Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

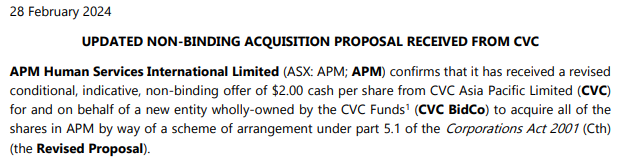

Further to press speculation contained in the Australian Financial Review on 18 February 2024, APM Human Services International Limited (ASX: APM; 'APM') confirms that it has been in discussions with CVC Asia Pacific Limited (CVC) and received on Friday, 16 February 2024 a conditional and non-binding indicative proposal pursuant to which funds or investment vehicles advised by CVC would acquire all of the shares in APM by way of a scheme of arrangement (the Proposal).

Under the terms of the Proposal, APM shareholders would receive consideration of A$1.60 cash per share less any dividends paid to shareholders after the date of the Proposal. The Proposal also included an option for all APM shareholders to receive all or part of the consideration in unlisted scrip in CVC's acquisition entity

The Board of directors of APM (Board), including its independent directors, have unanimously resolved not to pursue the Proposal on the basis that it does not sufficiently reflect the fundamental value of APM and the potential of its market leading platform globally. Although APM is currently operating in a challenging environment at a historic low point of the unemployment cycle, the Board remains confident in the outlook for APM

10-March-2023: Hi @Jimmy - in response to your question about what constitutes Insider Trading:

Insider Trading Australia Laws - Criminal Defence Lawyers Australia

Plain Text Link: https://www.criminaldefencelawyers.com.au/blog/insider-trading-australia-laws/

Basically, Insider trading is stock exchange trading to derive a benefit by accessing confidential information that isn’t available in the public. It includes buying, selling or trading shares or other securities such as bonds or stock options of listed companies from price-sensitive unpublished information that has the potential to affect the stock price that has not yet been disclosed.

Insider trading is only legal if the trading takes place on the foundation of publicly available information.

So then we get down to what is and what is not considered to be "price-sensitive information".

Many companies have trading policies that only allow their KMP (key management personnel) to trade in the company's shares during certain "windows" which are generally right after their half year reports, full year reports and sometimes their Annual Report are published. Others allow their KMP to trade all year around except for during "blackout periods" which will generally be the weeks leading up to those reports. Other aspects of those trading policies are that KMP are reminded of their obligations not to trade in the company's shares when they are aware of "price-sensitive information" that has not yet been made public. This obviously applies all of the time, all year 'round.

So, this could be a breach, however the company would argue that announcing these new contracts is NOT price-sensitive in that it is expected that they would win new contracts and that they would announce them as they win them, so just par for the course, normal conditions.

If it was trading when there is an undisclosed takeover in play, or knowing that a potential suiter has walked away before that info has been disclosed to the market, then I think we've got a stronger case. However, I would refer you to this:

Nuix CEO unaware of takeover bid when buying shares  [15-Sep-2022] [by Jessica Sier]

[15-Sep-2022] [by Jessica Sier]

That is a situation where the CEO of Nuix, Jonathan Rubinsztein, pictured above, bought Nuix shares, after seeking approval to do so from the Board Chairman (in line with Nuix's share trading policy for KMP) and the Chairman (Jeff Bleich) was involved with M&A discussions within the following week with Reveal’s chief executive officer Wendell Jisa while Jeff was on a trip to the United States. During the conversation, Mr Jisa inquired whether Nuix would be interested in potentially selling some of its assets.

Mr Bleich ultimately knocked back the suggestion saying Nuix wasn’t interested in exploring any transaction at that time, and the company says no proposed transaction was defined nor committed to writing.

Mr Rubinsztein’s purchase of Nuix shares was announced to the market on September 8.

Mr Bleich told the Nuix board and Mr Rubinsztein about the conversation with Mr Jisa on September 9.

That same day, shares in Nuix were put into a trading halt as press speculation had emerged around a potential takeover deal with Reveal.

Shares in Nuix had rocketed 27 per cent higher to 87¢ on the news and the company was forced to confirm it hadn’t received any bid or written proposal from Reveal.

Also, on September 9, Mr Bleich had another conversation with Reveal’s Mr Jisa where he re-confirmed Nuix wasn’t interested in selling any of its assets at that time and reiterated the conversations were confidential.

Nuix said Mr Bleich was unaware there was going to be any discussion around takeovers or bids when he began that first meeting with Mr Jisa on September 6.

In the statement to the ASX, Nuix said Mr Rubinsztein’s purchase of shares, made in an open trading window for directors following the release of the company’s annual results, was coincidental and Mr Rubinsztein wasn’t aware of any takeover discussions when he bought them.

The upshot of all that was that despite the matter being clearly spelled out in the AFR, and a series of letters being exchanged between the ASX and the Nuix Board about the matter, no crime or breach of the law was deemed to have occurred because of JR's "What? Me? I didn't know Nuthin'!" stance. And being backed up by the Board Chairman helped of course.

So even when a situation clearly would NOT pass the "Pub Test", there is often no action taken by the ASX or ASIC.

In this case [regarding APM], I'm not sure whether the ASX would deem it even worth enquiring about, because it's not a "Major Announcement" that would send the share price significantly higher or lower (like 10 to 20% higher or lower). In fact, when you look at their graph, APM still seem to be in a clear downtrend, despite a small rise today on the back of their announcement about the contract wins in North America. The ASX almost always only act when there is a significant share price movement and the circumstances almost demand to be investigated.

And by "Act", I mean they send a "Please Explain" letter to the company. And, as in the Nuix example I've outlined above, the company usually managed to convince the ASX that either (a) there was no breach of the listing rules or the law, or (b) there is sufficient evidence to suggest that there has been no clear breach, or that any breach that may have occurred would be difficult to prove in court (and probably not worth the money and the time to pursue).

ASIC will usually only get involved when the stakes are high (such as in the ISX/John Karantzis saga which involved hundreds of millions of dollars worth of shares being "earned" by dodgy accounting at best, and potential fraud at worst) or when the case is a "slam dunk" / "lay down misère" situation, i.e. they (ASIC) would have to be worryingly incompetent to not secure a conviction.

Hope that helps @Jimmy .

P.S. Additional: Footnote: "Please explain..." letters from the ASX in relation to substantial share price movements on no announcements from the company are sometimes colloquially referred to as "Speeding Tickets", a term that is thought to have been first used a few years ago (probably on the TV show, "Your Money, Your Call") by Tony Locantro, an investment analyst who specialises in smaller precious metals and other materials (mining) companies - and microcap biotechs - and used to be a Federal Police Officer before becoming a full-time investor/speculator and investment/speculation analyst. He did work for Argonaut but I think he works at Alto Capital nowadays. Tony does have a good sense of humour, and that definitely helps when you dabble in that (smaller and more speculative) end of the market.

I posted the other day how much confidence Director Megan Wynne was showing through the purchase of 845,000 shares for ~$1.985M.....and coincidentally today they post a somewhat material ASX release of new contract wins in Nth America.

As a shareholder the news is great however one must ask what constitutes insider trading?? Does anyone here know how the ASX/ASIC view and/or define insider trading....I'd be interested to learn??

Now this is showing confidence in your business with Director Megan Wynne purchasing 845,000 shares in an on market trade worth $1,985,224.00