Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

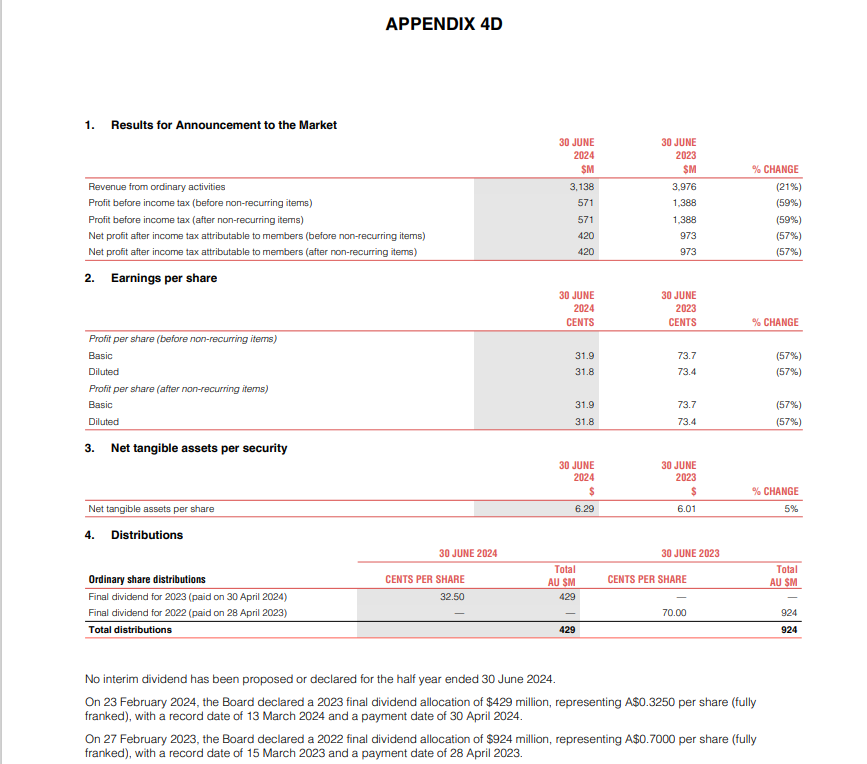

No interim dividend has been proposed or declared for the half year ended 30 June 2024.

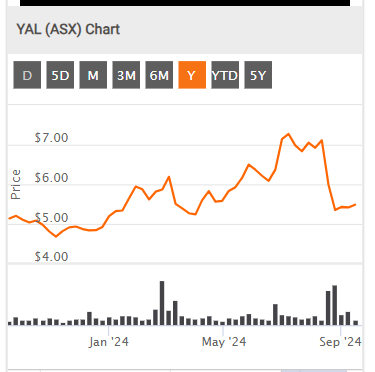

Share price went down in August when YAL report said about the Profit loss...

EPS down : 57%

The Group’s coal sales revenue is typically recognised on a Free on Board (“FOB”) basis when coal is loaded at the load port in Australia.

REVENUE HALF-YEAR ENDED 30 JUNE 2024 2023 CHANGE $M $M (%) Ex-mine coal sales10 2,980 4,003 (26%) Sale of purchased coal 47 (154) (131%) Other 3 4 (25%) Sale of coal 3,030 3,853 (21%) Sea freight 44 42 5% Royalty revenue 12 12 —% Other 13 17 (24%) Revenue 3,099 3,924 (21%) Total revenue decreased by 21% from $3,924 million in 1H 2023 to $3,099 million in 1H 2024 primarily due to a 21% decrease in coal sales revenue from $3,853 million in 1H 2023 to $3,030 million in 1H 2024. With respect to the decrease in coal sales revenue,

YAL have good Governance: Governance is rigorous .... must be the computer / AI related!!

GOVERNANCE Yancoal has developed rigorous governance processes to drive its Sustainability performance across the business. The Enterprise Risk Management framework is a key platform and includes the assessment and mitigation of material business risks, including social and environmental risks and the risks associated with climate change and the progressive transition to a lower carbon economy.

The HSEC Charter includes oversight of compliance with modern slavery regulations as a responsibility of the HSEC Committee. This will increase the governance and supervision of Yancoal's modern slavery risk.

The Board has ultimate responsibility for the oversight and approval of risk management and financial investment decisions, including those relating to climate change.

The Board regularly considers how climate change may affect physical, regulatory, commercial, and operating environments. These considerations inform the development of medium-tolong-term goals and strategies.

YAL summary:

Financial Performance:

- Revenue: The revenue decreased by 21%, from $3,976 million in the first half of 2023 to $3,138 million in 2024, mainly due to lower coal prices globally.

- Profit: Net profit after tax also decreased by 57%, from $973 million to $420 million.

- Earnings Per Share: Basic earnings per share dropped significantly by 57%, from 73.7 cents to 31.9 cents.

- Dividends: No interim dividend was declared for the half-year ended June 2024.

2. Coal Production:

- Saleable Production: There was a 16% increase in saleable coal production, reaching 21.6 Mt (million tonnes), compared to 18.6 Mt in 2023.

- ROM (Run-of-Mine) Production: This increased by 7%, from 26 Mt to 27.9 Mt, demonstrating improved operational efficiency.

- Coal Sales Volume: Total coal sales volume rose by 17%, driven by an 18% rise in attributable saleable production.

3. Market and Pricing:

- Thermal Coal: Sales revenue of thermal coal fell due to a 39% drop in average selling price from A$256 to A$156 per tonne.

- Metallurgical Coal: Sales revenue also decreased, as the selling price fell by 18%, from A$389 to A$319 per tonne.

- China and Japan: Significant shifts in export revenue destinations, with a notable increase in sales to China, from 15% to 33% of total coal sales revenue, and a decrease in revenue from Japan.

4. Operational Challenges and Improvements:

- Weather Conditions: Drier weather in 2024 enabled improved coal production, following challenges due to rain in 2023.

- Cost Control: Average operating costs per tonne decreased by 7%, from A$109 to A$101, helped by higher production volumes.

5. Environmental and Regulatory Factors:

- The report discusses Yancoal's focus on reducing emissions, improving environmental management, and complying with Australian and state-level regulations related to emissions reduction.

- Release Date: 19/08/24 18:58 An awkward accouncement released after Hrs..

- YAL share price at Open could tank..

Revenue of $3.14 billion, compared to $3.98 billion in 1H 2023;

the 37% decrease in realised coal price to A$176 per tonne1 exceeded the benefit of a 17% increase in attributable coal sales

Operating cash costs of $101 per tonne (exc. Government royalties), closely linked to the production volumes and inflation factors

Profit Before Tax down (59%) Ouch!!!!, Below:

* The 2024 guidance is for 35-39 million tonnes of attributable saleable production.

Outlook:

Greg Fletcher. I am the Co-Vice Chairman, an Independent Non-executive Director of Yancoal, and Chair of the Audit and Risk Management Committee

This year, we aim to produce at a level similar to the second half of 2023. The 2024 guidance is for 35-39 million tonnes of attributable saleable production. Output will vary quarter-to-quarter due to mine plan sequences, longwall moves and planned maintenance, and there will be a second half weighting to the production profile.

We aim to bring the cash operating costs per tonne down from the full-year 2023 level, and are focused on output given the direct relationship between the volumes we produce and the per tonne cash operating costs we report.

We have guided to Cash operating costs of $89/tonne - $97/tonne. Overall, it was another very strong performance by Yancoal in 2023. We finished the year with great operational momentum and a very strong financial position. That completes the 2023 review, I would like to hand back to Greg Fletcher for the remainder of the meeting.

We have distributed to shareholders A$2.5 billion of unfranked and A$1.8 billion of fully franked dividends since 2018.

Return (inc div) 1yr: 54.28% 3yr: 74.02% pa 5yr: 29.40% pa

Ex Divi: 5th Sept 2024 , Gross Div: 15.37%

5Yr Coal price

Dividends: The resource seactor generally been good. Will have to reduce the'payout Ratio'

Free Cash flow is drying up:

Recalibrate the business!

... ..........................

March Quarter 2024 (1Q 2024) A$180/t average realised coal price.

$260 million increase in cash holding.

$1.66 billion cash balance at 31 March 2024.

1 14.0Mt ROM coal production (100% basis). 11.3Mt Saleable coal production (100% basis).

8.8Mt Attributable saleable coal production.

8.3Mt Attributable coal sales

The overall realised coal price declined 8% from 4Q 2023, comprising a 12% decline in the realised thermal coal price and a 14% uplift in the realised metallurgical coal price. The realised thermal coal price was in line with coal index trends while the realised metallurgical coal price was better than the relevant indices due to higher priced carryover being supplied within the period.

But for the holders:

The company retains a strong financial position. We held $1.66 billion in cash at the end of March. Of this sum, $429 million goes to paying the fully franked 2023 Final dividend (A$0.325/share) on 30th April.

outlook 2024

No BIG graphics of the Revenue.. Because - Revenue 2023 3,976m VS 2022 4,879m down (20%)

But the dividend payment today is 37cps ( annually 107cps ) (Better than Spodumene!!!)

Divi' penciled in a Forecast 2024 annual 132cps so plenty of cash flow.

@wtsimis while the coal theme.

YAL annual dividend: 107cps

Share price at close: 514cps

= 20.82%pa

100%franked

Ex Dividend date: 5/9/2023

Ex Dividend: 5/9/2023

While looking at Dividends

https://strawman.com/reports/WHC/wtsimis

#wtsimis

2023 Interim dividend allocation is $489 million, A$0.3700/share (fully franked).

• The ~A$1.23/share 2022 Total dividend was a 20% dividend yield on the A$6.06/share year end share price.

• Franking credits of $1.4 billion available at 30 June 2023 for subsequent reporting periods, prior to the proposed $489 million interim dividend, assuming an income tax rate of 30%

Get the Dividend still time: Forecast Ex Div Date: 05/09/2023 (19 days away)

The Important Stuff below:

Trend is up:

They need coal..Burn, Burn..

Return (inc div) 1yr: 16.63% 3yr: 53.09% pa 5yr: 14.96% pa

Yancoal is currently trading on trailing PER of 2.3. However, coal prices are moderating..

Board policy is to pay out at least 50% of profit / cashflow as dividends. So the dividend yield is running above 20%.

Valuation of reserves: 3700 Million Tonnes (assumed 60% of resource is mineable). EV @ $1 per Tonne of coal. The market appears to be discounting about 90% of the resource.

Net tangible assets as at June 30, 2022: $5.11 per share.

NTA as at December 31, 2022: $6.03

Based on median Met coal of USD $188/ Tonne, and thermal coal of USD $150/Tonne, and total production cost of AUD $147 / Tonne, I come up with EPS of $1.49. At a PER of 5, I come up with a valuation of $7.40.

I am splitting the difference between NTA and median guidance of $1.49 EPS.

Key takeaways:

- Saleable production of 29.4 Mt, down from 36.7 Mt in the prior year.

- Avg realised sale price of $387 / Tonne, vs $141 / tonne prior year.

- Revenue : $10.5 billion, up from %5.4 Billion in prior year.

- NPAT: $3.5 billion or $2.70 per share

- Final Dividend: 70 cents per share fully franked.

Outlook:

- 2023 sales production guidance of 31-36 Mt.

- Operating cash costs: $92-102 / Tonne.

- Capital expenditure of $750 - 900 million.

Coal prices:

Yancoal assessment of coal prices going forward is:

- US$69-$239 / Tonne for thermal

- US$136-$240 / Tonne for metallurgical

The above estimate is based on the 2015 Paris Agreement, which indicates coal demand to be as follows:

- Seaborne demand for thermal coal to remain steady to 2024, then declining by 33% over the period to 2040.

- Seaborne metallurgical demand for metallurgical coal will actually increase up to 2040.

DISC - HELD

@Rapstar, I too think Yancoal is cheap (and tempting with its current valuation). That said, management don't exactly have a sparkling good track record and this business simply isn't managed as well as New Hope and Whitehaven. I think this is the main reason its cheap; it is mediocre alongside its competitors.

Their previous comments also suggest a shift away from coal. Part of what makes New Hope beautiful is their conservative management team: they are sensible capital allocators and have demonstrated that they actually give a shit about their shareholders -- large and small. New Hope management shouldn't and won't do something silly, like acquire a random iron ore mine in Mozambique (tongue in cheek here, but you get my point). I can't say the same for Yancoal; management worry me. So despite the attractive valuation, this one is a no for me.

There currently is a significant disparity in thermal coal prices, as indicated below:

- Newcastle Thermal coal, 6000kCal price per Tonne: $421 USD (Sept. 30 2022)

- API5, 5500kCal price per Tonne: $195 USD (Sept. 30 2022)

The 2021 YAL Annual report stated the majority of YAL thermal coal is sold on contracts linked to the API5 5500 kCal index..

However, in 2021, Yancoal implemented a "hard wash" strategy to reduce the ash content of its API5 coal in order to upgrade a portion of it to Newcastle Thermal coal 6000kCal grade. The hard wash strategy added $2 / Tonne production cost to the API5 coal in question (reported in 2021 AR), and is generating a remarkable return in the process.

Despite the Q3 2022 quarterly report stating that the majority of thermal coal is sold under the API5 5500 kCal index, the actual prices achieved reveal 62% of thermal coal was sold under the Newcastle Thermal coal, 6000kCal index price in Q3 2022.

I believe the market is misunderstanding the value of Yancoal's reserves, and its ability to generate higher returns through its "hard wash" strategy.

DISC - HELD.

Chinese authorities are said to be considering a partial end to the Australian coal ban

News article here