CHALLENGER LIMITED (ASX:CGF) - Ann: Challenger and Apollo business relationship, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

Context:

July 2021, Apollo has increased its equity stake in Challenger to 20% and the two businesses have built a strategic partnership, focused on delivering on a shared ambition to provide customers with financial security for a better retirement. Challenger and Apollo remain committed to pursuing a range of initiatives as part of their ongoing commercial partnership, including an asset origination and distribution partnership.

Apollo’s decision to reduce its ownership in Challenger supports redeployment of capital to other growth opportunities. Under the asset origination partnership formed in November 2023, Challenger Life has access to Apollo’s high-quality direct asset origination capabilities, which helps support both customer annuity rates and returns for Challenger shareholders. Through this partnership, Challenger has invested in Apollo’s private markets and private equity strategies. Since September 2023, Challenger has exclusively distributed Apollo’s Aligned Alternatives (AAA) strategy to Australian retail and wholesale clients, which continues to gain strong interest.

These strategic initiatives will continue and are not subject to Apollo’s shareholding in Challenger. Challenger Managing Director and Chief Executive Officer, Mr Nick Hamilton said: "Challenger and Apollo have developed a collaborative partnership that supports our broader growth strategy. We look forward to continuing this relationship and pursuing a range of initiatives to deliver value for Challenger shareholders, including through asset origination and distribution of Apollo’s highquality products in Australia. Apollo’s re-evaluation of its investment in our business will also significantly increase Challenger’s free float and improve trading liquidity." Apollo Head of Asia-Pacific, Mr Matthew Michelini, said: "We believe Challenger is a unique platform to offer the next generation of investment products to retirees in Australia.

As one of our most important long-term strategic partners globally, we look forward to continuing to collaborate on asset management and product design.” 05 September 2024 Challenger Limited A.B.N 85 106 842 371.

Disclaimer: The forward-looking statements, estimates and projections contained in this release are not representations as to future performance and nothing in this release should be relied upon as guarantees or representations of future performance. MS&AD Insurance Group Holdings Inc. (MS&AD) will become Challenger's largest shareholder, with a shareholding of 15.1%, which remains unchanged. MS&AD remain committed to the strategic reinsurance partnership with Challenger, having recently extended the agreement between Challenger Life and Mitsui Sumitomo Primary Life Insurance Company Limited (MS Primary) for five years in May this year

Noted:

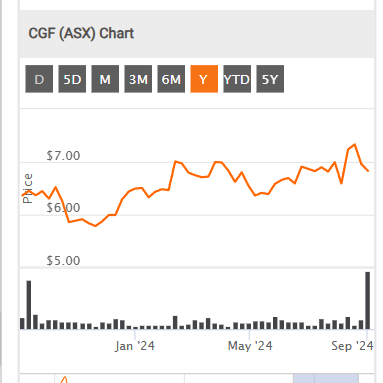

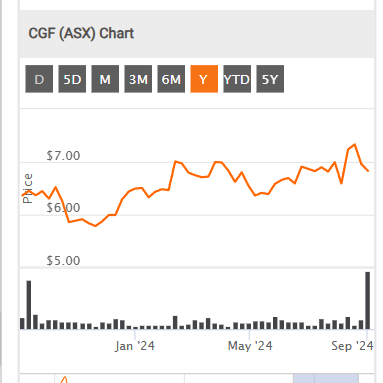

CGF Market reaction to the announcement: down 10%

CGF Net Profit Margin: 44.9%

Return (inc div) 1yr: 12.51% 3yr: 6.50% pa 5yr: 4.89% pa