** Edit 8th of April 2020 **

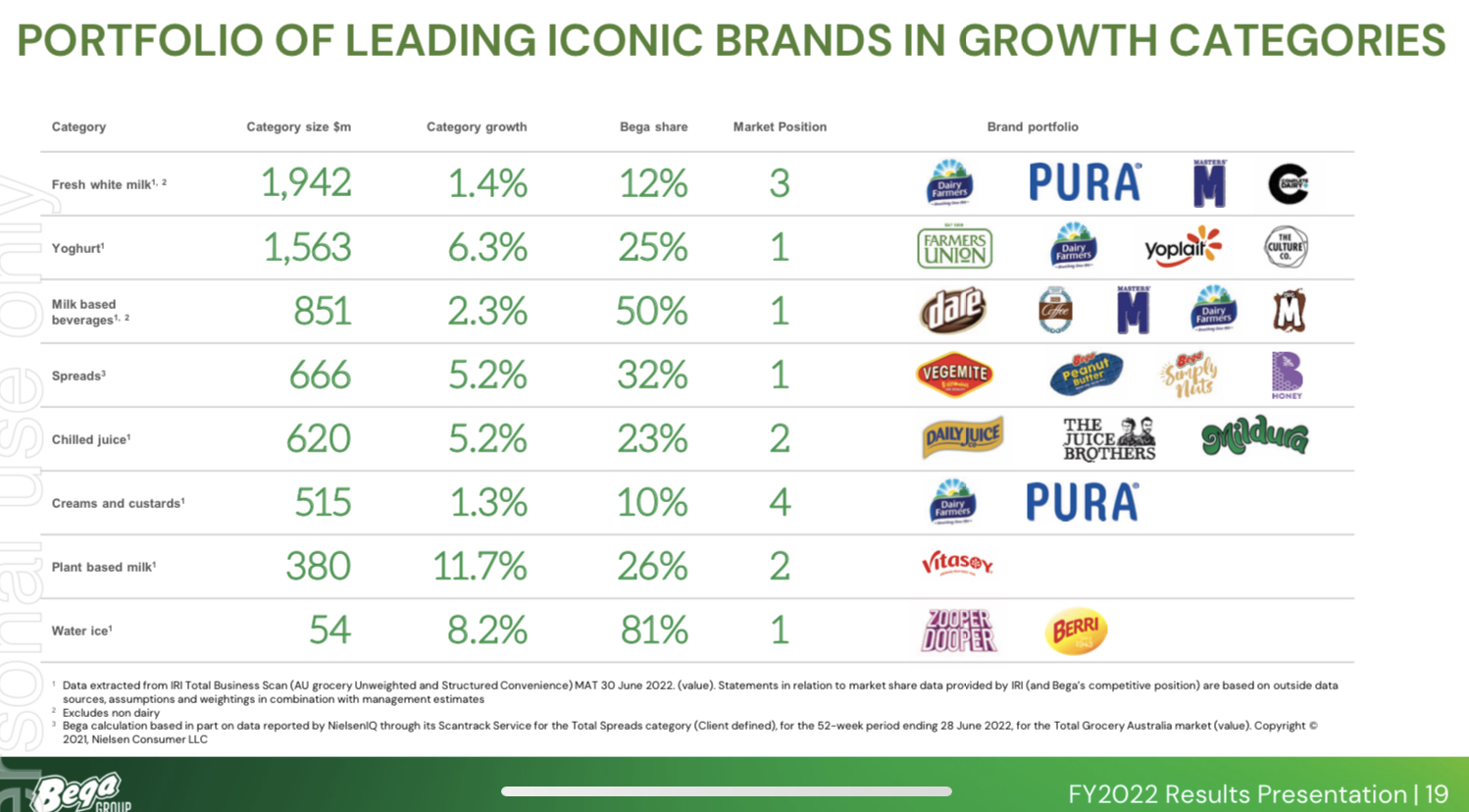

Bega is one of the few companies I own whose levels of debt going into the current public health crisis I find unconcerning. On most future outcomes I foresee Bega’s revenue remaining at levels sufficient to service this debt as it continues to sell milk, cheese, peanut butter, and vegemite through Australian supermarkets.

I am also predicting a short-term tailwind in Bega’s share price following a ‘flight to safety’ of capital as the full economic impact of the current crisis takes its toll on the balance sheets of the remainder of most of the ASX for the rest of 2020.

I am overweight on this company in both my Strawman and personal portfolios. I will not be purchasing more and if my thesis plays out I plan to re-deploy any realised capital gains to other opportunities that present themselves.

A methodical valuation of Bega should account for both Bega’s gross margin with respect to milk products (how much Bega is paying for milk at the farm gate) and it’s growing share of the retail peanut butter market. I am still across neither. And both have been affected by drought, bushfires and the current international trade environment making any degree of certainty even more elusive.

My less than methodical valuation is that I see an upside of 20% from today’s share price. This is more than hope but is admittedly far less than the precise estimate of intrinsic value that every investment deserves. Nevertheless, my valuation for Bega is now $5.50.

-------------------------------------------

Chasing cheese down a steep hill

Cooper’s Hill, located on the outskirts of a small village outside of Gloucester, comes to life once a year in late May. It is the home of that famous annual race whereby a small group of people (mainly young men in T-shirts or rugby jerseys) chase a wheel of cheese down a sheer drop with a larger group watching on the sidelines – the spectators themselves having to hold on to guide ropes for balance. At the bottom awaiting one them – in addition to the cheese – is a small (relative to the risk) amount of prize money and the likelihood of not buying their own pints of beer that night. Waiting for many of the rest of them is St John Ambulance. Probably not the worst metaphor for the stock market in general.

Only I did swear off that particular dream a bit earlier than the one of finding riches on the ASX. My early internet research of the festival, using a dial-up modem, returned images of X-rays depicting ankles with upwards of 15 metal pins inserted. Apparently Doctor Foster was going to Gloucester to check in with his booming Radiology Clinic. So the Cheese Roll and Wake may just be another dream that did not come to fruition, but honestly my regrets about this are few and the skeletal structures of my feet are intact.

Following a different prize cheese, Bega, down the hill feels far less dangerous however. Today I double down on this company. This is despite the current price being well below their current attempts at raising capital from retail investors to pay off debt used for the recent acquisition of the Koroit Facility (the bulk of it – $200 million of the $250 million – has already come from institutional investors) [1]. It remains a very long play for me. Despite the concerns of others about this situation [2], I am thoroughly unworried about whether they can find the money to pay off that debt immediately.

I mean, it’s the cheese and dairy business, it’s far from an extreme sport. These guys have been doing it for a long time and I don’t think impulsive and unresearched decisions form part of managing that business. I have confidence in their ability to deal with a temporary capital management issue. I’m also buying in again in the full knowledge that I have not won this race to the bottom. Let the average returns eventually start to roll up a gentle slope. It’s all just part of the ageing process.