Founded in 2007, BikeExchange listed earlier this year at 26 cents. Other than some first day volatility it's been trending south east ever since. Your gut feel is that it's an online marketplace that makes sense. It's a sizable and growing market with loads of tailwinds, including health consciousness, environmental concerns, government incentives and COVID. On top of that many cyclists tend to be willing to part with their hard earned for the latest gizmo that will shave grams of their bike weight or make them look prettier doing it. But these online marketplaces always seem to take longer than you might expect to get established.

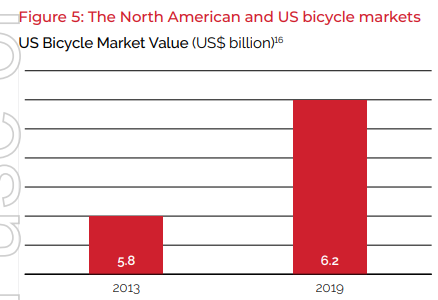

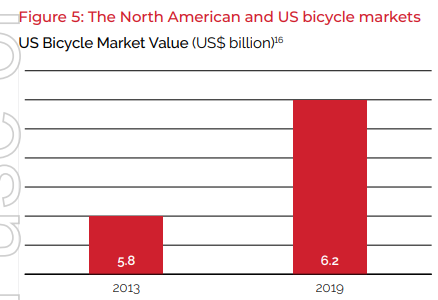

Something I like about BikeExchange is their Balance Sheet is pretty clean - in that cash is by far the biggest thing on there and they're not weighed down by lots of intangibles, goodwill, debt and other gremlins. The trouble is they're chewing through that cash really quickly. In 12 months time they're likely looking at a cap raise and they might need another after that before they become cashflow positive. That in itself is not a deal breaker (although a Cap Raise to keep the lights on is never great) but there's a few red flags in the mix as well. For one thing this company should stand trial for Crimes Against Graphs. Take this cracker from their Prospectus:

They get a tick for identifying sources in their Prospectus but that tick turns into a kick when you drill into the source. Here's how the footnotes typically appeared:

More than half of the sources they cited in the Industry Overview was them. I also think their Board and senior management are a bit light on experience for this sort of venture. I can't point at any of them as having the relevant experience and being a really safe set of hands to make this work. In the quarterly update they flagged revenue should exceed analyst estimates of $7.5m, which would be impressive growth of circa 65%. The trouble is Q1 'lookthrough' revenue was at a similar run rate to FY21, so they'll need to pick it up in the remainder of the year. I haven't made any allowances for seasonailty so that may be a factor.

They've benefited from the once-off impact of COVID but the risk of a resulting hangover now that the public can spend on stuff other than goods is another risk.

Overall I'm happy to sit by and see how they execute. Given the size of the market, if they deliver on their promises and really look like taking a pre-eminent position globally I'll be more than happy to pick them up at a higher price. For now it's just too speculative for me.