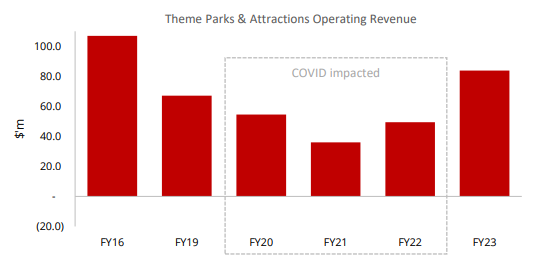

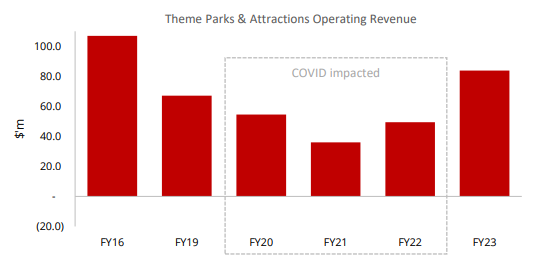

The theme park business continues to recover, with revenues for the second half up 30% on the previous corresponding period. For the full year, revenue will be up 70% and up 25% from pre-covid levels.

Shares up 13% on the news (although coming off a multi-year low)

The business has loads of cash following the sale of Main Event -- about $141m. So while the market cap seems expensive relative to revenues ($213 vs $84, respectively), things look a lot better on an enterprise value basis (currently at $72m). They also own a lot of land.

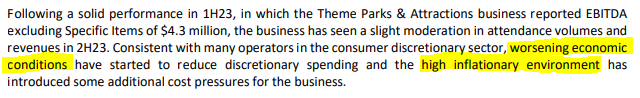

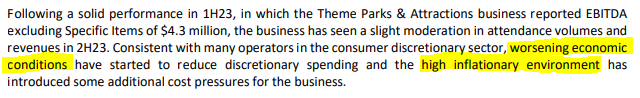

Bear in mind that a good chunk of cash is flagged for future development. Also, this is a business that is very much dependent on discretionary spending. In fact, things have been moderating since the first half though, with management echoing the sentiment of others in the discretionary retail space:

As a high fixed cost business, profits can really move around a lot. In 2016 -- their peak for theme parks, and before the tragic accident at Dreamworld -- the EBITDA margin was a massive 33%. Ever since, even on an adjusted or normalised basis, it's been very uninspiring (usually negative from what i can see).

So this is a bit of a turnaround play. Can they get a good return on investment with their spend on Theme parks? Can they ride out any short-term economic headwinds? Probably, but it's too tricky for me.

Today's update is here.