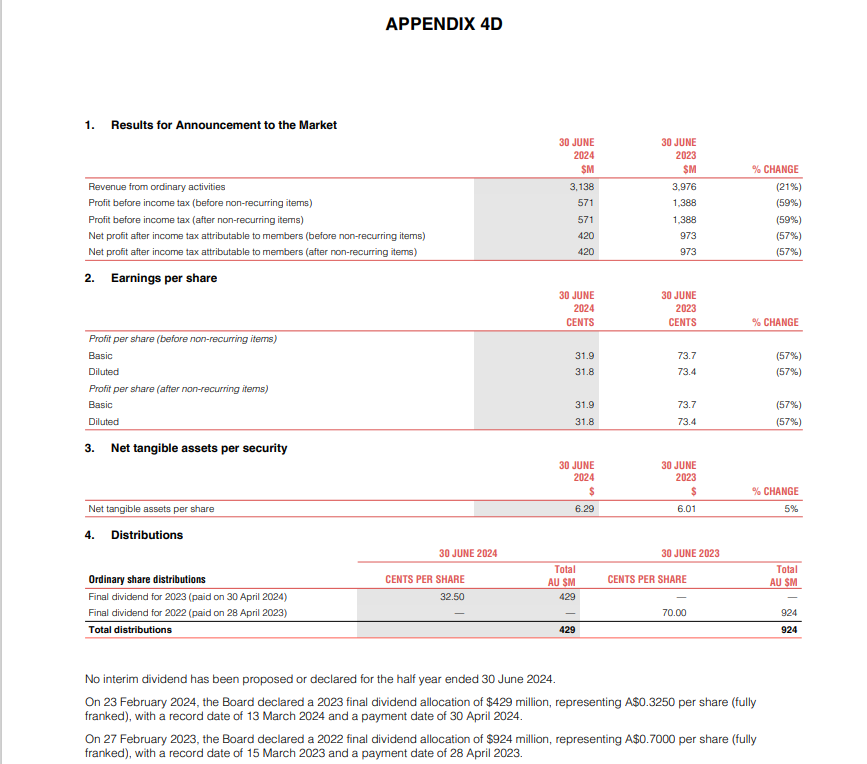

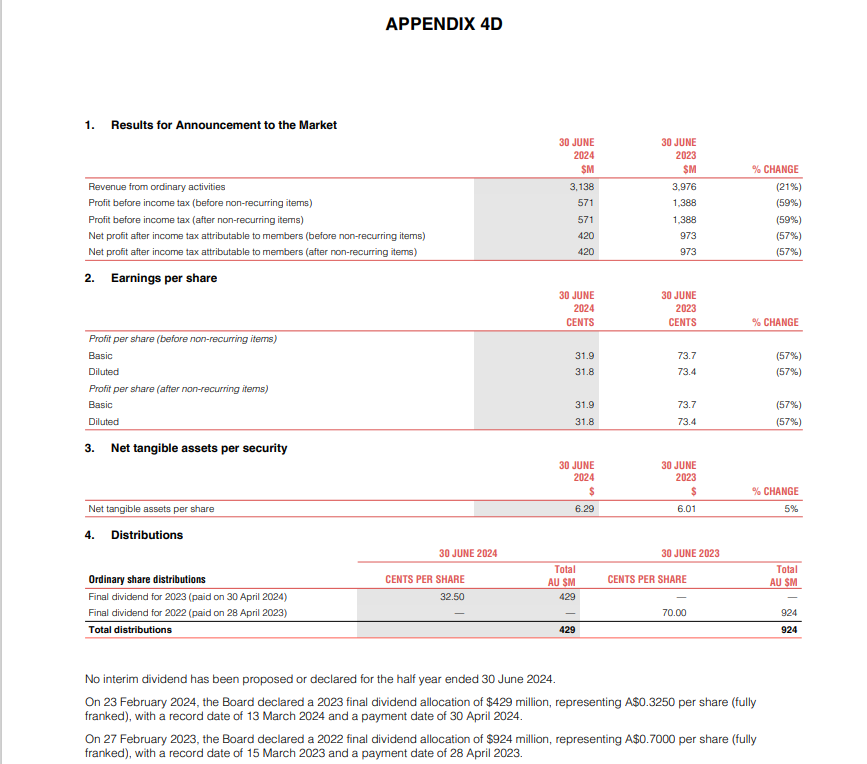

No interim dividend has been proposed or declared for the half year ended 30 June 2024.

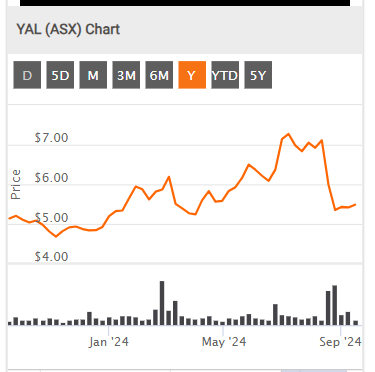

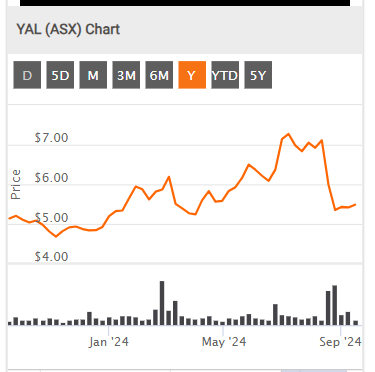

Share price went down in August when YAL report said about the Profit loss...

EPS down : 57%

The Group’s coal sales revenue is typically recognised on a Free on Board (“FOB”) basis when coal is loaded at the load port in Australia.

REVENUE HALF-YEAR ENDED 30 JUNE 2024 2023 CHANGE $M $M (%) Ex-mine coal sales10 2,980 4,003 (26%) Sale of purchased coal 47 (154) (131%) Other 3 4 (25%) Sale of coal 3,030 3,853 (21%) Sea freight 44 42 5% Royalty revenue 12 12 —% Other 13 17 (24%) Revenue 3,099 3,924 (21%) Total revenue decreased by 21% from $3,924 million in 1H 2023 to $3,099 million in 1H 2024 primarily due to a 21% decrease in coal sales revenue from $3,853 million in 1H 2023 to $3,030 million in 1H 2024. With respect to the decrease in coal sales revenue,

YAL have good Governance: Governance is rigorous .... must be the computer / AI related!!

GOVERNANCE Yancoal has developed rigorous governance processes to drive its Sustainability performance across the business. The Enterprise Risk Management framework is a key platform and includes the assessment and mitigation of material business risks, including social and environmental risks and the risks associated with climate change and the progressive transition to a lower carbon economy.

The HSEC Charter includes oversight of compliance with modern slavery regulations as a responsibility of the HSEC Committee. This will increase the governance and supervision of Yancoal's modern slavery risk.

The Board has ultimate responsibility for the oversight and approval of risk management and financial investment decisions, including those relating to climate change.

The Board regularly considers how climate change may affect physical, regulatory, commercial, and operating environments. These considerations inform the development of medium-tolong-term goals and strategies.

YAL summary:

Financial Performance:

- Revenue: The revenue decreased by 21%, from $3,976 million in the first half of 2023 to $3,138 million in 2024, mainly due to lower coal prices globally.

- Profit: Net profit after tax also decreased by 57%, from $973 million to $420 million.

- Earnings Per Share: Basic earnings per share dropped significantly by 57%, from 73.7 cents to 31.9 cents.

- Dividends: No interim dividend was declared for the half-year ended June 2024.

2. Coal Production:

- Saleable Production: There was a 16% increase in saleable coal production, reaching 21.6 Mt (million tonnes), compared to 18.6 Mt in 2023.

- ROM (Run-of-Mine) Production: This increased by 7%, from 26 Mt to 27.9 Mt, demonstrating improved operational efficiency.

- Coal Sales Volume: Total coal sales volume rose by 17%, driven by an 18% rise in attributable saleable production.

3. Market and Pricing:

- Thermal Coal: Sales revenue of thermal coal fell due to a 39% drop in average selling price from A$256 to A$156 per tonne.

- Metallurgical Coal: Sales revenue also decreased, as the selling price fell by 18%, from A$389 to A$319 per tonne.

- China and Japan: Significant shifts in export revenue destinations, with a notable increase in sales to China, from 15% to 33% of total coal sales revenue, and a decrease in revenue from Japan.

4. Operational Challenges and Improvements:

- Weather Conditions: Drier weather in 2024 enabled improved coal production, following challenges due to rain in 2023.

- Cost Control: Average operating costs per tonne decreased by 7%, from A$109 to A$101, helped by higher production volumes.

5. Environmental and Regulatory Factors:

- The report discusses Yancoal's focus on reducing emissions, improving environmental management, and complying with Australian and state-level regulations related to emissions reduction.