Hi Straw People (do we have any SW in our little community?)

Been looking into BlinkLab (ASX:BB1) – an early-stage Australian health tech developing an AI-powered, smartphone-based diagnostic tool for autism, ADHD and other neurodevelopmental conditions. Its technology has shown superior accuracy to FDA-approved alternatives, and with U.S. trials underway and regulatory approval expected in 2026, it is positioned to enter a large, underserved global market. Its backed by strong patents, reputable research partnerships (including Princeton and Monash), and a scalable, software-only model, BB1 offers significant upside as it transitions from clinical validation to commercialisation. I’m also thinking of possibilities down the line from players like Apple Health, given their move into biometric and neurological screening.

I like the company. It is largely founder-led, with the CEO, CTO, CSO and COO all being co-founders who helped develop the core neuroscience and software platform behind the product. The chairman, Brian Leedman (https://www.blinklab.org/investors), brings added credibility, having co-founded ResApp Health, a digital diagnostic company that was acquired by Pfizer for A$180M. The leadership team is well-aligned, technically strong, and has a track record of innovation and commercial success.

Of course, despite its promise, it’s not all blue skies — BlinkLab is a pre-revenue company with no regulatory clearance yet, limited cash reserves, and a likely need for shareholder dilution before revenue begins. Clinical adoption could be slow, and success depends not just on approval but also on changing entrenched diagnostic behaviours in healthcare — a challenging and uncertain path. That said, considering how many neurological conditions are still diagnosed subjectively and with long delays, BlinkLab offers a faster, cheaper, and more quantitative diagnostic alternative.

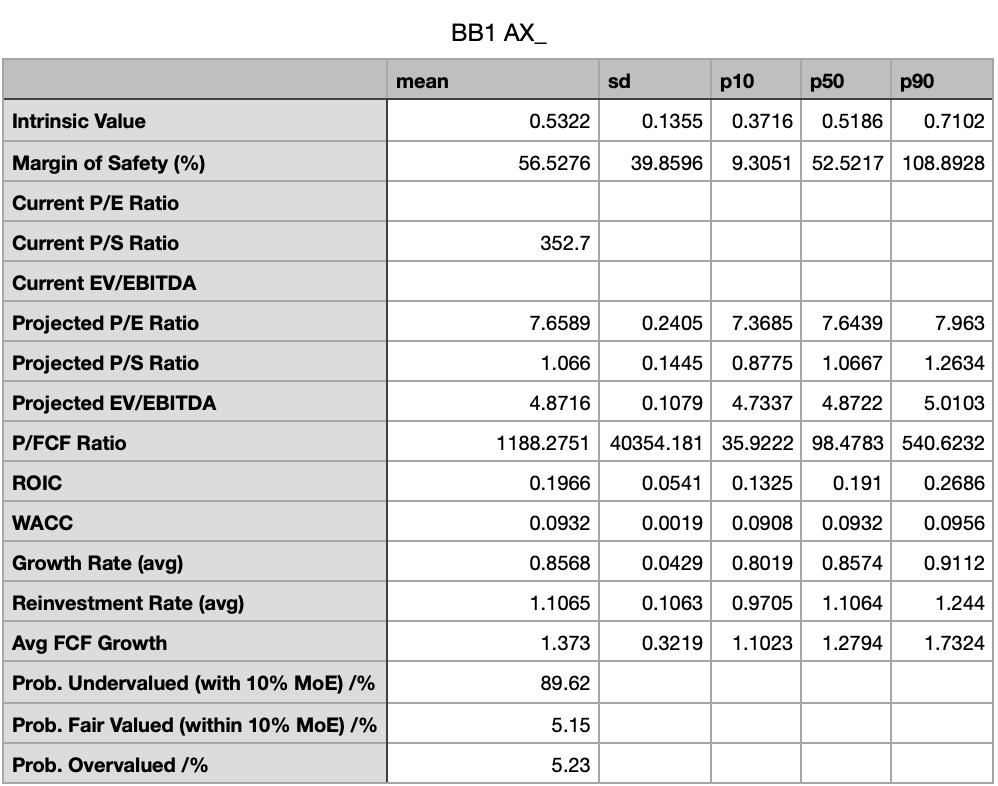

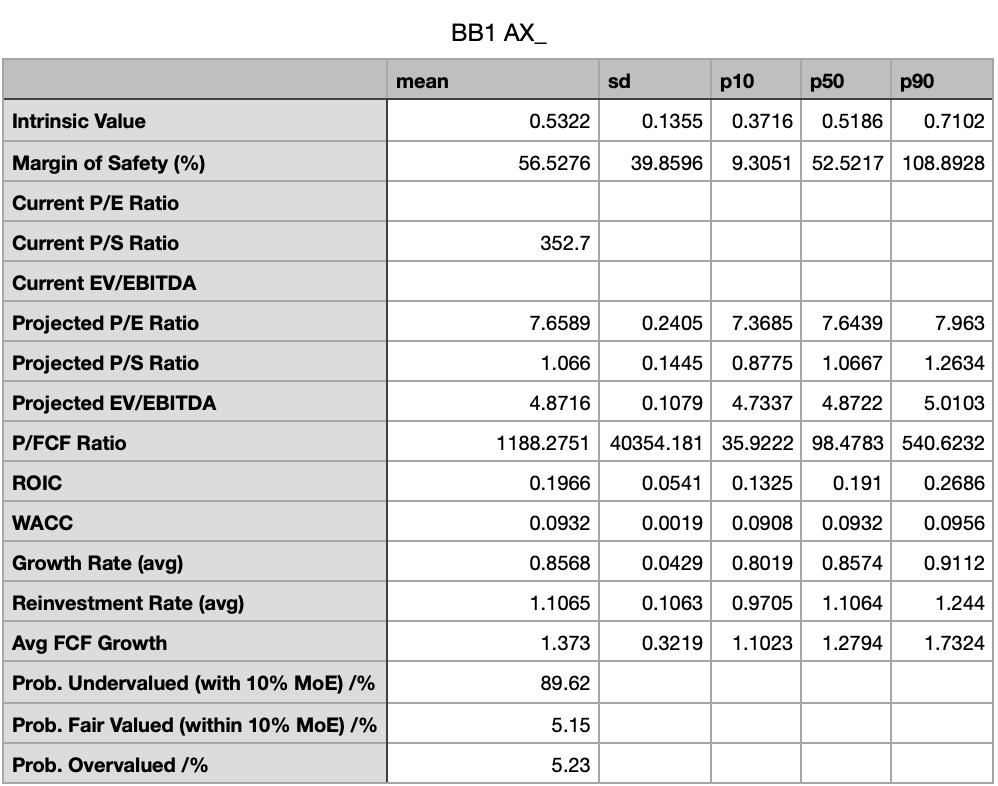

So, I ran a DCF using exponential growth fade assumptions and high reinvestment. Based on a high-growth revenue trajectory, the model estimates an intrinsic value of $0.52 per share (range: $0.37 to $0.71, 10th–90th percentile) compared to the current price of $0.35. This implies a margin of safety of ~56% (range: 9% to 108%). That places BB1 in a deep discount valuation category, reflecting high potential — if execution milestones are met. In terms of capital efficiency, BB1 is compelling. The model assumes a high-growth return on capital (ROC) of ~79%, which compares favourably to top-tier SaaS firms (60–80%), and well above average software (25–40%) or healthtech (15–25%) benchmarks. Even in the stable phase, BB1 is expected to generate a ROC of 13% and a ROIC of ~19%, exceeding mature software and medtech averages. Thus, BlinkLab could scale rapidly and profitably without requiring heavy capital.

Have any of you looked at BB1? and whether you had any thoughts. SW, I also thought a meeting with BB1 would be cool.

Cheers!