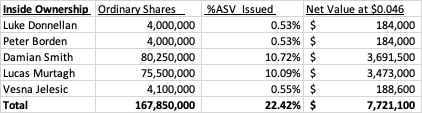

Market Cap at $0.046 is $34.436M

Management Bio’s

Luke Donnellan – Chairman and Non Executive Director

Luke is a former member of the Victorian Parliament. He was a Labor Party Member of the Victorian Legislative Assembly from 2002 to 2022, representing Narre Warren North. Luke served as the Minister for Roads and Road Safety and Minister for Ports from December 2014 to 2018 and the Minister for Child Protection and the Minister for Disability, Ageing and Carers from December 2018 until October 2021.

Peter Borden – Independent Non Executive Director

Peter began his career as a Chartered Accountant with KPMG in Melbourne He joined Ventia in 2016 as Chief Commercial Officer, before moving to the role of Group Executive – Transport. Prior to this, Peter held several roles at Downer over more than 18 years including Executive General Manager – Commercial and Risk, Infrastructure Division and Chief Executive Officer, Rail Division.

Damian Smith – Co-CEO and Executive Director

Damian co-founded Asset Vision in 2011 and continues to guide the platform’s growth, steering both its technical direction and expanding market presence. With 25 years in the asset management technology space, he has successfully built and scaled businesses and brings a blend of entrepreneurial drive and real-world experience to the continuous evolution of the Asset Vision platform.

Lucas Murtagh – Co-CEO and Executive Director

Lucas led the acquisition of Asset Vision in 2020 and has played an integral role in its vision, strategy and branding since that time. Lucas is a career entrepreneur, founding Method Group Consulting which was a BRW Fast Starter in 2013 and subsequently acquired by RXP Services Ltd (ASX:RXP). Lucas has strong experience in ASX listed companies and capital markets.