I met with the Count CFO and M&A lead during the week in Sydney about my business, so I decided to dig a bit into their historical and current financial performance.

Summary

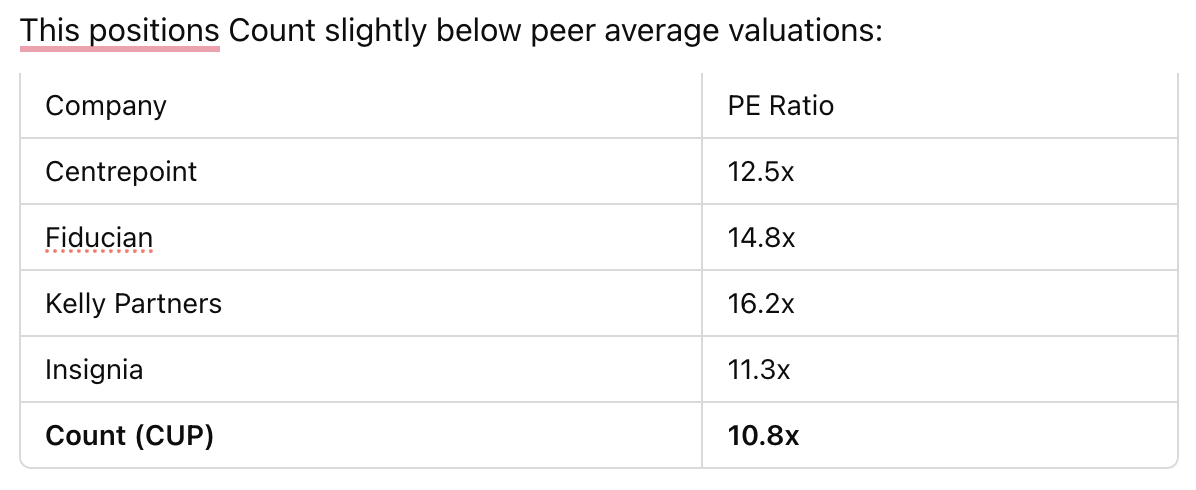

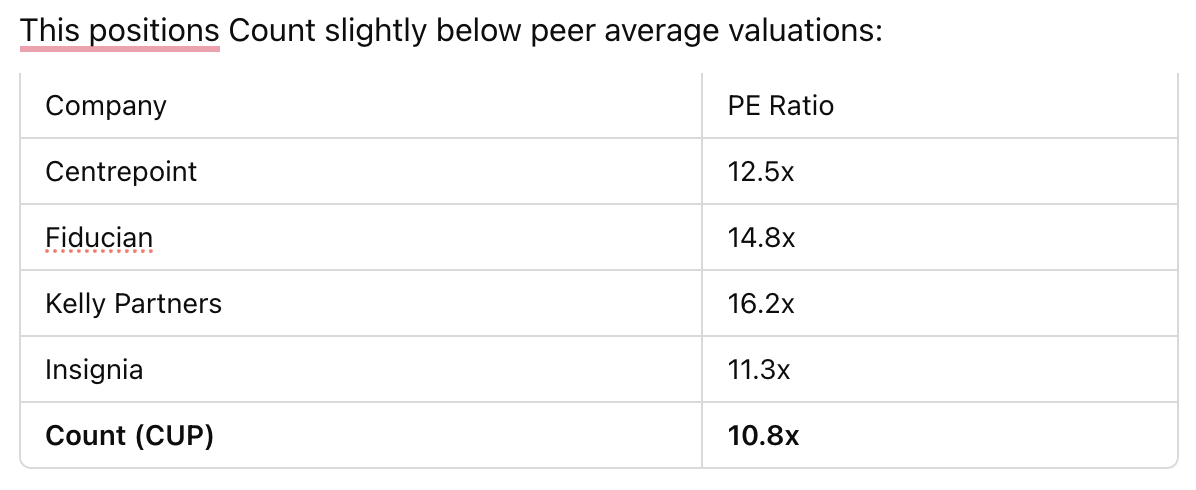

Count Limited has evolved into a leading financial services platform in Australia, executing a roll-up strategy across accounting and financial advice sectors. With a growing ecosystem, a diversified revenue base, and improving operational leverage, Count is delivering strong underlying earnings growth. At a current share price of ~$0.74 and a forecast FY25 EPS of ~6.2-6.5 cents, Count trades on a forward PE of ~10.8x – a potential discount to comparable ASX-listed peers.

In the past, Count has been seen by the market a stale company, without strong leadership. This might be changing but there is still the perception of it being stale so I'm not sure how long this will take to change. Also, roll-ups in financial services have had mixed success.

I'm wondering, if they start acquiring more financial services businesses at 5x NPAT and they are trading at 10x PE, this may help deliver more substantial returns in the future.

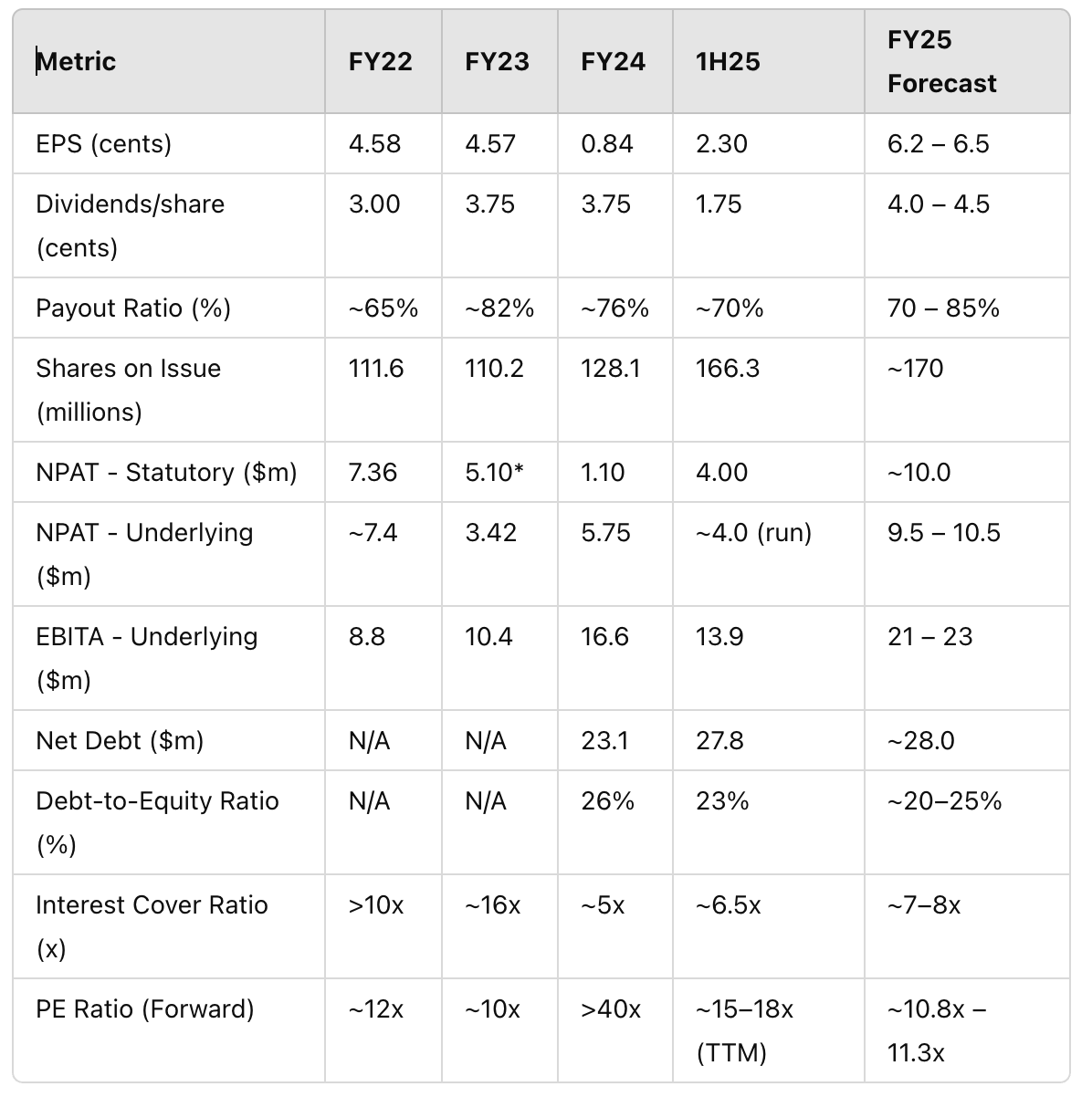

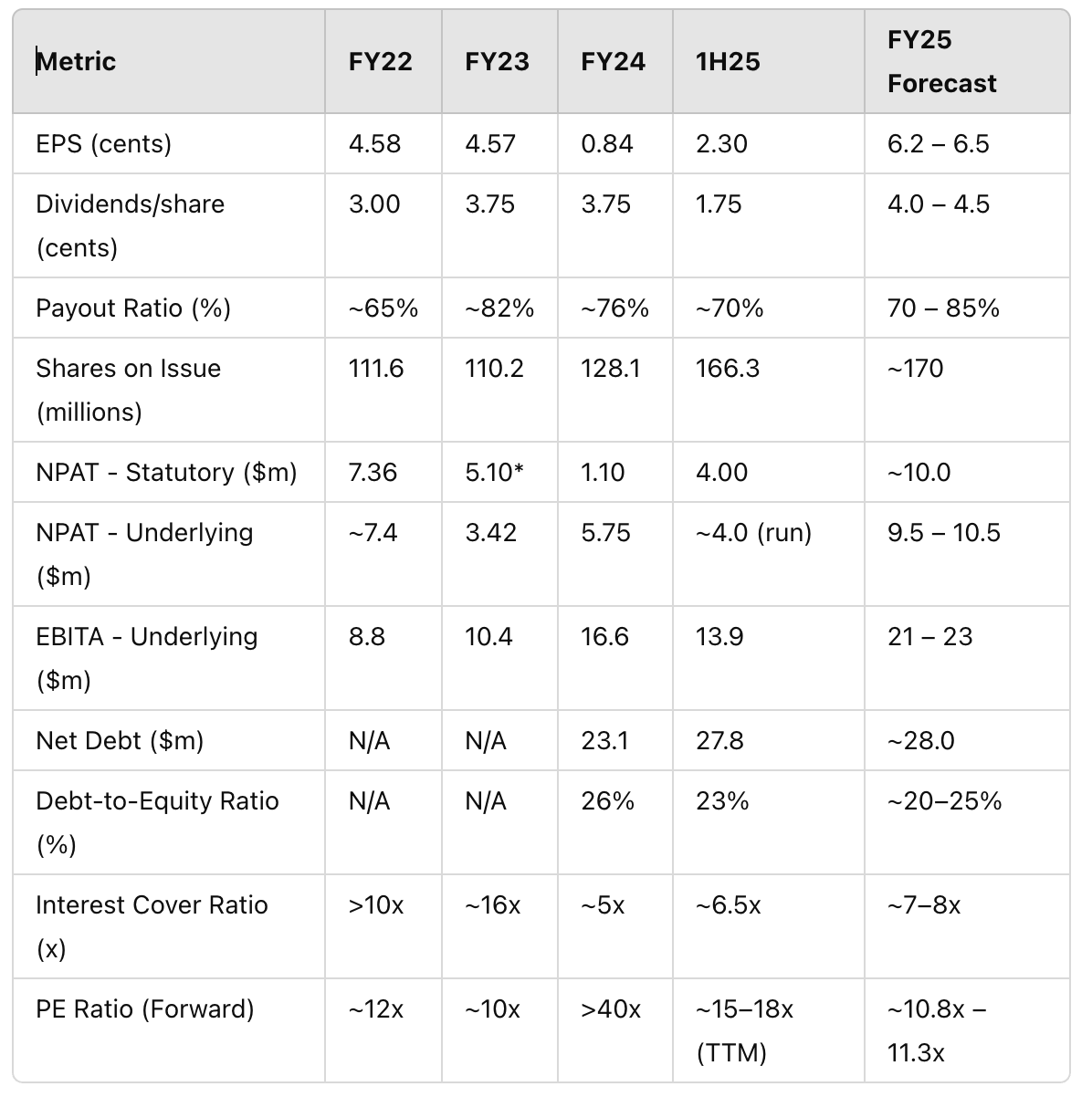

1. Financial Summary (FY22 to FY25 Forecast)

*Includes $3.16m bargain purchase gain from Affinia acquisition.

2. Acquisition Analysis & Growth Contributions

- FY22–FY23: Modest bolt-on acquisitions; Affinia added scale but was initially loss-making.

- FY24: Transformational acquisition of Diverger Limited. Delivered $15.4m in revenue and $2.08m NPAT in 4 months. Integration costs (~$5m) suppressed statutory NPAT.

- 1H25: Six new acquisitions and full contribution from Diverger. Annualised synergies of $4m forecast. Underlying EBITA and margins expanded strongly.

3. FY25 Forecast & Valuation

- Underlying NPAT: ~$10.5 million

- EPS Forecast: ~6.2 – 6.5 cents

- Dividend Forecast: 4.0 – 4.5 cents, fully franked

- Forward PE Ratio: ~10.8x

4. Roll-Up Strategy Risks (I see this as all being light risks)

- Integration Risk: Cultural or operational mismatches can delay synergy realisation.

- Acquisition Pricing Pressure: Competition may raise deal multiples.

- Platform Scalability: IT and operational infrastructure may require reinvestment.

- Regulatory Burden: Advice sector compliance is tight. Misconduct risks persist.

- Capital Allocation: Overuse of equity or debt can dilute returns.

5. Shareholder Base Assessment

- Colonial Holding Co. (24.3%) and HUB24 (11.6%) are strategic long-term holders.

- Founding presence: Barry Lambert still holds ~2%. I don't think this adds anything.

- Limited institutional ownership: Lower analyst coverage but room for future re-rating. The CFO said that they are entertaining more fund managers being interested, however, there aren't many shares on offer each day for a fund manager to get a substantial holding.

6. Worth investing??

Count is executing a well-managed roll-up strategy, growing recurring revenue and delivering operational leverage. It trades at a forward PE of ~10.8x, below comparable peers, with a strong dividend yield of ~6% (grossed-up). With integration of Diverger largely behind it, FY25 earnings and margins are set to expand. Risks are real but well-managed.

Target Price Range: $0.74 – $0.81

Total Return Potential: ~11% – 15% over 12 months (price + dividends).