Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I’m relatively new to ABV. It’s one of my 2026 picks and I have a relatively small holding IRL. Perhaps I should have allocated more to ABV looking at the Q2FY26 report! Very impressive! Sales up 34%, NPBT up 191%, Gross margins 48.% and cash in the bank. I’m guessing these figures might be lumpy and the market might already has factored in high expectations for the business. Nevertheless, I’m pleased to see the business is building momentum and performing exceptionally well.

December 2025 Quarterly Activities Report and Appendix 4C

Summary of Reporting Highlights:

• Product Sales Revenue of $5.6m for Q2 FY26, up 34% on prior corresponding period (pcp)1

• Reported NPBT for Q2 expected to be $0.35m, up 191% on pcp demonstrating strong operating leverage in the business

• Achieved Gross Margins of 48.3% for Q2

• Continuing to grow ABT install base of Failsafe safety systems,internationally

Perth, Australia: Advanced Braking Technology Ltd (ASX: ABV) (‘ABT’ or ‘the Company’ or ‘the ABT Group’) is pleased to report its quarterly activities report for the period ended 31 December 2025 (Q2).

Q2 saw a continued strategic emphasis on international market penetration, leveraging ABT’s reputation as a key provider of safety-critical braking solutions for the global mining industry.

Domestically, ABT achieved +70% growth in sales revenue in Q2 supported by continuing strong pipeline including a mandate for FailSafe brakes from MMG Dugald River, one of the world's top 10 zinc operations, located in Queensland.

Reported NPBT in Q2 is expected to be $0.35m, representing 191% growth on pcp. The Q2 NPBT result was achieved via increased revenue while also optimising operating cost management throughout the period.

Financial Commentary (versus previous corresponding period)

Reported revenue increased by 34% versus pcp and product sales included light and heavy vehicle brake systems as well as spares and consumables.

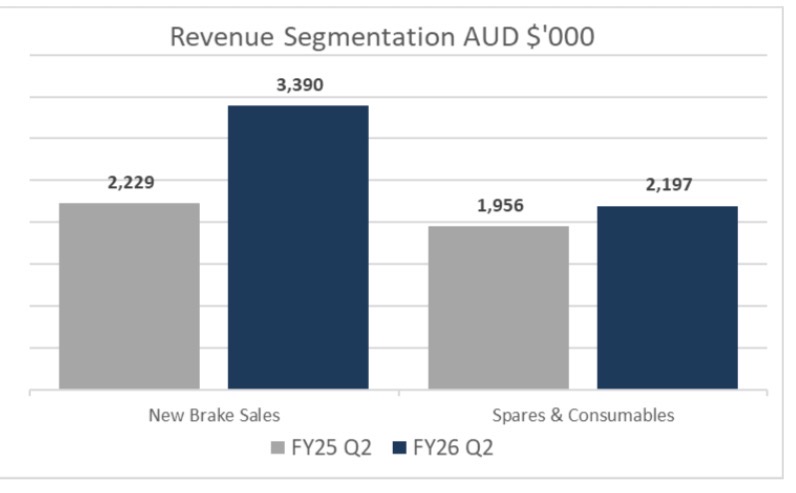

New Brake revenue increased 52%, driven by strong customer uptake and continued expansion of the install base.

Spares & Consumables grew 12%, supported by ongoing maintenance demand and utilisation across the installed fleet.

Cash & Cash Equivalents at the end of the period were $4.14m, representing a 44% increase vs FY25 end balance of $2.88m, and an increase of 76% on the previous corresponding period in FY25. The cash balance included the receipt of the $0.57m Research and Development tax incentive (RDTI) for the FY24 period during the quarter.

The Company’s strong liquidity position, effective working capital management and strong financial performance supported the decision to not renew the existing trade finance facility which expired on 31 October 2025.

The Company’s Managing Director and Chief Executive Officer, Andrew Booth, commented on the Q2 performance saying:

"ABT has commenced FY26 with strong momentum, demonstrating our ability to convert our strategic roadmap into robust financial performance, and the growth in products sales revenue is a testament to the growing global demand for our safety-critical braking solutions.”

“Whilst our strategic focus on international market penetration is yielding significant results, our domestic performance remained strong during the quarter. The securing of a mandate for our FailSafe brakes from MMG further validates our reputation within the Tier-1 mining sector.”

“Financially, the business is leaner and more efficient. We achieved a 191% increase in NPBT by pairing record sales with disciplined operating cost management. ABT’s balance sheet has never been stronger, with cash reserves growing to $4.14m, and we are well-positioned to fund our ongoing growth and innovation through our strong operational cash flows.”

This release is authorised by the Board of Directors.

- ENDS -

Another excellent quarterly activities report from Advanced Breaking Technology, a business which seems to have a lot of positive momentum.

Their sales revenue for Q2FY26 was $5.6m up 34% on pcp and NPBT was $0.35m up 191% as they continue to leverage into profitability. Of note to me is the administration and corporate costs decreased this quarter compared with last quarter by 16%.

New brake revenue increase by 52% verses pcp which is a good leading indicator for spares and consumables (spares and consumables were 45% of revenue in FY25).

Cash and cash equivalents was $4.14m for Q2FY26 up 44% verses FY25 end and up 76% on pcp.

ABV clearly have a product that is generating sales interest and a capable management steering the business.

Happy to hold this one.

Guessing out to FY29, key question for me is - as they scale their revenue can they improve margin. Currently 6% NPAT margin, excluding R&D credit but with no tax paid.

- Bull, 20% revenue growth, 15% NPAT margin

- Base, 15% revenue growth, 10% NPAT margin

- Bear, 10% revenue growth, 6% NPAT margin

Assuming 3% share dilution per year.

Weighting bear, base and bull cases equally I get a valuation of 10 cents.

Advanced braking Tech putting up some good numbers this morning. Summarised nicely by the CEO “We are delighted to report that ABT has commenced FY26 with strong momentum, demonstrating our ability to convert strategic initiatives into robust financial performance.”

They tick a lot of boxes for me. A great product that solves important problems for customers (their brake units lead to less air pollution underground, less frequent maintenance intervals, and safeguards against vehicle collisions). They have a nice buisness model, sell the units up front, then support after the fact with parts (with good margins). Their customers are all big miners, geographically diversified and happy to pay up for products that will help them operate safer and more profitability.

Risks: some sort of global mining slowdown.

Somebody else solves the same problems better and/or cheaper.

Happy hold for me for now irl and on sm.

Board Bio’s

Andrew Booth - Managing Director & Chief Executive Officer

Mr Booth is an accomplished business leader, skilled and experienced in corporate development and strategy across a range of industry sectors and international markets across a broad array of industry sectors including manufacturing, logistics, private equity, finance and resources. Mr Booth is above all, passionate about Australia’s unique intellectual property and immense opportunity in the region. Mr Booth has a Master’s of Business Administration (MBA) from the Australian Graduate School of Management (AGSM) and is a Graduate of the Australian Institute of Company Directors (GAICD).

Dagmar Parsons - Non-Executive Chair

Ms Parsons has more than 25 years of experience in the mining and resources industry across a range of functions, working in senior executive roles with Worley Parsons, AECOM and Downer. Ms Parsons has worked with major national and multinational entities to drive critical market success by providing strategic direction, visionary leadership and innovative thinking. As a Mechanical Engineer, Ms Parsons has developed an in-depth knowledge of engineering, manufacturing, and service industry environments in the Mining, Oil and Gas, Power and Infrastructure sectors.

David Slack - Non-Executive Director

Mr Slack has been a substantial shareholder and NED of Advanced braking for the past 16 years. He is a non executive director of two other public companies, apart from Advanced Braking Technology. He is an NED of Australian Wealth Advisor Group, an ASX listed company ( ASX: WAG) which is a financial planning and fund management group. He is a NED and Chairman of Transport Safety Systems Group, an Australian public unlisted company in the commercialisation phase of a new rail crossing technology.

Les Guthrie - Non-Executive Director

Mr Guthrie is an engineer with 45 years’ experience in the project delivery space. He has held corporate executive and project management roles, across the UK, Australia, North America, and Asia. It is a background steeped in the strategy, development and delivery of major capital programs spanning mining, infrastructure, and oil & gas. He is the Managing Director of Bedford Road Associates, where he has provided advice and delivery support to clients in Mongolia, South Korea, New Zealand as well as in Australia.

Management

Angela Godbeer - Chief Financial Officer

Ms Godbeer has over 20 years of experience in financial management and strategic leadership roles across a number of industries, including Engineering, Manufacturing, Media and Financial Services in the United Kingdom and Australia. Prior to joining ABT, Ms Godbeer extensive and diverse background in finance leadership encompasses developing’ and implementing financial strategies, ERP implementation, project management, business improvement, change management and risk control.

This was a big quarter and half for ABV. Revenue, EBITDA and NPAT all up by 20-25%. H1 NPAT 320k up from 100k in 24.

@Strawman ABV could be a good one to try to interview. As they have been slowly executing against there strategic roadmap over the last couple of years.

ABV make high quality sealed brake units that are retrofitted on mine vehicles, typically hills or land cruisers but also have brakes for larger trucks. The R&D and know how is all done in house and as far as I can tell they are well out in front of competitors in this area.

The big positive from this quarters result was the success they have had in launching there new product called BrakeIQ, this product integrates the brake units with the collision avoidance software. This was launched internationally late last year and I was a little nervous of how it would sell or whether this would be the small fish moving into a bigger pond problem. But it looks like the launch has been well received with good revenue, and commentary around sales pipeline is very positive. International sales up to 56% of revenue (42% in pcp).

Its an interesting micro cap that’s worth having a decent look at.

July 2024-

ABT released Q4 numbers and continued the good trend of the last couple of years. They don't release much information but this is a solid little Aussie manufacturer of sealed brakes. Good tailwinds from the mining industry with improved environmental outcomes with the sealed units. Added a brake unit to their range for the Toyota hilux, which is now in addition to the Toyota land cruiser.

Key numbers for the year

NPAT -$1.7m

EPS - 0.44 (20% yoy growth)

50% gross margin, improved slightly and seems like a stable level to project forward.

Cash increased to $2.4m

I have a fair value of 6.6-8.8, based on SOI 382.3 and PE multiple of 15-20.

They are trading at the low end of this valuation currently with strong momentum, but this one can swing on low volume pretty fast. I am happy to keep holding and will look to add more on a pull back.

-----------------------------------------------------------------------------------------------------------------------

2023 -ABT releseaed a good 2023 preliminary result, with all the metrics showing steady growth since 2021.

Key bits:

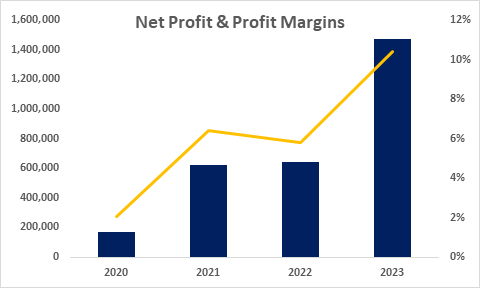

NPAT -$1.4M

sales margins back to 49.9%

Positive operating cash of $0.9M

Closing cash position $2.07M up from $1.73M (2022)

debt $179K

SOI-379.1

2023 ROE of around 25%

I have a todays valuation on this of 3.6c --5.5c based on eps of 0.37c and a PE of 10-15.

This is a solid business with a nice opportunity for further growth ahead of them as they finalise the prototype for the heavy vehicle Sealed Integrated Braking System (SIBS) for the Volvo FMX Haul Truck. Glencore payed $2.8M toawrds this development in 2023 but have since sold the mine that they were going to use it at so ABT are now able to sell it to anyone. End of 2023 expected to be ready.

I came across ABT through the DMX asset fund letter earlier this year.

Why I'm adding ABV - Advanced Braking Technology to my Strawman portfolio

•Blue chip customer base in mining, civil construction and miliary

•Profitable

•Global market leader in a niche market - largest SIBS supplier in the world

•International market, with company exporting to over 40 countries

•Own their IP

•Undemanding PE ratio of 11.6

•David Slack NED owns 19.81%; however, low insider ownership beyond him

•Appear to have a focus on culture, constantly mention team in AR

•ESG and mining tailwinds (e.g. EV metals growth)

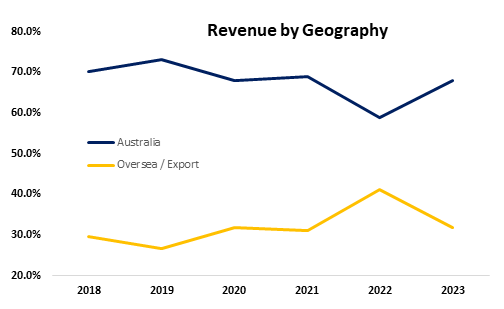

•>30% of revenue comes from overseas with ability to grow this

•Strong balance sheet with nearly no debt

•Free cash flow positive

•Healthy and improving gross and net margins

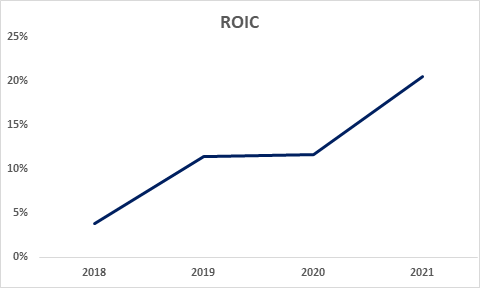

•ROIC of 21%

Why I would consider selling

•Overvalued

•Loss of major customer

•No longer profitable or free cash flow positive (excluding acquisitions)

•Single digit revenue growth

•Deteriorating ROIC

Financials

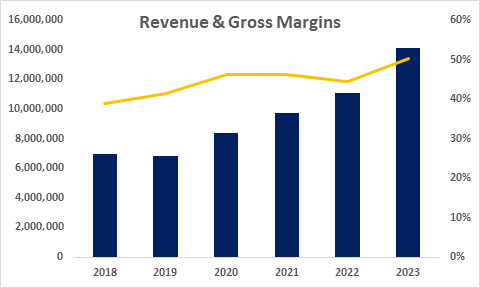

ABVs margins have grown from 45 to 50% over the past year, while revenues have grow 16, 14 and 28% over the past 3 years.

The company has been profitable and cash flow positive the past 4 years with profit growing from $644,000 to $1.474M and achieving a net profit margin of 10.4%.

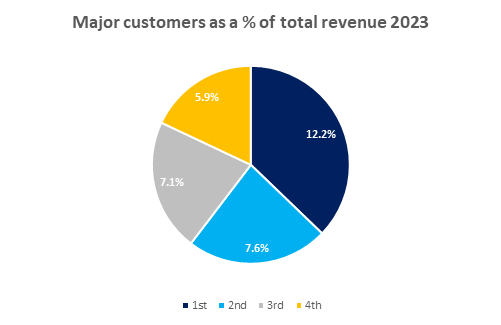

Segment revenue isn’t provided by ABV but they do brakedown (pun intended) revenue by geographical region as well as major customers. With 2023 revenues of $14.15M and profits of $1.474M, should ABV lose their largest customer they would, just barely, remain profitable.

The company has a strong balance sheet with $2M in cash, net assets of $6.9M and debt (interest bearing liabilities) of just $223,000.

Lastly, ROIC has been steadily improving over the past 4 years which could indicate ABVs moat is widening.

ASX: ABV – Advanced Braking Technology

Advanced Braking Technology has been around for 20 years. Pre 2019 they were predominantly an R&D company, investing millions into brake technology. Since 2019 they have pivoted to a commercial format with the appropriate management team to guide them. Their principal activities include research, development, design, commercialisation and manufacture of braking solutions for light, heavy, defence and electric vehicles as well as emergency braking and brake controllers under the ABT Failsafe, ABT Failsafe Emergency and Terra Dura brand names.

ABT export to over 40 countries, up from 16 a year ago and claim they are the market leader in failsafe braking. Management state innovation and safety are at their core and that they tick all 3 ESG boxes.

Heavy vehicles and their wet brake solutions are key to their growth. They offer recreational users a dry sealed product, Terra Dura. This is still too costly and not a priority for the company but they hope to one day get the cost down on this while maintaining margins.

The mining services industry makes up roughly 70% of their sales following by mining at 15%, fleet management at 7%, defence at 5% and waste management at 1%.

They are the original equipment manufacturer of their sealed brake technology and they own the IP. They’ve invested millions into their braking products which offer improved safety and performance and zero emissions, ticking the ESG box. As a result they have a strong blue chip customer base.

The Problem

Maintenance

Traditional open brake systems being used in mining are prone to contamination and corrosion and need to be stripped and cleaned every few weeks. This results in significant downtime on an asset that is being used 24/7. ABTs sealed integrated braking system (SIBS) offer operational improvement and considerable cost savings providing months of maintenance free operation, critical for mining companies with fleets of 100’s of vehicles in constant use.

Safety

ABTs Failsafe offerings can be incorporated into the park and emergency brake system to automatically apply when the E-Stop button is pressed, the engine is turned off or a vehicle door is opened. This provides a high level of safety for vehicle operators and site personnel ensuring the vehicle cannot roll away unexpectedly.

Emissions

50% of a diesel vehicles emissions are exhaust and 25% brakes. The company’s Sealed Integrated Brake Solutions (SIBS) protect the environment by eliminating all brake dust emissions, improving air quality.

Interested to see Ukraine asking for the Hawkei platform to be thrown into the mix for contributions to the Russia-Ukraine war. One of the reasons the government has cited for not yet offering it are braking issues. Australian Braking Technology (ABV) was contracted by Thales to provide a braking solution to the Hawkei platform in 2019. This was done under a licensing agreement with VEEM (VEE) - who predominantly provide maritime propulsion technology. ABV provide a number of braking capabilities to mining and commercial transport companies. I believe the Hawkei contract was around the park brake offering, called Failsafe. The brake issue cited with Hawkei seems to be around the service brake at medium/high speed and, therefore, not a reflection on ABV. However, I could be making that up and you'd want to fact check that before making an investment.

ABV has been on my watchlist for the last 12 months or so. It's been a listed entity for donkeys but has been a bit of a basket case for most of that. A change in Board/management has started to show some early signs of playing out but it's still early days. The cancellation/variation of a recent contract with Glencore has given a bit of pause, but it does seem to be more of a Glencore issue than an ABV one. It's one I'm keen to see the full year results of, to see whether the recent untick in performance can continue.

ABT awarded Defence Global Competitiveness Grant

Highlights

• ABT awarded a Defence Global Competitiveness Grant to the value of $240,000

• Grant to be used to strengthen ABT’s in-house manufacturing capability

• Positions ABT to capitalise on future defence contract opportunities

DISC: I have small holding