Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

There is gold>>

Net profit for the consolidated Group after income tax for the year ended 30 June 2025 was $237.0 million (30 June 2024: $5.4 million loss). The current period results include an unaudited underlying EBITDA1 of $619.4 million (FY24: $192.7 million).

Highlights of FY25 include:

• Full year FY25 gold sales of 385,232 ounces generated revenue of $1.43 billion. The Group posted a gross operating profit of $319.7 million

• Repayment and termination of the Red 5 project finance facility, and associated restructure of the hedging facility

• Delivery the King of the Hills process plant re-engineering study to increase throughput, reliability and lower costs under a two-stage expansion program to 7.5Mtpa

https://hotcopper.com.au/threads/ann-appendix-4e-and-fy25-annual-financial-statements.8722156/

Return (inc div) 1yr: 27.03% 3yr: 20.29% pa 5yr: 10.33% pa

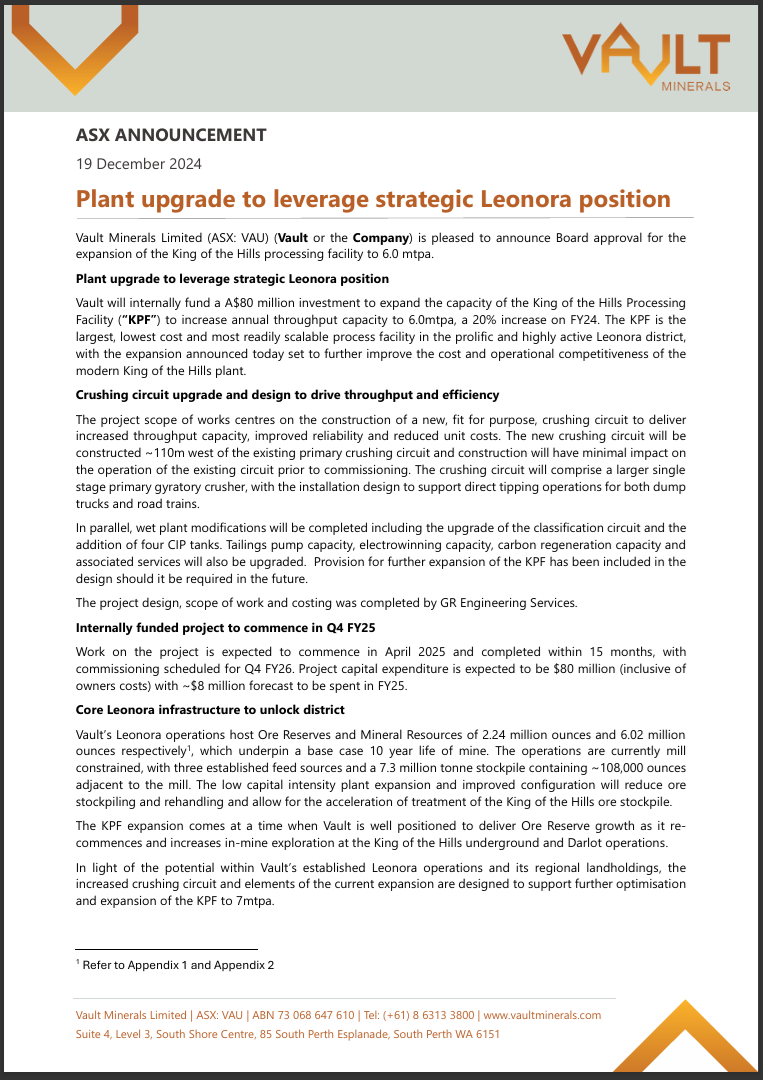

19-Dec-2024: Vault-(VAU)-Annoucement-Plant-upgrade-to-leverage-strategic-Leonora-position.PDF

That's the first page of that announcement. Click on the link above it to access the full announcement.

This actually makes a lot of sense IMO for Luke Tonkin and Vault, to (a) increase the value of VAU (Vault Minerals, the new name for the merged RED and SLR), (b) to piss off Raleigh Finlayson at GMD (Genesis Minerals) even further than he already has (which is a LOT), and (c) make it clear that Finlayson will either have to accelerate his plan to acquire VAU or else most probably have to pay more for VAU later.

The main things to know about Vault (VAU) is:

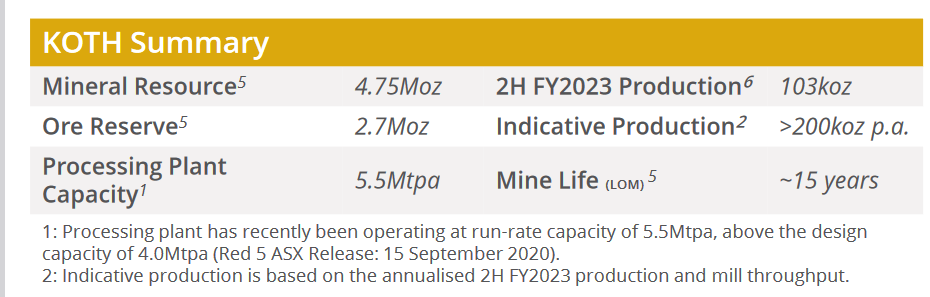

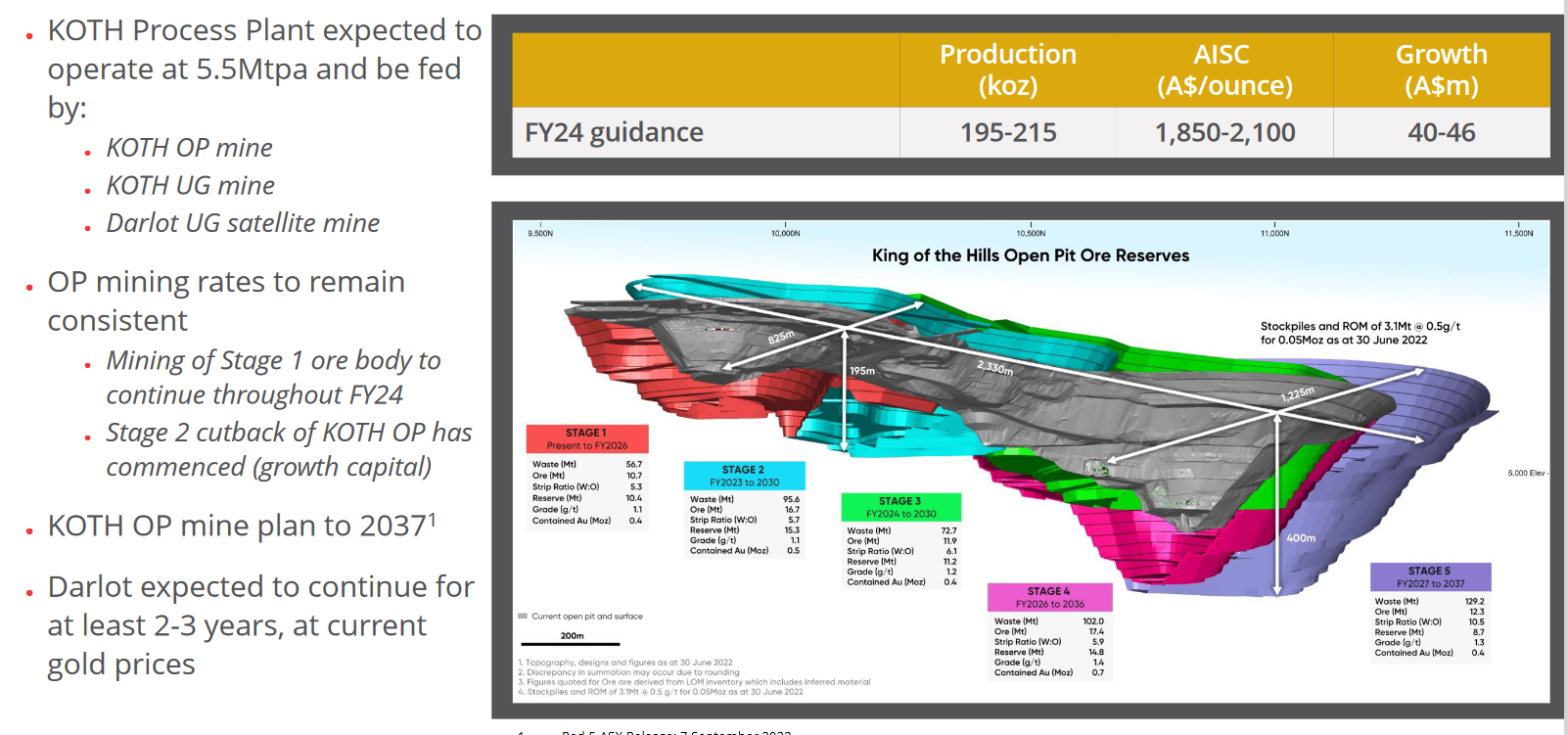

- KOTH (King of the Hills) is largely considered to be Vault's best asset, or at least their most strategically important asset, and the KPF (KOTH Processing Facility), i.e. the KOTH gold mill, is one of the largest capacity gold mills in the area already, with this announcement indicating that mill is now going to be expanded further, from 5 mtpa (million tonnes of ore per annum) to 6 mtpa;

- Vault describe their KOTH mill (KPF) as the, "largest, lowest cost and most readily scalable processing hub in the Leonora district" (source: https://vaultminerals.com/operations/leonora-operations);

- Raleigh Finlayson, the MD of GMD, has been very open about his desire to consolidate as much of the Leonora area's major gold assets as possible under Genesis Minerals' ownership, and the largest gold asset that Genesis does NOT already own in the Leonora area is KOTH (owned by VAU);

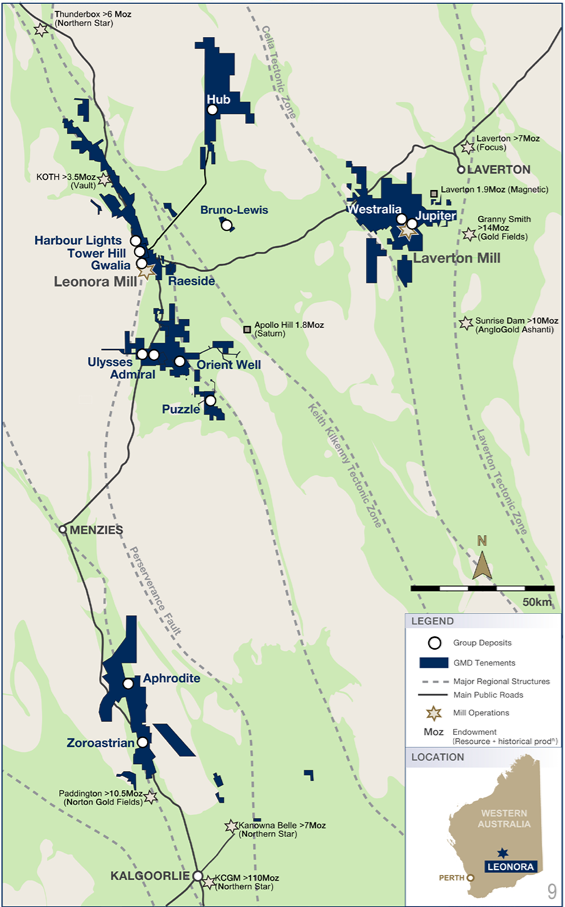

- GMD (Genesis Minerals) have land tenements on three sides of Vault's KOTH (see map below);

- It is going to be very difficult for Genesis to expand their Gwalia mill (called "Leonora Mill" on the map below) enough to allow for the simultaneous processing of ore from Gwalia (one of the world's deepest underground gold mines with ore now being extracted from around 2,000 metres below surface - i.e. 2 km vertical depth), Tower Hill, Harbour Lights, Raeside, Ulysses and Admiral, those last 5 being GMD's most developed projects to date outside of Gwalia which is already producing gold of course, or even from 3 or 4 of those;

- GMD don't need a second mill in the Leonora area right now, but they are going to at some point in the next few years, and KOTH's KPF (gold mill) would be perfect for that purpose, especially as it is easy enough to further upgrade to 7 mtpa ore processing capacity, as today's VAU announcement states, and the expansion would not be particulary expensive, with today's announced +20% capacity increase at KOTH (from 5 to 6 mtpa) expected to only cost Vault around $80 million, MUCH cheaper than building a new plant capable of anything approaching that sort of annual throughput capacity; and

- Luke Tonkin at Vault is a persistent thorn in Ral Finlayson's side, and he (Luke Tonkin, not to be confused with Stuart Tonkin, the MD of NST who is a much easier Tonkin to get along with) made Genesis' acquisition of St Barbara's (SBM's) Leonora assets in the middle of last year a friggin' nightmare, well, way more difficult than it might otherwise have been anyway, which I won't go into in great detail again now - I covered it well here at the time. Luke Tonkin, who was the MD of Silver Lake Resources at the time, had zero assets in the Leonora area, but still tried to bid against Genesis for those assets, stating that SLR wanted to own and further develop a brand new processing hub (for them) at Leonora. Genesis prevailed in that fight, however Luke didn't give up and he instead engineered a merger this year with RED (Red 5) who owned KOTH, where RED (the slightly larger market cap company at the time) acquired SLR, but the MD of RED agreed to leave the merged group and allow SLR's Luke Tonkin to take the top job at RED, which he did. LT then changed the name of the company to Vault Minerals (VAU) and now he's expanding the KOTH mill, which will only increase that asset's value, and that asset plus the KOTH gold deposit and surrounding VAU tenements is the only part of VAU that Ral at GMD wants to get his hands on.

Source: https://genesisminerals.com.au/our-assets/leonora-operations/

I should mention that the other GP (gold project) within that inner 50km-of-GMD's-Leonora-(Gwalia)-Mill circle above is Saturn Metals' Apollo Hill, however that one is lower grade gold that is close to surface and is expected to be developed into a large-scale heap-leach gold extraction operation more commonly used in the northern hemisphere than here in Australia, and is not suitable as mill feed for Genesis' Leonora or Laverton gold mills, mostly because of the grades, simple chemistry required to liberate the gold from the ore, and the distance of the project from the existing gold mills. Apollo Hill (and it's owner, Saturn Metals, STN.asx) are therefore either not in Raleigh Finlayson's sights as an acquisition target, or else are well down the list, so STN is not really a company that I expect to be acquired by Genesis any time soon.

Below is that same area as the above map, but expanded to show GMD's other 100%-owned gold development projects (Aphrodite and Zoroastrian) which are south of Leonora and closer to Kalgoorlie:

Source: Slide 9 of their 14th November 2024 AGM Presentation: https://gmd.live.irmau.com/pdf/a27ff2d3-d18f-4e73-81ad-ba84f08c2155/AGM-Presentation.pdf

And here are those projects on a map of WA:

Source: https://genesisminerals.com.au/our-assets/

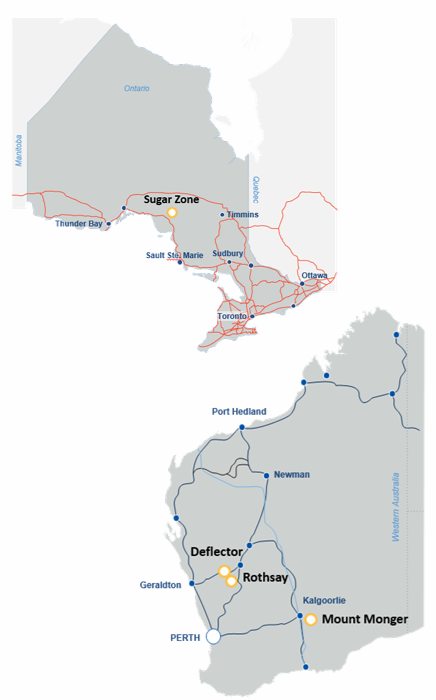

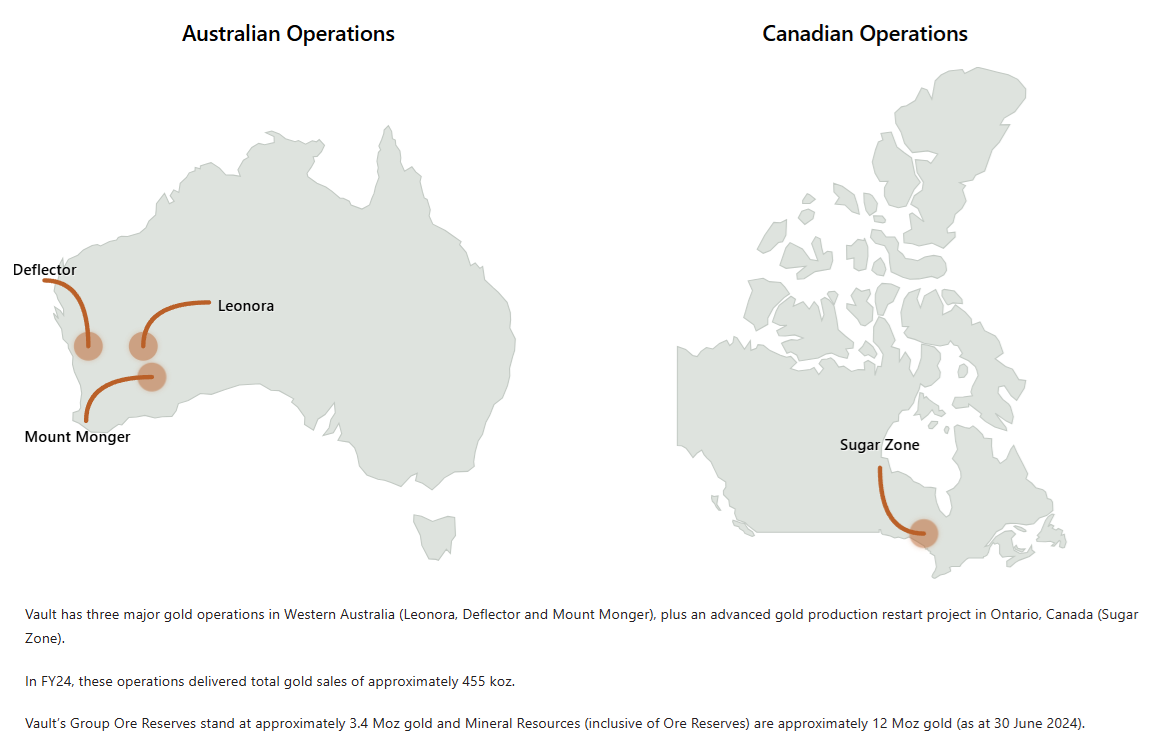

And here's what SLR owned prior to the merger with RED to form VAU:

Below is what they (now VAU) own now:

Source: https://vaultminerals.com/operations

The Sugar Zone Gold Project (SZGP or just Sugar Zone) in Canada is not currently a gold producing asset, and is reasonably immaterial to VAU's value. SLR acquired Sugar Zone in early 2022 via the acquisition of Harte Gold Corp which had gone broke; SLR were able to acquire the company and its assets through the Canadian CCAA process. The Canadian Companies' Creditors Arrangement Act (CCAA) is a statute that allows insolvent corporations to restructure their financial affairs and businesses so some value is hopefully preserved and creditors potentially lose less money.

Following its acquisition in early 2022, a period of investment was undertaken by SLR at Sugar Zone to upgrade the mining, processing and services infrastructure to a standard consistent with SLR's Australian operations. To enable completion of a 93,000m drilling program through FY24, including the development of three dedicated exploration drives, mining and processing activities at Sugar Zone were idled in August 2023.

Vault say on their website that internal studies are ongoing evaluating various production restart scenarios at ore throughput of approximately 0.30 - 0.35 Mtpa.

Source: https://vaultminerals.com/operations/sugar-zone

Because the asset (Sugar Zone) has relatively low value and is not producing any gold - and hasn't produced gold since August 2023 - I attribute little (no) value to it and regard Vault as an all-Australian gold miner, because at this point all of their gold is produced here in Australia.

I recently added VAU to my SMSF which already held GMD - with GMD being the larger position then and now - and VAU's share price has risen a little since then. I'm up a lot more on GMD, and they are the long-term position out of the two for me, with VAU being more of a trade both because they looked oversold at the time I bought them (the week after Trump won the latest election) and because I think it's inevitable that Genesis owns KOTH at SOME point in the future, probably sooner rather than later, and I can't see Luke Tonkin agreeing to let KOTH go unless Ral buys all of Vault (VAU).

It might not happen, but it is a very logical acquisition for Genesis and the only thing that is likely to get in the way - other than VAU's price at any given point in time - is the animosity between Raleigh Finlayson at Genesis and Luke Tonkin at Vault.

Another possibility is that a third party buys VAU and then that new owner sells KOTH to GMD, because Ral at GMD isn't interested in Vault's Mt Monger and Deflector gold production centres, or Sugar Zone, he only wants KOTH. If KOTH is NOT owned by GMD in 5 years' time I would be very surprised is all I'm saying.

Above: Luke Tonkin, CEO & MD of Vault Minerals (VAU).

Below: Raleigh Finlayson, CEO & MD of Genesis Minerals (GMD).

Both VAU and GMD have substantial cash and zero net debt, however to date Genesis has been streets ahead in terms of their track record of competent and value-accretive M&A and other capital allocation decisions, and I'm considering Vault (VAU) in terms of SLR as well coz Luke Tonkin ran SLR before Vault and SLR's assets are now owned by Vault.

This announcement today however is a good one for Vault, IMO, and is a good capital allocation decision by Luke Tonkin, as rare as that is.

Disclosure: I hold GMD and VAU in my SMSF. I also hold GMD here on SM and in a second real-money portfolio.

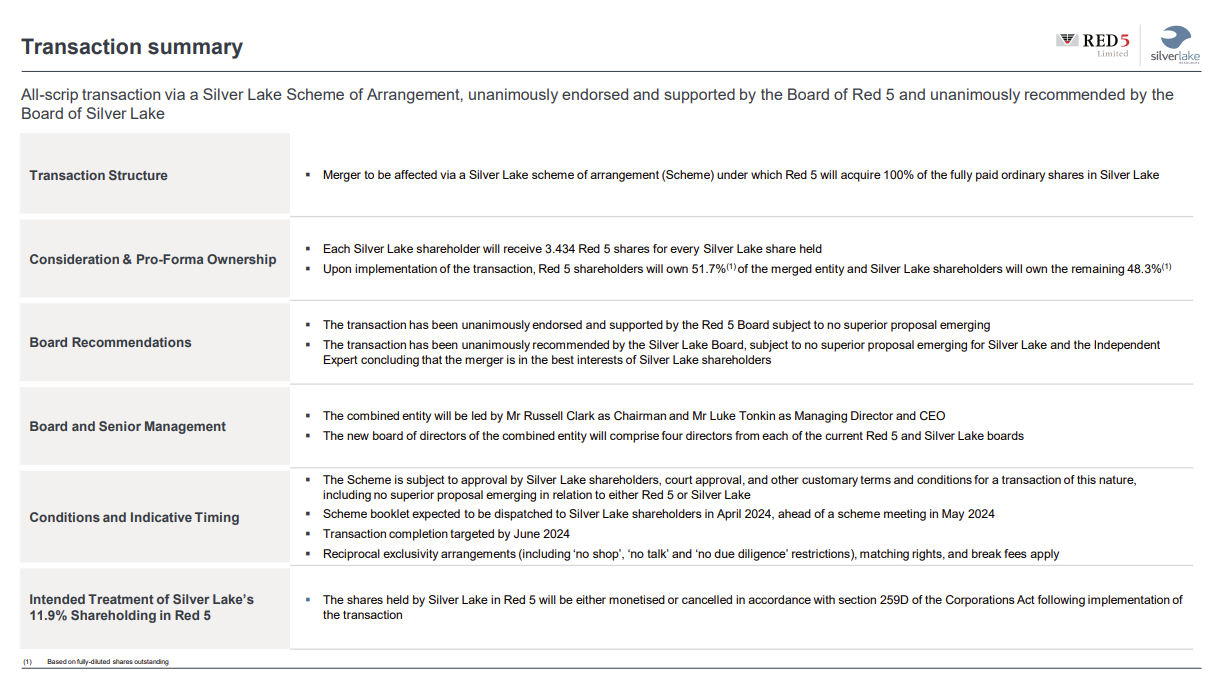

05-Feb-2024:

Here's what the MoM boys had to say about it all today in their podcast:

Red5 Dangles the Carrot for Genesis in $2.2Bn Merger with Silver Lake | Daily Mining Show - YouTube

Chapters:

0:00:00 Preview

0:00:00 Introduction

0:01:08 Silver Lake's alternative marketing strategies

0:07:02 Red 5 MERGING with Silver Lake Resources

0:43:00 Potential Lynas and MP Materials merger

0:44:29 Centaurus get Environmental approvals

0:45:09 Silvercorp/Orecorp update

0:45:36 New Copper producer on the ASX

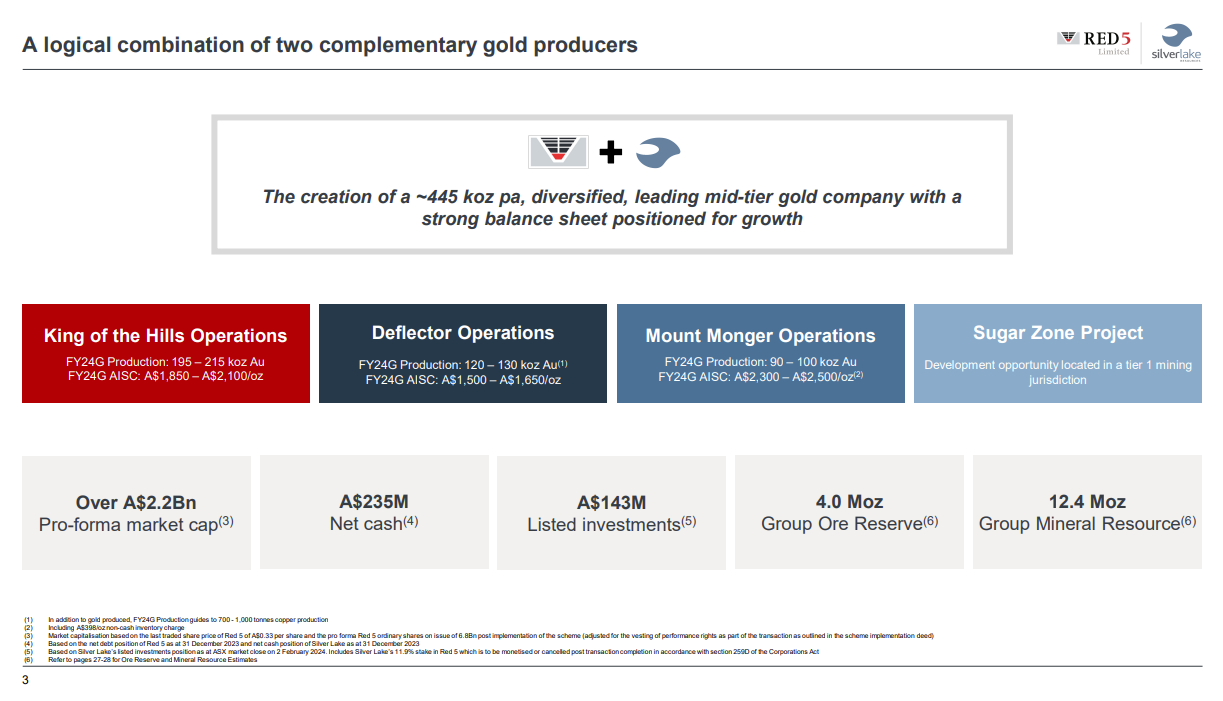

The short version:

The best thing about SLR is their large cash balance. The worst thing about RED is their debt and lack of cash, and to a lesser extent their out-of-the-money hedgebook. Putting the two companies together certainly makes sense for RED, as they need SLR's cash, and SLR will have better prospects to spend their cash on than they appear to have currently - in terms of exploration spending in highly prospective areas. And it will frustrate the hell out of Raleigh Finlayson at Genesis (GMD) who wants Leonora all to himself (or within his company, Genesis Minerals). Luke Tonkin might not have stopped the Gwalia sale from going through (from SBM to GMD), but he might just end up with RED, unless this deal gets trumped by Raleigh/GMD with a better deal.

For my longer post about this in the "Gold as an investment" thread - click here.

Luke Tonkin, above, the MD/CEO of SLR, will keep his job and be the MD/CEO of this larger new merged entity if the scheme is implemented and RED acquire SLR. RED's current MD, Mark Williams (pictured below), and RED's CFO, David Coyne, will both lose their jobs.

Below, RED's KOTH mill and underground mine:

Red 5 KOTH goes back underground - Australian Mining [7-Apr-2022]

Disc: I do not hold RED or SLR shares. I hold GMD shares, who may also be interested in RED, as I discussed here earlier tonight.

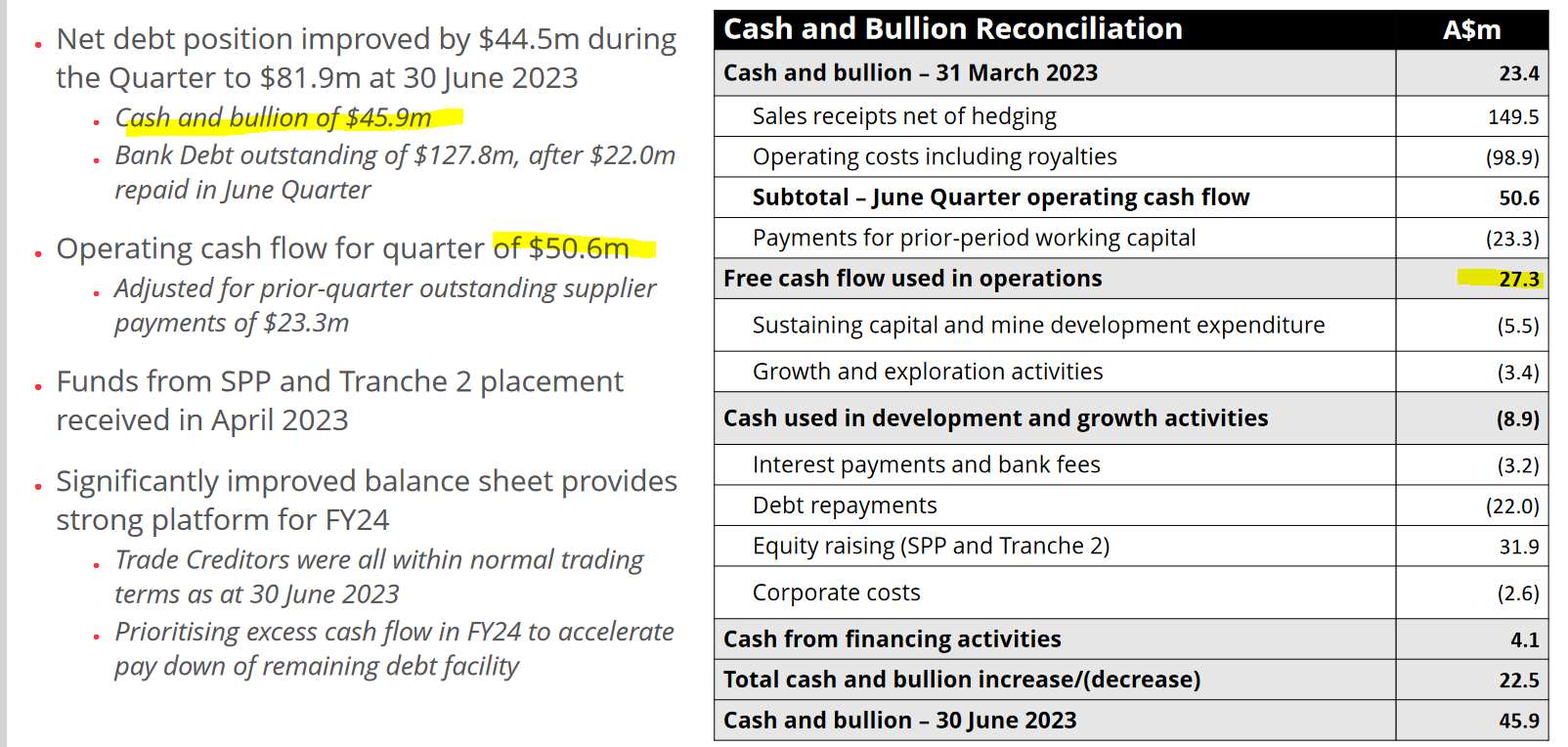

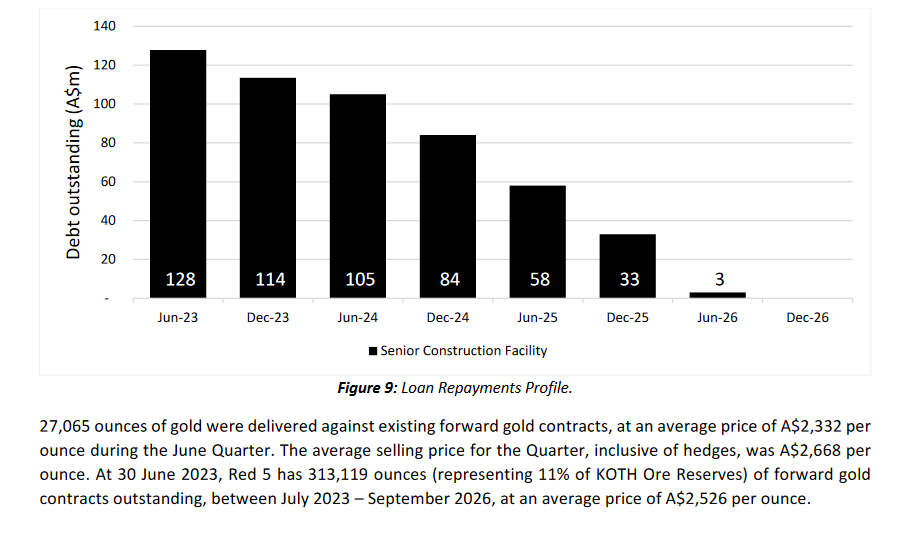

Some good news but a long road ahead. Still about 10 quarters of debt to pay if they keep going at this rate. So RED5 won't be debt free until maybe end of FY24. No update on that huge hedge book or whether they delivered some ounces into the hedges

Red5 up 11% to 0.295 and outperforming the rest of the gold sector. Approaching all time highs.

Wish I had this in my RL portfolio instead of my comp one.

Much of the recent share price action coming from strategic investment from SLR

Or maybe it could mean something more? Potential takeover perhaps after failing to acquire SBM's leonora operations?

Silver Lake Resources Limited (“Silver Lake” or the “Company”) wishes to advise that it has acquired approximately 383 million shares in ASX listed gold producer, Red 5 Limited (“Red 5”). The purchase represents approximately 11% of Red 5’s issued capital.

The acquisition of the holding in Red 5 is considered a strategic investment. Red 5 owns the King of the Hills operation and has an established broader footprint in the Leonora district in Western Australia. Silver Lake’s significant organically generated cash balance and forecast free cash flow provides it with the ability to move quickly on opportunities as and when they arise. Silver Lake will continue to make investment decisions and deploy capital into organic and external opportunities, consistent with its stated strategy to become a larger, lower cost and longer life business.

Although I don't look at gold miners that much, I can't ignore that Red5 looks like the only gold stock that has not followed the fall in the price of gold

However Red5 is working from a low base

Probably one reason is that they had positive operating cashflow for the quarter

The reserve size of KOTH is also double the size of Karlawinda

One negative is the cost of AISC ( around AUD 1837) due to the mix of Underground and Open Pit mining.

Another negative is the hedge book and debt.

Rough calc of the KOTH NAV is around $1.6bn AUD going by the AISC and average GP of $2860. This however does not include hedging or debt.

At the current market cap of $650m this seems materially undervalued but lots of things need to happen for a rerate a few being consistent production and cashflows and paying down debt quickly.

16-Dec-2022: Commercial-production-declared-at-King-of-the-Hills.PDF

RED have provided an operational update and some production guidance for H2 of FY2023.

Their SP is currently unchanged at 18 cps. That's actually a decent outcome on a poor day for the market and the gold sector, with the entire sector either down or flat, except for the two non-currency-hedged physical gold ETFs (GOLD & PMGOLD) being slightly up. Many of the producers are down between 2 and 5%, and yesterday was also a day of mostly red. Not a good week for the sector.

As I said when Pantoro (PNR) announced their first gold pour at Norseman recently, these minor milestones are good, but they don't tend to cause massive positive reratings. What will be far more important for RED is the reliability and production numbers at KOTH over the first year of production. The market will be looking for them to hit or beat their ownn guidance obviously, and for no major problems to develop at King of the Hills (KOTH).

Disclosure: I do not hold RED shares, although a good number of my holdings are in the Red today.