Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I got this call wrong! My investment case for Austin Engineering was based on what I’d researched about the business, the solid underlying and improving metrics for the business as it rapidly expanded in Indonesia, the USA, and Chile over 5 years. That was until the first cracks appeared in the Chile operation. The issue was not caused by a lack of sales, it was quite the opposite! The business failed to scale, or at least it failed to scale efficiently to handle the growth. It sounds like the general manager in Chile was totally incompetent, or perhaps it was the top management that had been asleep at the wheel?

There was a huge amount of steel wastage and the labour costs blew out as they used local contractors attempting to keep up with a huge OEM order. Then management came up with the great idea of drawing on the capacity at the Batam factory which in turn overloaded the capacity there and resulted in exactly the same issues! They needed to use contractors to keep up with the huge demand, and the costs blew out. Reading between the lines it sounds like the Indonesian operation is heading for a loss this year also. Not only that, a client in Indonesia has pushed their order out to next year. Now the sales are being hit!

Meanwhile, while management have been distracted plugging up the leaks in Chile and Indonesia, the USA operation (which had been powering ahead brilliantly) was undergoing similar pressures. Not only have they used contractors to keep up with the orders, they have engaged other manufacturers to build the trays for them! The margins here are being shot to pieces also!

What a debacle! It’s like the story of the rise and fall of Austin over five years! I had mistakenly given Austin management the benefit of the doubt. The ‘Austin 2’ strategy had been progressing swimmingly over the last 5 years. The business had turned around and the metrics were improving! Then what appeared to be a small crack in Chile turns out to be a systemic failure across the entire business. It appears management went to sleep at the wheel and woke up in a car cash!

So what am I doing in response? There are 3 choices; buy, hold or sell! Is management capable of fixing this mess? I’m not confident they will fix this mess given what is going on now!. The issues Austin management is facing now are mostly self inflicted. They didn’t foresee the issues ahead, they didn’t notice the issues as they occurred, they implanted a ‘fix’ that put stress on other parts of the business and made things worse!

They might manage to turn this mess around, but I have lost faith in management! So, while it hurts like hell, I’ve ripped off the bandaid and sold completely in SM, and 80% IRL (so far). I’ve copped a rapid and substantial loss.

Was there a lesson learned here? It’s always easy in hind sight of course, but it’s hard for me to say if I was faced with the same scenario again with a different business whether I’d do the same thing again? I would certainly look at the scars following this experience and be much more hesitant to jump in. Perhaps I would be less aggressive? When I think back to my investments in Codan and Nick Scali, were they much different at the time? Perhaps they were! Their issues were both external and not foreseeable. They were not cracks appearing in management as they were with Austin. Perhaps that was the first sign and the big lesson here?

I know there are a few more watching Austin Engineering after it was recently discussed by Claude and Chris Steptoe on the 'A Small Cap Wrap'.

They just came out today with a revenue downgrade aka 'a kick in the shins', and a buiness update.

There's a few layers to this s*** sandwich, but at a high level the commercial viability of a contract in Chile has now impacted it's Indonesian operations - so much so that profitability in Indonesia is now questionable. Further compunding this was a customer moving work into H2FY26, and a reduction in Aussie coal sector orders. As a result, they have reduced their workforce - this will have some flow on effects.

On the flip side, in North America they can't keep up with growth/demand and are having to outsource labour and manufacturing which comes at a higher cost and won't benefit the business over the longer term.

The full announcement is worth a read as it not only provides insight into the business but the difficulties associated with capital-heavy organisations such as ANG.

Can't see this resolving anytime soon, they're in for some headaches - and shareholders now have sore shins.

I have no position in the company but will continue to watch from the sidelines.

Right now the market is discounting Austin Engineering because of the Chile operation, and rightly so! Last year the Chile operation made a loss. Chile is dragging down the profits, increasing the debt, and taking the shine off the very attractive metrics for the rest of the business. I believe Austin’s valuation would be higher now without the Chile operation. Let me work through this:

Let’s assume the Chile operation could be sold off at book value. This would be the result:

- Removing Chile would increase ROE from 18.3 % to 22.2 % and gearing (net debt to equity) would be halved .

- Thats assuming no further losses, no impairment cost, and that divestment or wind-down occurs at book value.

- Even with a modest write-down (e.g., 25 %), ROE remains above 19 %, still stronger than reported FY25 results.

- Operationally, it makes Austin leaner, more cash-efficient, and more focused on its profitable regions (Australia, Indonesia/Batam, North America).

Assumptions

Base Data

Chilean Operation (FY25)

Pro forma Adjustments (Without Chile)

Pro-forma Results (Equity adjusted)

Should Austin Sell the Chile Operation?

I think the market might react positively if Austin carved off the Chile operation. Yet, I don’t think that would be in the best interests of shareholders. Chile is potentially a high growth geography because its products and repair work are focused on copper production. It would not make sense to withdraw from Chile just as the copper industry is ramping up here. The issues have arisen because of a large OEM contract for new truck bodies. This order is a first of a continuing supply contract for an OEM in Chile (the company is unnamed).

This first attempt went horribly wrong, and its a black mark against management that this happened at all! However, I believe they will turn Chile around rather quickly and we will see earnings continue to grow and margins across the business continue to improve. If not, there is always the option to sell it off!

Adding IRL and SM

While doing some research into the current board of directors and levels of share ownership I noticed that ex CEO, David Singleton still owned 5.23% of the business, currently worth $9.7 million. David is the second largest shareholder in Austin behind Thorney Investment Group which owns over 20%.

David Singleton - Ex CEO and the instigator of the “Austin 2” turnaround.

David was the instigator of the “Austin 2” strategy in 2021 which has been the key contributor to repositioning the business globally and for the growth and vast improvements in the business fundamentals over the past 4 years.

When David took over as CEO of Austin Engineering the shares were trading at around $0.12 per share. Over three years the share price climbed to a high of $0.67 (July 2024).

While some observers have speculated that David’s departure as CEO on 30 June 2025 is a “Red Flag” , the change of guard was planned back in June 2024. The share price has steadily declined since June 2024 and that could be the “Red Flag”! However, the business fundamentals remain solid (apart from the Chilean factory issues which are largely back on track).

With some help from Chat GPT I’ve pulled together a detailed profile of David Singleton’s background, his role at Austin Engineering Ltd (ASX: ANG), and what his appointment and transition mean for the company. I’ve also tracked his share trading.

Background & Career

- David Singleton holds an Honours degree in Mechanical Engineering from University College London, and he is also an Honorary Doctor of Engineering from Edith Cowan University.

- Early in his career he was involved in the UK defence & technology sectors: notably, he was Group Head of Strategy, Mergers & Acquisitions for BAE Systems in London; he also served as Chief Executive of Alenia Marconi Systems (Italy).

- He moved into Australia and held senior roles including:

- CEO & Managing Director of Clough Ltd (engineering & project services) between ~2003-2007.

- CEO & Managing Director of Austal Limited (shipbuilder) from April 2016 to December 2020.

- His résumé shows extensive international business experience (Europe, USA, Asia) and exposure to heavy manufacturing, engineering, strategy & M&A.

Role at Austin Engineering

- David Singleton joined Austin Engineering as a Non-Executive Director in 2019.

- On 14 July 2021, he was appointed CEO & Managing Director of Austin Engineering.

- Under his leadership from 2021 onward: the company undertook a strategic review and launched what has been referred to as “Austin 2.0” to reposition the business globally.

- The company states that during his tenure: “group revenue has nearly doubled, with profitability up circa 2.7 times” according to the company announcement.

Transition & Current Status

- In July 2024 Austin announced that David Singleton would retire from the CEO & MD role on 30 June 2025, and he would then remain on the Board as a Non-Executive Director.

- A handover period commenced on 1 May 2025 with incoming CEO & MD Sybrandt Van Dyk formally commencing on 1 July 2025. Singleton remains as non-executive director thereafter.

- From 1 July 2025 onward: Singleton has shifted from executive leadership to a non-executive governance role.

Significance & Implications

- Strategic impact: Singleton’s appointment in 2021 signified Austin’s drive to enhance operational discipline, global expansion and strategic capability, leveraging his engineering/manufacturing & M&A pedigree.

- Transition phase: The deliberate lead-time (announced ~2024 for the mid-2025 handover) suggests the board sought continuity and stability in leadership during a growth phase.

- Governance stance: By moving to a Non-Executive Director role, Singleton continues to contribute to oversight while relinquishing day-to-day execution – a good governance practice for leadership succession.

- Market perception: Given Singleton’s track record of revenue/profit changes under his tenure, investors may view the leadership change as a key inflection point for the company’s next growth leg.

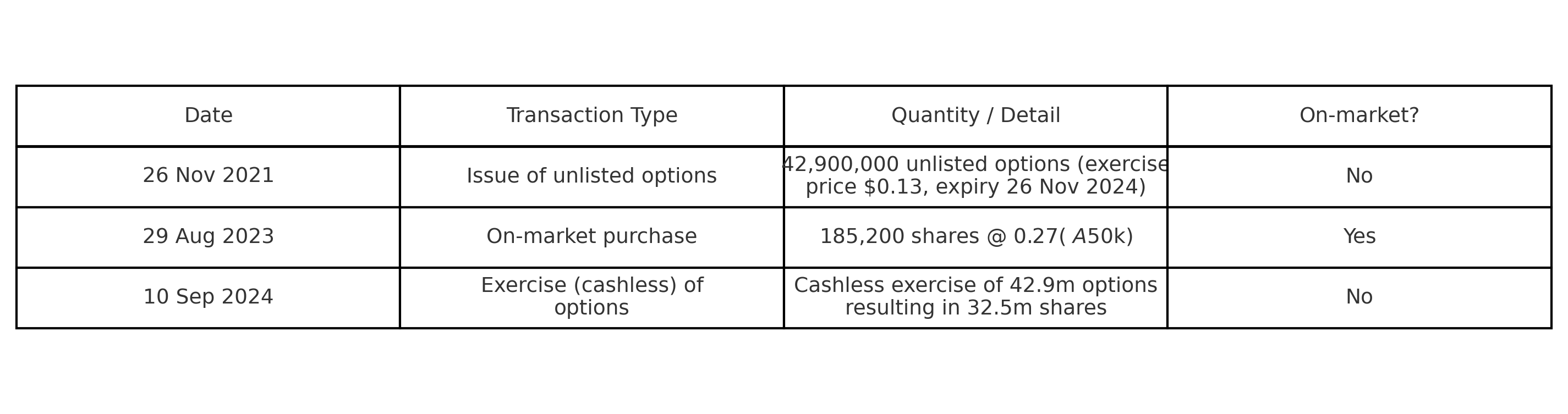

Share transactions while CEO

David Singleton acquired most of his shares by exercising options at $0.13 per share, although he did buy 185,200 shares on-market at $0.27 per share on the 29th August 2023. David has never sold any shares that I am aware of.

What to monitor

- How the business performs in FY 26 under the new CEO Sy Van Dyk — whether the foundations laid under Singleton convert into further growth.

- Any changes in strategic direction post-Singleton’s shift to non-exec, and how the board and management communicate them.

- Singleton’s influence as non-exec director: whether his engineering/manufacturing expertise continues to shape the company’s strategic choices.

- Market reaction in ASX announcements and media regarding his transition — this could signal investor sentiment around leadership change.

Orange Flag

David Singleton selling shares below $0.40 per share (my current valuation).

Green Flag

Any of the directors adding to their share holdings through on-market purchases. FY26 ROE >20%. Margin improvement. Double digit EPS growth.

Held IRL (3%) SM (4.8)

My thoughts first

There are not too many businesses on the ASX that look cheap at the moment. However, Grady Wuff from Bell Direct and Howard Coleman from Team Invest agreed Austin Engineering could be one of them. I tend to agree with them, and have been accumulating ANG for our IRL portfolios at the current share price.

What I like about ANG is the clear turnaround in the business. Margins have been improving, revenue and profit is growing and the international TAM is large. Grady believes the margin issues in Chile have already been addressed by the new CEO, Sy van Dyk.

I think ANG has a niche in the shear size in what it manufactures. It would not be easy for a competitor to come in with the scale of buildings, machinery, equipment and know-how needed to produce these mammoth dump truck trays and shovels. They also have some patents on lighter weigh trays to increase pay load for its clients. Then there is the logistics moving these things around the globe. They need to be manufactured close to where the demand is required. This is why ANG ran into trouble in Chile with margins. They called on the Indonesian factory to partly fill the orders they were committed to with blue chip clients in South America.

It’s the shear size, the logistics and capital that is needed that provides ANG with a small moat allowing them to increase margins. Their ROE has also been steadily increasing over several years, now sitting around 20%. This indicates to me they have some control over the pricing of their products.

I also like that their products are not tied to specific sectors of the mining industry. I can’t think of too many metals or minerals that don’t need big shovels and dump trucks in the operation.

However, they do rely on the mining industry for revenue. It’s interesting to hear what Howard had to say about this. He believes ANG do better when it gets tough for miners because they replace and repair trays and shovels rather than buying new equipment. When you think about this there is always some sectors of the mining industry that are doing it tough (eg lithium) and some that are booming (eg gold). The worst scenario is world wide economic recession. Then ANG should do OK using Howard’s reasoning.

Howard also mentioned ANG’s very low PE of 8. In fact the PE is even lower than that at just over 7 times, based on FY2025 statutory earnings (4 cps) and yesterday’s closing price (29.5 cps). Looking forward, analysts are forecasting double digit earnings growth with consensus FY2026 earnings of around 4.7 cps. Even on a PE ratio as low as 7 that puts ANG on a forward valuation of 33 cps. Considering ANG is trading on the lowest PE it has for several years, while at the same time the business fundamentals continue to improve just makes no sense. I think we will see further margin improvements once the issues in Chile are fixed and the figure demonstrate this.

Despite the ugly chart I don’t see much downside to buying ANG at 30 cps. However, I can see plenty of things I like, including improving revenue and margins, a solid balance sheet, good cash flows, huge TAM, a proven CEO at the helm who has been adequately incentivised to improve the fundamentals further. I like the 5% fully franked dividend going forward, and that I get paid well (7% yield including franking credits) to wait for Mr Market to realise what’s going on here at Austin Engineering!

Using a conservative PE of 8 and consensus Fy2026 earnings of 4.7 cps, I get a valuation of 37.6 cps. I think this is the bear case. Base case is 40 cps and bull case would be 50 cps (in line with Bell Potter’s share price target). Using McNiven’s Valuation formula and a required annual return of 15%, I get a valuation of 42 cps.

In summing up I see very little downside in buying ANG shares at 30 cps. However, the proposition here for upside looks very attractive. It may take some time because the chart looks ugly at the moment. However there does seem to be some support around 29 cps. I believe Mr Market follows the herd most of the time, and he thinks ANG should trade on 7 times. ANG needs to prove itself in FY2026 under Sy Van Dyk’s leadership. If this happens I can see a twelve month return of between 20% to 70% return (including PE appreciation, dividends and franking credits) as the PE adjusts to reflect the underlying business.

Held IRL and SM

Austin Engineering (ANG) - Transcript from “The Call”

“It's the global engineering company. And well, in fact, it's got a presence, obviously, here in Australia, but it has expanded into the Americas and Asia Pacific more broadly as well. The last result there, profit was up 70%.

It did have some good margin growth there, particularly in the Asia-Pac region. Some also, some revenue gains there in North America, although I gather that sort of offset some lower earnings that they saw in South America. Grady, what are your thoughts?

Grady Wuff

Yeah, we have a buy on them at the moment. So this is one opportunity in the market that I was talking about today, very few, but we're pretty optimistic about what we see. There's been a pretty strong turnaround in the company.

The operational challenges in Chile have been addressed, as we said, with the new CEO stepping in, they're implementing a turnaround plan. So it's kind of a bargain buy at the moment for what you're looking at. The results you mentioned, underlying profit increased 70% to 40 million, so back in the profit territory, which is really strong.

They've got good cash flow and working capital. They've worked through their ramp-up in capital at the moment. They're working through costs there.

Again, the implementation of a strategic turnaround. It often doesn't look good to say strategic review, but this is actually seeing a material turnaround in what they were doing. They've got strong revenue growth.

They're executing well, and we see that at the moment, they're trading in an attractive valuation. So yeah, we like what we see, and there is upside potential with growth on the horizon. So yeah, a buy rating for Austin.

Howard Coleman

if you look at this company, they do well when miners are short of cash. Why do they do well when miners are short of cash? Because when miners are flush with cash, they don't replace the buckets that they're using, they buy new ones instead of refurbishing them.

They don't worry about putting a new tray on the back of the truck, they buy a whole new truck. When they're short of cash, they want to repair everything. And that's where Austin Engineering makes its money.

It doesn't make its money from selling new equipment very much. I mean, they make some money from that. But the real margins that Austin makes is when miners are short of cash and they have this fleet of trucks or buckets that they're using to scoop things up, and they say, can't we manage to fix this?

And Austin lands up then fixing them at very high margins, which is cheaper for the mine than buying new ones. So if you believe that commodity prices are likely to be low and miners are going to be strapped for cash, it's a great time to be investing in it because it's only on a PE of eight. If on the other hand, you think that commodity prices are all going to go up because the American dollar is under pressure or whatever, then it's probably not a good time to buy it.

But we were talking about earlier that everything's in a bubble. We're looking at that graph. It's the opposite of a bubble.

It's been going down while everything else has been going up. So I wouldn't personally own Austin Engineering because it's too hard to predict. But if you are going to be looking for a company to buy that's not in a bubble and that's likely to benefit if mining does worse, Austin Engineering's dirt cheap at the moment.

Oh, we push you across the line there. Are you calling this a buy? I know not for you.

Well, not for me. And I don't think Teaminvest members would buy it. But for people out there who want some exposure.

Yeah. You wouldn't go probably terribly wrong if you bought it on a P of 8 when mining is likely to have some bad news in the near future.”

From The Call from ausbiz: the call: Thursday 16 October, 16 Oct 2025

https://podcasts.apple.com/au/podcast/the-call-from-ausbiz/id1506523664?i=1000732078884&r=861

This material may be protected by copyright.

25/09/2025

Today, Austin Engineering announced a 10% on-market share buy back and the shares gained nearly 20% to close at $0.335. The question now is, are the shares fully valued? I don’t think they are.

ANG had issues meeting their orders in Chile during FY2025 which pushed up costs, reduced margins and sent the shares lower. In the revised FY2025 results released on 26/08/25, the revised EPS was $0.043 per share.

Over the last 5 years the average PE for ANG was approx 10 times earnings. With improvement in the fundamentals over the last 8 years, I don’t think a PE of 10 is unreasonable.

Source: Commsec

I am expecting earnings to grow by about 10% per year from here with FY2026 EPS close to $0.046 per share. Using a PE of 9 times, ANG could be worth $0.41 per share in twelve months time.

Using McNivens Valuation and assuming ROE of 19% going forward, equity of 23 cps, a 35% payout ratio, and requiring a 15% return on investment, I get a valuation of $0.39 per share.

I’m happy to round off my valuation to $0.40 per share. At the current price I think ANG is a HOLD.

Held IRL 2.4%, SM 4.3%

I added Austin Engineering just prior to it going ex-dividend. I think it’s a decent global business, and it looks cheap! Given the capital, size of the buildings and equipment needed to manufacture these mammoth mining dump truck trays and shovels, I believe they could have a small moat.

Business performance was going gangbusters until they ran into issues supplying orders in Chile which put pressure on the margins here. I think it’s a temporary issue that new CEO, Sy van Dyk, can fix. I expect ROE to be over 18% going forward. I agree with Sy, that the 10% buy back with Austin’s strong fundamentals and low share price is an excellent use of capital for the business.

On-market Buy Back Announcement

Austin Engineering Limited (ASX: ANG, ‘Austin’ or ‘the Company’) is pleased to announce that the Board has approved an on-market share buy-back for up to 10% of Austin’s ordinary shares to be undertaken over the next 12 months, unless completed or terminated earlier.

Austin’s balance sheet provides it with the flexibility to pursue value accretive capital management initiatives through share buy-backs, whilst also continuing to reinvest in its business and growth.

The buy-back will commence on or after 10 October 2025 and be completed within 12 months. It will be conducted in the ordinary course of trading over the period of 12 months. The final amount of the buy-back and the timing of any trades will depend on several factors, including market conditions, the Company’s prevailing share price, its future capital requirements and any unforeseen developments or circumstances that may arise in the course of the buy-back.

The buy-back is in accordance with the ‘10/12’ limit permitted under the Corporations Act 2001 (Cth) and does not require shareholder approval.

Austin CEO and Managing Director, Sy van Dyk, said:

“The on-market share buy-back reflects both the strength of our balance sheet and the confidence we have in Austin’s long-term growth prospects.

“With strong cash generation expected and a clear capital management framework, we see the buy-back as an excellent use of a portion of our capital, given the current metrics of Austin shares.

“This initiative enhances returns to shareholders today while increasing their exposure to a business that is well-positioned to deliver sustainable value into the future.”

Held IRL and SM

Updated after 1H24 result.

Assuming full year NPAT of $32M. Using growth rate of 10% and future P/E of 10 and a purchase price of $0.49 gives a 14% return p/a. The key is whether the growth holds over that period.

ANG have just reported very strongly boosted a little by some revenue that didn't quite make last half. Full year outlook is very strong though.

Here are the highlights of the half.

- Revenue up 26% to $143.6 million

- EBITDA up 70% to $20.8 million

- NPAT up 2.8 times to $15 million

- Operating cashflow $6.9 million

- Net debt of $11.4 million, on track to be debt free in FY24

- Order book up 16% to a multi-year high of $184 million

- Return on Equity increased to 27%

- Interim dividend reinstated of 0.4 cents per share, fully franked

Full year outlook is just as strong.

- • FY24 revenue of $310 million - $330 million, up ~24% from FY23

- • FY24 NPAT of $31 million - $33 million, up ~75% from FY23

- • Company on track to be debt free in FY24

At 42c, at time of writing, the forward P/E is 7.7.

Order book is very strong at 27% higher than end of H2 23.

I didn't like the release stating 'recurring revenue' without stating what this meant. My interpretation is that this is bollocks. I think they have recurring customers, but that's it.

As with each of the mining service companies you need to judge how long the cycle will last. All of them still have very positive outlooks.

HELD.

ANG has upgraded guidance for the half year.

1H FY24Revenue of$138-$144million(versus original guidance of $120-140 million)

1H FY24 Underlying NPAT of$12-$14 million (versus original guidance of$10-$12 million)

Austin enters the second half of the financial year with improving group margins and with a new record level of order book following strong order in take in Australia and the commitment to a major 3 year contract extension in the USA.

They reported 'normalised NPAT' for the full year last year of $18.1M. Taking the mid-point of the 1H result and doubling it for full year gives them a forward P/E of about 7.

Rev + 27% but includes impact from Maintec acquisition - 11% organic growth

Underlying EBITDA (includes $11m in adjustments) was up 10%. Maintec contributed $3.2m so organic growth was negative. On a statutory basis EBITDA was down 23%

Operating cashflow in line with statutory EBITDA

Outlook: 1H guidance of $120-$140m Revs which includes $8m contribution from the acquisition. Presso says this is up 60% -- its actually an increase of 14% at the midpoint?! Unless I have missed something.

Historically the 1H was marginally stronger but was weaker in this result so tough to conclude on annualised numbers. Consensus has $285m for the full year +11%.

View: Smoke and mirrors- unsurprisingly David Singletons LTI is all related to the share price. Stock has done very well but come off the highs. Needs a catalyst to re-rate again and perhaps a quality result with no adjustments.

After taking a nibble at Austin Engineering (ANG) today, I thought I should search for other views on the business. Last week Tony Yoo from The Motley Fool shared a note by Shaw and Partners portfolio manager James Gerrish. James thinks “Austin Engineering has been oversold given the share price decline was harsh relative to the downgrade”. More below:

Punished too harshly, and ready to bounce back

The Austin Engineering Ltd (ASX: ANG) share price has crashed 27% since 2 May after a profit guidance downgrade.

According to Gerrish, there was a single source for the change in numbers.

“The downgrade stemmed from their Perth business unit which was expecting to deliver on a contract before year-end before the order was delayed,” he said.

“As a result, much of the fixed costs associated with the contract will be booked this year, while the revenue won’t land until 1Q24.”

Even with that nose dive, the stock is 18.75% higher than it was a year ago, which is an enviable performance considering the rest of the market.

The reality is that the rest of Austin Engineering is sound.

“The other business units are progressing well with revenue growth coming through and margins improving as a result.”

Thus Gerrish’s team is “bullish” on Austin Engineering shares.

“We see Austin Engineering as oversold, given the share price decline was harsh relative to the downgrade.”

Disc: Held IRL 0.5%

Austin Engineering, the dump truck tray manufacturer has been DUMPED following the earnings downgrade on the 4th May 2023 (ASX Announcement). Normalised Net profit after tax for FY23 is now expected to be in the range $17-$19 million for the Austin group, including Mainetec. This figure is down from the previously reported guidance of $24 million, primarily due to a delayed order from a major customer. This is also down on FY22 NPAT of $20.6 million. The share price reached a high of 40 cps in April and is now trading at 28 cps, down 30%. I think this is a buying opportunity, here’s why!

Since the guidance downgrade the order book has grown to record levels. Austin’s group order book to the end of May 2023 was up 21 percent year-on-year to $146 million and more than double from the same time two years ago (ASX Announcement). Put into context that’s around 57% of Forecast FY23 revenue.

A Quality Cyclical

Over the last seven years the ROE for the business has been consistently improving to 19.2% in FY22. FY23 ROE is expected to be weaker due to delayed orders (ROE 16% based on mid-point normalised NPAT of $18 million and shareholder equity of $111 million).

While there are eight analysts covering ANG on Simply Wall Street, only one analyst has provided forecast data. This analyst expects earnings to grow at 37% and ROE to be c. 21% over the next 3 years. Given the rapidly growing order book, I think this is feasible, especially on the back of delayed orders in FY23.

Conservative Debt

Net debt for the full year FY23 is expected to be circa $16 million (up from $12 million) primarily impacted by material procurement, partially offset by deposits following this delayed order, a situation which is expected to improve over the next few months as deliveries are made. Net debt on equity is still conservative at c. 14%.

Margins OK (FY22)

Gross Margins 45%

Net Profit Margin 6.2%

Valuation Ratios suggest it’s cheap

PE ratios:

Annual average PE ratios: 23.1 (FY19), 12.7 (FY20), 8.3 (FY21), 6.7 (FY22).

PE based on FY23 normalised earnings = 9.3 (28 cps / 3 cps)

PE based on forecast FY24 earnings = 5.6 (28 cps / 5 cps)

PEG = 0.3

PB = 1.5

Expected Annual Return 17%

Using McNiven’s StockVal Formula and assuming Normalised ROE of 20%, Equity of 19 cps, earnings reinvestment of 70%; You could pay up to 35 cps for a minimum annual return of 15%. At today’s share price (28 cps) you could expect an annual return of 17% (including growth, dividends and franking credits), or higher if PE adjusts upwards.

About Austin Engineering

Austin is a global engineering company. For over 50 years, Austin has partnered with mining companies, contractors and original equipment manufacturers to create innovative engineering solutions that deliver productivity improvements to their operations.

Austin is a market leader in the design and manufacture of loading and hauling solutions, including off- highway dump truck bodies, buckets, water tanks and related attachments, supporting both open-cut and underground operations. Complementing its proprietary product range are repair and maintenance services performed in our workshops and on clients’ mine sites, and spare parts.

Through Austin’s own design and engineering IP and range of tailored products, it delivers solutions for all commodity applications and drives increased efficiencies in productivity and safety in both open cut and underground mining operations.

Austin’s products can create more sustainable mining operations by delivering the lowest cost per tonne to end user, reducing fuel usage per material carried.

The Company is headquartered in Perth and has operations around the world in Australia, USA, Chile and Indonesia serving many of the major mining sites in the world both directly and through local partners.

Disc: Recently added IRL 0.5% (Cost price 28 cps)

Austin to acquire mining equipment company Mainetec

Mainetec is expected to have revenue of more than $40 million (on an annualised basis) for the 2023 financial year. In perspective - ANG revenue is currently $200M - so another 25%

Expected to be >20% EPS accretive to FY23 on a full year basis; expected significant operating and cost synergies.

Acquisition to be funded through cash plus new and existing debt facilities; prudent gearing maintained. Initial amount is only $19M. So it sounds like a great deal.

ang-to-acquire-mining-equipment-company-for-19-6-million-2751312 (1).pdf