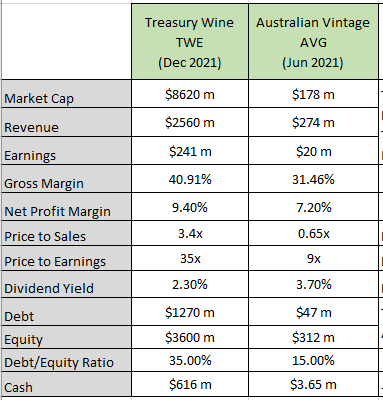

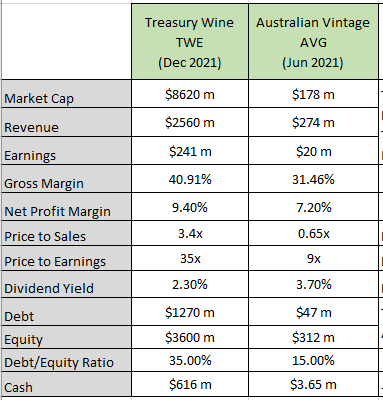

Just doing a bit of a comparison between Treasury Wine Estates (TWE) and Australian Vintage (AVG)

Admittedly these are very different sizes companies. However, it's interesting comapring the key metrics; in particular the PE, price/sales and net profit.

I started looking into AVG after receiveing a free sample of their Zero Alchohol (low sugar) Mcguinans Wine in my Woolworths online order. The sample was great (McGuinan Zero Pinot Grigio) which led me to start researchin the company.

Its still early days, but this is what I found:

- Multiple wineries in NSW and SA

- Focusing on sustainabilty and reducing their carbon footprint. Their wine processing facility in NSW is powered by 100% wind and solar energy sources including an onsite solar farm

- Their main sales are to UK & Europe; followed closely by Australia.

- They are not focusing on China sales due to high tarrifs. However, they do have a foot in the door with Jiang Yuan (founder of yesmywine - chinas largest online retailer) having a controlling interest and member of the board of AVG.

- Dec 2021, company directors have been buying shares at aroun $0.78

Below is a table comparing TWE and AVG.

TWE is trading at a premium with P/S of 3.4x (PE of 35x) compared to AVG 0.65x (PE 9x).

There net profit is similar as a percentage.

TWE debt/equity is 35% (increased from 11% to 55% between 2015 and 2021)

AVG debt/equity is 15% (reduced from 35% to 15% between 2015 and 2020)

Its still early days in my research.

Holding a small parcel in strawman but not in my real portfolio.