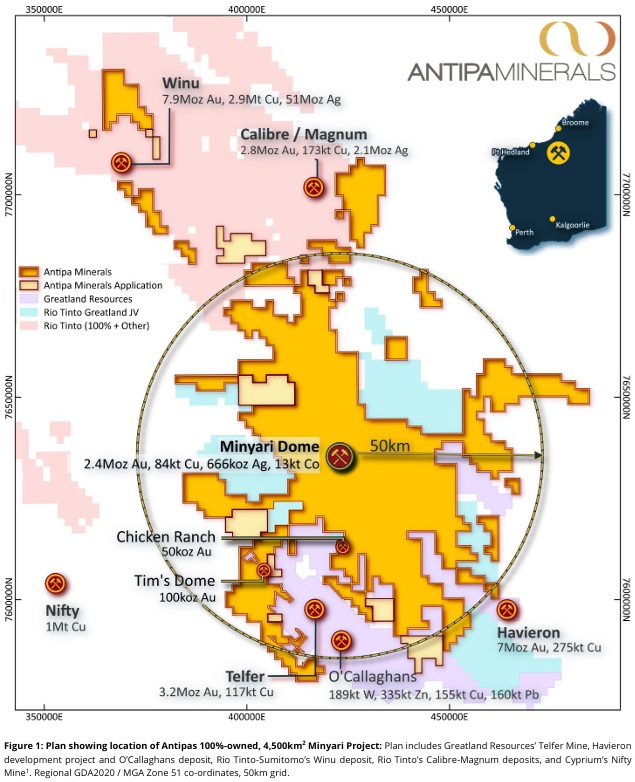

Minyari Development Project - PFS Workstreams Update (December 16, 2025)

Excerpt:

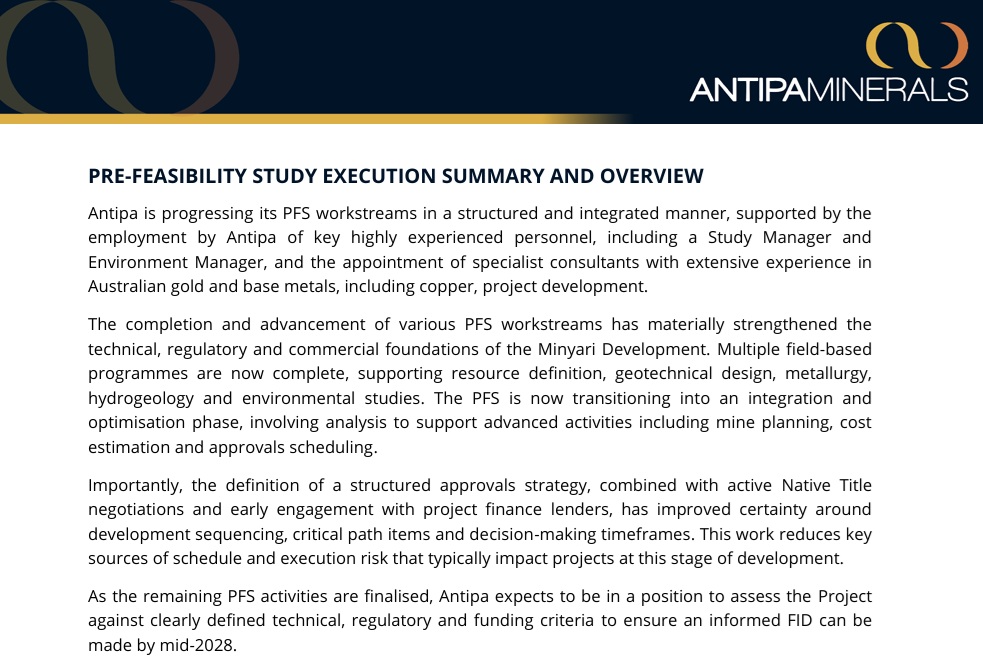

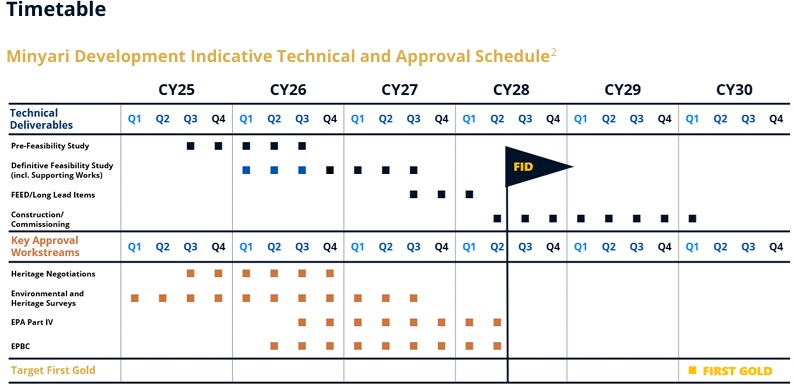

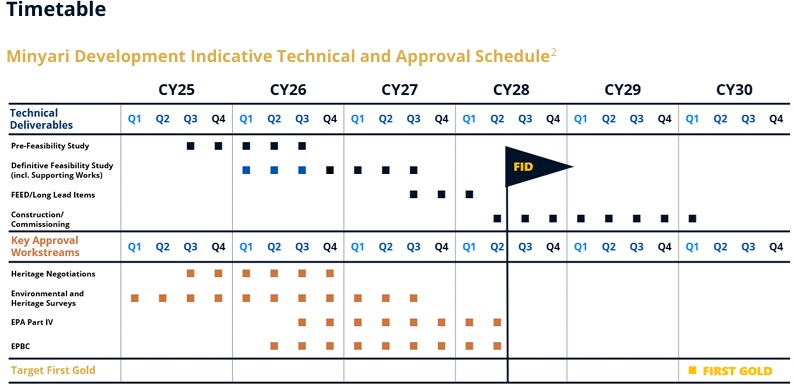

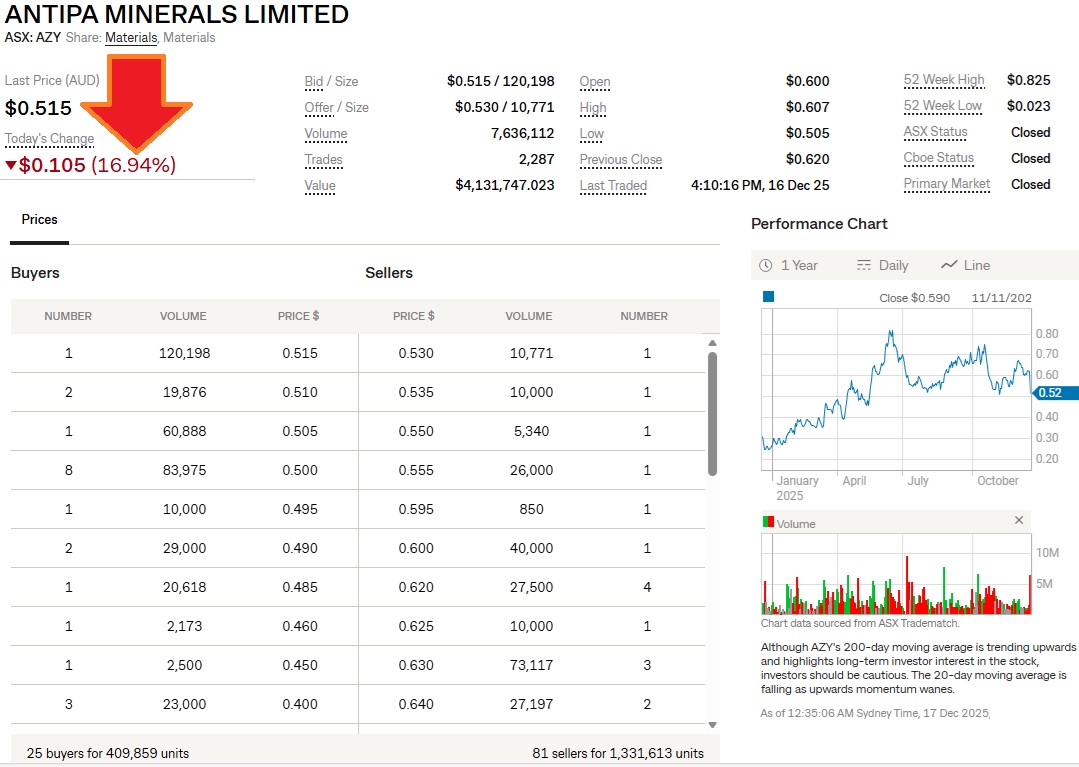

Methinks the market didn't like that timeline much, and specifically the FID not expected before mid-2028, as shown above and below:

First Gold in CY2030 is a little too far away for some people clearly:

More than three times the volume of sells to buys there, so sentiment towards AZY looks very weak at this moment in time.

However... I don't think that even Antipa Minerals' own management expect to be there to make that FID in 2028 - I reckon they reckon what I reckon, which is that Antipa gets taken out by Greatland (GGP) sometime between now and then, hence the lack of urgency here.

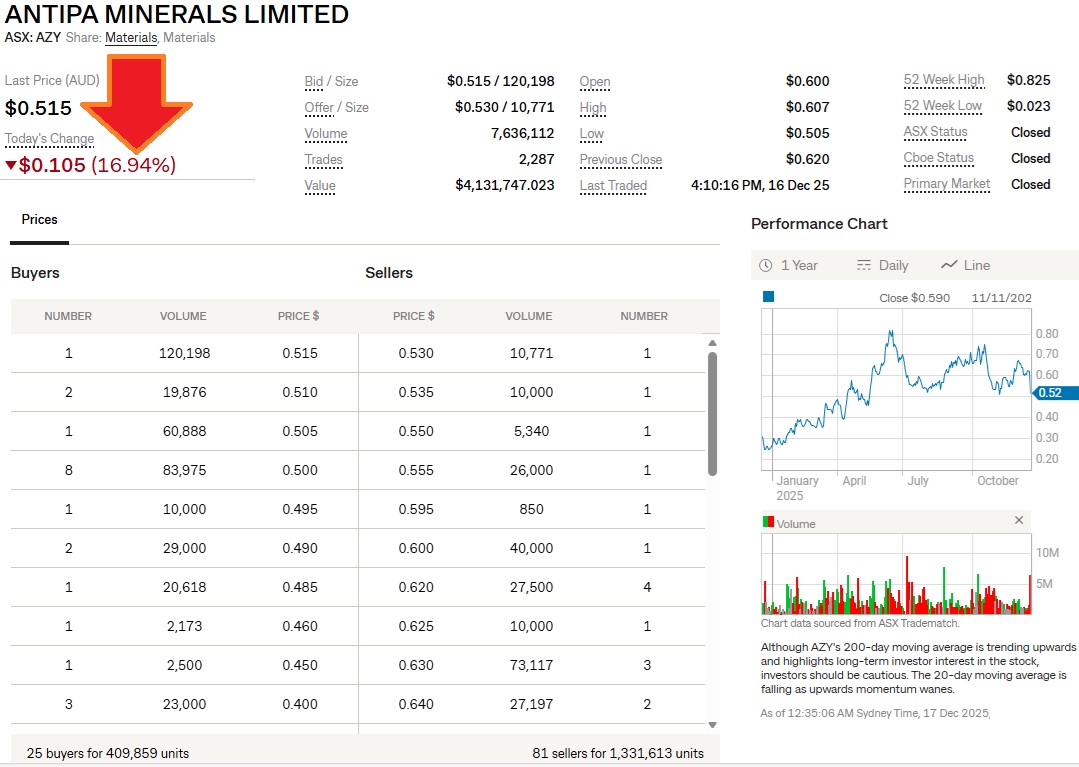

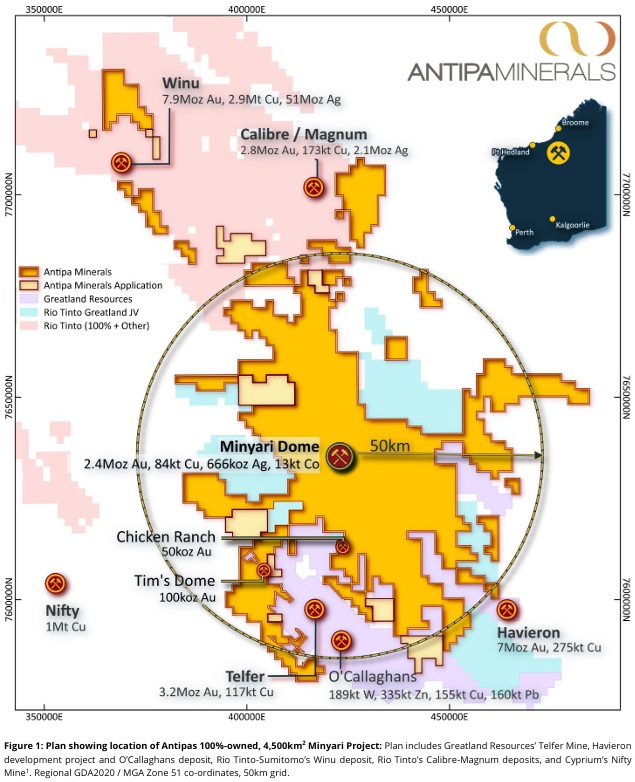

If you were Greatland, whose tenements are shown there in light purple/mauve (and their JV tenements with RIO shown in light blue), and whose current market cap is $6.3 Billion (source), wouldn't you REALLY like to own all those orange/gold tenements? Which are ALL owned by Antipa Minerals (AZY). And wouldn't you especially like to own the ones between Greatland's Telfer gold mine and mill and their large Havieron gold project.

Telfer is a very large gold processing facility (mill) with a nominal annual processing capacity of 20 million tonnes of ore per annum (20 Mtpa). The facility operates using two parallel processing trains, each with a 10 Mtpa capacity.

This significant capacity enables the current owner, Greatland Resources (GGP), to process not only their Telfer ore but also future ore from the nearby Havieron project, utilising a "hub-and-spoke" strategy. And AZY's Minyari Dome gold project, Antipa's most advanced project, is around the same distance north of Telfer as Havieron is east of Telfer, so the same thing applies to Minyari Dome - IF it became owned by Greatland (GGP).

My investment thesis for AZY is that it just makes too much sense for Greatland to buy them, so I believe it's a matter of when rather than if. And I can be patient. For a while. Until something shinier comes along.

I really can't see any sense in Antipa building their own mill when Telfer is RIGHT THERE!!

And Antipa is far too small to buy Greatland, however Greatland could easily swallow up Antipa (AZY).

So I expect a particularly volatile share price, and this one is held only in my Speccy PF (1.3% last Wednesday, one week ago, would be a bit less now), so an appropriately small weighting due to the risks with pre-revenue companies that are years away from production, UNLESS they get acquired first.

Plenty of people clearly got shaken out of AZY today by that reality check on the timeline. But like I said, Antipa's management are not in a rush because they don't really expect to be building their own mill. Please note: That's my opinion only, and I could be totally worng. This is Not advice - just my opinions and thoughts and a brief explanation of why I've dabbled in AZY with some money I can afford to lose.

Disclosure: I do not hold GGP, but I do hold AZY (1.3% last time I updates the prices in my spreadsheet, i.e. almost a week ago). I prefer to hold the potential targets in these scenarios rather than the potential acquirers, unless the acquirer has an excellent track record of good strategic acquisitions over multiple years (like GMD & EVN). Some would argue that also described Greatland (GGP) however GGP have a limited track record; they were a minnow before they acquired Telfer plus the remaining share of Havieron that they didn't already own from the world's largest gold mining company, Newmont (after Newmont acquired Newcrest), and while Greatland certainly have the potential to prove over time that that deal was so good it may yet one day rate as comparable to the sort of buys that Jake Klein made at Evolution back in EVN's early days, the Telfer/Havieron deal is only one year old (December 4, 2024) so it's early days for GGP - like I said, short track record so far, lets see how they go through a cycle.