Although I don't look at gold miners that much, I can't ignore that Red5 looks like the only gold stock that has not followed the fall in the price of gold

However Red5 is working from a low base

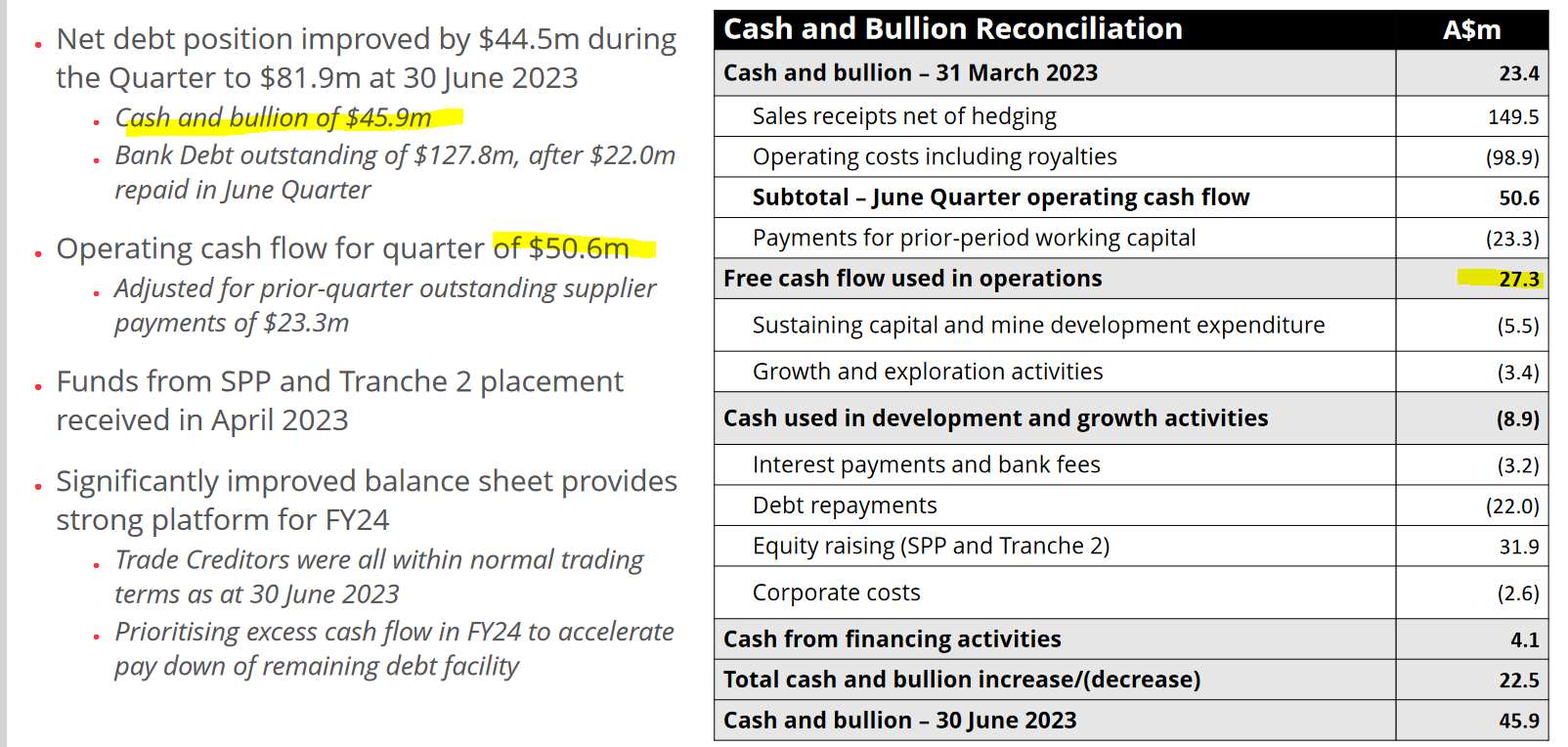

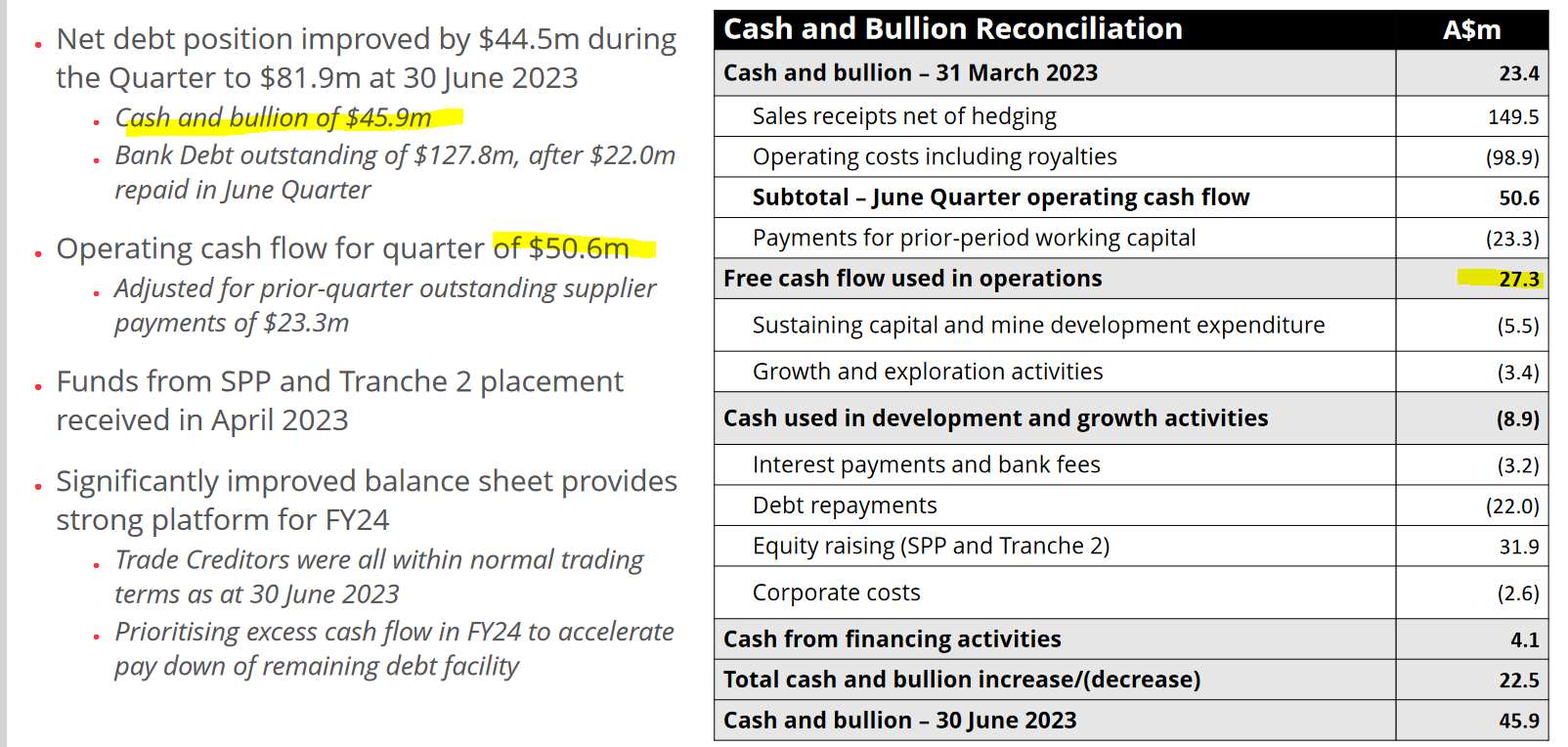

Probably one reason is that they had positive operating cashflow for the quarter

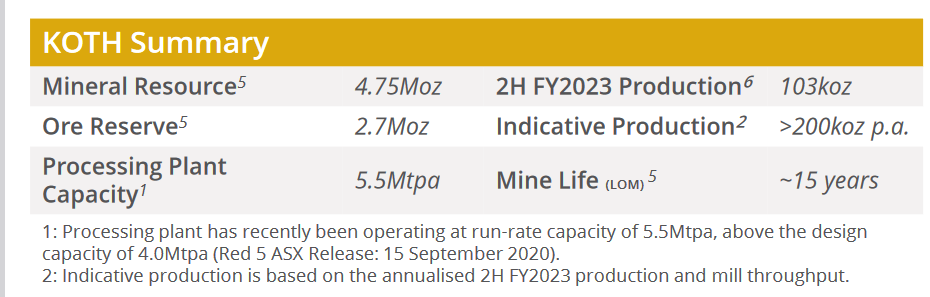

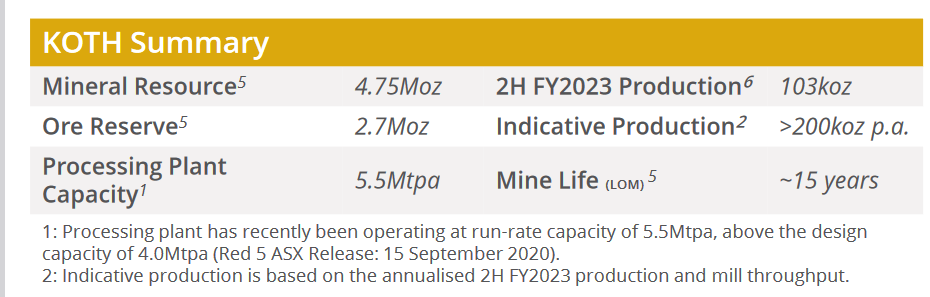

The reserve size of KOTH is also double the size of Karlawinda

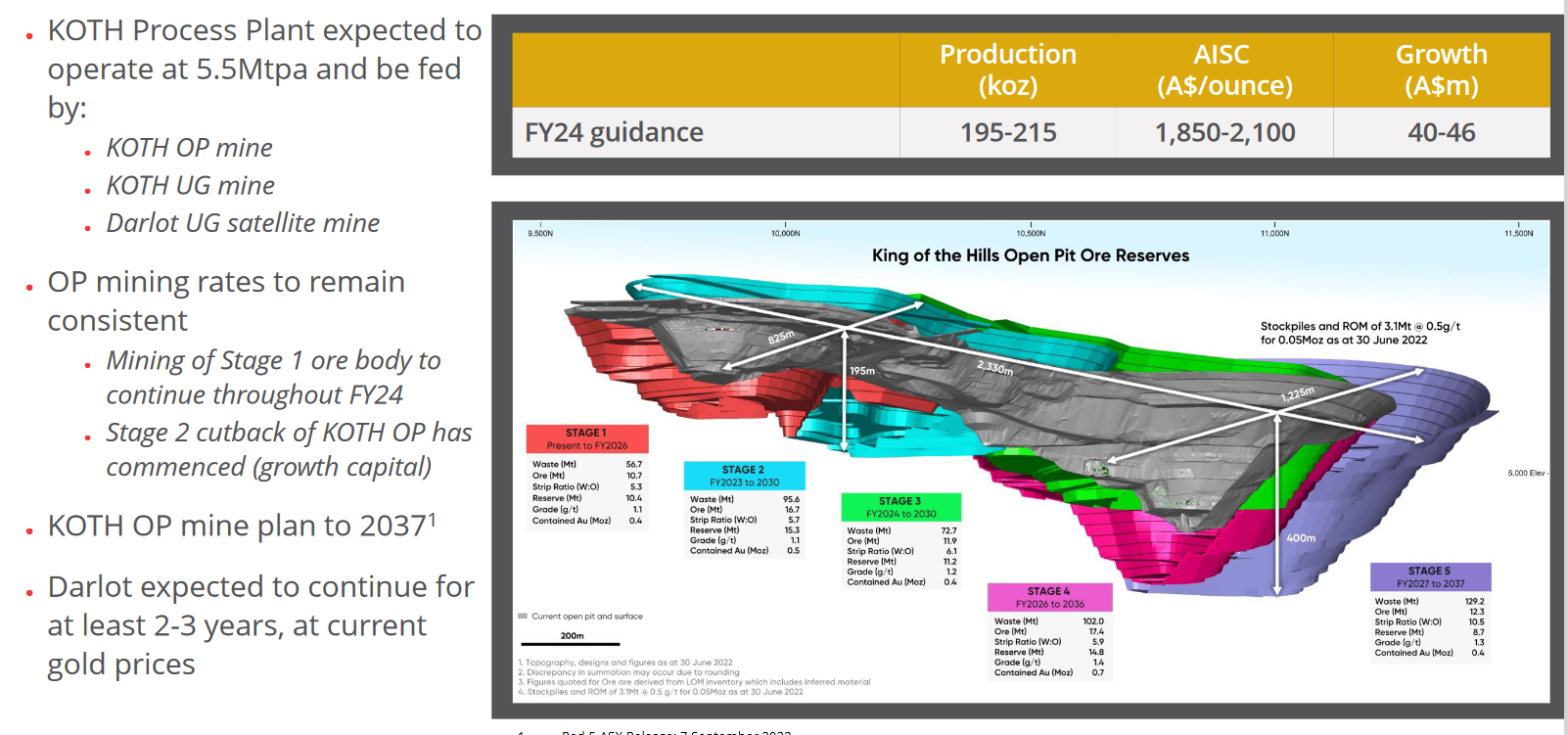

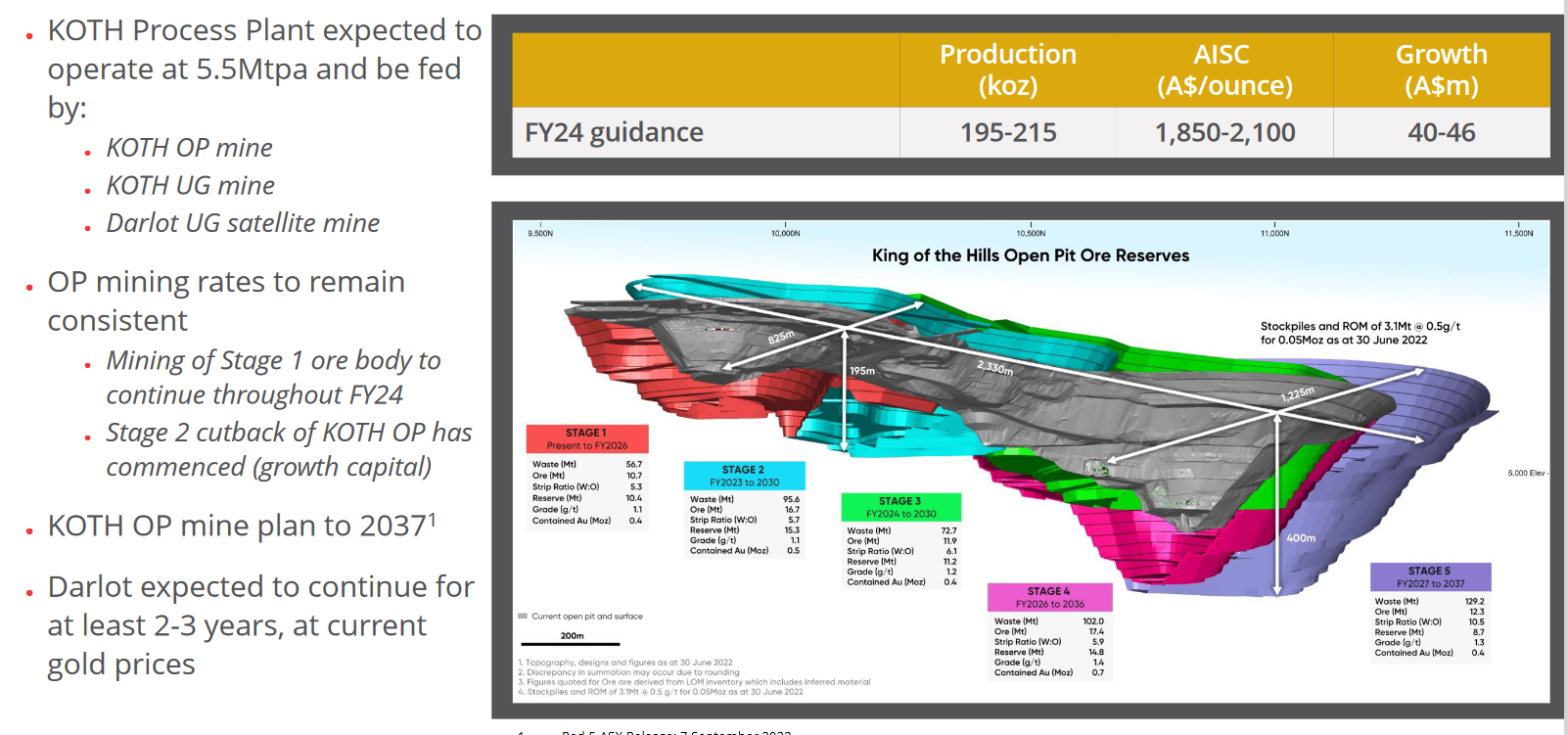

One negative is the cost of AISC ( around AUD 1837) due to the mix of Underground and Open Pit mining.

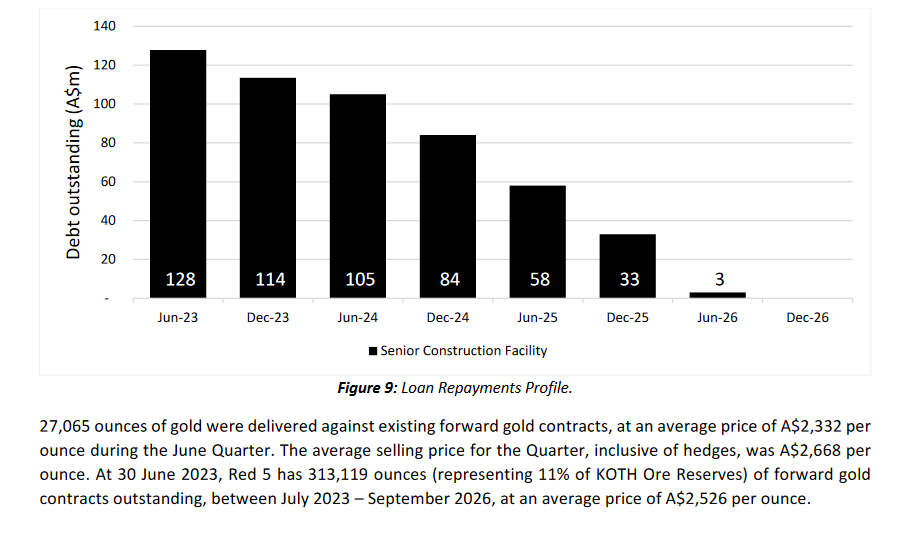

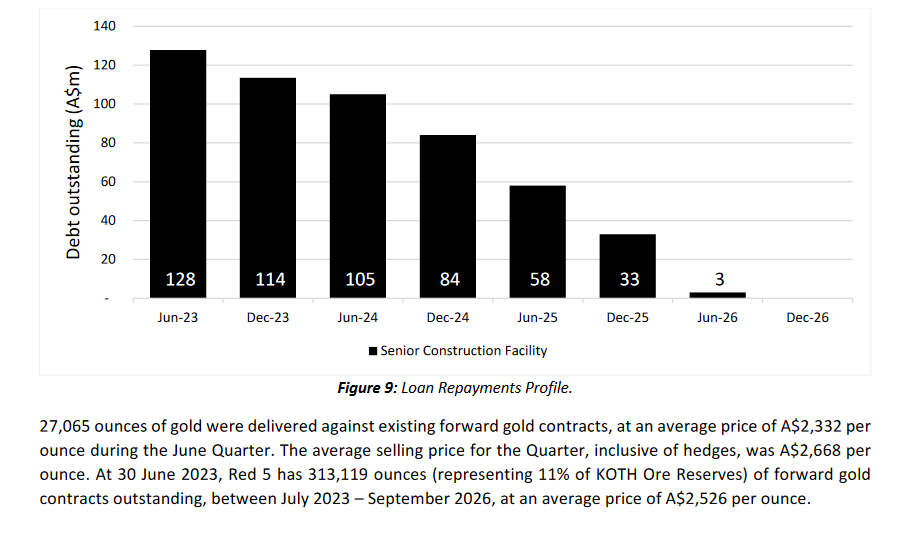

Another negative is the hedge book and debt.

Rough calc of the KOTH NAV is around $1.6bn AUD going by the AISC and average GP of $2860. This however does not include hedging or debt.

At the current market cap of $650m this seems materially undervalued but lots of things need to happen for a rerate a few being consistent production and cashflows and paying down debt quickly.