Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Scroll down - latest update is at the bottom.

11-Apr-2024: I reckon that Southern Cross Electrical Engineering (SCEE, SXE.asx) will likely head on up to around $1.40 or higher based on the strong momentum their SP is demonstrating currently.

Mining Services has been an "on-the-nose" sector (unloved) for a couple of years now but that seems to be changing - have a look at this:

That's from the 13th March investor presentation by Macmahon Holdings (MAH) at the recent Euroz Hartleys Conference on Rottnest Island (just off the coast from Perth in WA) (see here: MAH-Investor-Presentation---Euroz-Hartleys-Rottnest-Conference.PDF) where they are highlighting the large variance in valuations attributed by the market to both capital light mining and engineering services companies and to capital intensive mining and engineering services companies, and as well as within those two groups, as they say below the table, the materially higher multiples that the capital light group on the left are trading on compared to the capital intensive group on the right.

On the right, there are mining contractors who do the actual mining (contract miners) like MAH and NWH (NRW Holdings), there are mining equipment suppliers like Austin Engineering (ANG) and Emeco (EHL), and drilling contractors like Perenti (PRN, formerly Ausdrill) and Mitchell Services (MSV). NRW also have an engineering and construction arm, but that's not important for this discussion.

On the left side of that slide we have various capital light contractors, many of whom are essentially labour hire companies who specialise in particular areas, so SXE provide electricians and electrical services, Mader (MAD) provide fitters and mechanics for heavy duty earthmoving equipment like Cat, Komatsu and Liebherr gear in earthmoving and mining, Service Stream (SSM) mostly provide trained telecommunications technicians or people from other professional disciplines, and Monadelphous provide labour hire (my brother has worked for them) and also provide engineering and construction services to the mining, infrastructure, energy and other sectors. There are also engineering and construction firms that mostly derive income from engineering, design and project management (GNG, SRG) and facilities management firms that provide services to keep various facilities and assets operational and maintained like Ventia (VNT) and Downer (DOW). GNG's (GR Engineering's) Upstream PS division also provide similar services to the energy sector. The common thing about this group is that they are all companies that are heavy on people and light on equipment, so "capital light".

By contrast, the group on the right side are reliant on a lot of heavy equipment such as earthmoving gear, mining equipment and drilling rigs.

However, the thing to note is the range of PEs from the more fully priced companies towards the top of the left side list down to the low PE companies on the bottom left and pretty much all of the companies on the right list (the Capital Intensive companies) who are all on single digit PEs.

What they (Macmahon) are clearly suggesting is that the mining and engineering services companies classed as Capital Intensive are CHEAP at this point in time.

And I think they were right.

And the ones on the bottom of the left side were cheap also, particularly GNG, SRG, DOW and SXE, although I have issues with Downer based mostly on their management so won't be holding DOW shares any time soon.

Have a look at the recent share price movement with MAH and SXE:

The charts go up to today's closing price, and I've also highlighted the share prices they were at on 13-Mar-2024, being the day that MAH presented that slide at the Rottnest Island Conference. Could be coincidence, but they've risen nicely in the 4 weeks since then. Not everyone listed on that slide has done that, but those two have.

There were other factors at play clearly, some of which I'll discuss below.

I have held both MAH and SXE previously, both here and in real money portfolios, and I don't currently hold either of them, except here where I added a small SXE position today - which I will probably add to.

Another thing worth noting is that SXE were added to the Aussie All Ords Index on March 18th; MAH were already in it and did not get added to or removed from any index in March.

Latest Announcement from SXE: Data-Centre-and-Resources-awards-over-$70m.PDF [20-March-2024]

Source: (25) SCEE Electrical: Posts | LinkedIn

Latest presentation from SXE: SCEE-(SXE)-Investor-Roadshow-Presentation-March-2024.PDF [18-March-2024]

Both of those (the announcement and the roadshow presentation) would have contributed to SXE's positive SP movement in recent weeks.

Website: https://www.scee.com.au/

SCEE: Leaders in Electrical, Instrumentation, Communications and Maintenance Services

About SXE: https://www.scee.com.au/who-we-are/#about

Investor Page: https://www.scee.com.au/investors/investor-centre/

Past Project examples:

SCEE Group | RUDATA SYD053 DATA CENTRE

SCEE Group | BROOKFIELD PLACE SYDNEY

SCEE Group | WESTERN SYDNEY AIRPORT

SCEE Group | NATIONAL SERVICE AND MAINTENANCE CONTRACT

SCEE Group | BRISBANE METRO FLASH CHARGING FACILITIES

SCEE Group | EDL AGNEW GOLD MINE RENEWABLE HYBRID POWER STATION

SCEE Group | WESTCONNEX M4 EAST PROJECT

SCEE Group | KEMERTON LITHIUM PROCESSING PLANT

SCEE Group | GUDAI DARRI MINE [Rio Tinto]

SCEE Group | CHEVRON WHEATSTONE LNG

SCEE Group | WESTMEAD HOSPITAL CASB

SCEE Group | NORTHLINK STAGE II

Yeah, hopefully you get the idea. They've been around for a while. They've done a lot in that time. They're a decent company that appears to be getting an overdue positive re-rating by the market currently. And most people have probably never heard of them.

24-Nov-2024: Update:

Marked as stale. Reviewed. They're doing better than I expected. Raising price target to $1.96. Should report well in Feb, might go higher on new contract win announcements between now and then.

I like the way they have diversified away from mining services. That's a real positive if we have a "down" period in 2025 on the back of China weakness flowing through to lower commodity prices feeding into a depressed Australian mining sector.

SXE still have mining sector exposure, but not nearly as much as they did 5 years ago, and that's good, in my opinion. I'm not sure that the market fully understands the evolution of this business and the excellent execution that their management have delivered over the past couple of years, especially the past year.

They've had a positive rerating recently, but I think they can run further.

24-Aug-2025: Update:

This one was marked as stale again - I'm back in SXE here on SM - having bought back in after digesting their results, which I'll share my thoughts on below. I'm not in SXE in real life however due to all of my investable capital being tied up in other (hopefully better) companies, but SXE have reported very well and I think they should get a positive re-rating on the back of their report and outlook - they do not look expensive; But they do look like dependable wealth winners for their investors.

This is another one that I would hold in my SMSF if I had more capital to invest. Actually I wouldn't because my SMSF is currently limited to ASX300 companies and SXE is in the All Ords but not the ASX300 yet - give them a few more years and I reckon they will be - I would instead hold them in my other portfolio outisde my super that holds companies like LYL and GNG (and previously EGL, DUR & SRG), buy that's full of LYL, GNG and GOR right now.

Firstly - SCEE's (SXE's) share price trends well, both up and down, currently in a decent uptrend during this calendar year:

But they're not at the top of that rising channel right now - interestingly they rose +3.1% (+6 cents) on Tuesday (19th) leading into their results release on Wednesday August 20th, then dropped -1.5 cps on the day, another -11 cents on Thursday (-5.56%) another cent on Friday to finish the week down -4.1% (-8 cents) @ $1.86.

I believe they've been sold down on a slightly lower current order book (-4.9% vs pcp) and a slightly lower gross margin and EBIT margins (with a flat NPAT margin) and lower growth guidance for the current FY than for FY25 - still good profit growth, just not the outstanding growth that we got in FY25.

Two points on that: (1) These companies keep adding to their order books as the year progresses, so there's scope for guidance upgrades, which are always a lot nicer than guidance downgrades, and (2) Thorney (TIGA/TOP) is their second largest shareholder (SCEE's founder Frank Tomasi is #1) and Alex Waislitz at Thorney is a fairly unpredictable character and could be selling down - which would certainly be on brand for him - he usually loads up on companies that are going backwards and either reduces exposure or sells out of companies that are poised for good growth or who are continuing to execute well.

And the results last Wednesday were good:

Full year results announcement (6 pages)

Investor presentation - FY25 results (32 pages)

Annual Report to shareholders (94 pages)

Appendix 4E (2 pages)

It's going to be hard to maintain that sort of momentum, and we know that SXE management are conservative, preferring to underpromise and overdeliver, especially their CFO, Chris Douglass who we have had on here with Andrew not too long ago; Chris was also previously SCEE's Interim Managing Director and CEO, currently their CFO, so it's notable that despite some minor margin compression at the Gross Margin and EBIT/EBITDA levels, and a flat NPAT margin of 4% (same as FY24), as well as an order book that is -4.9% lower than it was a year ago, they're still giving guidance for further decent profit (EBITDA) growth this FY:

"The group is anticipating further growth in FY26 with EBITDA in the range of $65m-68m, growing 18 to 24% on FY25 EBITDA. "

So what's to like?

A heap actually.

Firstly there's their inside ownership a.k.a. "skin in the game".

Next, there's their industry positioning - electrical contractors - but no longer just to the mining and energy sectors - now a major player in infrstructure including data centres, hospitals, transport infrastructure, shopping centres, it's a long list.

There's also the fact that they have zero debt, and a nice pile of cash relative to their low market cap:

Next we have a very strong Balance Sheet, growing Earnings that are supporting increasing Dividends (returns to shareholders), and competent and conservative manegement that are aware of the dangers of being too reliant on one or two sectors, so have been busy diversifying into other sectors (from almost entirely mining and energy a few years back), mostly via smart and strategic acquisitions where they never seem to overpay, and they have an excellent track record of gaining immediate benefits from those acquisitions - it's smart growth via M&A rather than growth for the sake of growth - they are building a bigger, better and more resilient company that will be able to withstand downturns in different industries or sectors.

I'll stop there, as there are 32 pages in the Presso in addition to the 6 page announcement, plus another 94 pages in their Annual Report (also released on Wednesday, link below), so hopefully I've given the main broad outline of why I think they're an investable company and currently one of my 20 best investment ideas - just outside my top 14 that I actually hold in real money portfolios - I've been an SXE shareholder IRL before and done well out of them, and I'm sure I will be again. Great company.

Sources: Full year results announcement (6 pages)

Investor presentation - FY25 results (32 pages)

Annual Report to shareholders (94 pages)

Appendix 4E (2 pages)

...with some additions from me (mostly in blue, orange and green).

And I've got some SXE back in my SM portfolio again now - not a ticker code best suited for dyslexics - but otherwise not much there to complain about.

Disclosure: Holding (here).

31-March-2025: Seems to be the day for announcing acquisitions - both SXE and EGL today.

SCEE (SXE): Acquisition-of-Force-Fire-Holdings.PDF

Also: Investor Presentation - Acquisition of Force Fire Holdings.PDF

Last week in his meeting with us, SCEE's CFO Chris Douglass said they are definitely acquisitive and looking to expand their capabilities through further acquisitions. He wasn't fibbing. Obviously they were all set to announce today's acquisition, but Chris couldn't give us any details of that last week (due to ASX continuous disclosure obligations) but he gave us plenty of strong hints.

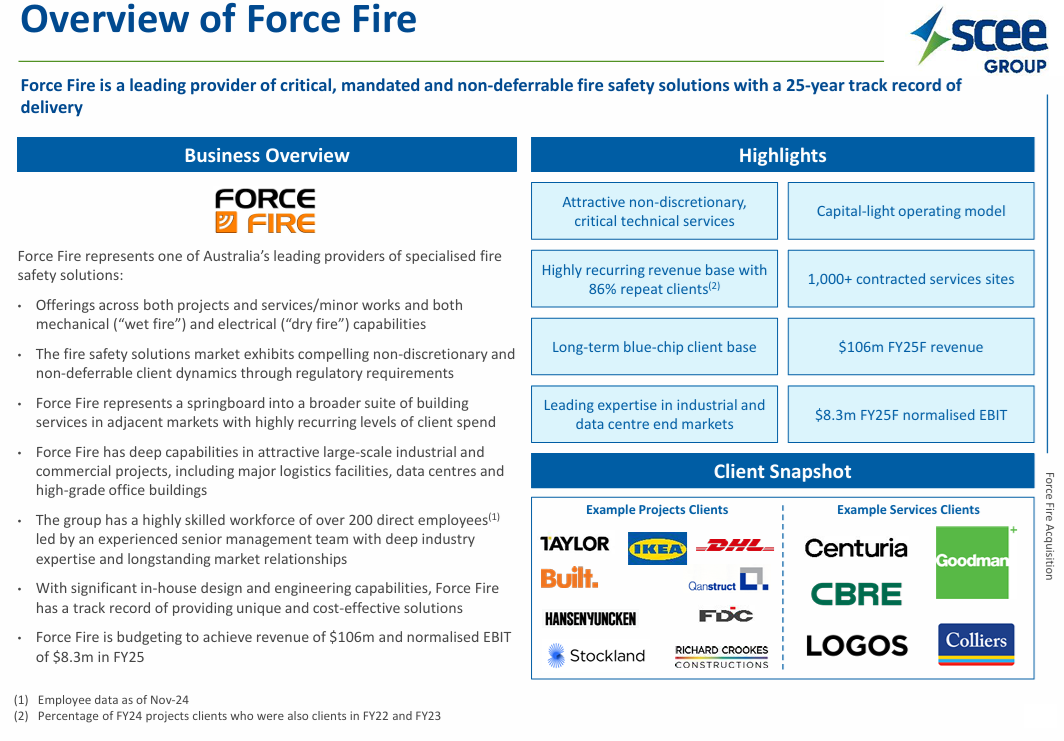

Acquisition of Force Fire Holdings: Highlights:

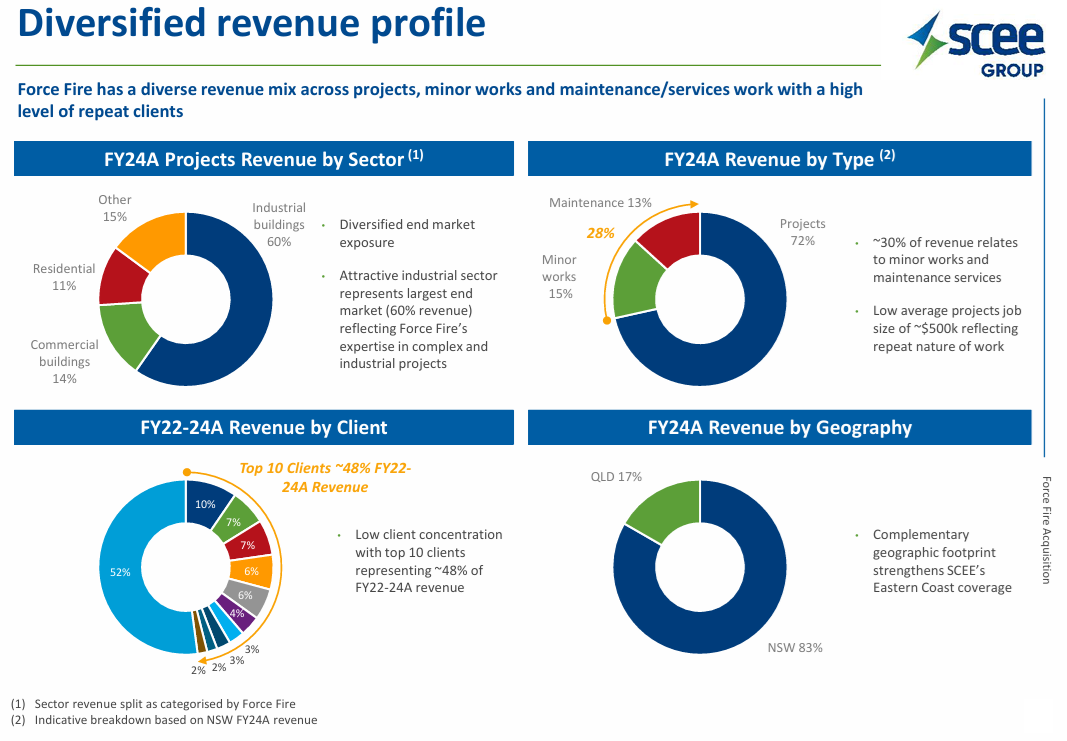

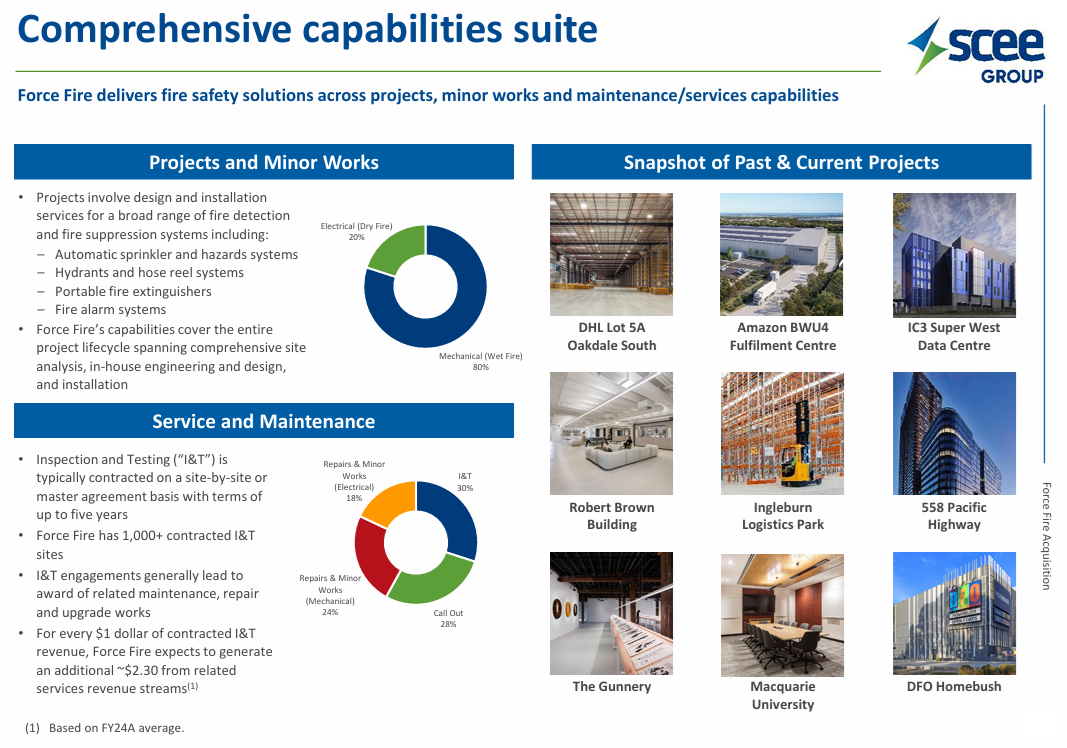

- SCEE to acquire Force Fire Holdings, a leading New South Wales and Queensland based provider of fire safety solutions to the commercial and industrial sectors

- Initial upfront consideration of $36.3m and a total consideration of up to $53.5m for delivering EBIT growth targets in FY26 and FY27

- Fire sector is a natural adjacency to SCEE’s current capabilities

- Further growth in maintenance and recurring style works which account for circa 30% of Force Fire’s revenue

- Transaction to be funded through SCEE’s existing cash reserves

- Forecasting EBIT contribution of at least $10m for FY26 and beyond

Again, like EGL's acquisition of Advanced Boilers and Combustion (also announced today), this acquisition of FFH by SCEE (SXE) is to be paid using their own cash, so no dilution through additional shares being issued or any debt involved. Chris made it clear to us last week that as long as he's their CFO, they would always be in a net cash position. He does not like debt.

In SXE's case they had $100m+ of net cash at December 31, however this acquisition will only use $36.3m of that, with up to $17.2m in deferred consideration to be paid if FFH deliver on EBIT growth targets in the following two financial years.

Chris made it clear last week that SXE run each business unit as a standalone business and they like to keep existing management in place and incentivised to continue to grow that business even after it becomes part of Southern Cross Electrical Engineering (SXE). The terms of this acquisition are certainly consistent with that.

It is also once again a complimentary bolt-on for SXE, expanding further on their capabilities through another adjacent area that also involves electricians, their core business focus.

Remember that Chris said that they look at around 200 opportunities each year and only do a deal on about one every two years, on average, although I did get the idea from Chris that the frequency might increase in the near term.

It certainly shows the power of saying "No" most of the time. When they have actually said Yes and done a deal in prior years, those deals have all been good ones that have enabled SCEE (SXE) to grow at a good clip and provide increasingly good TSRs for their shareholders. This one looks like another one in the same vein.

EPS accretive (of course): The transaction is forecast to result in at least 18% EPS accretion on a FY25 pro forma basis. The impact to SCEE is anticipated to be broadly neutral in FY25 as Force Fire’s contribution in FY25 will be offset by the transaction costs. Their contribution in FY26 is forecast to be at least $10m EBIT.

Disc: Holding both here and IRL.

Looks good. And the market likes it - on a day in which most companies are being sold down, EGL has been up as high as 26.5 cps this morning, and SXE has been up to $1.66/share, both are currently lower than that now, but both are still well up for the day.

I quite enjoyed the chat today with Chris Douglas, CFO at Southern Cross Electrical Engineering.

I must admit, going in I wasnt that interested -- a people business that serves a variety of cyclical industries, and which has used acquisitions to fuel growth..? Not my typical cup of tea. But Chris made some really good points, and it's clear that per share metrics have been steadily improving over a long period of time.

Anyway, a few notes while it is still fresh:

- The most important quality SXE can deliver to customers is reliability. Cost, is a secondary factor for their clients, who need SXE to come in after huge investments have been made, and for which any delays could be extremely costsly

- Clients include big names like Rio, BHP, Woolies, Coles, Multiplex, etc. with very long standing relationships

- Most of the 2000+ staff are full-time employees on Enterprise Bargaining Agreements (EBAs), well-paid, and looked after. EBAs are negotiated regularly and they seem to charge on a cost+ basis.

- They don’t struggle to find or keep staff — being a reliable employer gives them a big edge, especially with the nationwide shortage of sparkies.

- Labour and material costs have gone up 20–40% post-COVID, but SXE can pass these on because their contracts are priced just before they start.

- About $200m of revenue is recurring — includes long-term maintenance, rollouts for supermarkets, ongoing work for miners, and framework agreements.

- Data centers now make up about $100m in annual revenue — competitive market but growing strongly.

- Other tailwinds include hospital and airport projects, renewables, batteries, and general electrification needs.

- There’s also a growing focus on critical infrastructure and redundancy (e.g., substations), which could drive more work.

- The company has grown by acquiring quality businesses in adjacent areas (comms, security, manufacturing) and keeping their management teams.

- They're careful and selective — only acquire every few years, but have $50m cash available (outside of working capital requirements) and up to $200m firepower if needed.

- Balance sheet is very strong — ~$95m net cash and no debt.

- They maintain a cash buffer for stability and flexibility, but also because they are eyeing off more acquisitions.

- Dividend has grown steadily and won’t be cut unless absolutely necessary.

- Customer concentration is worth considering -- about half of revenue comes from a handful of big players. BUT they are very established, low risk customers.

- Australia’s electrical standards and licensing rules create a natural barrier to overseas competition.

- Long-term shortage of electricians actually plays in their favour, especially since they’re a top-tier employer.

- Final point from Chris: electricity use is only going up, which means more work for electricians — and that’s great for SXE.

Based on FY guidance, the business is on a 5.5x EV/EBITDA (I use that multiple as the large cash balance and no debt is worth accounting for, and the company has provided FY EBITDA guidance) and offer a 4.7% yield, fully franked (6.9% grossed up). Doesnt strike me as that demanding. Actually, it seems quite cheap *if* SCEE can sustain even modest growth.

Of course, it's worth remembering that services business can experience a sudden and significant drop in work, and with a lot of expensive sparkies on the payroll, that can take a knife to profits. Yes, they are diversified in terms of industry exposure and geography, but it's something to be mindful of.

I'm sure I missed a bunch of stuff, but you can watch the full interview on the meetings page.

Southern Cross Electrical Engineering announced half year results today.

- Record half year revenue $397.4m, up 55.5% on PCP

- Record half year EBITDA of $27.1m up 58.5%, record half year EBIT of $23.2m up 73.7% and record half year NPAT of $16.2m up 67.8% on PCP

- Fully franked 2.5 cps interim dividend declared, up 150% on prior interim dividend

- Reiterating FY25 EBITDA guidance of at least $53m with expectations of further growth beyond

Looks good to me. What surprised me the most was cash of $114.8m, no debt, against market cap of circa $400m.

Three key matters stand out for me as to WHY this announcement qualifies as ‘material’ & potential catalysts for the recent price increases..

1. SCEE has been awarded ‘balance of plant’ contract

2. Whilst the Collie project will be largely complete in 2025, there is clearly more projects to come over the NEXT 5 years.

3. Strong tie up with Synergy, WA’s largest energy supplier and closely related to the WA government and their ambitious decarbonisation plans.

It should be noted that this (the Collie project) is the 3rd project by Synergy with the previous two (known as KBESS1 & KBESS2) going to Power Electronics who bill themselves the #1 world leader in manufacture of solar inverters etc. Apparently a company which started in Spain but is now hugely USA based. So, big feather in the SXE cap to unseat such a large contender. BTW, the Collie project is 10 times the size of the other two projects.

The WA government is investing over $3bn in new wind farms & battery storage systems with the intention of fully closing two coal-based mines – Collie (Oct 2027 retirement date) and Muja C & D (retirement dates to be April 2025 & Oct 2029 respectively). These retirement dates would suggest at least another large battery storage project. Both these coal mines are operated by Synergy.

Conclusion: Good link between WA government – Synergy & SXE = proven expertise to handle big projects which other states might note!

So, expertise on batteries to store renewable energy sources, data centres and an already existing stream of recurring income = KABOOM!

SXE delivered its AGM report today [31/10/22] and it's largely a regurgitation of the entirety of the presentation as delivered for the FY22 results on 31st of August 2022.

The only adjustments to the presentations between the dates referred to above are to acknowledge the winning of the Atlassian project of $35+m plus and the Brisbane Metro EV charging project of $10+m

They added one new slide which might indicate a growing thread to make 7th pillar to the diversity of this business – that of ‘Decarbonisation’ and they are chasing business in the areas of battery, solar and wind projects together with green buildings (Atlassian project win) and electric vehicle charging systems (Brisbane Metro EV infrastructure win). Additionally in this space they are in a perfect position to offer decarbonisation solutions to their resource clients.

They have reaffirmed FY23 outlook of EBITDA in the range of $36m to $38m which I have extrapolated through to an FY23 EPS of 6.9c (v 6.1c for FY21) and a ff dividend of 5.5c

Certainly, worth a consideration @ a SP of 67.5c as the ff dividend will be generate a grossed-up return of 11.6%

My only concern is their order book which is expected to potentially flatten as they finish a number of WA resource projects in FY23. But they are resourceful and on slide 18 they did state “Atlassian HQ building contract announced in September with further awards anticipated soon’

SCEE today announced that it expects a record half of revenue in H21 FY22 anticipated and furthermore updated their FY22 full-year forecast to revenues of circa $550m, EBITDA of over $34M.

WA border opening up and minimum Covid downtime losses are where management provided the most colour.

I like the inside ownership, conservative management, and easy-to-understand nature of this business (the electronic "picks and shoveles" of the mining/infrastructure sectors).

I hold inside my SMSF so the Fully Franked yield (~10% trailing) is great for super long term wealth creation IMO.

FY22 eps now likely at 6c with 7.5% growth for 5 years 3% terminal and 12% discount = 83c

MS has moved its IV up from 91c to 96c in last 2 weeks.

SCEE is an electrical contractor diversified across 3 sectors - resources, commercial and infrastructure. Its growth strategy is to deepen its presence in these sectors with an emphasis on targeting maintenance & recurring earnings.

Its recent (Dec 2020) successful acquisition of Trivantage has substantially increased exposure to service & maintenance style work which gives it a growing stream of continuously steady income. All of the above, plus its focus on opportunities in the global decarbonisation arena, will drive future growth.

It’s a well run company which has transparency in its reporting and no mumbo jumbo, voodoo accounting jargon deigned to ‘smokescreen reality’.

It’s not going to be a growth star, more a steady Eddie. 1HFY22 results showed good growth on the top (+86%) and bottom (+48%) lines. And 2H promises even better results. Based on 1H results and the companies reconfirmed outlook, my expectations are that FY22 will see eps around 5.7c with a dividend paid of 4.5 to 5c ff (a gross yield of 12.5% on a SP of 57c). Not too shabby when compared to a boring CBA deposit savings account paying diddly squat.

Of course, risk and reward are always associated and here SXE is well situated. It has $49m in cash and no debt. Plus, it has a current order book of $550m which is a full years revenue and this is growing. Assuming the resources sector across the board does not fall out of bed and given its growing bank of predictable maintenance style income, the risks are minimal.

Disclosure: I hold in RL for the grossed up dividends which I think/hope will be consistent going forward.

24-Feb-2021: Half Year Results Announcement plus Investor Presentation - Half Year Results and Appendix 4D and Interim Financial Report

I hold SCEE (ASX:SXE) shares. This was a poor H1 report, and they were sold down -3.6% today to 53.5 cps, after being down as low as 49 cps (-11.7%) earlier in the day at the height of the pessimism. The saving grace was that they have guided for a MUCH stronger second half. If they achieve that guidance, I would expect a strong positive re-rate. I guess we'll see in August. Meanwhile, there are a number of larger contract wins that they could announce between now and then that get start that ball rolling.

Highlights

- Revenue of $135.4m down 27% on prior 6 months impacted by later than anticipated award and execution of major resources projects

- EBITDA of $9.7m down 9%, EBIT of $7.3m down 9% and NPAT of $4.5m down 15% on prior 6 months

- Coronavirus continues to have impacts on productivity

- Acquisition of Trivantage Group completed in period

- Expecting significantly expanded H2 with works carried over from H1 and Trivantage contribution

- Targeting full year revenues of $420m

- Balance sheet remains strong with net cash of $53.3m and no debt

- Record order book of $500m

Outlook

- Order Book

- The Group continues to win work across its core markets. Significant awards during the half year included the Rio Tinto Gudai-Darri project ($65m) and circa $40m of commercial and datacentre projects in Sydney and Canberra.

- The Group now has a record order book of $500m, including a $60m contribution from the acquisition of Trivantage, with secured works well balanced across SCEE’s three sectors.

- There are currently over $700m of submitted tenders with clients pending decision and strong visibility of the Group’s opportunity pipeline.

- Markets

- Resources

- Resources activity has rebounded since the low levels of FY20. The pipeline is expected to continue to grow as commodity prices remain high. Significant opportunities are emerging in iron ore, lithium, and renewables developments alongside resources projects.

- Current ongoing works at the Kemerton Lithium Plant, Rio Tinto Gudai-Darri and Rio Tinto Gove projects will be strong revenue contributors in the second half.

- We continue to perform minor works projects at various Rio Tinto and BHP sites and at Sino Iron and Boddington Gold.

- Commercial

- The Commercial sector remains the largest component of the order book. Wynyard Place and the Ribbon Project are expected to be the largest revenue generators in the sector in the second half of the year.

- The medium-term outlook for the sector remains strong as developments commence around new infrastructure hubs.

- Infrastructure

- Infrastructure will be a less significant contributor in FY21 as the WestConnex, RAAF Tindal and Westmead Hospital projects are largely completed. However, peak activity in the sector is still to come with significant investment sanctioned and electrical work generally later in cycle.

- Works on the Pitt Street Metro project will ramp up in FY22 and we are bidding further opportunities on Sydney Metro and continue to target other hospital, transport and defence opportunities.

- Resources

- Full year expectations

- A significantly expanded second half is expected as work carried over from H1 is delivered and the Trivantage contribution is added to the Group. Full year revenues of $420m are targeted.

Strategy

SCEE primarily sees itself as an electrical and associated services contractor diversified across the resources, commercial and infrastructure sectors.

Our growth strategy falls in two parts:

- To continue to deepen our presence and broaden our geographic diversity in those sectors, noting the strong outlooks for resources and infrastructure; and

- To grow our services, maintenance and recurring earnings offerings to complement our construction capabilities.

We will achieve this through both organic initiatives and by continuing to actively pursue acquisition opportunities.

CEO Comment

Commenting on the results, SCEE’s CEO Graeme Dunn said “the first half of the year has seen us significantly expand the Group’s capabilities and geographical presence through the acquisition of the Trivantage Group. The combination of this acquisition and a record order book means we are confident of delivering a much stronger second half result. Going forward, with a resurgent resources sector and strong infrastructure pipeline, we are well placed to execute our growth strategy.”

--- end of excerpt --- [I hold SXE shares.] --- click on the links at the top for more ---

The chart below is part of the Macromonitor series on Transport Infrastructure Construction, and it is updated each year; this one was updated in January 2021 (last month). In their presentation (link above) SCEE (SXE) mention that there is an infrastructure construction activity "peak" coming. What I have noticed is there is always an activity peak in these charts, and it is always about 2 to 3 years ahead of wherever we are today, and there is always a sharp drop off in activity after that (as can be seen on the chart below). In my experience, every time these Macromonitor charts are updated (which is annually) that peak has moved back another year, which suggests that the drop off is simply because we lack visibility of projects that far into the future; the projects are coming, we just can't see them yet. That's why the peak does not appear closer on this year's chart than it did on last year's chart, or the year before, or the year before. It is always 2 to 3 years out into the future, and it may stay that far out for another 5 or 10 years. That's my experience anyway. For what it's worth.

18-Nov-2020: Strategic Acquisition plus Investor Presentation - Acquisition of Trivantage

Highlights

SCEE to acquire Trivantage for an enterprise value of up to $53.5m*:

- Trivantage is a specialised electrical services group with over 50 years operational experience of providing complex electrical solutions across Australia

- Trivantage is primarily a services oriented business characterised by a strong degree of recurring and maintenance work

- Acquisition is a milestone in SCEE’s strategy to enhance its service and maintenance capabilities and grow into adjacent and complementary sectors and new geographies

- Trivantage is budgeted to achieve FY21 revenue of circa $130m and normalised EBIT of $10.8m**, delivering enhanced scale and double digit EPS accretion for FY21F for SCEE on a pro forma basis***

- Following the acquisition, the combined SCEE group is expected to generate revenue of circa $500m on a pro forma FY21F basis

- Anticipate strong operational synergies and considerable cross-selling opportunities

- Acquisition consideration structured to ensure ongoing alignment and acquisition success. Initial consideration is payable via $25.0m in cash on completion, and a further $10.0m cash and $5.5m in SCEE shares payable after achievement and confirmation of Trivantage FY21 targets. Further cash components will be payable subject to achieving performance hurdles in FY22 and FY23

- SCEE to maintain a strong balance sheet with flexibility to pursue further growth opportunities

- Trivantage management to remain in business

- Paul Chisholm (significant shareholder and Chairman of Trivantage) to be invited to join SCEE Board

Overview

Southern Cross Electrical Engineering Limited (“SCEE”, ASX:SXE) today announced that it has executed a Share Purchase Agreement to acquire 100% of Trivantage Holdings Pty Ltd (“Trivantage”) from the current shareholders of Trivantage for an enterprise value of up to $53.5m on a debt free basis. Completion is expected to occur in mid-December 2020.

With over 50 years of operational experience, Trivantage is a leading provider of specialised electrical services across a range of sectors. Trivantage is characterised by a large degree of recurring service and maintenance work with a relatively low risk contracting profile. Headquartered in Melbourne, Trivantage has approximately 400 employees Australia-wide with offices in Victoria, Western Australia, Queensland, New South Wales, South Australia and Tasmania.

Notes:

- (*) Refer Appendix for detailed transaction terms, including nature and timing of acquisition consideration

- (**) On a full year basis and excludes potential synergies, transaction and integration costs

- (***) Before synergies, transaction costs, integration costs and amortisation of customer related intangibles

--- click on the first link at the top for the full announcement including the appendix referred to in Note 1 above ---

--- The second link (at the top) is to a presentation that SXE have released today concerning this acquisition ---

[I hold SXE shares. I like this acquisition. Double digit earnings accretive in FY21. Even more recurring revenue for SCEE (SXE) - there's plenty to like about this.]

On Tuesday- 16th April 2019 - Thorney Investment Group Australia (TIGA, ASX: TOP) increased their shareholding in SXE from 12.83% to 14.15%. Westoz Funds Management (WIC) still hold 5.4%, and Colonial First State still hold 8%. The founder of the company, Frank Tomasi also still holds 20% of the shares on issue. Between TIGA, WIC, Colonial & Tomasi, that's 47.55% of the shares taken care of, leaving the remaining 52.45% as the free float (i.e. not held by substantial holders).

Disclosure: While not exactly a substantial holder, I do own shares in Southern Cross Electrical Engineering. SRG & SXE look remarkably cheap among their peer group - I hold them both.

Update (16-Oct-2020): The latest substantial shareholder numbers in SXE are:

- With 18.9%, Frank Tomasi

- With 18.53%, TIGA/Thorney Investment Group Australia/ASX:TOP

- With 8.5%, Mitsubishi UFJ Financial Group, Inc.

- With 6.12%, Perennial Value Management Limited

- With 5.4%, Westoz Funds Management Pty Ltd

Those 5 holders together now own 57.45% of Southern Cross Electrical Engineering (SCEE, ASX: SXE), so the free float (available shares less substantial shareholders) has now reduced from 52.45% (see above) to 42.55%.

Over the same 18 month period, SXE's SP (share price) has reduced from around 55c to now being around 45c, so the market capitalisation (market cap) is now around 18% lower as well.

[I still hold SXE shares. I see significant upside from here, and it shouldn't take longer than a year or two for a serious positive market re-rate of SXE, IMO. Management are doing an excellent job. They're just not in a favoured sector at this point, so there is no positivity around the company. Unloved and unappreciated. My sort of company really.]

11-June-2020: Decmil Subcontract Update

This highlights the pitfalls of being a subcontractor when the company you have been subcontracted by are rather sub-par (as Decmil - DCG - clearly are). I note this work was performed a couple of years ago, and that Southern Cross Electrical Engineering (SCEE, ASX: SXE) have a business model that has evolved somewhat from then. I believe SXE are a better company now - with better risk management. That's why I hold SXE shares. I also note that SXE have said, "SCEE remains committed to pursuing its substantive claims and is confident as to its entitlement. SCEE does not believe that this matter will have a material impact on the financial performance of the company for the year ending 30 June 2020 or any subsequent financial years.”

In other words, the eventual outcome of this to SCEE (SXE) is not going to be particularly material. It was a pretty small contract, and the money owed to them by DCG (according to SXE) is not a particularly large sum in the overall scheme of things.

Decmil's announcement (09-June-2020): DCG: Adjudication Update

Disclosure: I hold SXE shares, but do NOT hold DCG shares.

I note that the S&P Index rebalance announcement today mentioned that both SXE and DCG are going to be removed from the All Ords Index on June 22nd (in 10 days' time).

05-May-2020: Contract Awards and Coronavirus Update

Sounds like business as usual mostly for SXE and that they are well positioned to capitalise on opportunities regarding increased infrastructure spending. Over $50m in net cash (no debt). Disclosure: I hold SXE shares.

19-Dec-2019: Contract Awards

Highlights

- Over $35m of projects won across the SCEE group

- Awards in the resources, commercial, health and telecommunications and data centre sectors

Southern Cross Electrical Engineering Limited (“SCEE”) is pleased to announce that it has secured a number of new contracts with a total value of over $35m across the commercial, resources, health infrastructure and telecommunications sectors.

Resources

SCEE has been awarded the following resources projects:

- Talison Lithium Australia Pty Ltd has awarded SCEE a contract to install, erect, test and commission the primary and secondary equipment for an electrical infrastructure upgrade at the Greenbushes lithium mine in southern Western Australia. The works involve an electrical load increase from 25MVA to 60MVA installed capacity and are expected to be completed over the first half of 2020.

- Energy Resources of Australia Pty Ltd (“ERA”) has awarded SCEE a Master Services Agreement to provide electrical and instrumentation services at the Ranger Mine in Jabiru, Northern Territory. SCEE will provide ongoing support to ERA’s operations and assist with mine closure works for an initial term of two years and ERA has the option for a further two 12-month extensions.

Commercial

SCEE’s East Coast-based subsidiary Heyday has been awarded the following commercial projects:

- Shape Australia Pty Ltd has awarded Heyday the electrical fit-out of 14 floors of government office accommodation at 231 Elizabeth Street, Sydney. The new office accommodation will provide 21,600m2 of floor space for use by employees of Transport for NSW, and the Departments of Premier & Cabinet, of Finance, Services & Innovation and of Justice. The building fit-out is being managed by Property New South Wales on behalf of the government agencies. Heyday’s scope of work includes the distribution switchboards, cable support systems, specialist lighting and small power, communication services, security and access control systems and is expected to be completed over the first half of 2020.

- In Canberra, Heyday has been awarded a contract by Geocon Constructors (ACT) Pty Ltd on the City – 7 Development Project. The development comprises three buildings encompassing 544 apartments and 10 retail tenancies. The scope of works is for the design and construction of lighting, communication services, security and access control systems and is expected to be completed in early 2021.

- Also in the ACT, Heyday has secured a contract from Icon for work on the Parade Project which is part of Icon and JW Land’s mixed-use C5 Development in Barton. The development comprises 242 apartments, a 65-room hotel and eight retail tenancies. Heyday’s scope of work includes lighting, communication services, security and access control systems and is expected to be completed by the end of 2020.

Health infrastructure

SCEE’s subsidiary Datatel has entered into an agreement with Health Support Services in Western Australia for the provision of breakdown repair, planned maintenance and minor works activities and projects as required to the East Metropolitan, North Metropolitan and South Metropolitan Health Services. The agreement is a panel arrangement for an initial period of three years with options to extend the term for up to a further eight years.

Telecommunications and data centres

Heyday has been awarded a further stage of works by J. Hutchinson Pty Ltd at the RUData SYD53 data centre at Eastern Creek in Sydney’s western suburbs. This scope includes the full fit-out of an additional 1,000m2 of data hall space with Heyday’s scope including HV and LV reticulation, switchboards, UPS and generator systems and lighting and small power. The work is expected to be completed in the first half of 2020.

Datatel has secured new and extensions to existing term contracts to perform customer connection works on the NBN, Optus and Telstra networks.

Comment

Commenting on the awards, SCEE Managing Director Graeme Dunn said “I am pleased to be able to announce these new awards which demonstrate SCEE’s capabilities across a broad range of sectors and geographies.”

-------------------

Disclosure: I hold SXE shares.