set to announce today's acquisition, but Chris couldn't give us any details of that last week (due to ASX continuous disclosure obligations) but he gave us plenty of strong hints.

Acquisition of Force Fire Holdings: Highlights:

- SCEE to acquire Force Fire Holdings, a leading New South Wales and Queensland based provider of fire safety solutions to the commercial and industrial sectors

- Initial upfront consideration of $36.3m and a total consideration of up to $53.5m for delivering EBIT growth targets in FY26 and FY27

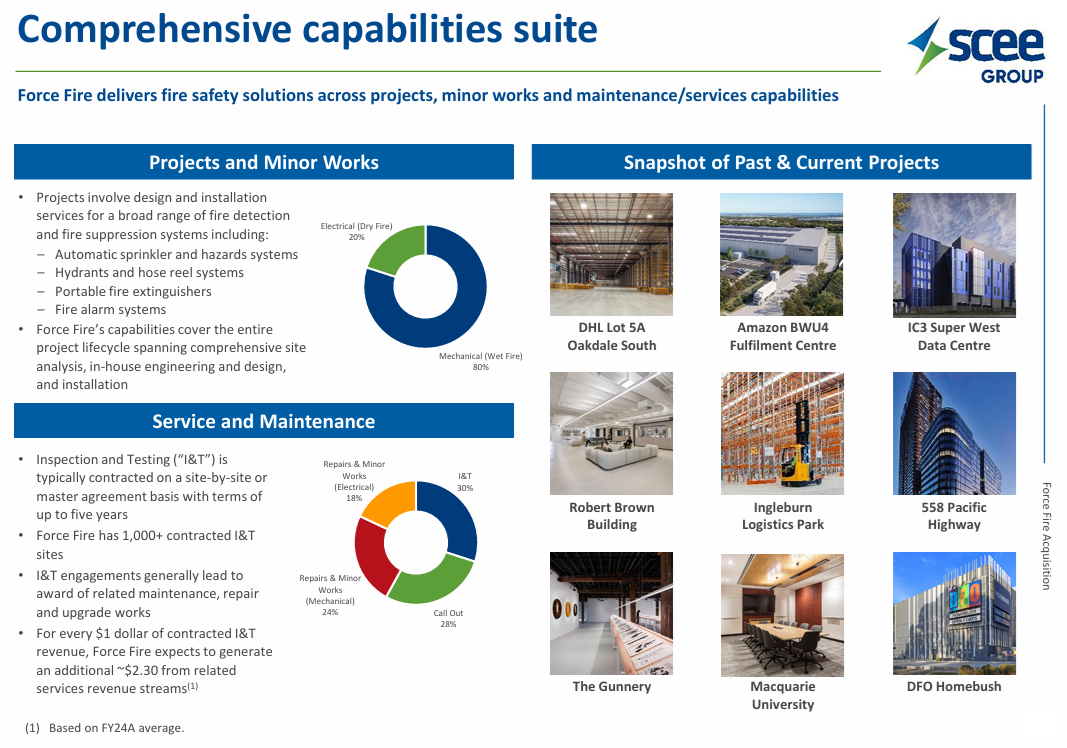

- Fire sector is a natural adjacency to SCEE’s current capabilities

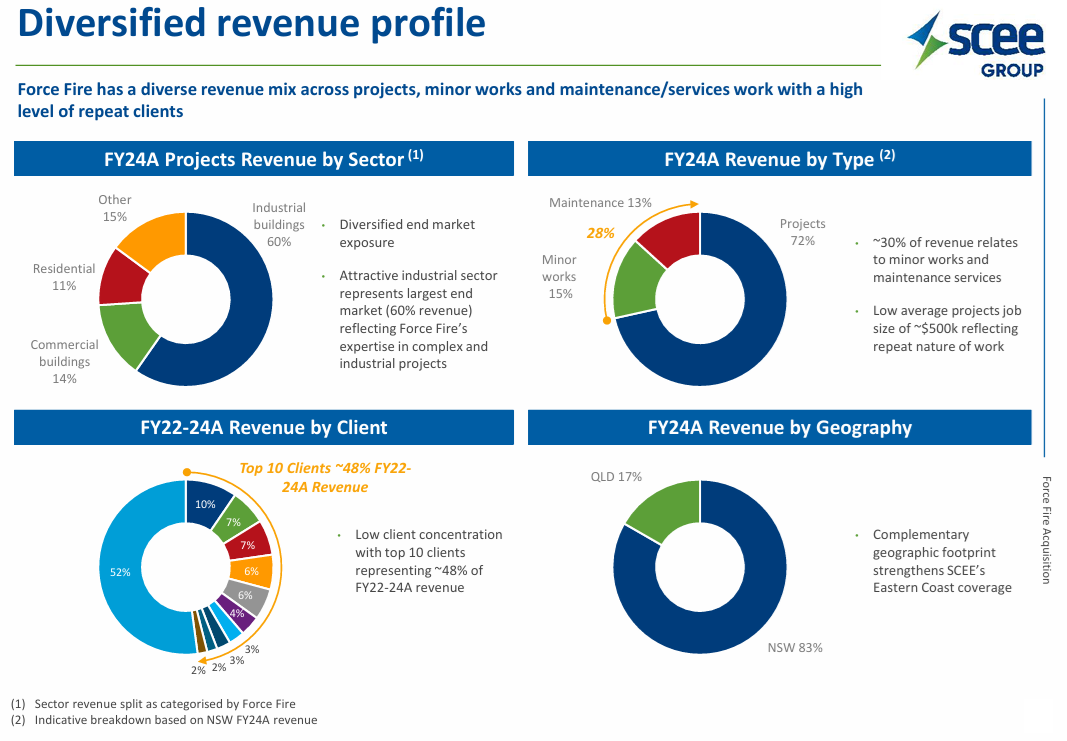

- Further growth in maintenance and recurring style works which account for circa 30% of Force Fire’s revenue

- Transaction to be funded through SCEE’s existing cash reserves

- Forecasting EBIT contribution of at least $10m for FY26 and beyond

Again, like EGL's acquisition of Advanced Boilers and Combustion (also announced today), this acquisition of FFH by SCEE (SXE) is to be paid using their own cash, so no dilution through additional shares being issued or any debt involved. Chris made it clear to us last week that as long as he's their CFO, they would always be in a net cash position. He does not like debt.

In SXE's case they had $100m+ of net cash at December 31, however this acquisition will only use $36.3m of that, with up to $17.2m in deferred consideration to be paid if FFH deliver on EBIT growth targets in the following two financial years.

Chris made it clear last week that SXE run each business unit as a standalone business and they like to keep existing management in place and incentivised to continue to grow that business even after it becomes part of Southern Cross Electrical Engineering (SXE). The terms of this acquisition are certainly consistent with that.

It is also once again a complimentary bolt-on for SXE, expanding further on their capabilities through another adjacent area that also involves electricians, their core business focus.

Remember that Chris said that they look at around 200 opportunities each year and only do a deal on about one every two years, on average, although I did get the idea from Chris that the frequency might increase in the near term.

It certainly shows the power of saying "No" most of the time. When they have actually said Yes and done a deal in prior years, those deals have all been good ones that have enabled SCEE (SXE) to grow at a good clip and provide increasingly good TSRs for their shareholders. This one looks like another one in the same vein.

EPS accretive (of course): The transaction is forecast to result in at least 18% EPS accretion on a FY25 pro forma basis. The impact to SCEE is anticipated to be broadly neutral in FY25 as Force Fire’s contribution in FY25 will be offset by the transaction costs. Their contribution in FY26 is forecast to be at least $10m EBIT.

Disc: Holding both here and IRL.

Looks good. And the market likes it - on a day in which most companies are being sold down, EGL has been up as high as 26.5 cps this morning, and SXE has been up to $1.66/share, both are currently lower than that now, but both are still well up for the day.

24-Feb-2021: Half Year Results Announcement plus Investor Presentation - Half Year Results and Appendix 4D and Interim Financial Report

I hold SCEE (ASX:SXE) shares. This was a poor H1 report, and they were sold down -3.6% today to 53.5 cps, after being down as low as 49 cps (-11.7%) earlier in the day at the height of the pessimism. The saving grace was that they have guided for a MUCH stronger second half. If they achieve that guidance, I would expect a strong positive re-rate. I guess we'll see in August. Meanwhile, there are a number of larger contract wins that they could announce between now and then that get start that ball rolling.

Highlights

- Revenue of $135.4m down 27% on prior 6 months impacted by later than anticipated award and execution of major resources projects

- EBITDA of $9.7m down 9%, EBIT of $7.3m down 9% and NPAT of $4.5m down 15% on prior 6 months

- Coronavirus continues to have impacts on productivity

- Acquisition of Trivantage Group completed in period

- Expecting significantly expanded H2 with works carried over from H1 and Trivantage contribution

- Targeting full year revenues of $420m

- Balance sheet remains strong with net cash of $53.3m and no debt

- Record order book of $500m

Outlook

- Order Book

- The Group continues to win work across its core markets. Significant awards during the half year included the Rio Tinto Gudai-Darri project ($65m) and circa $40m of commercial and datacentre projects in Sydney and Canberra.

- The Group now has a record order book of $500m, including a $60m contribution from the acquisition of Trivantage, with secured works well balanced across SCEE’s three sectors.

- There are currently over $700m of submitted tenders with clients pending decision and strong visibility of the Group’s opportunity pipeline.

- Markets

- Resources

- Resources activity has rebounded since the low levels of FY20. The pipeline is expected to continue to grow as commodity prices remain high. Significant opportunities are emerging in iron ore, lithium, and renewables developments alongside resources projects.

- Current ongoing works at the Kemerton Lithium Plant, Rio Tinto Gudai-Darri and Rio Tinto Gove projects will be strong revenue contributors in the second half.

- We continue to perform minor works projects at various Rio Tinto and BHP sites and at Sino Iron and Boddington Gold.

- Commercial

- The Commercial sector remains the largest component of the order book. Wynyard Place and the Ribbon Project are expected to be the largest revenue generators in the sector in the second half of the year.

- The medium-term outlook for the sector remains strong as developments commence around new infrastructure hubs.

- Infrastructure

- Infrastructure will be a less significant contributor in FY21 as the WestConnex, RAAF Tindal and Westmead Hospital projects are largely completed. However, peak activity in the sector is still to come with significant investment sanctioned and electrical work generally later in cycle.

- Works on the Pitt Street Metro project will ramp up in FY22 and we are bidding further opportunities on Sydney Metro and continue to target other hospital, transport and defence opportunities.

- Resources

- Full year expectations

- A significantly expanded second half is expected as work carried over from H1 is delivered and the Trivantage contribution is added to the Group. Full year revenues of $420m are targeted.

Strategy

SCEE primarily sees itself as an electrical and associated services contractor diversified across the resources, commercial and infrastructure sectors.

Our growth strategy falls in two parts:

- To continue to deepen our presence and broaden our geographic diversity in those sectors, noting the strong outlooks for resources and infrastructure; and

- To grow our services, maintenance and recurring earnings offerings to complement our construction capabilities.

We will achieve this through both organic initiatives and by continuing to actively pursue acquisition opportunities.

CEO Comment

Commenting on the results, SCEE’s CEO Graeme Dunn said “the first half of the year has seen us significantly expand the Group’s capabilities and geographical presence through the acquisition of the Trivantage Group. The combination of this acquisition and a record order book means we are confident of delivering a much stronger second half result. Going forward, with a resurgent resources sector and strong infrastructure pipeline, we are well placed to execute our growth strategy.”

--- end of excerpt --- [I hold SXE shares.] --- click on the links at the top for more ---

The chart below is part of the Macromonitor series on Transport Infrastructure Construction, and it is updated each year; this one was updated in January 2021 (last month). In their presentation (link above) SCEE (SXE) mention that there is an infrastructure construction activity "peak" coming. What I have noticed is there is always an activity peak in these charts, and it is always about 2 to 3 years ahead of wherever we are today, and there is always a sharp drop off in activity after that (as can be seen on the chart below). In my experience, every time these Macromonitor charts are updated (which is annually) that peak has moved back another year, which suggests that the drop off is simply because we lack visibility of projects that far into the future; the projects are coming, we just can't see them yet. That's why the peak does not appear closer on this year's chart than it did on last year's chart, or the year before, or the year before. It is always 2 to 3 years out into the future, and it may stay that far out for another 5 or 10 years. That's my experience anyway. For what it's worth.

18-Feb-2021: New Contract Awards

Highlights

- SCEE awarded $40m of commercial and datacentre works in NSW and ACT

Southern Cross Electrical Engineering Limited (“SCEE”, ASX:SXE) is pleased to announce its East Coast-based subsidiary Heyday has been awarded a range of projects totaling $40m as follows.

Heyday has been awarded the following contracts with a combined value of over $15m:

- In Sydney, a contract novation for The Ribbon Project from Probuild Constructions (Aust) Pty Ltd. The novation was as a result of Grocon Constructions, to whom Heyday was performing earlier works, and their client Greaton concluding their construction relationship and Greaton subsequently engaging with Probuild to complete the project with an increased electrical scope of work. The works consist of a new Imax cinema, 449 hotel rooms, 143 serviced apartments, and other office and retail offerings. The project is due for completion in December 2021.

- In Canberra, Heyday has been awarded the design and construct contract to provide electrical, communications and security services for the new Throsby Primary School from Icon SI (Aust) Pty Ltd. In line with ACT Education requirements the school will achieve zero emissions through the use of energy efficient systems, solar PV array and airtight mechanical systems and buildings. The completion of the project is to align with the start of the school year in January 2022.

In Sydney, the following datacentre projects have been secured by Heyday with a combined value of circa $25m:

- From Multiplex Australasia Pty Ltd, a contract for the design and construct of Stage 1 - Phase 1 electrical and communication works for the NextDC S3 datacentre in Artarmon. The S3 datacentre will be constructed to meet the Uptime Institute Tier IV Level Certification requirements and the works include MV/LV and communications infrastructure and fitout of data halls and offices. Project completion is August 2022.

- J. Hutchinson Pty Ltd has engaged Heyday for a further stage at the RuData SYD053 datacentre in Eastern Creek in Sydney’s western suburbs, which is the fifth separate subcontract to Heyday on the site. This scope includes the full fit-out of an additional 1,200m² of data hall space, new HV and LV reticulation, switchboards, UPS, generator systems, lighting, and power. The works are expected to be completed by the end of third quarter 2021.

Comment

Commenting on the above, SCEE Managing Director Graeme Dunn said “This range of work once again demonstrates the strong position Heyday holds in these sectors in Sydney and Canberra.

It is particularly pleasing that we are now in a position to complete the electrical works on the prestigious Ribbon project on which we had so successfully performed at an earlier stage.”

--- ends --- [I hold SXE shares.]

23-Nov-2020: SCEE awarded work at Rio Tinto Gudai-Darri

- SCEE awarded electrical and instrumentation works at Rio Tinto’s Gudai-Darri iron ore mine

- Contract valued at over $65m

Southern Cross Electrical Engineering Limited (“SCEE”) is pleased to announce that it has been awarded a contract valued at over $65 million by Rio Tinto for work at their new Gudai-Darri (formerly known as Koodaideri) iron ore mine located in the Pilbara region of Western Australia.

SCEE will perform the plant electrical and instrumentation works at the mine as part of the Gudai-Darri Phase 1 Project. Mobilisation for SCEE is scheduled to commence late in 2020 with completion planned for December 2021.

Commenting on the award, SCEE Managing Director Graeme Dunn said “We are pleased to secure this significant award with such a longstanding and valued client as Rio Tinto for whom we have undertaken many successful projects in the Pilbara. This further boosts our already strong order book and will provide a solid base of construction work in the resources sector into the 2022 financial year.”

--- ends --- [I hold SXE shares.]

18-Nov-2020: Strategic Acquisition plus Investor Presentation - Acquisition of Trivantage

Highlights

SCEE to acquire Trivantage for an enterprise value of up to $53.5m*:

- Trivantage is a specialised electrical services group with over 50 years operational experience of providing complex electrical solutions across Australia

- Trivantage is primarily a services oriented business characterised by a strong degree of recurring and maintenance work

- Acquisition is a milestone in SCEE’s strategy to enhance its service and maintenance capabilities and grow into adjacent and complementary sectors and new geographies

- Trivantage is budgeted to achieve FY21 revenue of circa $130m and normalised EBIT of $10.8m**, delivering enhanced scale and double digit EPS accretion for FY21F for SCEE on a pro forma basis***

- Following the acquisition, the combined SCEE group is expected to generate revenue of circa $500m on a pro forma FY21F basis

- Anticipate strong operational synergies and considerable cross-selling opportunities

- Acquisition consideration structured to ensure ongoing alignment and acquisition success. Initial consideration is payable via $25.0m in cash on completion, and a further $10.0m cash and $5.5m in SCEE shares payable after achievement and confirmation of Trivantage FY21 targets. Further cash components will be payable subject to achieving performance hurdles in FY22 and FY23

- SCEE to maintain a strong balance sheet with flexibility to pursue further growth opportunities

- Trivantage management to remain in business

- Paul Chisholm (significant shareholder and Chairman of Trivantage) to be invited to join SCEE Board

Overview

Southern Cross Electrical Engineering Limited (“SCEE”, ASX:SXE) today announced that it has executed a Share Purchase Agreement to acquire 100% of Trivantage Holdings Pty Ltd (“Trivantage”) from the current shareholders of Trivantage for an enterprise value of up to $53.5m on a debt free basis. Completion is expected to occur in mid-December 2020.

With over 50 years of operational experience, Trivantage is a leading provider of specialised electrical services across a range of sectors. Trivantage is characterised by a large degree of recurring service and maintenance work with a relatively low risk contracting profile. Headquartered in Melbourne, Trivantage has approximately 400 employees Australia-wide with offices in Victoria, Western Australia, Queensland, New South Wales, South Australia and Tasmania.

Notes:

- (*) Refer Appendix for detailed transaction terms, including nature and timing of acquisition consideration

- (**) On a full year basis and excludes potential synergies, transaction and integration costs

- (***) Before synergies, transaction costs, integration costs and amortisation of customer related intangibles

--- click on the first link at the top for the full announcement including the appendix referred to in Note 1 above ---

--- The second link (at the top) is to a presentation that SXE have released today concerning this acquisition ---

[I hold SXE shares. I like this acquisition. Double digit earnings accretive in FY21. Even more recurring revenue for SCEE (SXE) - there's plenty to like about this.]

On Tuesday- 16th April 2019 - Thorney Investment Group Australia (TIGA, ASX: TOP) increased their shareholding in SXE from 12.83% to 14.15%. Westoz Funds Management (WIC) still hold 5.4%, and Colonial First State still hold 8%. The founder of the company, Frank Tomasi also still holds 20% of the shares on issue. Between TIGA, WIC, Colonial & Tomasi, that's 47.55% of the shares taken care of, leaving the remaining 52.45% as the free float (i.e. not held by substantial holders).

Disclosure: While not exactly a substantial holder, I do own shares in Southern Cross Electrical Engineering. SRG & SXE look remarkably cheap among their peer group - I hold them both.

Update (16-Oct-2020): The latest substantial shareholder numbers in SXE are:

- With 18.9%, Frank Tomasi

- With 18.53%, TIGA/Thorney Investment Group Australia/ASX:TOP

- With 8.5%, Mitsubishi UFJ Financial Group, Inc.

- With 6.12%, Perennial Value Management Limited

- With 5.4%, Westoz Funds Management Pty Ltd

Those 5 holders together now own 57.45% of Southern Cross Electrical Engineering (SCEE, ASX: SXE), so the free float (available shares less substantial shareholders) has now reduced from 52.45% (see above) to 42.55%.

Over the same 18 month period, SXE's SP (share price) has reduced from around 55c to now being around 45c, so the market capitalisation (market cap) is now around 18% lower as well.

[I still hold SXE shares. I see significant upside from here, and it shouldn't take longer than a year or two for a serious positive market re-rate of SXE, IMO. Management are doing an excellent job. They're just not in a favoured sector at this point, so there is no positivity around the company. Unloved and unappreciated. My sort of company really.]

31-Aug-2020: Full Year Results Announcement and Investor Presentation - FY20 Results plus Preliminary Final Report (Appendix 4E)

Highlights

- Third successive year of record revenues with FY20 revenue of $415.1m up 8%

- EBIT of $16.4m down 16% and NPAT of $10.9m down 14%

- Profitability impacted by Coronavirus disruption, lower average margins on now finished transport infrastructure projects and delay of some project scope into FY21

- Balance sheet remains strong with net cash of $55.3m and no debt

- Fully franked dividend of 3.0 cents per share

- Targeting FY21 revenues of $400m

- Order book of $440m includes over 80% of FY21 revenue target

- Over $900m of submitted tenders

- Continuing to pursue commercial close out of claims and variations

- Acquisition activity resumed following suspension in second half

--- click on links above for more ---

[I hold SXE shares.]

19-Aug-2020: Contract Awards

Highlights

- SCEE awarded over $30m of commercial work in NSW and ACT

Southern Cross Electrical Engineering Limited (“SCEE”) (ASX: SXE) is pleased to announce its East Coast-based subsidiary Heyday has been awarded a range of commercial projects totaling in excess of $30m as follows.

In NSW Heyday has been awarded the following contracts with a combined value of circa $15m:

- The 5 & 7 Parramatta Square project by Built Pty Ltd, which involves the design and construction of the electrical, security, audio-visual and ICT services for the 8,000m², six floor and two basement level building which is integrated with the adjoining heritage-listed Parramatta Town Hall. The project is due for completion in the final quarter of 2021.

- Heyday has been engaged by J. Hutchinson Pty Ltd for a further stage at the RuData SYD053 data centre at Eastern Creek in Sydney’s western suburbs, which is the fourth subcontract for Heyday on this site. This scope includes the fit-out of an additional 1,200m² of data hall space, new HV and LV reticulation, switchboards, UPS, generator systems, lighting and power. The works are expected to be completed by December 2020.

In Canberra Heyday has secured from Geocon Pty Ltd the Nightfall, Aspen and Establishment Apartments projects with a combined value in excess of $15m. All three projects are design and construct and fully inclusive of all electrical and communications infrastructure:

- Nightfall comprises 334 residential apartments and 17 commercial tenancies and is the final stage of the Republic development which compliments the previously announced High Society and Republic unit blocks. Expected completion is in the third quarter of 2021.

- The Establishment and Aspen developments are made up off 289 apartments and 2 commercial tenancies over two towers, and 622 apartments and 19 commercial tenancies over four towers, respectively. Expected completion of the Establishment towers is mid-2022 and the Aspen towers is the fourth quarter of 2022.

Comment

Commenting on the above, SCEE Managing Director Graeme Dunn said “I am pleased to announce such a range of work demonstrating the high regard in which Heyday is held in the sectors in which it operates. All of these awards were negotiated since the onset of the Coronavirus pandemic and will serve to underpin the Group’s performance this financial year and next.”

--- click on link above for the full announcement ---

[I hold SXE shares]

SXE only has a market capitalisation of $104 million, so they're a small microcap company. $30m worth of new work is substantial for a company that is as small as they are. More importantly, these positive announcements are coming fairly regularly now.

11-June-2020: Decmil Subcontract Update

This highlights the pitfalls of being a subcontractor when the company you have been subcontracted by are rather sub-par (as Decmil - DCG - clearly are). I note this work was performed a couple of years ago, and that Southern Cross Electrical Engineering (SCEE, ASX: SXE) have a business model that has evolved somewhat from then. I believe SXE are a better company now - with better risk management. That's why I hold SXE shares. I also note that SXE have said, "SCEE remains committed to pursuing its substantive claims and is confident as to its entitlement. SCEE does not believe that this matter will have a material impact on the financial performance of the company for the year ending 30 June 2020 or any subsequent financial years.”

In other words, the eventual outcome of this to SCEE (SXE) is not going to be particularly material. It was a pretty small contract, and the money owed to them by DCG (according to SXE) is not a particularly large sum in the overall scheme of things.

Decmil's announcement (09-June-2020): DCG: Adjudication Update

Disclosure: I hold SXE shares, but do NOT hold DCG shares.

I note that the S&P Index rebalance announcement today mentioned that both SXE and DCG are going to be removed from the All Ords Index on June 22nd (in 10 days' time).

20-May-2020: SXE - Award of Energy Queensland Services Agreement

05-May-2020: Contract Awards and Coronavirus Update

Sounds like business as usual mostly for SXE and that they are well positioned to capitalise on opportunities regarding increased infrastructure spending. Over $50m in net cash (no debt). Disclosure: I hold SXE shares.

10-Mar-2020: SCEE awarded Sydney Metro Pitt Street Station

26-Feb-2020: A great set of results from SXE released this morning:

- Record half year revenue of $230.3m, up 27% on prior corresponding period

- EBIT up 22% on PCP to $8.4m and NPAT up 24% on PCP to $5.5m

- Balance sheet remains strong with total cash of $53.3m and no debt

- Public infrastructure and commercial were largest revenue contributors in half year (decreased reliance on resources/mining industry contracts)

- Resources revenues to increase following recent significant project wins

- On track to exceed FY20 revenue forecast of over $420m

- Expecting stronger H2 profitability

- Order book of $440m at 31 December 2019 with over $250m secured for FY21

- Actively pursuing acquisition opportunities

Half year results announcement

Investor presentation - HY20 results

Half Yearly Report and Accounts

Appendix 4D - Half year results

Disclosure: I do hold SXE shares.

28 Aug-2019: SCEE (SXE) have reported this morning, and it's a good report:

Full Year Results Announcement

Full Year Results Announcement

Investor Presentation - FY19 Results

Disclosure: I hold SXE shares.

13 August 2019: Contract Awards

- Over $35m of projects won across the SCEE group

- Awards in the commercial, data centre and energy sectors

Hot on the heels of their announcement yesterday of a slew of new contracts that extend right across their various business divisions, Southern Cross Electrical Engineering (SCEE, ASX: SXE) have made this additional announcement this morning:

20-Dec-2019: SCEE awarded Kemerton lithium plant project

This one is worth circa $65m and is for the E&I (electrical and instrumentation) work at MARBL Lithium Joint Venture’s new Kemerton lithium hydroxide processing plant (just north of Bunbury in WA). The JV is 40% owned by ASX-listed Mineral Resources (MRL, ASX: MIN) and 60% owned by the giant global battery metals corporation Albemarle.

The turnaround continues (I hold SXE).

19-Dec-2019: Contract Awards

Highlights

- Over $35m of projects won across the SCEE group

- Awards in the resources, commercial, health and telecommunications and data centre sectors

Southern Cross Electrical Engineering Limited (“SCEE”) is pleased to announce that it has secured a number of new contracts with a total value of over $35m across the commercial, resources, health infrastructure and telecommunications sectors.

Resources

SCEE has been awarded the following resources projects:

- Talison Lithium Australia Pty Ltd has awarded SCEE a contract to install, erect, test and commission the primary and secondary equipment for an electrical infrastructure upgrade at the Greenbushes lithium mine in southern Western Australia. The works involve an electrical load increase from 25MVA to 60MVA installed capacity and are expected to be completed over the first half of 2020.

- Energy Resources of Australia Pty Ltd (“ERA”) has awarded SCEE a Master Services Agreement to provide electrical and instrumentation services at the Ranger Mine in Jabiru, Northern Territory. SCEE will provide ongoing support to ERA’s operations and assist with mine closure works for an initial term of two years and ERA has the option for a further two 12-month extensions.

Commercial

SCEE’s East Coast-based subsidiary Heyday has been awarded the following commercial projects:

- Shape Australia Pty Ltd has awarded Heyday the electrical fit-out of 14 floors of government office accommodation at 231 Elizabeth Street, Sydney. The new office accommodation will provide 21,600m2 of floor space for use by employees of Transport for NSW, and the Departments of Premier & Cabinet, of Finance, Services & Innovation and of Justice. The building fit-out is being managed by Property New South Wales on behalf of the government agencies. Heyday’s scope of work includes the distribution switchboards, cable support systems, specialist lighting and small power, communication services, security and access control systems and is expected to be completed over the first half of 2020.

- In Canberra, Heyday has been awarded a contract by Geocon Constructors (ACT) Pty Ltd on the City – 7 Development Project. The development comprises three buildings encompassing 544 apartments and 10 retail tenancies. The scope of works is for the design and construction of lighting, communication services, security and access control systems and is expected to be completed in early 2021.

- Also in the ACT, Heyday has secured a contract from Icon for work on the Parade Project which is part of Icon and JW Land’s mixed-use C5 Development in Barton. The development comprises 242 apartments, a 65-room hotel and eight retail tenancies. Heyday’s scope of work includes lighting, communication services, security and access control systems and is expected to be completed by the end of 2020.

Health infrastructure

SCEE’s subsidiary Datatel has entered into an agreement with Health Support Services in Western Australia for the provision of breakdown repair, planned maintenance and minor works activities and projects as required to the East Metropolitan, North Metropolitan and South Metropolitan Health Services. The agreement is a panel arrangement for an initial period of three years with options to extend the term for up to a further eight years.

Telecommunications and data centres

Heyday has been awarded a further stage of works by J. Hutchinson Pty Ltd at the RUData SYD53 data centre at Eastern Creek in Sydney’s western suburbs. This scope includes the full fit-out of an additional 1,000m2 of data hall space with Heyday’s scope including HV and LV reticulation, switchboards, UPS and generator systems and lighting and small power. The work is expected to be completed in the first half of 2020.

Datatel has secured new and extensions to existing term contracts to perform customer connection works on the NBN, Optus and Telstra networks.

Comment

Commenting on the awards, SCEE Managing Director Graeme Dunn said “I am pleased to be able to announce these new awards which demonstrate SCEE’s capabilities across a broad range of sectors and geographies.”

-------------------

Disclosure: I hold SXE shares.

17 June 2019: New Contract Awards (June 2019)

20 May 2019: New Contract Awards (May 2019)

My bull case is summed up well in this broker report from Moelis Australia - which is titled, "SOUTHERN CROSS ELECTRICAL, BUY, Diversified, late stage exposure presents timely buying opportunity". Their PT (price target) is 88c. Mine is 77c. Both are good numbers, although mine is better, IMHO.

They could take 18 months to get there, but there's no rush. They have no debt, had $56m in cash at Dec 31st (over 40% of their market capitalisation), have succesfully diversified their revenue away from their traditional mining services revenue, including via two strategic aquisitions, have tailwinds, provide exposure to increased infrastructure spending (by governments as well as public/private companies) - as well as increased mining construction capex, they're cheap - the second cheapest in the sector - after SRG Global (ASX: SRG, who I also hold), and there's some smart money on the register. Thorney (TIGA/TOP) were buying SXE shares in August and again in October and now own 12.83% of SXE. Westoz (WIC) also own 5.4% of SXE. The Moelis report is reasonably comprehensive - especially concerning tailwinds and opportunities, as well as risks. That report is basically my investment thesis.

This company presentation (released on Feb 27th with their half year results) is also useful for getting your head around what this company does, and how they have changed (diversified) their revenue mix and order book over the past 12 months. Moelis suggests they have been sold down on sector concerns - including the demise of RCR and issues experienced by LLC (Lendlease) - and that makes sense to me. The company itself looks to be well run, with a good outlook, and is cheap. They also pay a dividend. It's a once per year final dividend, but based on the last one, their yield is over 5% fully franked, which is not to be sneezed at.

Disclosure: I bought some SXE yesterday (9th April).

Warning: Dyslexics beware.

Post a valuation or endorse another member's valuation.