Despite my past grievances regarding the complexity in CNI's financials, I have formed the view that it would be a prime candidate for some sort of corporate action.

I'm currently focusing attention on 3 fund manager/REITs which I think would achieve good synergies if they were to join forces:

CNI - $1.3B MC

HMC - $1.1B MC

DXS - $8.3B MC

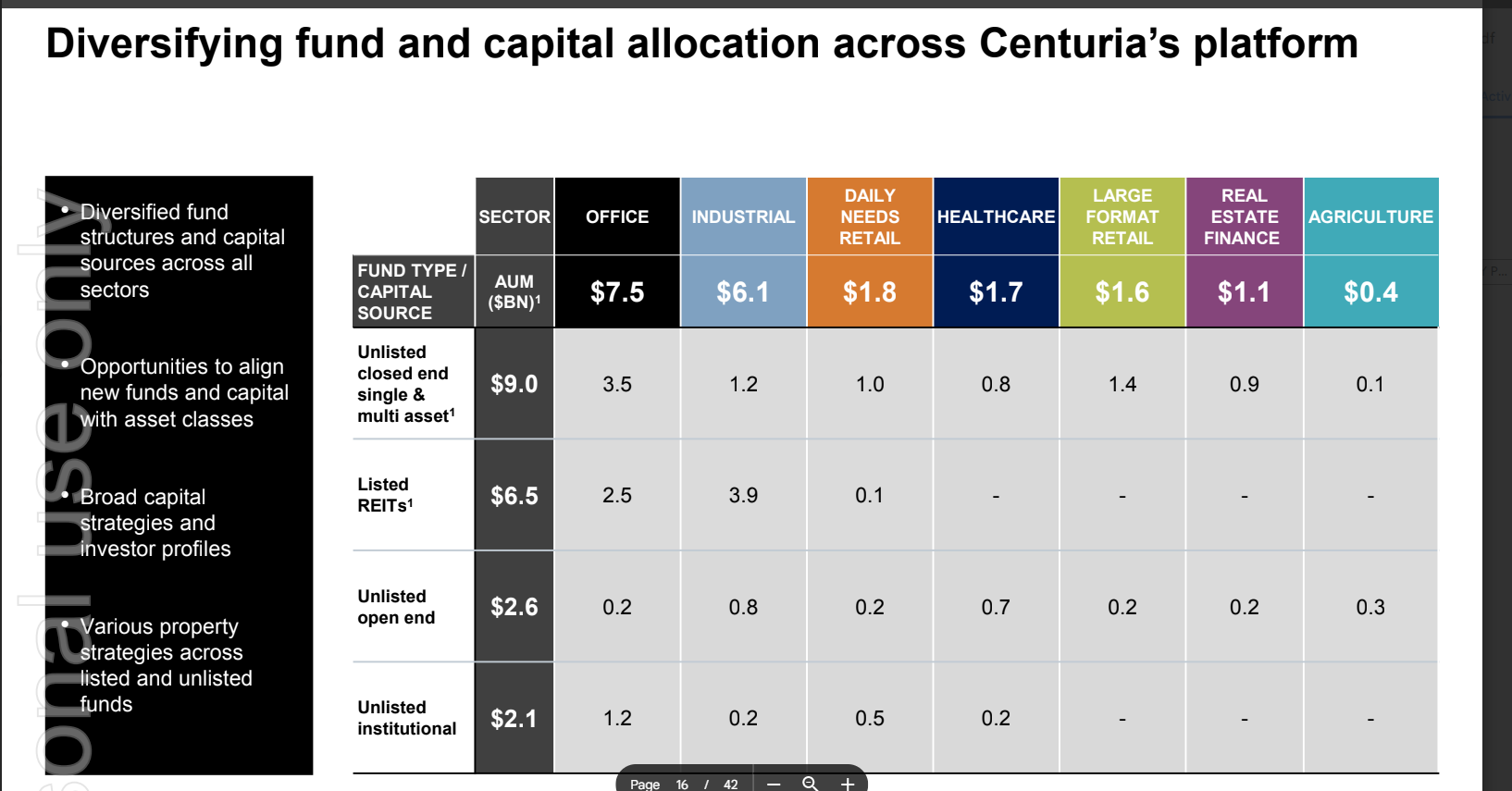

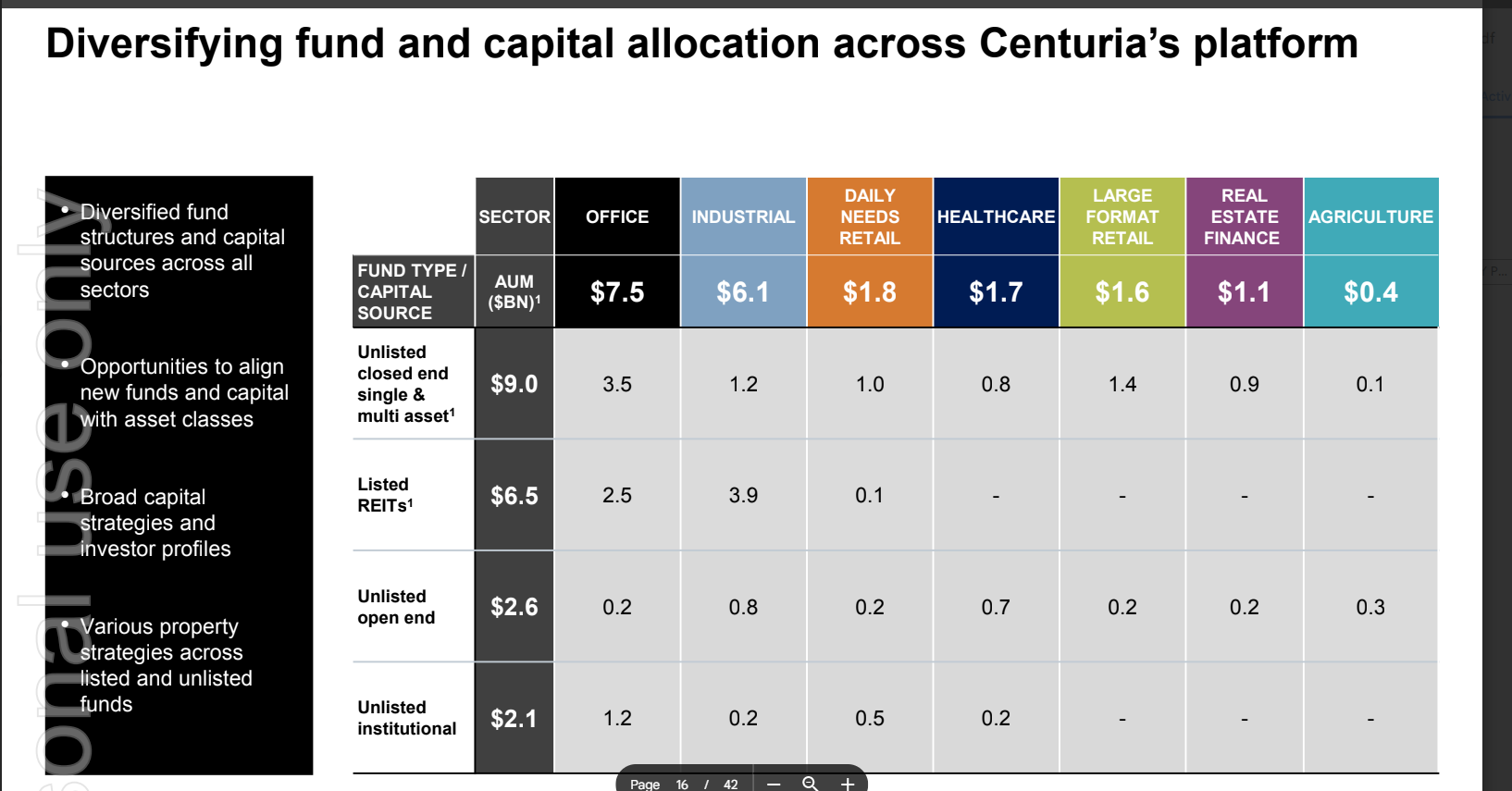

CNI and DXS would be able to merge their Industrial REITs (DXI, CIP) to create a mammoth $8 Bil pureplay industrial REIT with no listed competition. DXS could also sell some assets into CNI's office REIT - COF to free up some capital. They also both have some healthcare and retail asset funds which may be able to be benefit from increased scale. This would transform Dexus into a one stop shop for pretty much any asset class (except listed equities). CNI's FUM breakdown is below:

HMC also has two listed REITs - HDN and HCW which could work quite well if folded into CNI or DXS. I imagine CNI has quite a few retail assets/funds that it could fold into HDN or vice versa. HCW is focused on healthcare and could provide CNI with some opportunities to roll over some of it's unlisted healthcare funds into a listed form or vice - versa.

Watch this space.