16 Jun 2025: More Gold Sooner - to be Held Longer - Gold Bullion Strategy

What's bold about BC8's new strategy is that they now plan to hold a lot of their gold in the Perth Mint rather than sell it, so selling what they need to sell and accumulating the remainder of the gold they produce, somewhat similar to what Rand Mining (RND) and Tribune Resources (TBR) have been doing for years with their share of the EKJV (East Kundana Joint Venture) gold.

The MoM lads had a chin-wag about this new BC8 strategy today (17th June) and did mention RND and TBR - see here - however please DYOR before going near either of those two companies - their management's interests appear to be NOT very well aligned with their ordinary retail shareholders - so you can make money with Rand and/or Tribune if you get your timing right or get lucky, but you can also get screwed, I've discussed them previously here, so I'll leave it there.

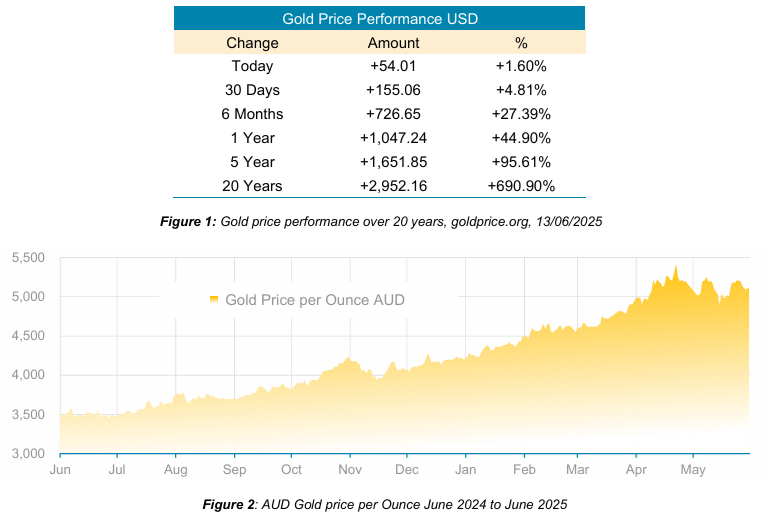

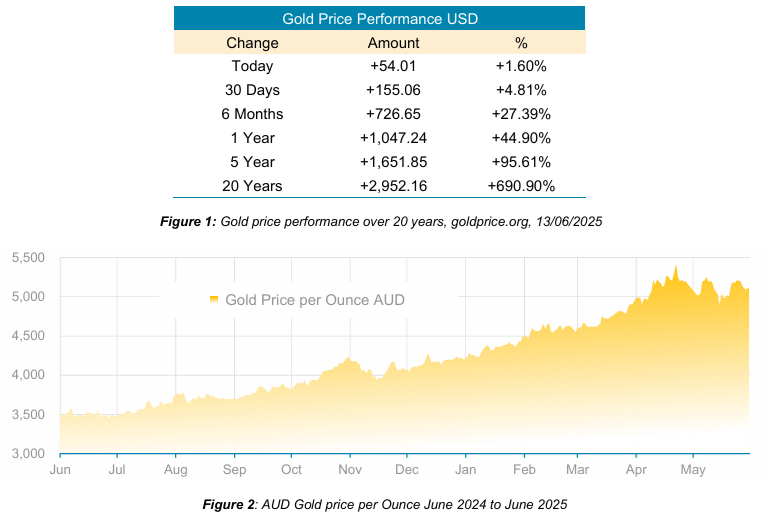

But back to Black Cat (BC8) - here's what they announced on Monday:

--- ends ---

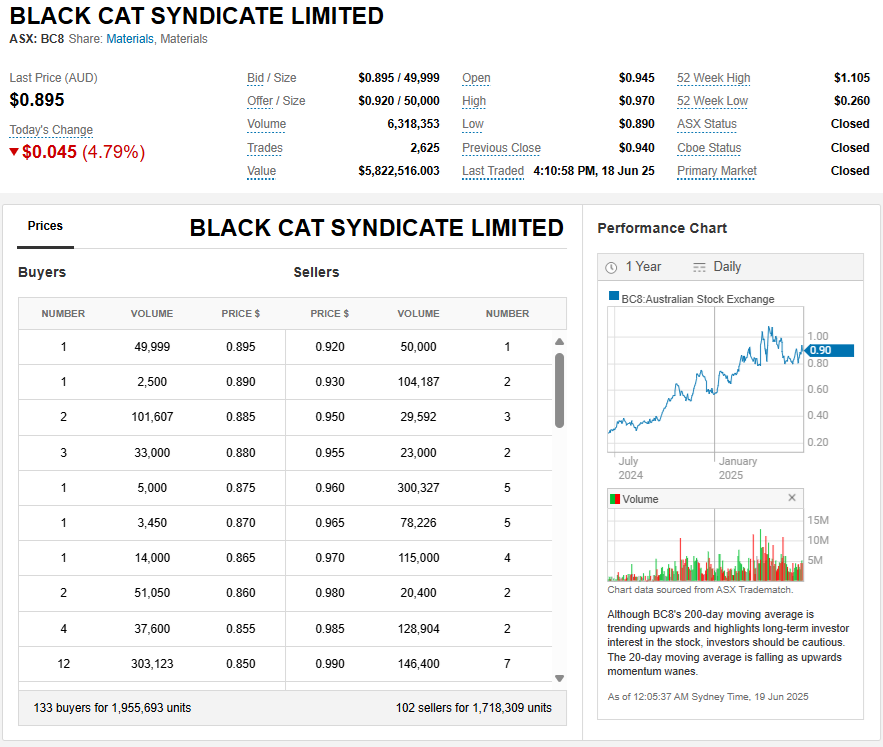

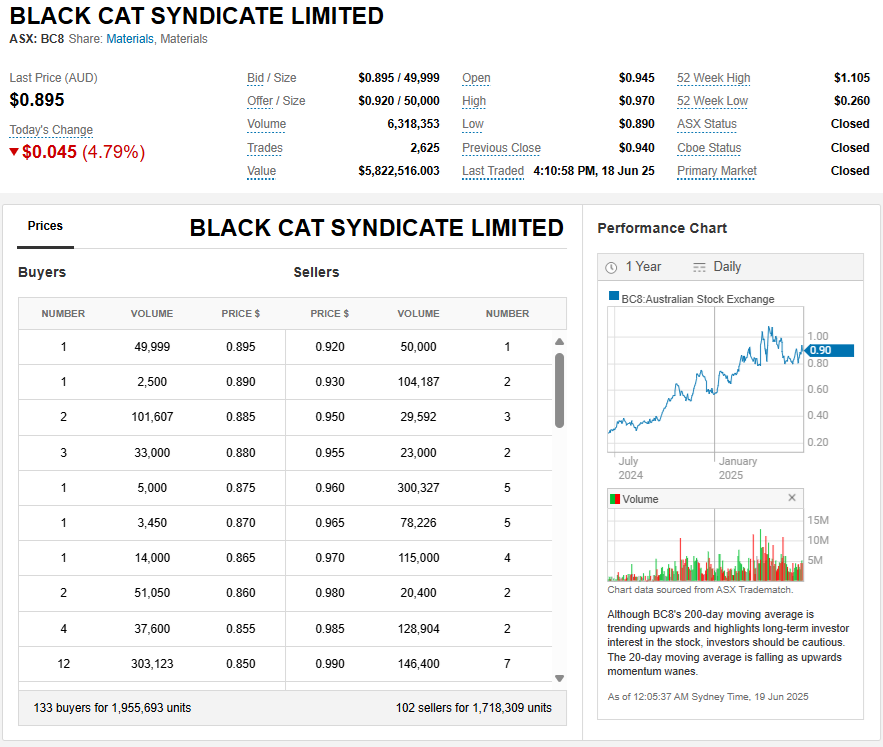

Not sure how shareholders will embrace this new strategy, but based on their share price trajectory punters have liked what BC8 has done this past 12 months:

Disc: Not currently holding this one, did hold them a few months ago for a couple of months and did well out of them, but I rotated the money into other goldies. I normally don't hold TBR or RND either, but I have held them on a couple of occasions and done Ok out of them by being reasonably nimble, and a little lucky too, last time being when they had a complaint made about them to the Takeovers Panel (TOV) and a declaration of unacceptable circumstances was made in relation to the ownership structure and a bunch of shares had to be sold, with EVN being the buyer of those shares - EVN later bought NST's operator (largest) share of the EKJV and EVN are now the operators of the EKJV with TBR and RND still having minor shares (compared to EVN) in the JV, but no longer feuding with NST because NST are no longer involved in that JV or its assets. I made the coin by getting RND and TBR shares before they paid the massive special dividends that they declared during that TOV investigation (they sold a bunch of their Perth Mint Gold and pre-paid tax and rushed through a fully franked special dividend each (this was in 2018) all within about a week and before the TOV could hand down their orders and force the shares to be sold. I sold out immediately on the ex-div date, and copped a capital loss but the fully franked dividends left me in front overall, and allowed me to offset gains elsewhere with those capital losses while generating a nice amount of income through those massive fully franked divies. It might have not been worth the effort for most people, but it was for me. But not without risk, as holding RND and/or TBR shares always is, IMO. Their disclosure is limited to exactly what they legally have to disclose, not a word or number more than that, and there are big questions over whether they should be listed at all considering they are really a cashbox company making money out of a sh!ttonne of gold in the Perth Mint and from being a silent (non-operator) partner in a producing gold mine. The Perth Mint gold is likely worth between 5 and 7 times what they say it is in their books (where it is recorded at cost, not at market value), and the ounces are not disclosed, just the total value (cost, not market value) of the gold. So even that is opaque. But anyway, BC8 is nothing like them, and I would hold BC8 again, I just don't currently hold them, because I see better value in the sector elsewhere.