BPM is a new pocket money punt like PLC was as per the Sub 2C Punters thread. Fortunately I can mark this properly as the stock is over 2c haha.

BPM has rejigged the portfolio with a new asset on the south eastern margin of the Yilgarn craton, within the metamorphic zone formed when it crashed into the Albany-Frasor Oregon. This is the same structure that Tropicana sits on to the north.

The tenement was last worked by Anglo/IGO prior to their discovery of Tropicana. Smoke was found but was not enough in comparison so was left behind. The tenements were picked up by some prospectors who then vended into BPM, even joining them to progress exploration.

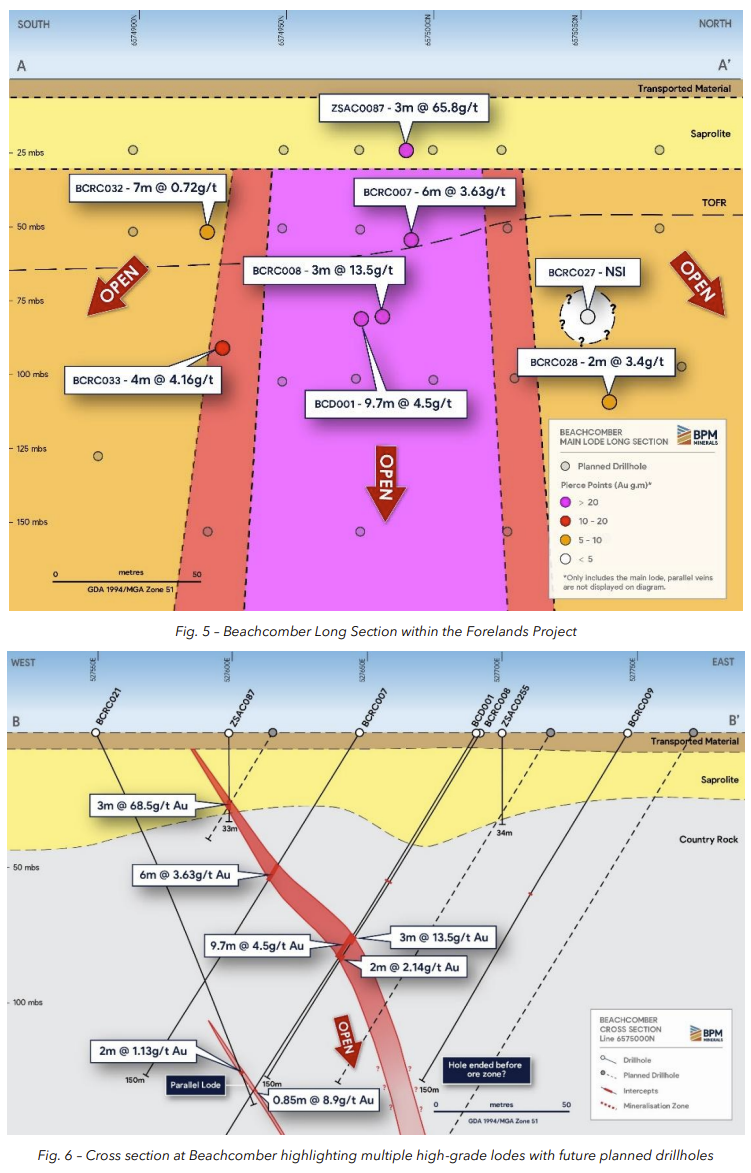

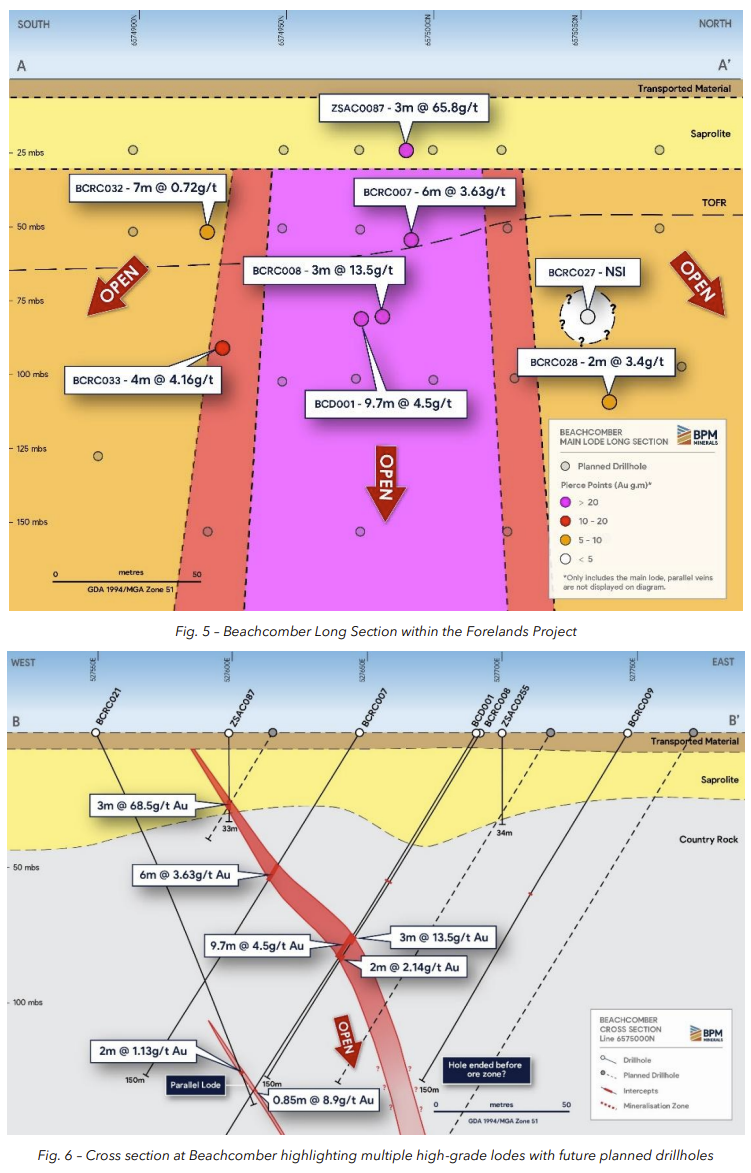

The prior hits, notably at the Beachcomber prospect, are of economic potential and BPM will focus the first drill campaign here with 3000m of RC planned. The release detailed the planned pierce points which show a largely systematic appraoch along strike and depth, both of which remain open. This is detailed below:

After a quick catch with the co, there is 6-12wks to get native/heritage in line before drilling can commence. 3000km of RC can be done quick (~2-3wks) with the variable being lab turnarounds being 4-6wks atm given activity has picked up recently. Duration of the trade is 12-21wks.

Cash and equivs are $3.5m post the subsequent asset sale to CMM with $900k being CMM stock which has no escrow, thus BPM has plenty of runway to drill this initial prospect and others.

Mcap is ~$4.5m so an EV of $~1.0m which is cheap for high impact near term drilling. This gives the asymmetric risk/return profile ones needs on a spec punt.