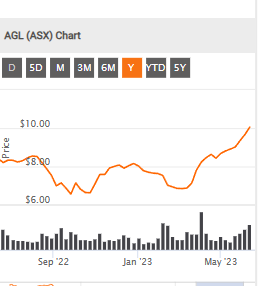

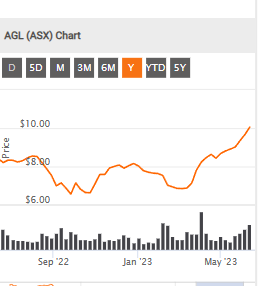

16th June, Share price reaction $11.05 up 14.4% . Turning a Fossil Fuel Co into a 'Popular fuel source" see how the scales weigh up here in the long term. I've noted share price appreciation. So the AGL has pivoted.

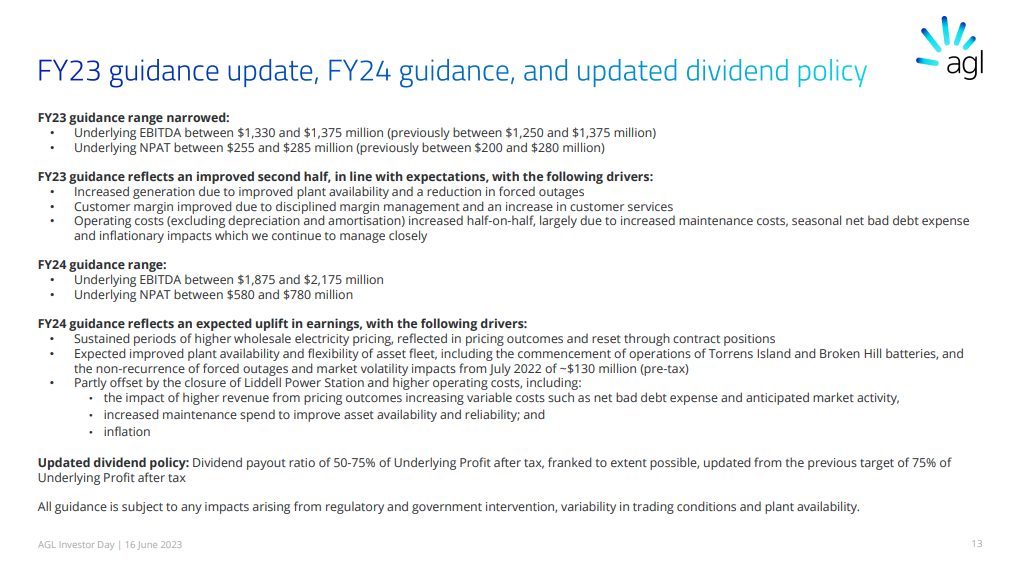

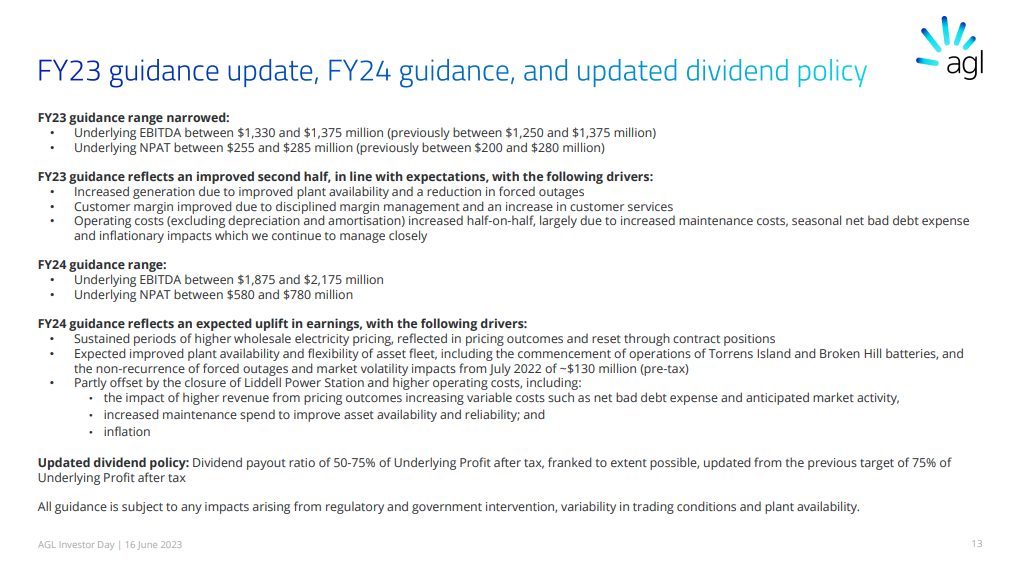

Underlying EBITDA between $1,330 and $1,375 million (previous guidance was between $1,250 and $1,375 million); and Underlying Profit after tax between $255 and $285 million (previous guidance was between $200 and $280 million).

FY24 interim dividend. AGL will target a payout ratio of 50 to 75 percent of Underlying Profit after tax, which will be franked to the extent possible.

AGL ENERGY LIMITED. (ASX:AGL) - Ann: Investor Day, FY23 & FY24 guidance and dividend policy, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum