Disc: I bought PA in the recap which was done at $0/10/sh and my strawman trade is booked at $0.11/sh

TLDR summary, shitco rebooted, new MD owns a lot, funded for exploration, high impact low hanging fruit to be drilled, tight cap structure enables big re-rates, low EV minimise downside risk for an asymmetric set up.

Company Presentation

NML recently returned to the boards after a long hiatus due to going through administration. A run down of the history leading into admins is that NML was a Victorian focused gold explorer who’s key asset is located to the south of the Stawell Mine. After delineating a resource, the prior management team decided to buy the MT Carlton mine from EVN, however this proved to be their undoing as they could never manage to operate the mine profitably. When it couldn’t continue raising capital, the company was tipped into admin in order to rid itself of Mt Carlton and expunge any liabilities that were generated with it. This also led to a wipe out of most the equity prior to admin.

Current MD, James Gurry, joined the company just prior to admin and was a driver for doing so in order to reboot the company and return to the Victoria roots. James managed NML through the admin process and raised $1.7m in capital via a con note to support an offer under the DOCA to enable the company to retain the Vic assets and give it an opportunity to reboot and return to the ASX. AT this time, Richard Taylor joined the board to help support the reboot of the company. Combined they put in $125k into the con note alongside investors. This con note was converted at $0.10/sh as part of the relisting. Between this time (June 2024) and the resumption of trading in Nov 2024, the company made payments to keep their assets and JVs in good standing as well as get up to date on all outstanding ASX reporting and compliance matters.

In October 2024, the company sought to raise equity capital to support a relisting on the ASX. The company went on to raise the max amount of $6m at $0.10/sh which enables it to relist, resume trading and kick of some serious exploration. I note James and Richard tipped in another $125k into the raise. The company states the raising can support 12-18mths of continuous drilling, noting an initial 7000m is underway at Stawell (St Irvine/Resolution) which I think will cost ~$1.7-2m.

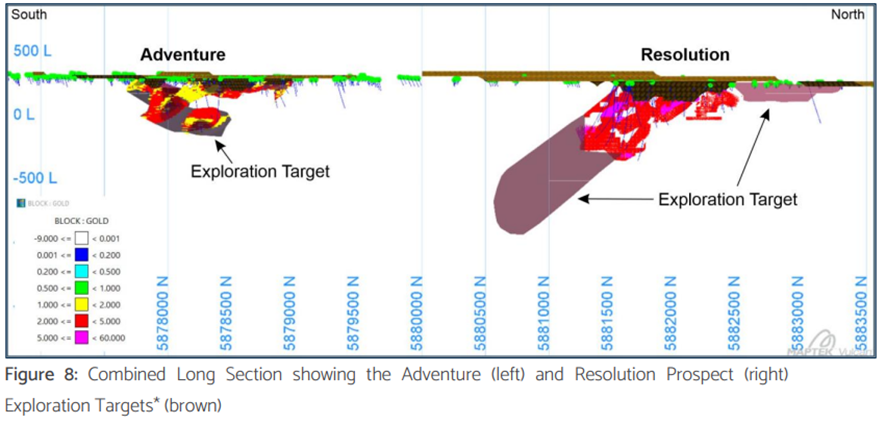

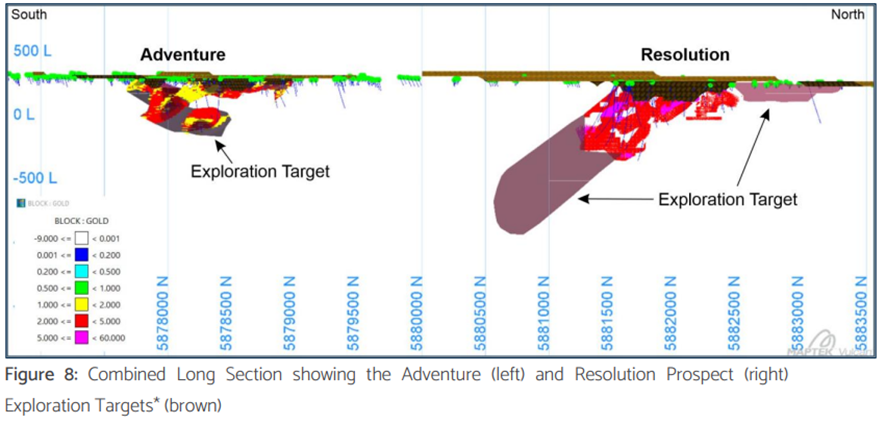

The Stawell project is the focus on this intro as it holds the company’s existing JORC resource and what I think is the lowest hanging fruit from an exploration perspective. It is the focus on NML’s current drilling campaign representing 5000 of the 7000m of diamond announced (see slide 10 of the preso). Prior to acquiring Mt Carlton, NML released a JORC resource showing an inferred resource of 304koz at 2.4gpt across two ore bodies, Resolution & Adventure. Most of the ounces are within Resolution and comprise both an open pit and underground component to the resource. In the same release, NML detailed an exploration target that detailed the potential to add another 280-420koz at 2-3gpt at both ore bodies noting resolution makes up 200-300kzo of the total. Resolution’s ET has extension at both along strike at surface (OP) and down plunge (UG). Resolution excites the most as the down plunge drilling has the potential to create the kind of hits that could drive a massive rerate in the stock that Victorian gold is know for. Part of the drilling at Resolution will be infill which will aim to improve upgrade some portion of the resource into indicated as well.

Post recap, James currently owns 5.8% of the company which has in part been earned from blood & sweat as well as through conversion of the con note, the recap raise and buying out old shareholders prior to IPO. Most of this has been paid for at $0.10/sh and represents real skin in the game. Richard Taylor also amassed his holding in the same manner. In total, B&M hold 6.5% of the company post relisting. I note the board has been rounded out with the appointment of Angela Lorrigan who is consults to SXG on their Sunday Creek project.

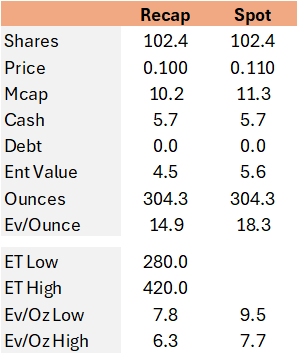

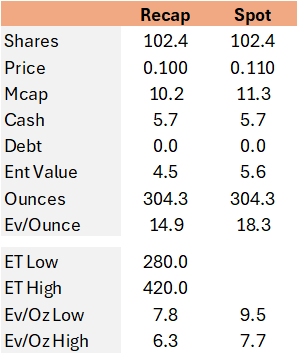

Valuation wise, at the relisting price of $0.10/sh, NML is on a mcap of $10.2m and an enterprise value of $4.5m. This represents an EV/Oz of just $14.9 which by explorer standards is at the low end and not unreasonable given the need to rebirth the company and that the entire resource is just inferred. I do note that even the poorest M&A in recent years has not been below $25/oz and is an important consideration as NML’s resource is truckable the Stawell Gold Mine which reportedly underutilised and starting to run low on feed. If NML can even start to prove out the low end of the ET, it could support a material re-rate from both proving higher ounces and through a potential multiple expansion as it would give better economic scale to the resource.

Vic gold is also known for very high grade hits so you never know if the drill bit shows something that gets the punters frothing like a dog with rabies. But this is not the kind of reaction to bank on but just something that is possible to keep in mind.

The main risk here is that the ET was more academic than proven it reality which would mean the stock would drift down as drill hits come up light and resource growth seems marginal, but given the starting EV, the downside is limited vs the upside potential thus why it is a punt. Other than the Tandarra JV with Catalyst, the other projects are very early stage and require additional work to become drill ready.

In summary, I think NML represents an interesting trading opportunity as it offers an attractive risk/return given the low EV and the potential high impact exploration potential. The company is now funded to embark on ongoing exploration and is operated by an MD who has put money on the line and has real skin in the game.