BAP Investor Day Report (Edited to include two more broker updates)

I attended the Bapcor Investor Day yesterday. It was a good opportunity to hear from each of the Executive team members and to find out about the plans for the transformation program: “Better Than Before”. (Refer to earlier straws on here expressing dismay that CEO Noel has succumbed to bringing in a certain management consultancy!)

I’ll not try to summarise everything from the day, other than some of the key takeaways for me, as a long-term holder of $BAP in RL. (2.2%). The presentation pack is quite self-explanatory.

The good news is that there is nothing radical or whacky in the transformation program, although the target is very ambitious. $BAP has grown in part by bolting acquired auto-parts businesses onto the historical Burson core. If I could characterise the transformation in my own words, it is simply to drive operational efficiency through improved procurement and logistics, and more consistent pricing, enabled by investment in systems and digitialisation, customer relations (loyalty program), and culture/capability development of the team.

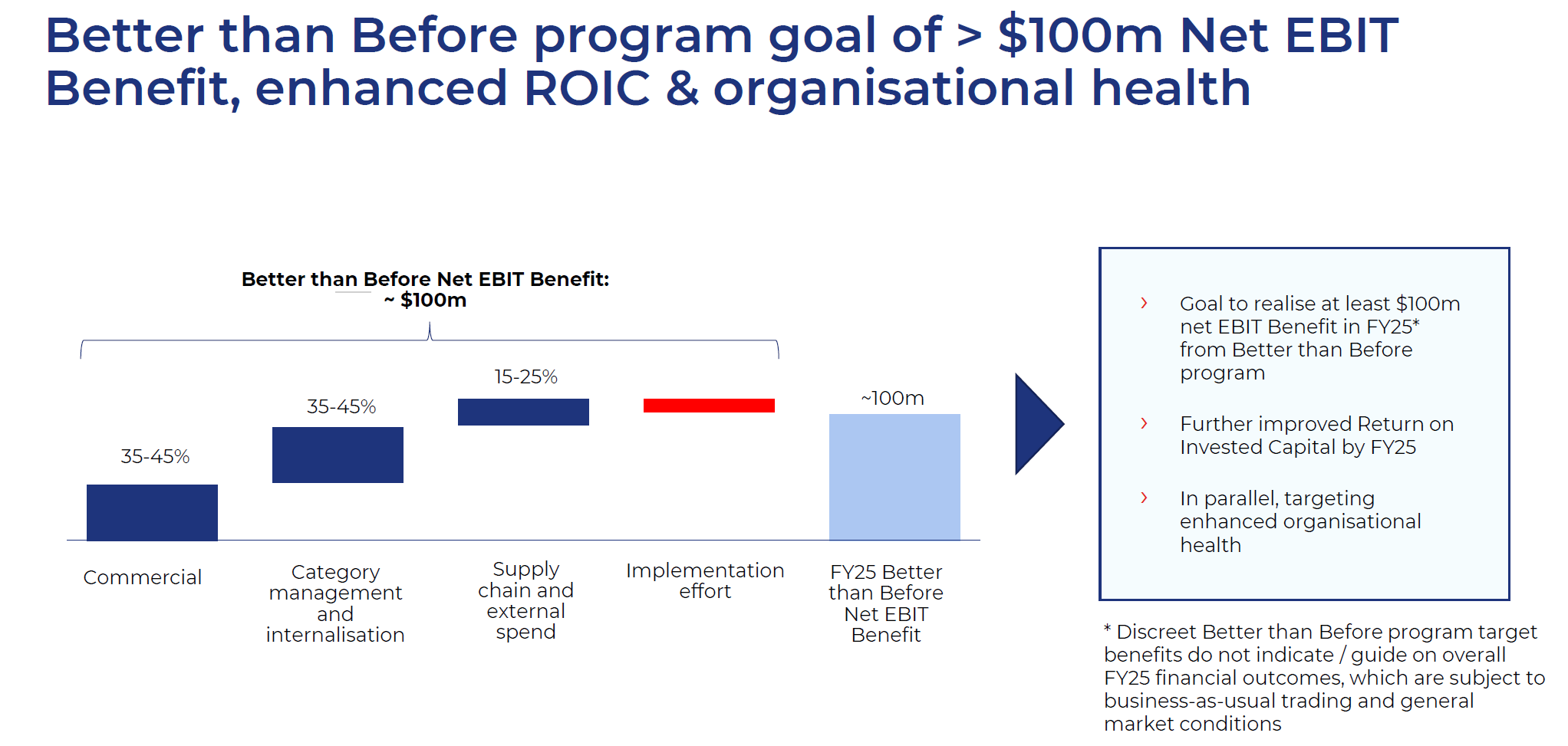

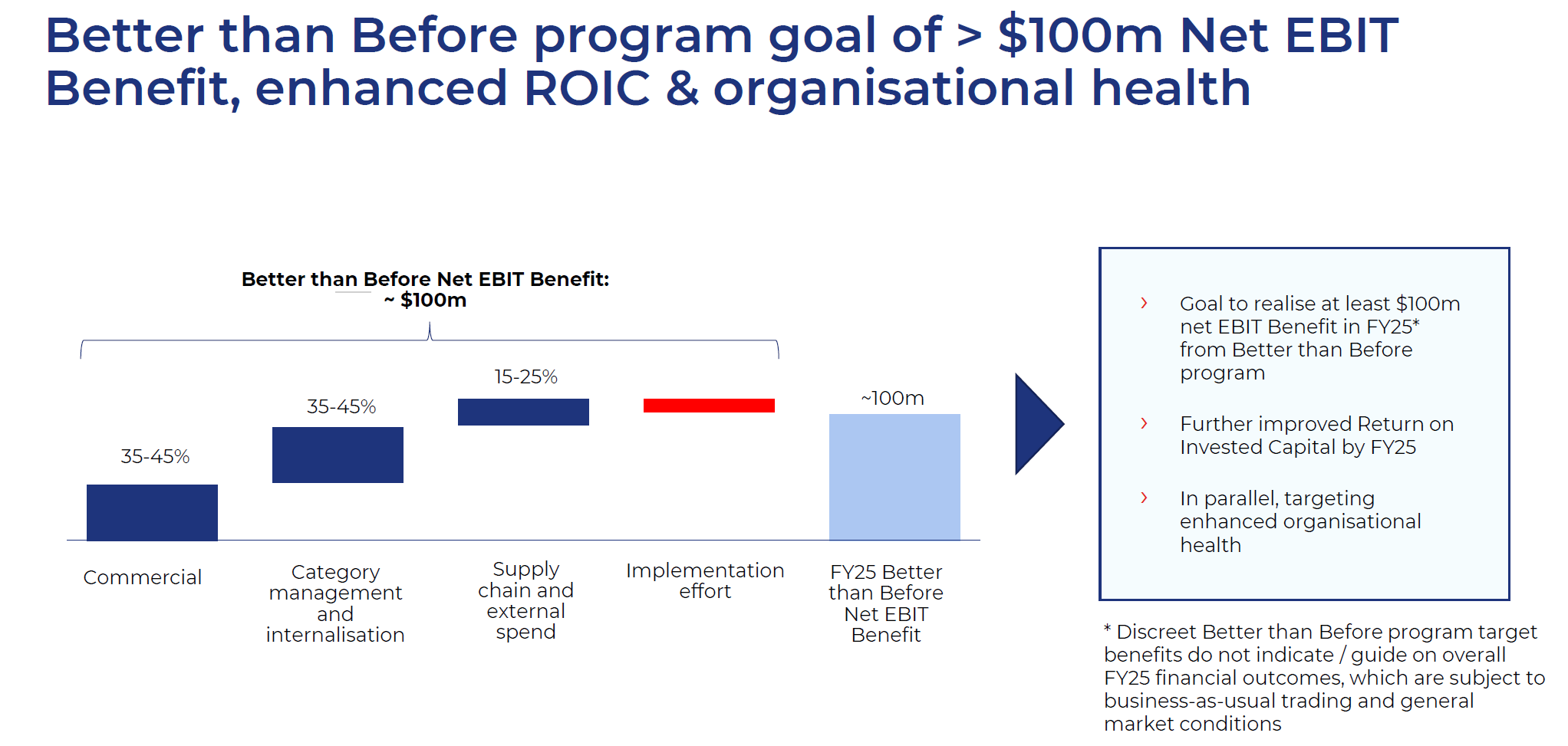

The aim of these efficiency improvements is to add $100m in EBIT in FY25, although the build-up to this will be:

- FY23 - upfront costs only partly offset by benefits in FY23 (a $20m opex hit)

- FY24 $20-30m EBIT delivery; and

- FY25 +$100m EBIT.

(Having spent some of own my career involved in and studying operations improvement, this is a reasonable even ambitious profile.)

The main components are shown below. NOTE: EBIT was $206m in FY22.

Now, many of us will be sceptical. After all, studies show that most transformation programs don’t deliver their targets and, even if they do, gains are often not sustained. But I am prepared to give $BAP management a better than even chance. Their basic function is to buy stuff, move it, sell it, and get it to customers. So, they need to be excellent at logistics. The ongoing programs to develop the two centralised DCs are already well-advanced (DCV up and running and teething problems largely sorted out, and DCQ on track, with opportunity to learn from DCV experience). They now must upgrade the systems to take the friction out of their internal and external supply chain. This is a much more well-worn path than say 10 years ago, and Noel has strengthened the management team in this area.

$BAP is now entering a more mature phase in its growth. ANZ is a maturing business, and Malaysia still remains just a growth option (given there are only 6 outlets to date). What is encouraging is that $BAPs future growth is now not going to be driven by 5-year new store targets. They are taking a more capital disciplined approach to investing only in proposals for new locations from the individual business units where they can get the returns. Given their footprint and the market maturity, this is good news. They will be much more focused on the quality of locations, refits/upgrades and focused on where new stores can take share from competition.

As part of developing the strategy, Noel and members of his team visited O’Reilly Automotive ($ORLY) the market leader in the USA, with more than 10x the scale. (So on a comparative basis it is the $BAP of the USA.)

By comparison $ORLY achieves ROA of 19% ($BAP 7%) and Net Margin of 15% ($BAP 6.8%). While Noel stated that they wouldn’t close the gap to $ORLY – which has much greater scale advantages – it is a benchmark they are learning from and it gave them confidence that their targets are achievable. ($ORLY achieves c. 12% earnings growth p.a. over the last 5 years.)

Analysts have updated as follows:

- Citi has upgraded target SP from $7.82 to $7.96, noting the transformation target is higher than they expected but comments on headwinds in the current macro environment

- Morgan Stanley revised SP target down to $7.00 from $7.20, focusing on the -$20m opex hit to FY23 from the transformation, and noting the reference to softening trading conditions since the AGM.

- Credit Suisse have increased TP from $6.60 to $6.80, crediting 60% of transformational benefits, 100% of the costs, and noting commentary on increasingly difficult trading environment.

- Macquarie has increased price target from $8.85 to $9.70, incorporating the program costs and benefits. (Note: compares to my upside case of $10.06)

As is the case more generally in the retail sector, SP’s are being held back by the macroeconomic conditions, with rising interest rates impacting consumer spending and business confidence. There were several references to this during the day, and it sounded like FY23 is not tracking all that strongly. However, Noel noted that when consumers slow their purchases of new vehicles it accelerates the ageing of the “car park” which over time is good for them. In addition, a lot of their spend is not really discretionary. If an owner tightens their belt for a year or two, the maintenance still has to be done and might cost more if deferred.

Looking longer term, Noel also showed current projections for EV penetration, which is widely considered to be a head-wind for $BAP. It is still several years before this meaningfully starts to impact the total fleet in Australia. Meanwhile, $BAP are working to figure out how to adapt. For example, while EVs require fewer parts and maintenance compared with IC vehicles, new categories of spend will emerge, such as charging cables. So, while it is definitely an issue to monitor, I wouldn’t write them off yet.

In closing, yesterday we got to see Noel’s refreshed management team – some long term $BAP team members and some new recruits with relevant experience for the challenges ahead. I am encouraged both by the commitment to operational capability and efficiency and to capital discipline. They've stuck to their core vales and overall strategy.

On an undemanding forward PE of 16.2, there is significant opportunity to outperform if the new team can execute. Equally, with the risk of macro-headwinds, softer FY23 trading conditions, and increased costs partly due to transformation as well as inventory levels still high due to supply chain issues, there is the risk of a disappointing FY23, which might be only partly reflected in the SP. So I am not a buyer today.

I remain a holder for now, because this is a strong business that is investing in its core capabilities with opportunities to continue to grow share through good customer service and competitive pricing. But the new management team need to prove themselves, so I can no longer say $BAP is a high conviction holding. For yesterday, at least, there were no mis-steps.

Valuation

I start with today’s SP of $6.68 and forward PE of 16.2. Assuming average annual earnings growth of 7% (pre-cost savings), then add 50% of the targeted EBIT benefit by FY25, at a PE of 17, I get FY25 SP of $9.29, which discounts back 2.5 years at 10% to $7.32.

If they deliver the full target benefits of $100m EBIT, then today’s value per share is $8.55 or if PE expands to 20, then it would be $10.06.

Of course, if earnings underperform consensus in FY23, there is further downside risk, which could offer an attractive entry point if it is driven by macro conditions and not the team's ability to execute.

On balance there is enough upside potential within management's control that $BAP remains interesting to me.

Disc: Held in RL only.

(I only hold companies on SM that are yet to prove themselves)