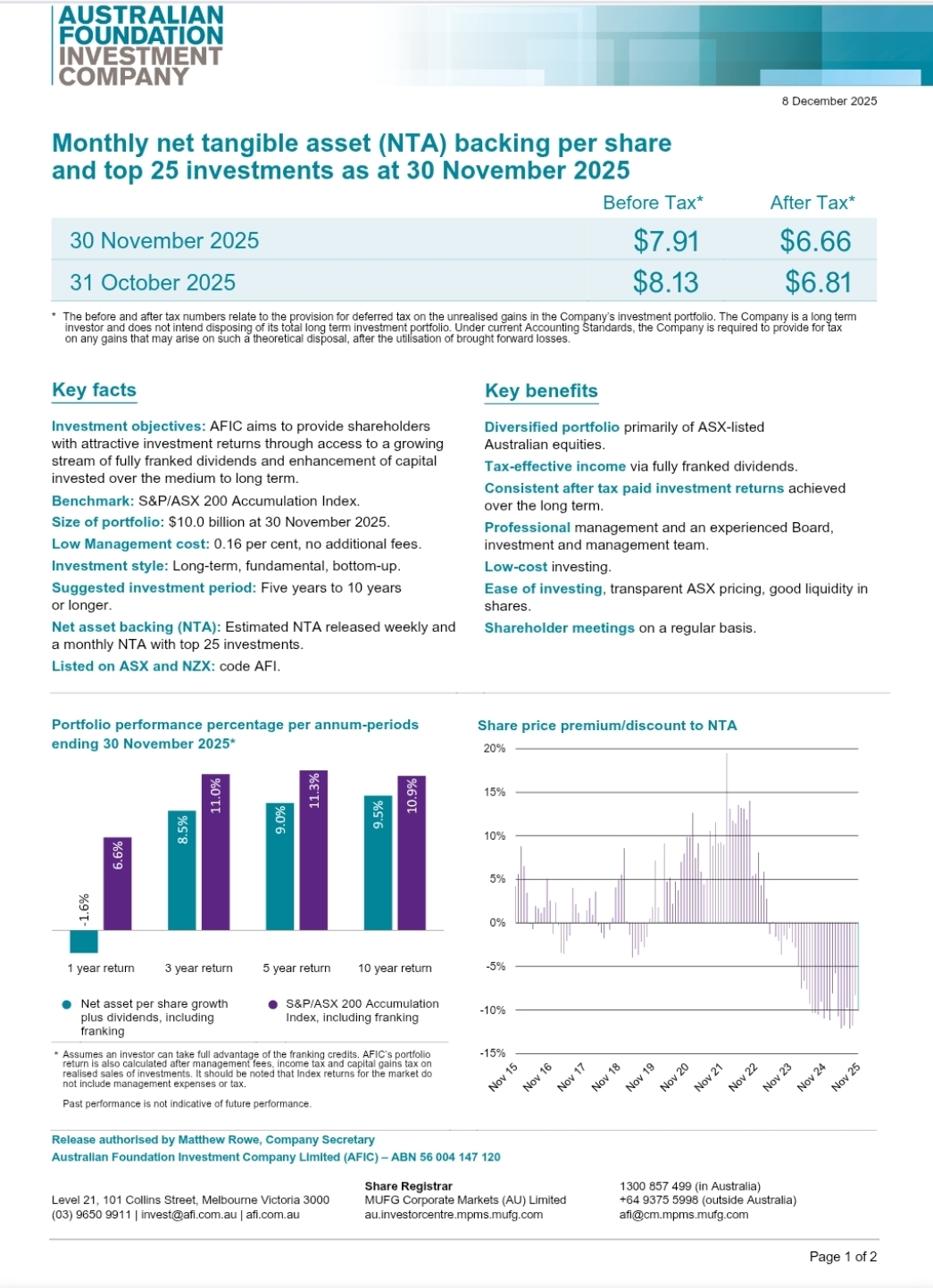

Released 8th Dec 2025.

I Just checking the performance returns of our professional peers. ..before inflation not really good!

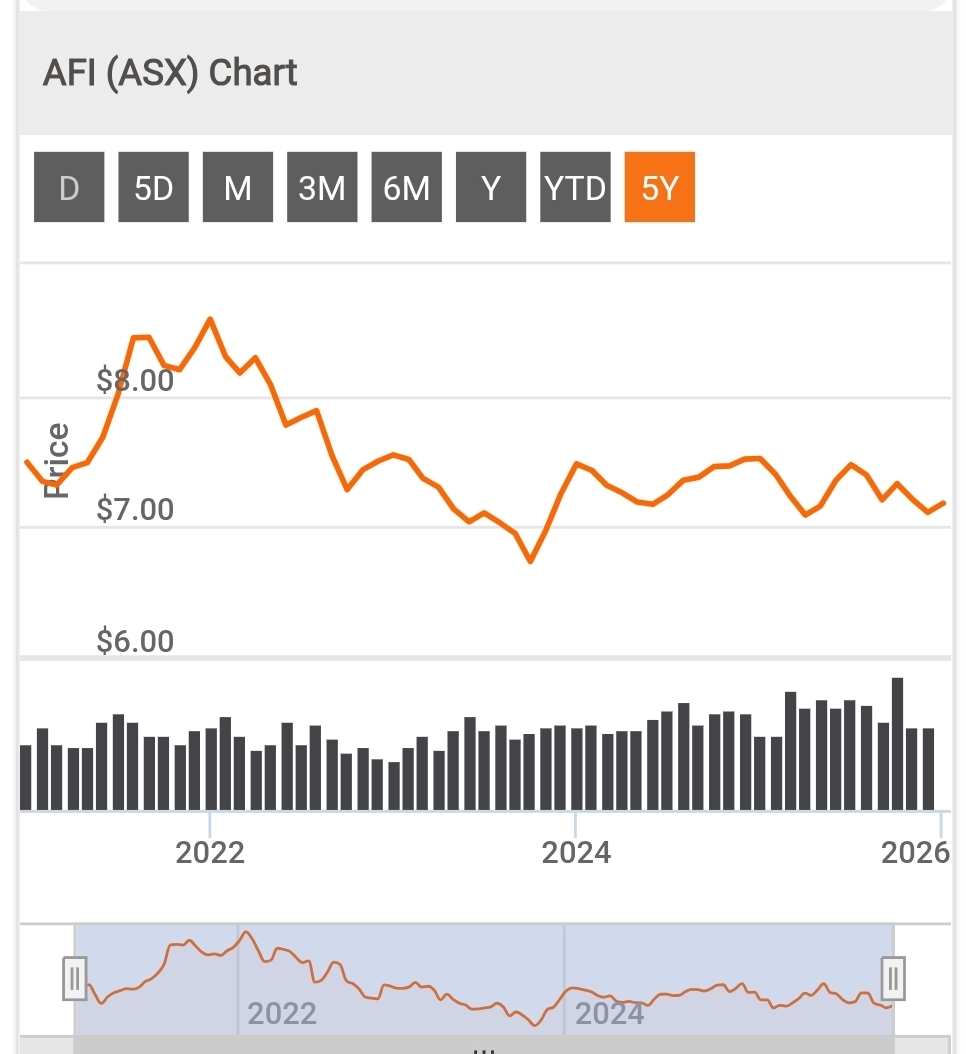

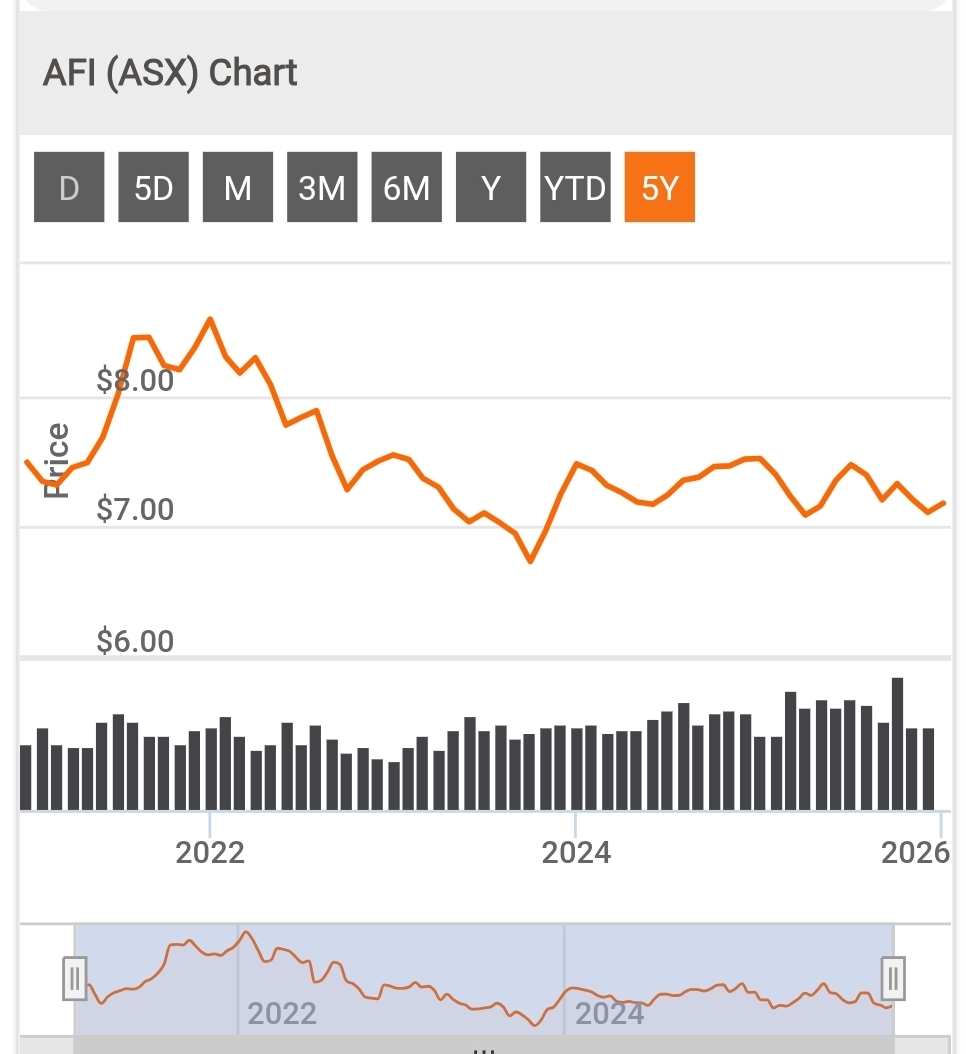

Investing very challenging at the moment 2025/26 the charts have more saw teeth than the humble Stihl chain saw.. Though Gold, silver continue substantial growth..

Market Summary: RBA maintain a hold on rates.

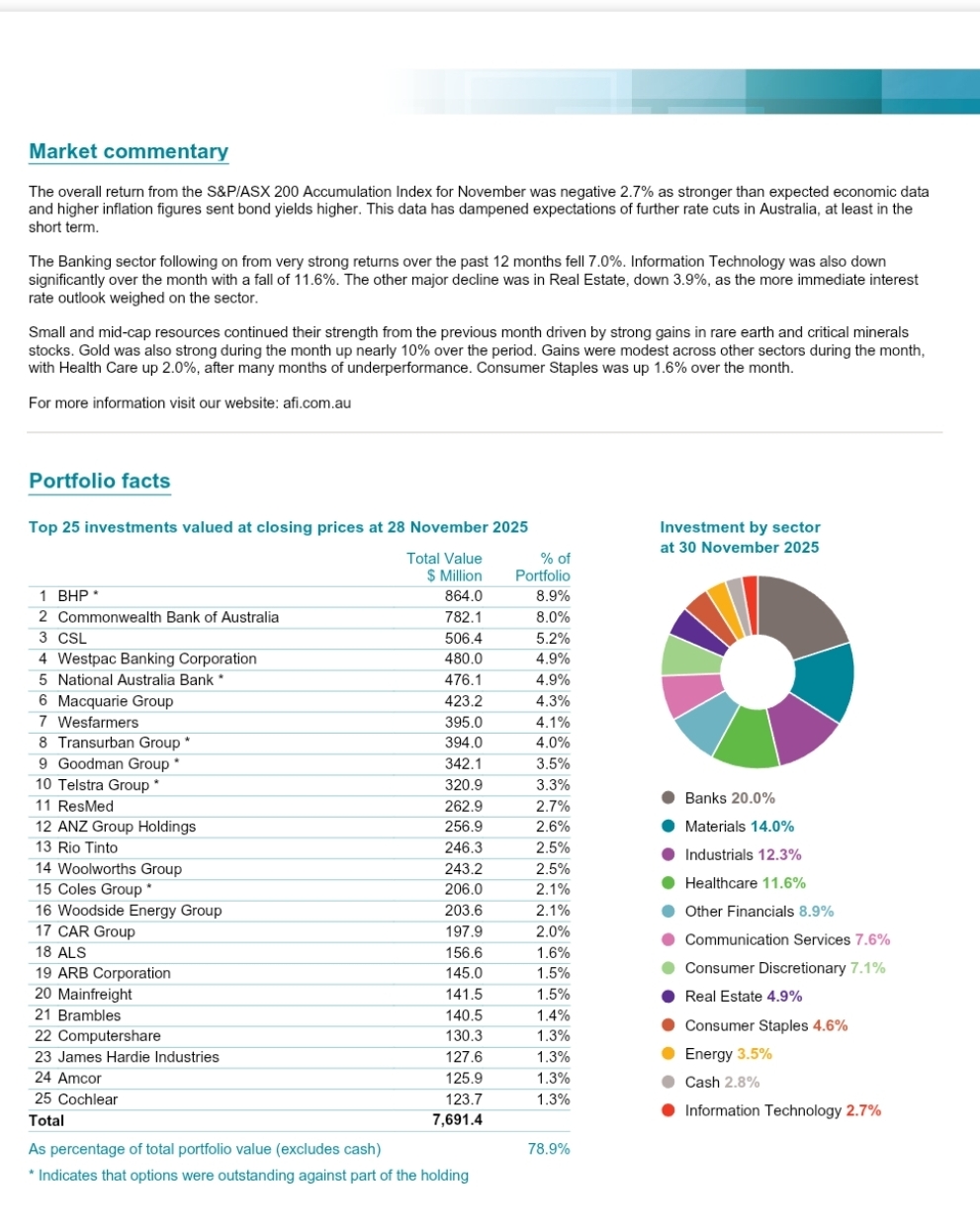

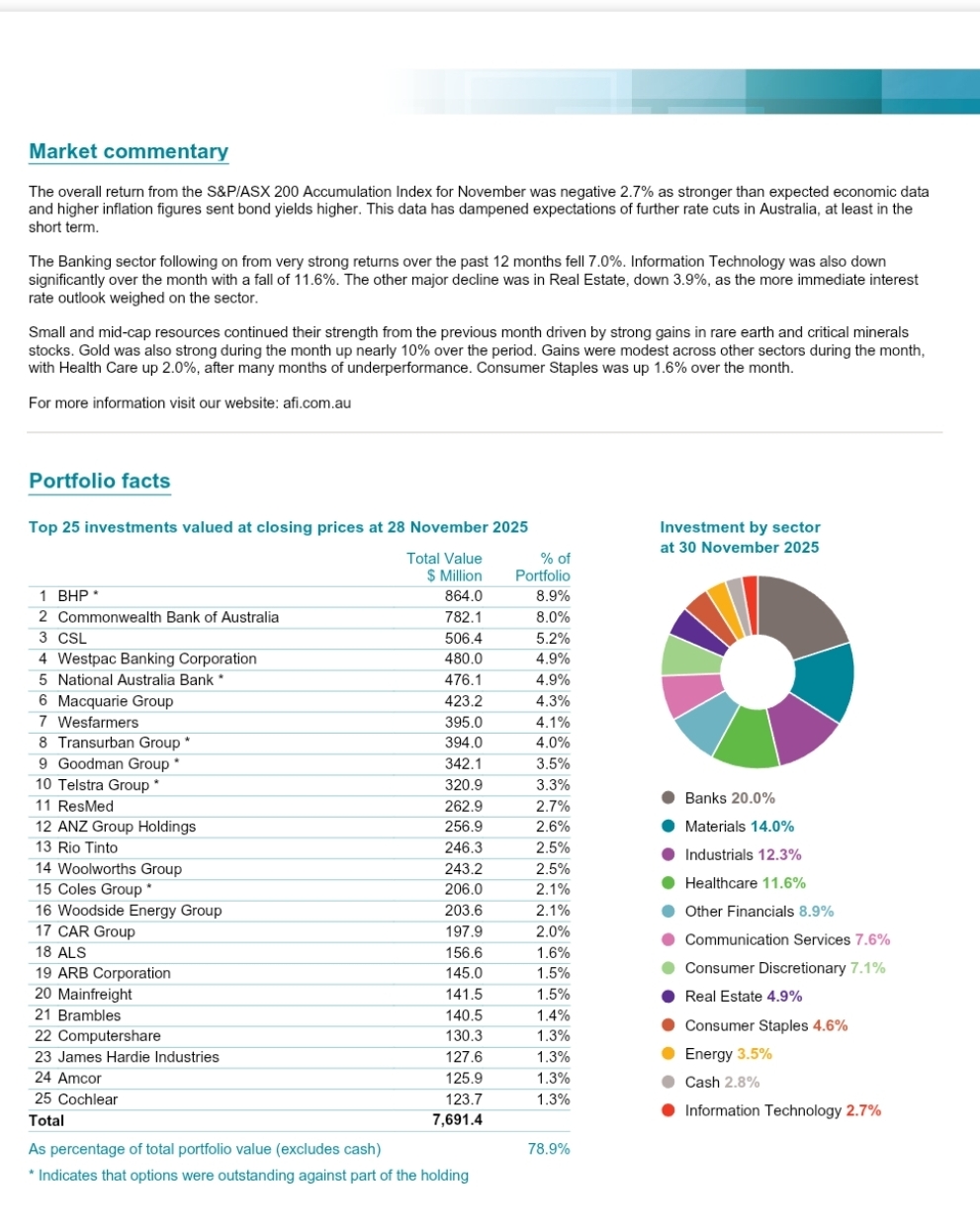

The Banking sector following on from very strong returns over the past 12 months fell 7.0%. Information Technology was also down

significantly over the month with a fall of 11.6%. The other major decline was in Real Estate, down 3.9%, as the more immediate interest

rate outlook weighed on the sector.

Small and mid-cap resources continued their strength from the previous month driven by strong gains in rare earth and critical minerals

stocks. Gold was also strong during the month up nearly 10% over the period. Gains were modest across other sectors during the month,

with Health Care up 2.0%, after many months of underperformance. Consumer Staples was up 1.6% over the month.

Low Management MER cost: 0.16 per cent, no additional fees.

25 holdings

Still very much into banks for their rich dividends.

Not much Info Tech at 3% so AFI avoided some draw down there.

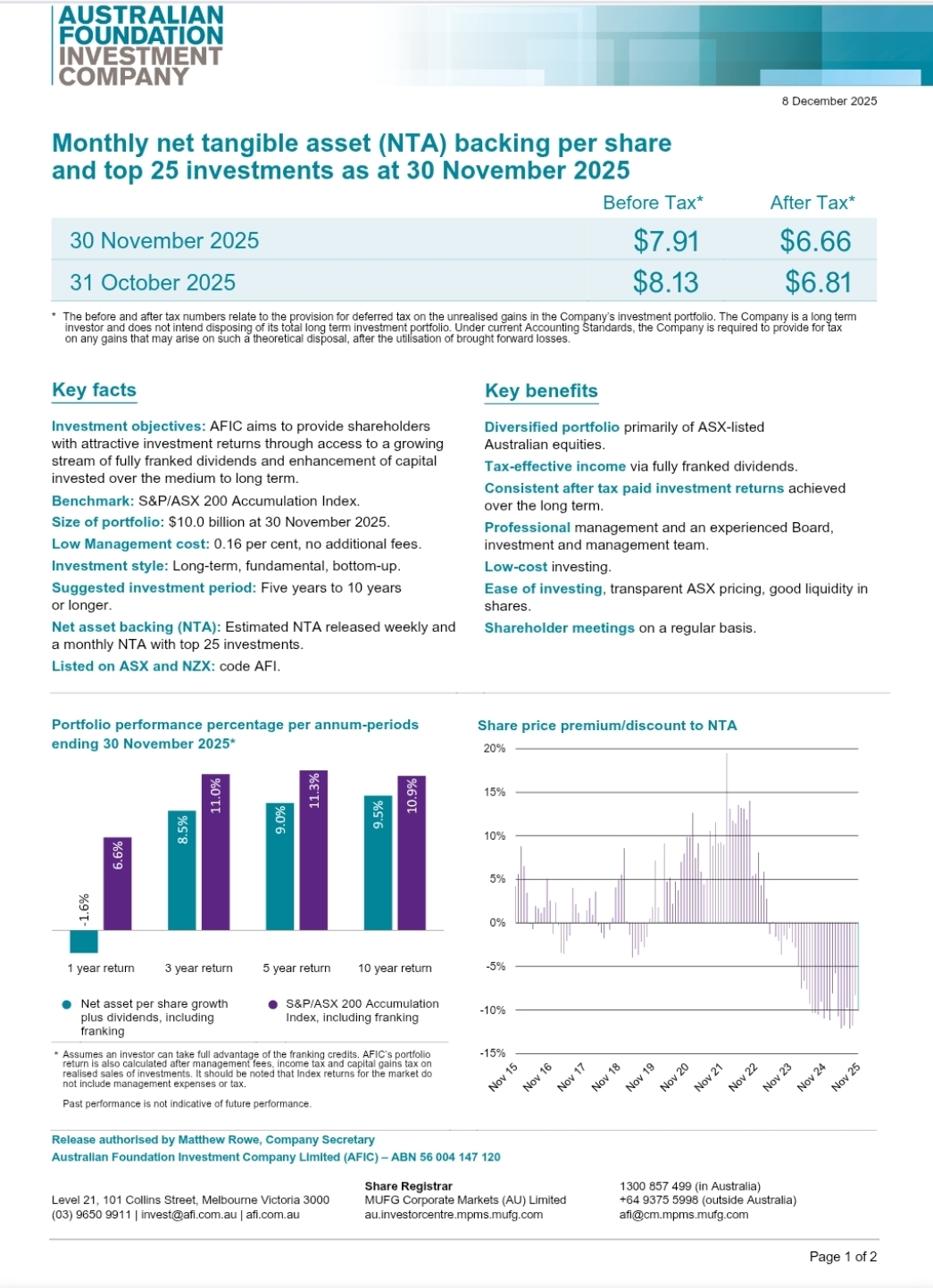

Result of all the professional investment over 5 years..

Return (inc div) 1yr: 0.80% 3yr: 2.39% pa 5yr: 3.08% pa