On the proposed acquisition of $LVT, $BTH have said

"To date, Bigtincan has received very limited engagement from the Board of LiveTiles, beyond acknowledgement of our proposal. Whilst the Board of Bigtincan believes the combination of the LiveTiles business with Bigtincan is a compelling opportunity for shareholders, without genuine engagement from LiveTiles and the opportunity to undertake due diligence, Bigtincan is unlikely to be in a position to make a formal proposal, but reserves the right to do so."

Maybe (and just spitballing here), the reason why $LVT hasn't replied is that they realise that what stands between today and a profitable business for $LVT is all the management, board and sales and marketing costs that wouldn't be need if $BTH swallowed it. Just saying.

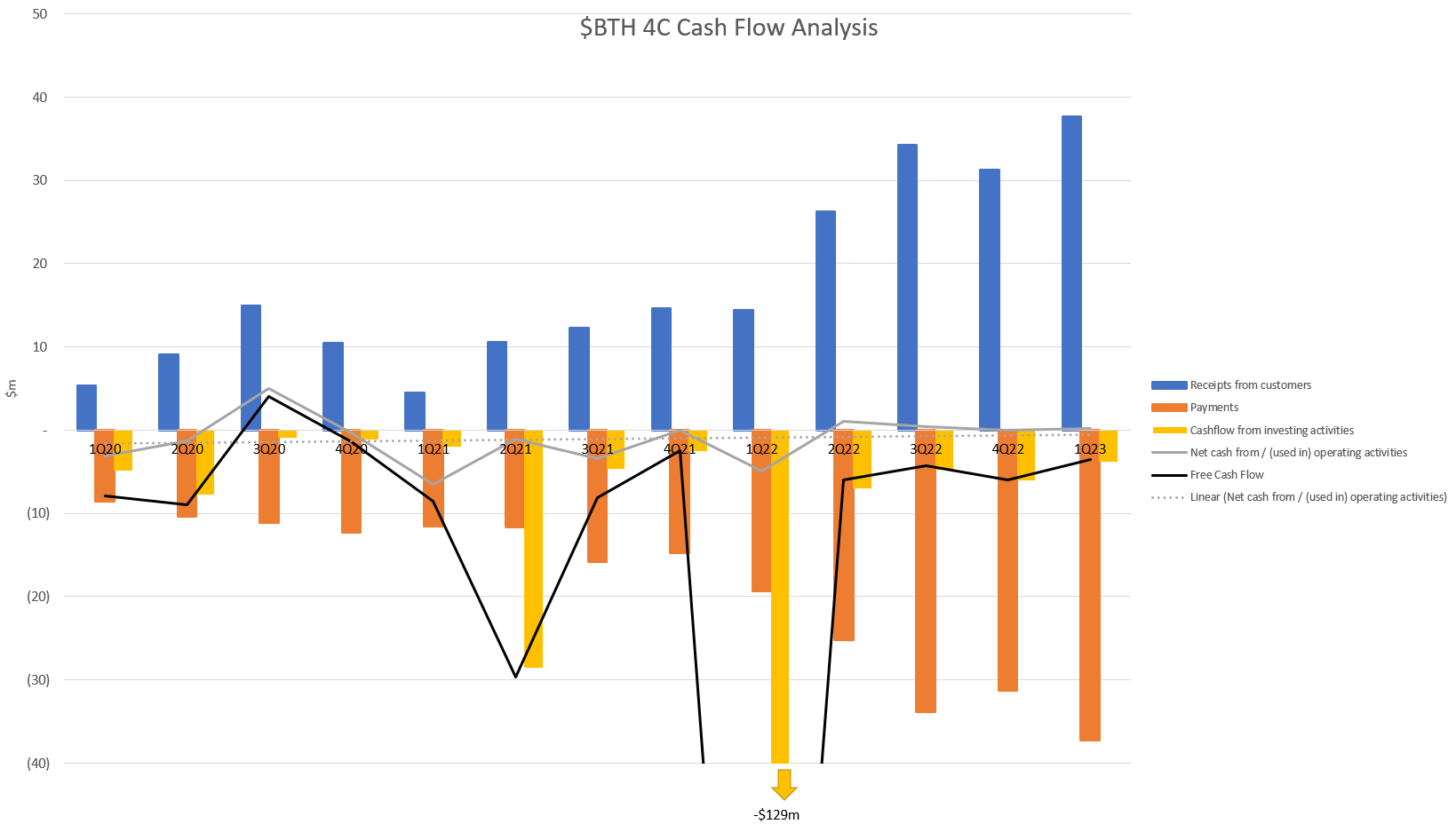

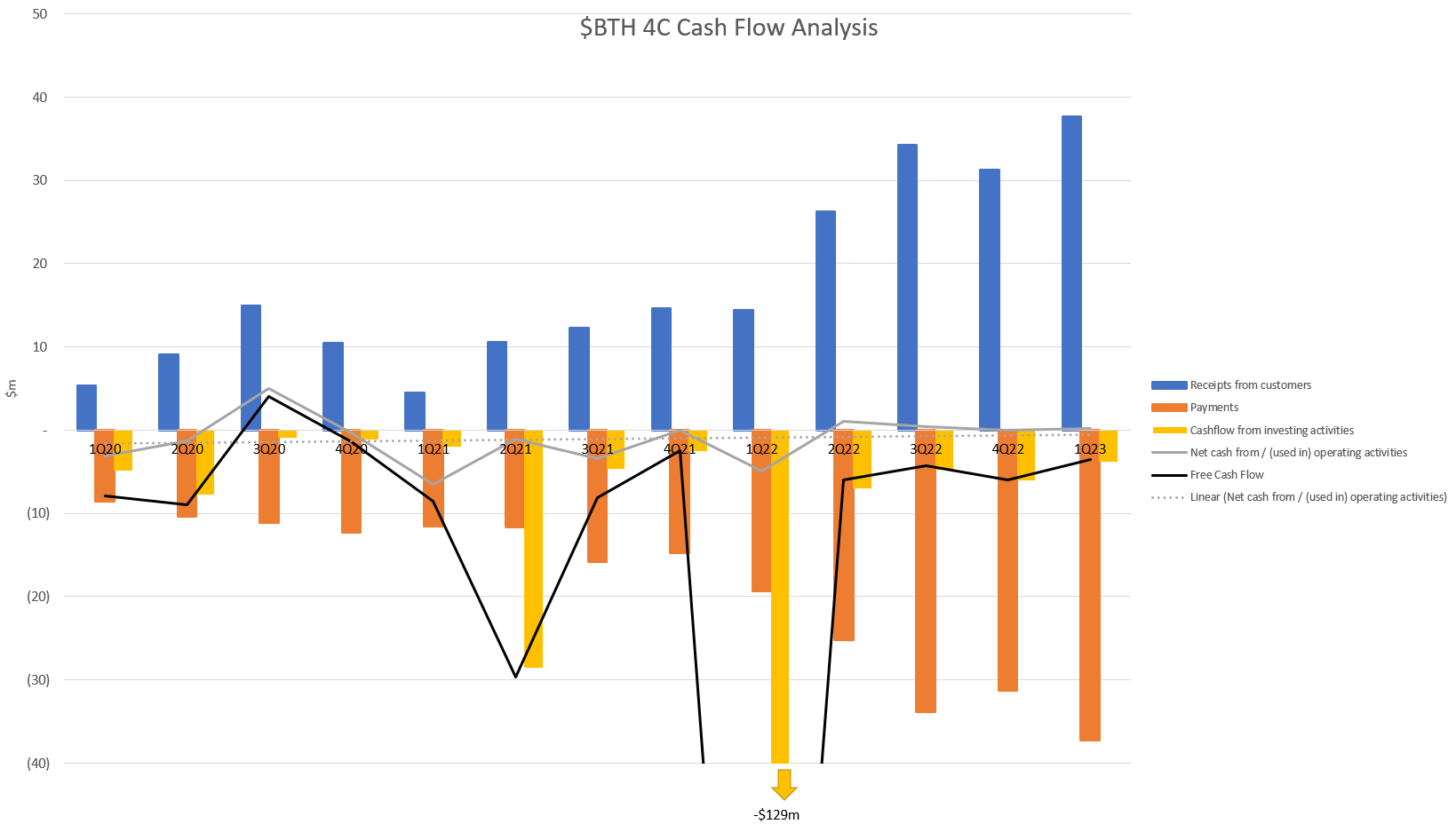

While online, my usual CF analysis is below. You can see the effort over the last 3Qs to manage operating and investing expenditure. What's positive, is that during this time, growth in receipts has held up well. If this continues then maybe $BTH starts to become interesting again.

So, I hope the $LVT acquisition doesn't once more muddy the waters. More than happy for the calls to go unanswered. But given the early shoots of progress towards a profitable business, I don't know why $BTH doesn't just focus on execution and organic growth.

Disc: Not Held